Article explains about Issue of Auto-population of ITC figures in Table 8A of Form GSTR-9 based on Form GSTR-2A, Issue Faced While Using GSTR 9C Offline Utility, When to Use INITIATE FILING of GSTR – 9C, Action on JSON File – After receipt of JSON file and Signature Related Issue Faced while Using GSTR 9C Offline Utility.

Page Contents

- 1. Issue: Auto-population of ITC figures in Table 8A of Form GSTR-9 based on Form GSTR-2A

- 2. Issue Faced While Using GSTR 9C Offline Utility

- 3. When to Use INITIATE FILING – Important point for filing of GSTR – 9C

- 4. Action on JSON File – After receipt of JSON file

- 5. Signature Related Issue- Issue Faced while Using GSTR 9C Offline Utility

1. Issue: Auto-population of ITC figures in Table 8A of Form GSTR-9 based on Form GSTR-2A

One of the possible reasons for non matching of ITC (pre-populated in table 8A of Form GSTR 9) with figure appearing in Form GSTR 2A is:

- Figures in table 8A of Form GSTR 9 are Auto populated only for GSTR 1 filed by the supplier taxpayer by due date of its filing i.e. 30th April, 2019.

- ITC on supplies of the financial year 2017-18, if reported after 30th April, 2019, will not get auto-populated in table 8A of Form GSTR-9 but will appear in Form GSTR-2A.

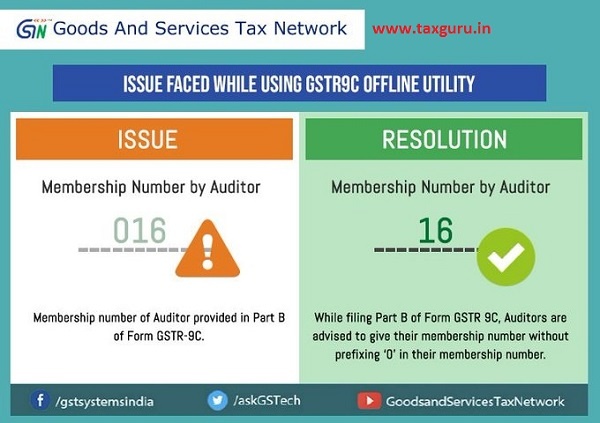

2. Issue Faced While Using GSTR 9C Offline Utility

3. When to Use INITIATE FILING – Important point for filing of GSTR – 9C

A. The ‘INITIATE FILING’ tab is to be used first to Download GSTR 9C Table derived from GSTR 9 (PDF) and then Taxpayer has to send the PDF file to the Auditor (for preparation of Form GSTR 9C for reference).

B. For preparing GSTR 9C by the auditor, pre-filed JSON file is not required to be downloaded from the portal. Please do not try to download JSON file if you have not uploaded such file prepared by your Auditor.

4. Action on JSON File – After receipt of JSON file

(Reconciliation statement as prepared & singed by Auditor)

- ‘PREPARE OFFLINE’ tab is to be used to upload ‘JSON File’ (Reconciliation statement as prepared & singed by Auditor) on GST Portal. This button is to be used to download error JSON file, if any.

- The ‘INITIATE FILING’ tab is to be used to upload Balance Sheet, P&L Account etc. in PDF/JPEG format and to be file Form GSTR 9C prepared by the auditor.

- ‘PROCEED TO FILE’ tab will be enabled only after successful uploading of Reconciliation statement (Singed JSON file) & Audited Financial Statement.

5. Signature Related Issue- Issue Faced while Using GSTR 9C Offline Utility

ISSUE: User is getting the error “Auditors sign is invalid.”

RESOLUTION

1. Digital Signature Certificate (DSC)

i. Digital Signature Certification (DSC) must be PAN based and in format PKCS7

ii. DSC must not be corrupted

iii. DSC should be valid and must not have expired.