Case Law Details

Raj Kumar Singh Vs Commissioner of Customs (CESTAT Allahabad)

CESTAT Allahabad held that penalty imposable for the act of smuggling of battery scrap by concealing the same with plastic scrap through un-notified route from Nepal. Accordingly, penalty upheld and appeal dismissed.

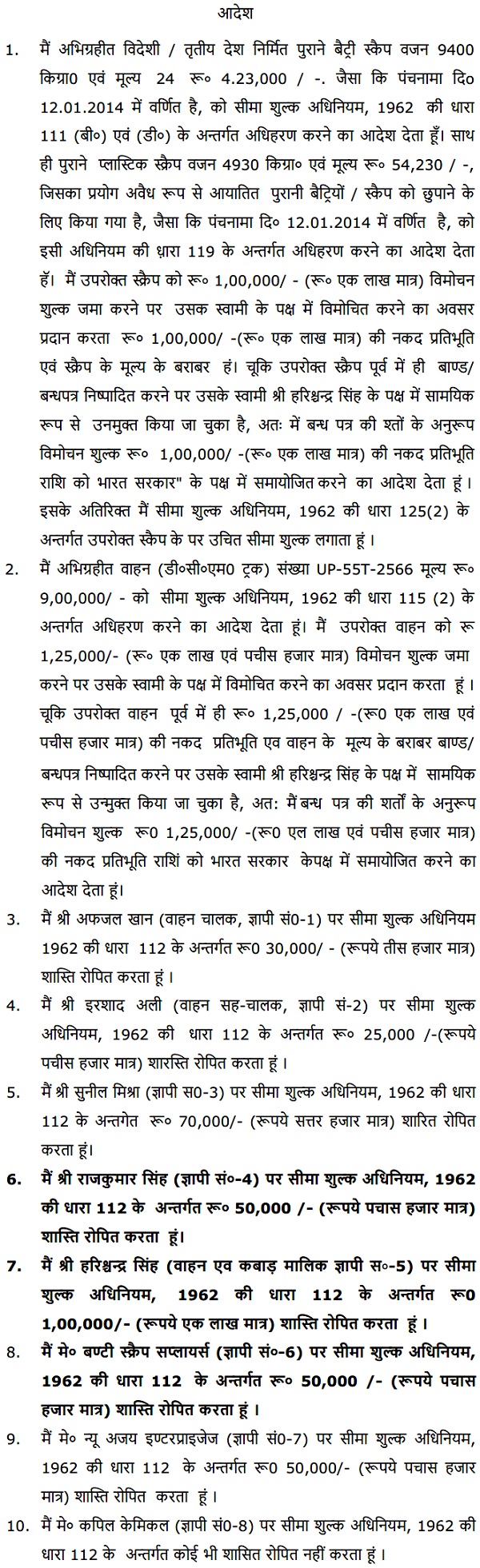

Facts- The officers of Gorakhpur Customs intercepted a vehicle bearing registration no. UP 55 T 2566 on the Basti-Bansi route near Rudhauli. The driver of the vehicle Shri Afzal Khan (Appellant-1) produced tax invoice No. 14 & 16 both dated 12.01.2014 issued by M/s Bunty Scrap Suppliers, Bansi, Siddharthnagar, whose proprietor is Appellant-2, showing sale of battery scrap and plastic scrap to buyers in Kanpur.

The driver also told that the goods were loaded on the vehicle at Shohratgarh at Indo-Nepal border. Shri Sunil Mishra s/o Shri Daya Ram Mishra Khunwa Bazar, Siddharthnagar, brought the impugned consignment from Nepal through unauthorized route near Khunwa and that the same was loaded on the truck in Shohratgarh. Owner of the vehicle is Shri Harish Chandra Singh and that the latter knows that the smuggled goods were being carried in the said vehicle. These facts have been confirmed by the co-driver of the vehicle Shri Irshad Ali, as recorded in the Panchnama dated 12.01.2014.

Thus, it appeared that the said scrap is liable to confiscation u/s. 111 and 119 of the said Act. The said vehicle also appeared liable to confiscation u/s. 115(2) of the said Act. Therefore, the scrap and the vehicle were seized u/s. 110 of the said Act.

Being aggrieved, the present appeal is filed.

Conclusion- Held that the impugned goods are smuggled goods smuggled through un authorized routes from Nepal. Appellant 1 who is the owner of the truck and the matser mind in the entire episode has been subjected to penalty of Rs 50,000/- as per the impugned order, which in our view is not excessive and needs to be upheld. On Appellant 2, who has provided the invoices to cover up the illegal transportation of the goods a penalty of Rs 50,000/- is imposed which also is not harsh, taking into account the fact that “battery scrap”, falls under the category of “Hazardous Goods”, to dangerous for the environment and eco system of our country.

FULL TEXT OF THE CESTAT ALLAHABAD ORDER

These appeals are directed against Order-In-Appeal No.384-386-CUS/APPL/ LKO/2018 dated: 19.07.2018 of the Commissioner (Appeals) Customs, GST & Central Excise Lucknow . By the impugned order, the Order-in-Original No. 32/2015, dated 17.03.2015 passed by Joint Commissioner, Customs, Lucknow holding as follows has been modified to the extent of setting aside the penalty on the appellant 1 as proprietor of the proprietorship firm on which the penalty has been imposed and reducing the penalty on appellant 2 to Rs 10,000/-

2.1 The officers of Gorakhpur Customs intercepted a vehicle bearing registration no. UP 55 T 2566 on the Basti-Bansi route near Rudhauli. The driver of the vehicle Shri Afzal Khan (Appellant-1) produced tax invoice No. 14 & 16 both dated 12.01.2014 issued by M/s Bunty Scrap Suppliers, Bansi, Siddharthnagar, whose proprietor is Appellant-2, showing sale of battery scrap and plastic scrap to buyers in Kanpur.

2.2 The driver also told that

> the goods were loaded on the vehicle at Shohratgarh at Indo-Nepal border.

> Shri Sunil Mishra s/o Shri Daya Ram Mishra Khunwa Bazar, Siddharthnagar, brought the impugned consignment from Nepal through unauthorized route near Khunwa and that the same was loaded on the truck in Shohratgarh.

> owner of the vehicle is Shri Harish Chandra Singh (Appellant-3 who is father of Appellant-2) and that the latter knows that the smuggled goods were being carried in the said vehicle. These facts have been confirmed by the co-driver of the vehicle Shri Irshad Ali, as recorded in the Panchnama dated 12.01.2014.

2.3 The said driver and co-driver in their statements dated 12.01.2014 under section 108 of the Customs Act, 1962 (the said Act) reiterated the above facts. The said statements have not been retracted.

2.4 In view of the above, it appeared that the said scrap is liable to confiscation under section 111 and 119 of the said Act. The said vehicle also appeared liable to confiscation under section 115(2) of the said Act. Therefore, the scrap and the vehicle were seized under section 110 of the said Act.

2.5 After completion of investigations a show cause notice dated 23.06.2014 was issued to the appellants and other concerned persons asking them to show case as to why:

2.6 The show cause notice was adjudicated as per the order in original referred in para 1 above. Aggrieved appellant filed the appeal before the First appellate authority which has been disposed as per the impugned order.

2.7 Aggrieved appellants have filed this appeal.

3.1 We have heard Shri Surabhi Sinha Advocate for the appellants and Shri A K Choudhary Authorized Representative for the revenue.

4.1 We have considered the impugned order along with the submissions made in appeal and during the course of arguments.

4.2 Impugned order records the findings as follows:

I have gone through the case record, As per the Panchnama dated 12.01.2014, the driver and the co-driver both disclosed on the spot that the impugned scrap was brought from Nepal by Shri Sunil Mishra s/ 0 Shri Daya Ram Mishra, Khunwa Bazar, Siddharthnagar, through unauthorized route near Khunwa and that the same was loaded on the truck in Shohratgarh This has been again confirmed by them in their respective statement under section 108 of the said Act. The said statements have not been retracted and, therefore, have evidentiary value. In view of the above, it is evident that the impugned scrap was improperly imported from Nepal through unauthorized route and that the owner of the vehicle knew about the smuggled nature of the goods which was being carried in his vehicle. Therefore, the confiscation of the impugned scrap and the vehicle is sustainable. However, in the facts and circumstances of the case, the amount of redemption fine on vehicle is reduced to Rupees twenty five thousand. Consequently, the penalty imposed under section 112 of the said Act is also justified. Nevertheless, separate penalty on proprietor cannot be imposed when the proprietorship concern has already been penalized. As penalty has already been imposed on M/s Bunty Scrap Suppliers, there is no justification for imposing penalty on its proprietor i.e. Appellant-2. Therefore the penalty imposed on the Appellant-2 is set aside. Further, in the facts and circumstances of the case, penalty on Appellant-1 is reduced to Rupees ten thousand and penalty on Appellant-3 is reduced to Rupees fifty thousand.

4.3 Order in original records the findings as follows:

“Exide- Sale for only Nepal, MxV Olta UKB Co. Ltd., Korea, CSB Battery (Guang Zhou) Co. Ltd., Made in China, YUASA corporation Made in Taiwan, SUNCA, sun Fat Cader & Sons Ltd., Honkong. GS Plus, Thailand”

4.4 The order in original has held Noticee No 1 to 7 to be responsible for the act of smuggling of battery scrap by concealing the same with plastic scrap, through un-notified route from Nepal. The case is based on the interception of the truck containing the said goods and on examination the goods were found to be battery scrap of third country origin concealed in the bags of plastic scrap. Both the driver and co-driver admitted about the goods being loaded in the truck by one Shri Sunil Mishra on the Nepal border, and gave other details in respect of the concealment and transpiration. They category stated that Shri Harischandra Singh (Appellant 1) who is the owner of truck had instructed them to load the said consignment from Siddharthnagar which was brought in tractor trolleys from Nepal through unauthorized routes. The above facts have been stated by them in their statement recorded under Section 108. These facts were also confirmed by Shri Sunil Mishra who had transported the goods from Nepal to India in his statement. None of these statements have been retracted at any time. In the case of Naresh J. Sukhawani [1996 (83) E.L.T. 258 (S.C.)] Hon’ble Supreme Court has observed as follows:

4. It must be remembered that the statement made before the Customs officials is not a statement recorded under Section 161 of the Criminal Procedure Code, 1973. Therefore it is a material piece of evidence collected by Customs officials under Section 108 of the Customs Act. That material incriminates the petitioner inculpating him in the contravention of the provisions of the Customs Act. The material can certainly be used to connect the petitioner in the contravention inasmuch as Mr. Dudani’s statement clearly inculpates not only himself but also the petitioner. It can, therefore, be used as substantive evidence connecting the petitioner with the contravention by exporting foreign currency out of India. Therefore we do not think that there is any illegality in the order of confiscation of foreign currency and imposition of penalty. There is no ground warranting reduction of fine.

4.5 In the case of K.I. Pavunny [1997 (90) E.L.T. 241 (S.C.)] Hon’ble Supreme Court has observed as follows

19. Next question for consideration is : whether such statement can form the sole basis for conviction? It is seen that, admittedly, the appellant made his statement in his own hand-writing giving wealth of details running into five typed pages. Some of the details which found place in the statement were specially within his knowledge, viz., concealment of the 200 biscuits in his earlier rented house till he constructed the present house and shifted his residence and thereafter he brought to his house and concealed the same in his compound; and other details elaboration of which is not material. The question then is : whether it was influenced by threat of implicating his wife in the crime which is the sole basis for the claim that it was obtained by threat by PW-2 and PW-5? In that behalf, the High Court has held that it could not be considered to be induced by threat that his wife will be implicated in the crime and accordingly disbelieved his plea. It is seen that admittedly after the appellant gave his statement, he was produced before the Magistrate though no complaint was filed and was released on bail. He did not complain to the Magistrate that Ex. P-4 statement was given under inducement, threat or duress. It was raised only subsequently making accusations against PW-5, the Inspector of Customs. Therefore, obviously it was only an afterthought. The High Court, therefore, rightly has not given any weightage to the same. It is true that the Magistrate has given various reasons for disbelieving the evidence of PW-3, the panch witness who had also, at one point of time, indulged in smuggling. It is unlikely that PW-3 would bring 200 gold biscuits of foreign marking and conceal them in the compound of the appellant without appellant’s knowledge for safe custody. It is not his case that he had facilitated PW-3 in concealing them in his compound. The place of concealment of the contraband is also significant at this juncture. It is just near and visible from the window of his bed-room through which he or family members could always watch anyone frequenting the place where the contraband was concealed. This fact becomes more relevant when we consider that after concealment of the contraband in the compound one would ensure that others having access to the compound may not indulge in digging and carrying away the same. As soon as the appellant and/or the members of his family had sight of such visitor or movement by others, they would immediately catch hold of such person or would charge them. Obviously, therefore, it would be the appellant who had concealed 200 gold biscuits of foreign marking in his compound at a place always visible from his bedroom window. Therefore, the High Court was right in its conclusion, though for different reasons, that Ex. P-4 is a voluntary statement and was not influenced by threat, duress or inducement etc. Therefore, it is a voluntary statement given by the appellant and is a true one.

26. In Naresh J. Sukhawani v. Union of India – 1996 (83) E.L.T. 258 (S.C.) = 1995 Supp. 4 SCC 663 a two-Judge Bench [to which one of us, K. Ramaswamy, J., was a member] had held in para 4 that the statement recorded under Section 108 of the Act forms a substantive evidence inculpating the petitioner therein with the contravention of the provisions of the Customs Act as he had attempted to export foreign exchange out of India. The statement made by another person inculpating the petitioner therein could be used against him as substantive evidence. Of course, the proceedings therein were for confiscation of the contraband. In Surjeet Singh Chhabra v. Union of India – 1997 (89) E.L.T. 646, decided by a two-Judge Bench to which one of us, K. Ramaswamy, J., was a member the petitioner made a confession under Section 108. The proceedings on the basis thereof were taken for confiscation of the goods. He filed a writ petition to summon the panch (mediater) witnesses for cross-examination contending that reliance on the statements of those witnesses without opportunity to cross-examine them, was violative of the principle of natural justice. The High Court had dismissed the writ petition. In that context, it was held that his retracted confession within six days from the date of the confession was not before a Police Officer. The Custom Officers are not police officers. Therefore, it was held that “the confession, though retracted, is an admission and binds the petitioner. So there is no need to call Panch witnesses for examination and cross-examination by the petitioner”. As noted, the object of the Act is to prevent large-scale smuggling of precious metals and other dutiable goods and to facilitate detection and confiscation of smuggled goods into, or out of the country. The contraventions and offences under the Act are committed in an organised manner under absolute secrecy. They are white-collar crimes upsetting the economy of the country. Detection and confiscation of the smuggled goods are aimed to check the escapement and avoidance of customs duty and to prevent perpetration thereof. In an appropriate case when the authority thought it expedient to have the contraveners prosecuted under Section 135 etc., separate procedure of filing a complaint has been provided under the Act. By necessary implication, resort to the investigation under Chapter XII of the Code stands excluded unless during the course of the same transaction, the offences punishable under the IPC, like Section 120B etc., are involved. Generally, the evidence in support of the violation of the provisions of the Act consists in the statement given or recorded under Section 108, the recovery panchnama (mediator’s report) and the oral evidence of the witnesses in proof of recovery and in connection therewith. This Court, therefore, in evaluating the evidence for proof of the offences committed under the Act has consistently been adopting the consideration in the light of the object which the Act seeks to achieve.

32. It is true that in criminal law, as also in civil suits, the trial Court and the appellate Court should marshal the facts and reach conclusion, on facts. In a criminal case, the prosecution has to prove the guilt beyond doubt. The concept of benefit of doubt is not a charter for acquittal. Doubt of a doubting Thomas or of a weak mind is not the road to reach the result. If a Judge on objective evaluation of evidence and after applying relevant tests reaches a finding that the prosecution has not proved its case beyond reasonable doubt, then the accused is entitled to the benefit of doubt for acquittal. The question then is : whether the learned Single Judge of the High Court has committed any error of law in reversing the acquittal by the Magistrate. Not every fanciful reason that erupted from flight of imagination but relevant and germane requires tested. Reasons are the soul of law. Best way to discover truth is through the interplay of view points. Discussion captures the essence of controversy by its appraisal of alternatives, presentation of pros and cons and review on the touchstone of human conduct and all attending relevant circumstances. Truth and falsity are sworn enemies. Man may be prone to speak falsehood but circumstantial evidence will not. Falsity is routed from man’s proclivity to faltering but when it is tested on the anvil of circumstantial evidence truth trans. On scanning the evidence and going through the reasoning of the learned Single Judge we find that the learned Judge was right in accepting the confessional statement of the appellant, Ex. P-4 to be a voluntary one and that it could form the basis for conviction. The Magistrate had dwelt upon the controversy, no doubt on appreciation of the evidence but not in proper or right perspective. Therefore, it is not necessary for the learned Judge of the High Court to wade through every reasoning and give his reasons for his disagreement with the conclusion reached by the Magistrate. On relevant aspects, the learned Judge has dwelt upon in detail and recorded the disagreement with the Magistrate and reached his conclusions. Therefore, there is no illegality in the approach adopted by the learned Judge. We hold that the learned Judge was right in his findings that the prosecution has proved the case based upon the confession of the appellant given in Ex. P-4 under Section 108 of the Evidence Act and the evidence of PWs 2, 3 and 5. The prosecution proved the case beyond doubt and the High Court has committed no error of law.”

4.6 On the basis of the objective evaluation of the evidences the authorities below have arrived at the conclusion that the impugned goods are smuggled goods smuggled through un authorized routes from Nepal. Appellant 1 who is the owner of the truck and the maser mind in the entire episode has been subjected to penalty of Rs 50,000/- as per the impugned order, which in our view is not excessive and needs to be upheld. On Appellant 2, who has provided the invoices to cover up the illegal transportation of the goods a penalty of Rs 50,000/- is imposed which also is not harsh, taking into account the fact that “battery scrap”, falls under the category of “Hazardous Goods”, to dangerous for the environment and eco system of our country.

4.7 We do not find any merits in these appeals. 5.1 Appeals are dismissed.

(Order pronounced in open court on-21 October, 2024)