Case Law Details

In re Prajapati Keval Dineshbhai (GST AAR Gujarat)

GST @12% applicable on unbranded pre-packaged namkeens and salted/flavoured potato chips

The AAR, Gujarat in the matter of M/s Prajapati Keval Dineshbhai [Order No. GUJ/GAAR/R/2022/54 dated December 30, 2022] has held that, the supply of un-branded packaged namkeens and potato products such as chips/sev etc., according to pre-determined weights, will attract Goods and Services Tax (“GST”) at 12% as per Sl. No. 46 of Schedule-II of Notification No. 01/2017 – Central Tax (Rate) dated June 28, 2017 (“the Goods Rate Notification”). Further held that, the supply of dry potato starch powder as a bye product has a specific entry and is classified under Sl. No. 18 of Schedule-II of the Goods Rate Notification, attracting GST rate of 12%.

Facts:

M/s Prajapati Keval Dineshbhai (“the Applicant”) is an un-registered person and intended to set-up a manufacturing unit of various unbranded food products like potato chips (various flavours), potato sev, potato chivda, gathiya and other snacks (“the Products”) and supply in packages of pre-determined weight. Further, the Applicant will be producing ‘dry potato starch powder’ as a by-product of manufacture of potato based products.

The Applicant submitted the manufacturing process of all the Products and contended that the Products fall under the category of ‘Namkeens’ and should be classified under Sl. No. 101A of Schedule – I of the Goods Rate Notification and Customs Tariff Heading (“CTH”) 2106 90 99 irrespective of their ingredients and shall be liable to be taxed at 5% GST. Further, the dry potato starch powder shall be classified under Sl. No. 18 of Schedule – II of the Goods Rate Notification and under CTH 1108 13 00 and shall be liable to be taxed at 12% GST.

The Applicant filed this application to the AAR seeking the classification and applicable GST rates on the Products.

Issue:

Whether the unbranded food Products manufactured by the Applicant is to be taxed at 5% GST or at 12% GST?

Held:

The AAR, Gujarat in Order No. GUJ/GAAR/R/2022/54 of 2022 held as under:

- Observed that, the word ‘Namkeen’ is not defined under the Central Goods and Services Tax Act, 2017 (“the CGST Act”) and applying the common parlance test, deciphered that ‘Namkeen’ is a savoury snack that is ready to eat and is prepared by applying salt, masala, etc.

- Referred to the Judgment of Hon’ble CESTAT, New Delhi in the matter of Pepsico India Holidings (P.) Ltd. v. CCE & ST [2015 (318) ELT 278 (Tri – Delhi)]wherein, it was observed that salted food preparations are called ‘Namkeen’.

- Observed that, the Applicant intends to supply pre-packaged and labelled food products. Further, w.e.f. July 18, 2022, SI. No. 101A of the Schedule-I of the Goods Rate Notification is applicable to the goods that are not pre-packaged and labelled, which was earlier applicable to un-branded packages which do not contained any brand name. Thus, the Applicant is not eligible to tax rate of 5% GST under SI. No. 101A of the Schedule-I of the Goods Rate Notification.

- Stated that, the Products of the Applicant are classifiable under CTH 2106 90 99, even though the Applicant is intending to supply its products unbranded, the Products will be pre-packaged and labelled as per the Legal Metrology Act, 2009 and therefore, the Products will be classified under Sl. No. 46 of Schedule-II of the Goods Rate Notification and will attract GST at 12%.

- Further stated that, potato starch has a specific entry and is classified under CTH 1108 13 00 under Sl. No. 18 of Schedule-II of the Goods Rate Notification, attracting GST rate of 12%.

- Held that, the Products of the Applicant are classified under CTH 2106 90 99 and attract GST at 12%. Further held that, the by-product i.e. dry potato starch powder is classified under CTH 1108 13 00 and will attract GST at 12%.

Relevant Provisions:

Sl. No. 46 of Schedule – II of the Goods Rate Notification:

“Schedule II – 6%

|

S. No. |

Chapter / Heading / Subheading / Tariff item | Description of Goods |

| 46. | 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form [other than roasted gram], pre-packaged and labelled” |

Sl. No. 18 of the Goods Rate Notification:

“Schedule II – 6%

|

S. No. |

Chapter / Heading / Subheading / Tariff item | Description of Goods |

| 18 | 1108 | Starches; inulin” |

FULL TEXT OF THE ORDER OF AUTHORITY FOR ADVANCE RULING, GUJARAT

Brief facts:

M/s. Prajapati Keval Dineshbhai (referred as “the Applicant”) is un-registered person and intends to set up a manufacturing plant of various items including but not limited to following unbranded food products:-

I. Potato chips (salted and masala for various flavors)

II. Potato Sev (Aloo Sev)

III. Potato Chivda (Potato Salli Mixture)

IV. Sing Bhujiya

V. Sev Mamara (Roasted Puffed Rice with Nylon Sev)

VI. Chana Daal (Fried split Bengal Gram)

VII. Gathiya

VIII. Khatta Mitha Chevda Mixture

IX. Dry Starch Powder

2. The applicant has submitted the manufacturing process for each of above mentioned food products. The manufacturing process of all the above products is as follows:

I. Potato Chips (salted and masala for various flavors):-

-

- Raw potatoes shall be fed into clearing machine to remove stones heavy materials. Then machine-based grading shall be done to remove the small size potatoes. Then machine-based washing shall be done to remove dust and dirt from potatoes. Then Peeling machine shall remove the thin layer of skin from the potatoes and again a machine based washing shall be done to completely remove the peel from potato.

- During this process extra water and starch shall be extracted, as a byproduct. Then slicing machine shall slice, the peeled potatoes into uniform slices and such slices shall be passed from vibrator machine to again remove extra water and starch from sliced potatoes.

- Then potato slices shall be fried in fryer machine in continuous deep fry at 180-187 °C temperature, which shall convert the potato slices into fried potato chips. Then manual sorting of damaged chips shall be done and then seasoning with various masala or flavors shall be done of such fried chips and then final packing of such potato chips shall be done in unbranded plastic bags, which it to be sold to customers.

II. Potato Sev (Aloo Sev) :-

-

- Frist of all Dry mixture of Longi Mirch (Eagle Eye Chilly), White Salt, Turmeric powder, Potato Flakes, Gram flour, Starch powder and Rice flour is prepared by Sieving of powder formed Raw materials.

- Then Dough is prepared in dough mixture machine by adding water in dry mixture of raw materials.

- Then dough extrusion machine extrudes sieve into fryer machine where deep frying in vegetable oil is done at 174 °c temperature for 70 seconds.

- Then it is put on de-oiling and cooling conveyer belt and passed through tumbler and seasoning applicator to add various spices flavors and then packed in plastic unbranded bags of different size and weights, which is to be sold to customers.

III. Potato Chivda (Potato Salli Mixture):–

-

- Raw potatoes shall be infeed into machine elevator which shall then pass through grader, destoner and peeler machines which shall wash the potatoes, removes dust / dirt and also peel the thin skin of potatoes. During this process extra water and starch shall be extracted, as a byproduct.

- Then slicing machine shall slice, the peeled potatoes into potato sticks and such potato sticks shall be passed from vibrating washing drums to again remove extra water and starch from sliced potato sticks. Then air blower machine shall remove the small potato sticks and remaining potato sticks shall be fried in deep fryer machine.

- Then manual sorting of damaged fried potato sticks shall be done on inspection conveyor belt and then it is passed through the tumbler with seasoning applicator where various flavors of spices are added in fried potato sticks. Then in mixing roller machine, fried potato sticks are mixed with sugar, rock salt, red chili, green chili, turmeric powder, fried masala Sabu dana , raisin, Peanuts, and other dry fruits as per standard mixing ratio to manufacture the Potato Chivda (Mixture).

- Then such mixture is collected in clean drums and packed into plastic unbranded bags of different sizes/weights to be sold to customers.

IV. Sing Bhujiya :-

-

- First of all Sieving of powdered Raw materials & Sorting of Countable Raw materials is done.

- A dough is prepared by Mixing of Gram flour, salt, spices and minimum water in paste like consistency.

- Then Peanuts are mixed in this prepared dough and transferred to frying machine.

- Then dough extrusion machine extrudes sieve into fryer machine where deep frying in vegetable oil is done at 175 °c temperature for 15 seconds.

- Then it is put on de-oiling and cooling conveyer belt and passed through tumbler and seasoning applicator to add various spices flavors and then packed in plastic unbranded bags of different size and weights . which is to be sold to customers.

V. Sev Mamara (Roasted Puffed Rice with Nylon Sev):-

-

- Frist of all Sorting of raw puffed rice is done to remove damage & faulted material.

- Then puffed rice is roasted on medium heat.

- Then roasted puffed rice are polished with hot oil uniformly.

- Then roasted and polished puffed rice material is transfered into the seasoning drum and seasoning of various flavors is done.

- Then pre-prepared nylon sev is mixed with the seasoned and roasted puffed rice as per standard ratio in mixing drum.

- Then it is packed in plastic unbranded bags of different size and weights, which is to be sold to customers.

VI. Fried Chana Daal (Split Bengal Gram),-

-

- First of all Repeated washing by water for approx 10 times is done for raw Split Bengal gram (chana Daal) > Then soaking of water for 8-10 hours is done for washed chana Daal.

- Dewatering is done for soaked Daal with filtration machine.

- Then soaked chana daal is deep fried in hot oil at 190°C +/- 5°C. For 1520 second.

- Then it is put on de-oiling and cooling conveyer belt and passed through tumbler and seasoning applicator to add various spices flavors and then packed in plastic unbranded bags of different size and weights , which is to be sold to customers.

VIL Manufacturing process for Gathiya :-

-

- First of all, sieving of powdered Raw materials & Sorting of Countable Raw materials is done.

- Then dry mix of White Salt, Baking Soda, Gram flour, Pea Floor, Black pepper, carom seeds and Starch Powder is prepared.

- Then dry mixture is mixed with edible oil and then dough is prepared by adding water in the that mixture.

- Then dough extrusion machine extrudes sieve into fryer machine where deep frying in vegetable oil is done at 178 °c temperature for 20 seconds.

- Then it is put on de-oiling and cooling conveyer belt and passed through tumbler and product conveyor belt then packed in plastic unbranded bags of different size and weights, which is to be sold to customers.

VIII. Khata Mitha Chevda Mixture:

-

- First of all Sieving of powdered Raw materials & Sorting of Countable Raw materials is done.

- Then various semi-finished raw materials are manufactured for final product as follow :

| 1. Chana Dal |

| Soaking (8-10 Hrs) |

| Dewatering / Centrifugation (8-10K.g) |

| Bhatti Oil Sampling & Testing (FFA) |

| Frying 190° +/- 5° C, Dwell time 200 +/- 30 Second |

| DE oiling + Cooling |

| Collect into Clean Bucket with Liner |

| 2. Green Pea |

| Soaking (10-12 Hrs) |

| Dewatering / Centrifugation (8-10Kg) |

| Bhatti Oil Sampling & Testing (FFA) |

| Frying 190° +/- 5° C, Dwell time 220 +/- 30 Second |

| DE oiling + Cooling |

| Collect into Clean Bucket with Liner |

| 3. Masoor Dal |

| Soaking (10-12 Hrs) |

| Dewatering / Centrifugation (8-10Kg) |

| Bhatti Oil Sampling & Testing (FFA) |

| Frying 190° +/- 5° C, Dwell time 160 +/- 30 Second |

| DE oiling + Cooling |

| Collect into Clean Bucket with Liner |

| 4. Sada Sev |

| Make Dry mix of Whit Salt, Gram Besan, Starch and Pea Floor |

| Blend Prepare Dry mix With Edible Oil |

| Make dough into dough Mixer (Dry mix + Water) |

| Take into Tray |

| Transfer to Batch Fryer for Frying |

| QC Person Testing Bhatti Oil FFA, PV |

| Extrusion from Extruder Sieve into fryer Heat oil |

| Frying at 175° +/- 2°C for 70 +/- 10 Second |

| Collect into Clean Bucket with Liner |

| 5. Bhavnagri Gathiya |

| Make dry mix of White Salt, Baking Soda, Gram Flour, Pea Floor, Ajwain, and Starch Powder |

| Mixing Of Drymix with Edible Oil |

| Make dough into dough Mixer (Drymix + Water) |

| Take into Tray |

| Tranfer to Fryer for Frying |

| QC Person Testing Bhatti Oil FFA, PV |

| Extrusion from Extruder Seive into fryer Heat oil |

| Frying at 178° +/- 2°C for 100 +/- 20 Second |

| Collect into Clean Bucket with Liner |

| 6. Bundi |

| Make Dry mix of Pea Floor, Gram Flour Coarse |

| Make Slurry into dough Mixer (Dry mix + Water) |

| Take into Tray |

| Transfer to Fryer for Frying |

| QC Person Testing Bhatti Oil FFA, PV |

| Drop the prepared Slurry by Sieve into fryer Heat oil |

| Frying at 178° +/- 2°C for 180 +/- 15 Second |

| DE oiling by Centrifuge & Collect into Clean Bucket with Liner |

| 7. Rice Flake |

| Take Sorting rice flakes into Batch fryer |

| Frying at 210° +/- 5°C for 10 – 12 Second |

| Mix turmeric powder |

| Collect into Clean Bucket with Liner |

| 8. Red Peanut |

| Take Sorting Red Peanut into Batch fryer |

| Frying at 170° +/- 5°C for 3- 4 Minute |

| Mix turmeric powder |

| Collect into Clean Bucket with Liner |

-

- Then All above mentioned semi-Finished Products are mixed in Tumbler & Seasoning is done with Sugar, Mango Powder, Citric Acid, White Salt, Black Salt, Turmeric Powder, Fennel seeds in it.

- Then the final mixture is packed in plastic unbranded bags of different size and weights, which is to be sold to customers.

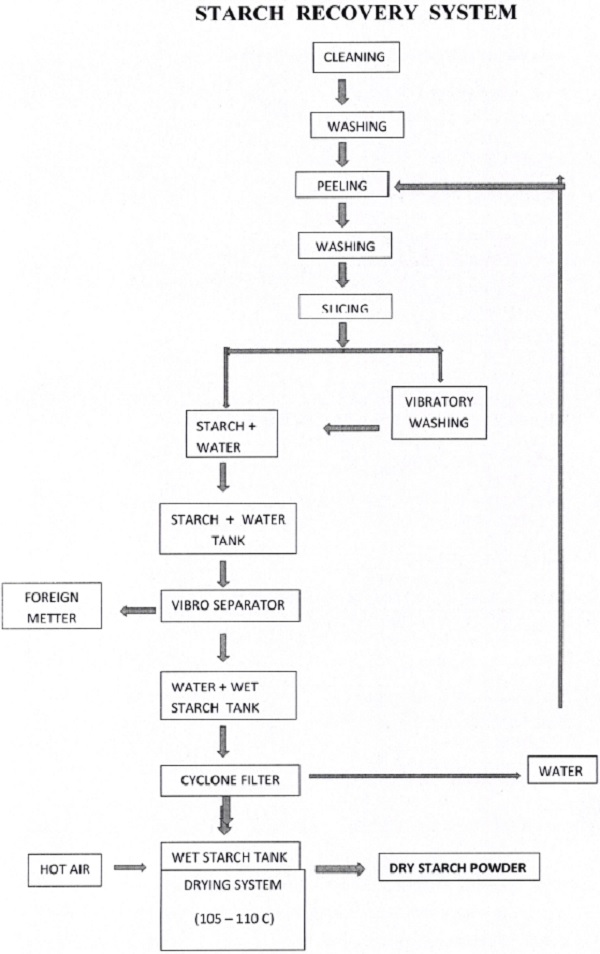

IX. Manufacturing process for Dry Starch Powder:

-

- During manufacturing of main products like Potato Chips, Potato Sticks Mixture and Aloo Sev etc. products. Starch is also getting manufactured as by Product.

- Such starch is then converted into Dry Starch powder by following below mentioned recovery system:

The applicant has referred Supplementary Note No. 6 of Chapter 21- MISCELLANEOUS EDIBLE PREPARATIONS of Customs Tariff Act and same is reproduced as under:

| 6. | Tariff item 2106 90 99 includes sweet meats commonly known as “Misthans” or “Mithai” or called by any other name. They also include products commonly known as “Namkeens”, “mixtures”, “Bhuiia”, “Chabena” or called by any other name. Such products remain classified in these sub-headings irrespective of the nature of their ingredients. |

3.1 It is submitted that the products which are commonly known as “Namkeens”, “mixtures”, “Bhujia”, “Chabena” or called by any other name, should be classified under tariff item 2106 9099 and Such products remain classified in these sub-headings irrespective of the nature of their ingredients.

3.2 The applicant has submitted that the word “Namkeen” is not defined under GST Law and it has been specifically provided in supplementary note No 6, that “Products commonly known as Namkeen” are covered under that tariff item No 2106 90 99. The applicant has referred the dictionary meaning of Nankeen:

As per oxford dictionary:

| Namkeens means “any small meal or amount offood that tastes of salt “ |

As per laxico dictionary:

| Namkeens means “A small savoury snack or dish ”

& savoury means “(of food) belonging to the category that is salty or spicy rather than sweet. “ |

3.3 In general, Namkeen is the Hindi word used to describe a savory flavor. The word namkeen is derived from the word namak (meaning salt). It is also used as a generic term to describe savory snack foods. Thus, any salty and spicy snacks items are commonly known as “Namkeen”.

3.4 The applicant has referred the relevant para of CIRCULAR NO. 113/32/2019- GST [F.NO. 354/131/2019-TRU], DATED 11-10-2019 ISSUED FOR CLARIFICATION REGARDING GST RATES & CLASSIFICATION is also reproduced here under :

|

“….. 3. Classification of leguminous vegetables when subject to mild heat treatment (parching): 3.1 Doubts have been raised whether mild heat treatment of leguminous vegetables (such as gram) would lead to change in classification. 3.2 Dried leguminous vegetables are classified under HS code 0713. As per the explanatory memorandum to the HS 2017, the heading 0713 covers leguminous vegetables of heading 0708 ‘which have been dried, and shelled, of a kind used for human or animal consumption (e.g., peas, chickpeas etc.). They may have undergone moderate heat treatment designed mainly to ensure better preservation by inactivating the enzymes (the peroxidases in particular) and eliminating part of the moisture. 3.3 Thus, it is clarified that such leguminous vegetables which are subjected to mere heat treatment for removing moisture, or for softening and puffing or removing the skin, and not subjecting to any other processing or addition of any other ingredients such as salt and oil, would be classified under HS code 0713. Such goods if branded and packed in a unit container would attract GST at the rate of 5% [S. No. 25 of notification No. 1/2017- Central Tax (Rate), dated 28-6-2017]. In all other cases such goods would be exempted from GST [S. No. 45 of notification No. 2/2017- Central Tax (Rate), dated 28-6-2017]. 3.4 However, if the above dried leguminous vegetable is mixed with other ingredients (such as oil, salt etc) or sold as namkeens then the same would be classified under Sub heading 2106 90 as namkeens, bhujia, chabena and similar edible preparations and attract applicable GST rate. ………….” |

3.5 It is submitted by the applicant that in para 3.4 of the Circular, it has been clarified that, if the item is sold as namkeens then same would be classified under Sub heading 2106 90 as namkeens, bhujia, chabena and similar edible preparations and attract applicable GST rate. Thus, this circular supports the view that, when salted or masala flavored potato chips are sold as namkeens in market then it shall be classified under tariff heading 2106 90 only.

4. The applicant has referred Entry No 101 A. Schedule -1 (for 5 % GST Rate) of NOTIFICATION NO. 1/2017-CENTRAL TAX (RATE), DATED 28-6-2017, is reproduced here under :

|

SI. No. |

Chapter/ Heading/ Subheading/ Tariff item | Description of Goods |

| 101A | 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form, other than those put up in unit container and,-

(a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or any enforceable right in respect of such brand name has been voluntarily foregone, subject to the conditions as specified in the ANNEXURE]] |

5. The applicant has submitted that Salted or Masala flavored potato chips are sold in market as “Namkeen” items only and it is considered as savory snacks in general. Thus, it shall get squarely covered under the chapter note no 6 of chapter 21 of GST Tariff and thus should be classified under tariff item no 2106 90 99.

5.1 The applicant has submitted that they intend to sell manufactured salted and masala potato chips without any brand name , it shall be covered under si no 101A of schedule -I of Notification No 01/2017- Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

For Question No: 2 (For Aloo Sev [Potato Sev])

2.1 As per the manufacturing process described in statement of facts, it is clear that Aloo Sev (Potato Sev) is manufactured with various raw materials like Longi Mirch (Eagle Eye Chilly), White Salt, Turmeric powder, Potato Flakes, Gram flour, Starch powder and Rice flour. Thus, the final product is totally different from anyone specific basic ingredient used to manufacture the same.

2.2 The Final product of Aloo Sev (Potato Sev) is being sold in market as “Namkeen” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Namkeen” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -1 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

2.3 Thus “Aloo Sev (Potato Sev)” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 3 (For Potato Chivda [Potato Salli Mixture]) :

3.1 As per the manufacturing process described in statement of facts, it is clear that Potato Chivda [Potato Salli Mixture] is manufactured with various raw materials like raw potato, sugar, rock salt, red chili, green chili, turmeric powder, fried masala Sabu dana , raisin, Peanuts, and other dry fruits. Thus the final product is totally different from anyone specific basic ingredient used to manufacture the same.

3.2 The Final product of Potato Chivda [Potato Salli Mixture] is being sold in market as “Mixture” or “Chabena” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Mixture” or “Chabena” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -1 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

3.3 Thus “For Potato Chivda [Potato Salli Mixture]” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 4 (For Sing Bhujiya):

4.1 As per the manufacturing process described in statement of facts, it is clear that Sing Bhujiya is manufactured with various raw materials like peanuts, Gram flour, salt and various spices. Thus, the final product is totally different from anyone specific basic ingredient used to manufacture the same.

4.2 The Final product of Sing Bhujiya is being sold in market as “Bhujiya” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Bhujiya” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -1 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

4.3 Thus “Sing Bhujiya” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 5 (For Sev Mamara [Roasted Puffed Rice mixed with Nylon Sev|:

5.1 As per the manufacturing process described in statement of facts, it is clear that Sev Mamara [Roasted Puffed Rice mixed with Nylon Sev] is manufactured with various raw materials like puffed rice, ready Nylon Sev and various spices. Puffed rice and Nylon sev are also one kind of finished products which are manufactured from other food items like rice and gram flour.

5.2 The Final product of Sev Mamara [Roasted Puffed Rice mixed with Nylon Sev] is being sold in market as “Namkeen” or “Mixture” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Namkeen”, “Mixture” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -I of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

5.3 Thus “Sev Mamara [Roasted Puffed Rice mixed with Nylon Sev] “ shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No; 6 (For Fried Chana Daal (Split Bengal Gram|):

6.1 As per the manufacturing process described in statement of facts, it is clear that Fried Chana Daal [Split Bengal Gram] is manufactured with various raw materials like Split Bengal Gram, edible oil, water and various spices. Thus, the final product is totally different from anyone specific basic ingredient used to manufacture the same.

6.2 The Final product of Fried Chana Daal [Split Bengal Gram] is being sold in market as “Namkeen” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Namkeen” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -1 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

6.3 Thus “Fried Chana Daal [Split Bengal Gram)” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 7 (For Gathiya):

7.1 As per the manufacturing process described in statement of facts, it is clear that Gathiya is manufactured with various raw materials like White Salt, Baking Soda, Gram flour, Pea Floor, Black pepper, carom seeds, edible oil and Starch Powder. Thus, the final product is totally different from anyone specific basic ingredient used to manufacture the same.

7.2 The Final product of Gathiya is being sold in market as “Namkeen” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Namkeen” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -I of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

7.3 Thus, “Gathiya” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 8 (For Khata Mitha Chevda Mixture):

8.1 As per the manufacturing process described in statement of facts, it is clear that Khata Mitha Chevda Mixture is manufactured with various raw materials like chana daal, green peas, masoor daal, Sev, Gathiya, Bundi , Rice flakes, Red Peanuts and various spices. All the raw materials used are also one kind of finished products which are manufactured from other food items. Thus, the final product is totally different from anyone specific basic ingredient used to manufacture the same.

8.2 The Final product of Khata Mitha Chevda Mixture is being sold in market as “Mixture” or “Chebana” only, and commonly it is used a savory snacks only. And as discussed in detailed in Justification Reply for Question no -1 above, when the “Mixture” or “Chebana” or similar other edible preparations in ready for consumption form are sold without brand name, then it shall be classified under entry No 101 A of schedule -1 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 and thus shall be liable to GST rate of 5%.

8.3 Thus, “Khata Mitha Chevda Mixture” shall be classified under tariff item No 2106 90 99 and is liable for GST rate of 5 % when sold without brand name.

For Question No: 9 (For Dry Starch Powder):

9.1 As per the manufacturing process described in statement of facts, it is clear that starch is being produced as By-Product while manufacturing of other food items from raw potatoes. Then further process is done to convert the said potato starch in to Dry form of starch powder.

9.2 Entry No 18 of Schedule -2 (for 12 % GST Rate) of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 is reproduced here under :

| SI. No. | Chapter/ Heading/ Sub-heading/ Tariff item | Description of Goods |

| 18. | 1108 | Starches; inulin |

Detailed entry of Chapter -11 of PRODUCTS OF THE MILLING INDUSTRY; MALT; STARCHES; INULIN; WHEAT GLUTEN is as under :

| Tariff Item | Description of goods | Unit | 12% IGST/6% CGST/6% SGST or UTGST : 1108 : Starches; inulin | |||

| 1108 | Starches; inulin | |||||

| – | Starches: | CGST | SGST/UTGST | IGST | ||

| 1108 11 00 | — | Wheat starch | kg. | 6% | 6% | 12% |

| 1108 12 00 | — | Maize (corn) starch | kg. | 6% | 6% | 12% |

| 1108 13 00 | — | Potato starch | kg- | 6% | 6% | 12% |

| 1108 14 00 | — | Manioc (cassava) starch | kg- | 6% | 6% | 12% |

| 1108 19 | — | Other: | ||||

| 1108 19 10 | — | Sago | kg- | 6% | 6% | 12% |

| 1108 19 90 | — | Other | kg- | 6% | 6% | 12% |

| 1108 20 00 | – | Inulin | kg- | 6% | 6% | 12% |

9.3 Thus, ”Dry Starch Powder extracted from potatoes” shall be classified under tariff item No 1108 13 00 and is liable for GST rate of 12 %.

4. Question on which Advance Ruling sought:

1. What is the correct tariff classification for “salted and flavored Potato Chips”? and if it is sold without brand name, what GST rate shall be applicable on the same?

2. What is the correct tariff classification for “Potato Sev (Aloo Sev)”? and if it is sold without brand name, what GST rate shall be applicable on the same?

3. What is the correct tariff classification for “Potato Chevda (Potato Stick Mixture)”? and if it is sold without brand name, what GST rate shall be applicable on the same?

4. What is the correct tariff classification for “Sing Bhujiya”? and if it is sold without brand name, what GST rate shall be applicable on the same?

5. What is the correct tariff classification for “Sev Mamara (Roasted Puffed Rice mixed with Nylon Sev)’ ? and if it is sold without brand name, what GST rate shall be applicable on the same ?

6. What is the correct tariff classification for “Chana Daal (Fried Split Bengal Gram)”? and if it is sold without brand name, what GST rate shall be applicable on the same?

7. What is the correct tariff classification for “Gathiya”? and if it is sold without brand name, what GST rate shall be applicable on the same?

8. What is the correct tariff classification for “Khatta Mitha Chevda Mixture”? and if it is sold without brand name, what GST rate shall be applicable on the same?

9 . What is the correct tariff classification for “potato starch”? and what GST rate shall be applicable on the same?

Personal Hearing:

5. Personal hearing granted on 26-9-22 was attended by Shri Meet M Jadawala, CA and he reiterated the submission.

Revenue’s Submission:

6. Revenue has neither submitted its comments nor appeared for hearing.

FINDINGS:

7. We have considered the submissions made by the Applicant in their application for advance ruling as well as the submissions made by authorised signatory, during the personal hearing proceedings on 26-9-22 before this authority. We also considered the issue involved, on which advance ruling is sought by the applicant, relevant facts & the applicant’s interpretation of law.

8. At the outset we would like to make it clear that the provisions of CGST Act and GGST Act are in parimateria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the GGST Act.

9. We find that the issue before us is to determine the classification and applicable GST rate of un-branded product viz. salted and flavored Potato Chips, Potato Sev (Aloo Sev), Potato Chivda (Potato Salli Mixture), Sing Bhujiya, Sev Mamara (Roasted Puffed Rice with Nylon Sev), Chana Daal (Fried split Bengal Gram), Gathiya, Khatta Mitha Chevda Mixture and Dry Starch Powder.

10. The applicant has submitted that they intend to supply food products as mentioned above in the plastic bags of different weights and it does not contain any brand name. The contention of the applicant is that all the food products fall under the category of “Namkeens” and hence is appropriately classifiable under Customs Tariff Heading 2106 90 and is liable to GST at the rate of 5 % as per entry at SI Nos. 101 and 101A of Schedule I of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017.

11. We find that Chapter 21 of the Customs Tariff covers “Miscellaneous edible preparations”. The Heading 2106 of the Chapter 21 covers food preparations not elsewhere specified or included. Supplementary Notes 5(b) of Section IV of Heading 2106 of Ch-21 of Customs Tariff Act includes, ‘preparation for use, either directly or after processing for human consumption’. Those food preparations, not specified or included elsewhere in the tariff being preparations for use either directly or after processing for human consumption are to be classified under this head. Supplementary Note 6 of Section IV of Heading 2106 of Ch-21 of Customs Tariff Act is reproduced as under:-

6. Tariff item 2106 90 99 includes sweet meats commonly known as “Misthans” or “Mithai” or called by any other name. They also include products commonly known as “Namkeens”, “mixtures”, “Bhujia”, “Chabena” or called by any other name. Such products remain classified in these sub-headings irrespective of the nature of their ingredients.

12. The product which are commonly known as Namkeens”, “mixtures”, “Bhujia”, “Chabena ” or called by any other name shall be classified under Tariff Item 210690900. The term NAMKEEN is not defined under the CGST Act. So, common parlance test has to be applied. In common/commercial parlance, NAMKEEN means SAVOURY SNACK that is ready to eat and is a food product prepared by applying salt, masala and the like. Further, we refer the DICTIONARY MEANING of NAMKEEN: https://www.lexio.com/defmition/namkeen – NOUN namkeen. namkeens – Indian -A small savory snack or dish.

12.1 The Hon’ble CESTAT, New Delhi has observed in Paragraph 8 of its order reported as Pepsico India Holidings (P.) Ltd. v. CCE & ST 2015 (318) ELT 278 (Tri – Delhi) that salted food preparations are “namkeen”.

12.2 We refer to the CTH 2106 of Customs Tariff Act and same is read as under :

| 2106 | FOOD PREPARATIONS NOT ELSEWHERE SPECIFIED OR INCLUDED |

| 2106 10 00 | – Protein concentrates and textured protein substances |

| 210690 | – Other: |

| — Soft drink concentrates: | |

| 2106 90 11 | — Sharbat |

| 2106 90 19 | — Other |

| 2106 90 20 | — Pan masala |

| 2106 90 30 | — Betel nut product known as “Supari” |

| 2106 90 40 | — Sugar-syrups containing added flavouring or colouring matter, not elsewhere specified or included: lactose syrup: glucose syrup and malto dextrine syrup |

| 2106 90 50 | — Compound preparations for making non-alcoholic beverages |

| 2106 90 60 | — Food flavouring material |

| 2106 90 70 | — Churna for pan |

| 2106 90 80 | — Custard powder |

| — Other: | |

| 2106 90 91 | — Diabetic foods |

| 2106 90 92 | — Sterilized or pasteurized millstone |

| 2106 90 99 | — Other |

12.3 It is observed that those food preparations, not specified or included elsewhere in the tariff being preparations for use either directly or after processing for human consumption are to be classified under this head. Therefore, it is evident that the entry is a residuary entry in respect of edible preparations and hence the edible preparations shall be classified under, this entry only if the same are not classifiable under any of the other specific entries for edible preparations.

12.4 We find that the applicant food products salted and flavored Potato Chips, Potato Sev (Aloo Sev), Potato Chivda (Potato Salli Mixture), Sing Bhujiya, Sev Mamara (Roasted Puffed Rice with Nylon Sev), Chana Daal (Fried split Bengal Gram), Gathiya and Khatta Mitha Chevda Mixture are salted and savory products. These products are ready to eat and directly consumed by human beings. Therefore, we hold that the applicant food products be classified under CTH 21069099 of Customs Tariff Act.

13. Having come to the conclusion that all the food products are classifiable under Tariff Items of Heading 21069099 of Chapter 21 of the Customs Tariff Act, 1975 we now proceed to determine the rate of GST applicable on the applicant food products viz. salted and flavored Potato Chips, Potato Sev (Aloo Sev). Potato Chivda (Potato Salli Mixture), Sing Bhujiya. Sev Mamara (Roasted Puffed Rice with Nylon Sev), Chana Daal (Fried split Bengal Gram), Gathiya and Khatta Mitha Chevda Mixture. We find that the applicant has argued that all the foods products cover under Entry No 101 A, Schedule -I (for 5 % GST Rate) of Notification No. 1/2017-CT (RATE) dated 28-6-2017, is reproduced here under :

| SI. No. | Chapter/ Heading/ Subheading/ Tariff item | Description of Goods |

| 101A | 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form, other than those put up in unit container and,-

(a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or any enforceable right in respect of ‘such brand name has been voluntarily foregone, subject to the conditions as specified in the ANNEXURE]] |

13.1 We find that the applicant argument that its food product cover under Entry No. 101A is based on the basis that the packages do not contain any brand. It means applicant food packages does not bear brand name and are un-branded. The above entry No. 101A has been amended vide Sr. No. (xi) of notification No. 6/2022-Central Tax (Rate) w.e.f 18-7-22 is reproduced as under :

(xi) against S. No. 101 A, in column (3), for the portion beginning with the words “other than those put up in” and ending with the words and bracket “as in the ANNEXURE/“, the words “, other than those pre-packaged and labelled “ shall be substituted:

13.2 After the said amendment Entry No. 101A of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 with effect from 18-7-22 is read as under:

Schedule-II { GST Rate @ 5%}

| 101A. | 210690 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form other than those pre-packaged and labelled. |

13.3 The clause (ii) of explanation of notification No. 6/2022-Central Tax (Rate) has defined the meaning of ‘pre-packaged and labelled’. Clause (ii) of explanation is reproduced as under :-

‘(ii) The expression ‘pre-packaged and labelled’ means a ‘pre-packaged commodity” as defined in clause (1) of section 2 of the Legal Metrology Act, 2009 (1 of 2010) where, the package in which the commodity is pre-packed or a label securely affixed thereto is required to bear the declarations under the provisions of the Legal Metrology Act,2009 (1 of 2010) and the rules made thereunder. ‘

13.4 We find that the applicant supply its food product in packages (plastic bag) of pre-determined weight and have mandatory declarations which required as per the Legal Metrology Act,2009 (1 of 2010) and the rules made there under. Thus applicant intended supply of food products is pre-package and labelled where as the entry No. 101A of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 is applicable to the goods which are not pre-packaged and labelled. The entry No. 101A of the Notification before amendment w.e.f 18-7-2022 is applicable with regard to the un-branded packages means do not contain any brand name but after amendment with effect from 18-7-2022, the applicability of GST on the supply having/containing brand name was omitted and in this place applicability GST on the supply of pre-packaged and labelled was came into existence. As discuss above applicant supply of food products are pre-packaged and labelled, therefore applicant is not eligible to tax rate of GST @5% at entry No. 101A of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017

13.5 CBIC have issued FAQs on GST applicability on ‘pre-packaged and labelled’ goods from F. No. 190354/172/2022-TRU dated 17-7-2022 and relevant clarification of the FAQ is as follows :

| S. No. | Question | Clarification |

| 1. | What change has been made with respect to packaged and labelled commodity with effect from the 18th July, 2022? | Prior to 18th of July, 2022, GST applied on specified goods when they were put up in a unit container and were bearing a registered brand name or were bearing brand name in respect of which an actionable claim or enforceable right in a court of law is available. With effect from the 18lh July 2022, this provision undergoes a change and GST has been made applicable on supply of such “pre-packaged and labelled” commodities attracting the provisions of Legal Metrology Act, as detailed in subsequent questions. For example, items like pulses, cereals like rice, wheat, and flour (aata), etc., earlier attracted GST at the rate of 5% when branded and packed in unit container (as mentioned above). With effect from 18.7.2022, these items would attract GST when “pre-packaged and labelled”. Additionally, certain other items such as Curd. Lassi, puffed rice etc. when “pre-packaged and labelled” would attract GST at the rate of 5% with effect from the 18th July, 2022.

Essentially, this is a change in modalities of imposition of GST on branded specified goods to “pre-packaged and labelled” specified goods. [Please refer to notification No. 6/2022-Central Tax (Rate) and corresponding notification under respective SGST Act, IGST Act] |

| 2. | What is the scope of ‘pre packaged and labelled’ for the purpose of GST levy on food items like pulses, cereals, and flours? | For the purposes of GST, the expression ‘prepackaged and labelled ‘ means a ‘pre-packaged commodity’ as defined in clause (1) of section 2 of the Legal Metrology Act, 2009, where the package in which the commodity is pre packed, or a label securely affixed thereto is required to bear the declarations under the provisions of the Legal Metrology Act and the rules made thereunder. Clause (1) of section 2 of the Legal Metrology Act reads as below:

(1) “pre-packaged commodity ” me ans a commodity which without the purchaser being present is placed in a package of whatever nature, whether sealed or not, so that the product contained therein has a pre determined quantity. Thus, supply of such specified commodity having the following two attributes would attract GST: (i) It is pre-packaged; and (ii) It is required to bear the declarations under the provisions of the Legal Metrology Act, 2009 (1 of 2010) and the rules made there under. However, if such specified commodities are supplied in a package that do not require declaration(s)/compliance(s) under the Legal Metrology Act, 2009 (1 of 2010), and the rules made thereunder, the same would not be treated as prepackaged and labelled for the purposes of GST levy. In the context of food items (such as pulses, cereals like rice, wheat, flour etc), the supply of specified prepackaged food articles would fall within the purview of the definition of ‘pre-packaged commodity’ under the Legal Metrology Act, 2009, and the rules made there under, if such pre-packaged and labelled packages contained a quantity upto 25 kilogram [or 25 litre] in terms of rule 3(a) of Legal Metrology (Packaged Commodities) Rules, 2011, subject to other exclusions provided in the Act and the Rules made there under. |

13.6 We refer to Entry No. 46 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 of Schedule-II attracts GST Rate@ 12%

| 46 | 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form, other than those put up in unit container and,-

(a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or any enforceable right in respect of ‘such brand name has been voluntarily foregone, subject to the conditions as specified in the ANNEXURE]] |

13.7 The said entry was amended vide No. Not. No. 6/2022-CT (rate) dated 13-7-2022 w.e.f 18-7-22 vide Sr. No. (iii) of Schedule-II as under :

(iii) against S. No. 46, in column (3), for the portion beginning with the words “put up in ” and ending with the words and bracket “in the ANNEXURE] “, the words “, pre-packaged and labelled” shall be substituted;

13.8 Amended Entry No. 46 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 of Schedule-II and GST Rate @12% with effect from 18-7-2022 is read as under:

| 46 | 2106 90 | Namkeens, bhujia, mixture, chabena and similar edible preparations in ready for consumption form [other than roasted gram] [, pre-packaged and labelled] |

13.9 The above entry no. 46 is eligible for the supply of pre-packaged and labelled in terms of clause (ii) inserted in explanation of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017. We have already hold that the applicant intended supply of food product viz. salted and flavored Potato Chips, Potato Sev (Aloo Sev), Potato Chivda (Potato Salli Mixture), Sing Bhujiya. Sev Mamara (Roasted Puffed Rice with Nylon Sev), Chana Daal (Fried split Bengal Gram), Gathiya and Khatta Mitha Chevda Mixture is pre-packaged and labelled, therefore covers under entry No. 46 of of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 as amended vide Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 of Schedule-II attracts tax rate of GST @12% with effect from 18-7-2022.

We, now take up the question of determination of classification of potato starch and applicable tax rate of GST for discussion.

14.1 The applicant has own submitted that Potato Starch is produced as by-product during the manufacturing process of Potato Chips, Potato Sticks and Allo Sev. This Starch is converted into dry form by carrying out the certain manufacturing process which is shown in Para 2(ix) of the Ruling. We refer to CTH 1108 of Customs Tariff Act, 1975 in which Starches and Inulin are classified. CTH 1108 is read as under:

| 1108 | STARCHES; INULIN |

| – Starches : | |

| 1108 11 00 | — Wheat starch |

| 1108 12 00 | — Maize (corn) starch |

| 1108 13 00 | — Potato starch |

| 1108 14 00 | — Manioc (cassava) starch |

| 110819 | — Other |

| 1108 19 10 | — Sago |

| 11081990 | — Other |

| 1108 20 00 | – Inulin |

14.2 We find that the Potato Starch has specific entry in tariff and merits classification under CTH 11081300 of Customs Tariff Act, 1975.

14.3 Having determined the classification of potato starch, we refer to Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 as amended for tax rate of GST on supply of potato starch. Entry No. 18 Schedule-II (Tax Rate @12%) of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 as amended is reproduced as under :

Schedule-II (GST Tax Rate @12%)

| 18. | 1108 | Starches; inulin |

14.4 We hold that the applicant product ‘Potato Starch’ which is by-product of Potato and generate during the course of manufacture of Chips, Potato Sticks and Allo Sev, covers under entry No. 18 of Notification No 01/2017-Central Tax (Rate) – dated 26.06.2017 as amended and attracts tax rate @12% {CGST 6%+SGST 6% and IGST 12%}.

15. We, hereby pass the Ruling:

RULING

The tariff classification and GST Tax rate of the applicant products are as under :

| SI. No. | Name of the Product | Classification (HSN code) | GST Tax Rate |

| 1 | Salted and flavored Potato Chips | 21069099 | 12% {CGST6%+SGST6% & IGST 12%} |

| 2 | Potato Sev (Aloo Sev) | 21069099 | 12%{CGST6%+SGST6% & IGST 12%} |

| 3 | Potato Chivda (Potato Salli Mixture) | 21069099 | 12%{CGST6%+SGST6% &IGST 12%} |

| 4 | Sing Bhujiya | 21069099 | 12%{CGST6%+SGST6% & IGST 12%} |

| 5 | Sev Mamara (Roasted Puffed Rice mixed with Nylon Sev) | 21069099 | 12%{CGST6%+SGST6% & IGST 12%} |

| 6 | Chana Daal (Fried Split Bengal Gram) | 21069099 | 12%{CGST6%+SGST6% &IGST 12%} |

| 7 | Gathiya | 21069099 | 12%{CGST6%+SGST6% & IGST 12%} |

| 8 | Khatta Mitha Chevda Mixture | 21069099 | 12%{CGST6%+SGST6% & IGST 12%} |

| 9 | Potato starch | 11081300 | 12%{CGST6%+SGST6% &IGST 12%} |

*****

(Author can be reached at info@a2ztaxcorp.com)