Case Law Details

In re Anshul Life Sciences (CAAR Mumbai)

CAAR rule that pea protein merit classification under subheading 21061000 of the first schedule of the Customs Tariff Act, 1975.

FULL TEXT OF ORDER OF CUSTOMS AUTHORITY OF ADVANCE RULING, MUMBAI

M/s. Anshul Life Sciences, 401, 4th Floor, Jagdamba House, Peru Baug, Goregaon East, Mumbai- 400063 filed an application for advance ruling in terms of section 28H (1) of the Customs Act, 1962 (hereinafter referred to as the ‘Act’) before this authority, constituted under section 28-EA of the said Act read with Customs Authority for Advance Rulings, Regulations, 2021 [issued vide CBIC notification No. 01/2021-Customs (N.T.) dated 04.01.2021]. The application, based on the submissions of the applicant, was admitted.

2. The applicant seeks advance ruling in respect of the classification of ‘Pea Protein’ (hereinafter referred to as the ‘subject goods’), under Customs Tariff Act, 1975 (51 of 1975) as their supplier says HS code for pea protein is 2106 1000 and they need more clarity as protein substance is mentioned at 3504 0099 as well. The applicant submits that they propose to before import the subject goods through the sea port of Nhava Sheva, Mumbai Customs Zone-II and Air Cargo Complex, Sahar, Mumbai Customs Zone III. Accordingly, comments from the jurisdictional Principal Commissioner/Commissioner of Customs were invited in respect of the application for advance ruling in respect of the classification of subject goods. However, no comments were received from the jurisdictional Principal Commissioner/Commissioner.

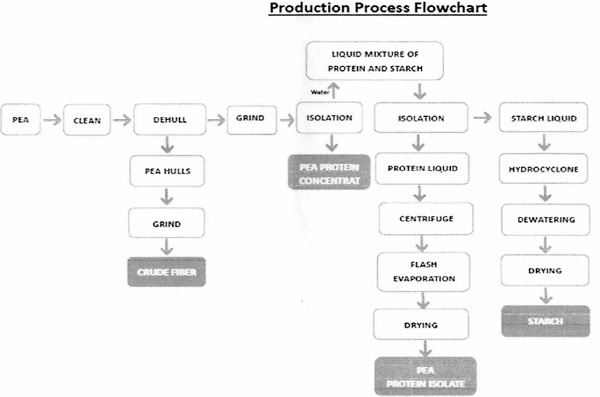

3. The personal hearing in the matter was conducted on 26.04.2022. Shri. Sushil Kumar Pahade alongwith Shri. Ramesh appeared on behalf of the applicant. Shri. Pahade informed that they have already imported a few consignments of pea protein through Nhava Seva port classifying it under subheading 21061000. They were asked to provide details of such prior imports along with B/E nos. & dates. He was also asked to provide the manufacturing process of pea protein. He explained that even though they had classified their earlier imports under chapter 21, they still have doubts whether the proper classification would be under chapter 35 and sought a few days’ time to submit the details of earlier imports as well as manufacturing process of pea protein. They have submitted the details of earlier imports of the said goods from Nhava Shelia port as well as the manufacturing process flow chart vide their e-mail dated 26th Apr’ 2022.

| Sr. No. | B/E No. | Date | Item name/ Pack size | Tariff no. | Qty | Supplier |

| 1 | 7489098 | 03-08-2018 | Pea Protein Powder 80% | 21061000 | 1280 | Yantai Oriental Protein Tech Co., Ltd. China |

| 2 | 7530465 | 06-08-2018 | Pea Protein Powder 80% | 21061000 | 2000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 3 | 9249949 | 14-12-2018 | Pea Protein Powder 80% | 21061000 | 2000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 4 | 9885582 | 01-02-2019 | Pea Protein Powder 80% | 21061000 | 3000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 5 | 5409682 | 23-10-2019 | Pea Protein Powder 80% | 21061000 | 2000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 6 | 6767630 | 05-02-2020 | Pea Protein Powder 80% | 21061000 | 4000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 7 | 2433694 | 20-01-2021 | Pea Protein Powder 80% | 21061000 | 2000 | Yantai Oriental Protein Tech Co., Ltd. China |

| 8 | 3914572 | 12-05-2021 | Pea Protein Powder 80% | 21061000 | 3000 | Yantai Oriental Protein Tech Co., Ltd. China |

4. Explanatory notes to chapter 7 provide that edible vegetables and certain roots and tubers are covered under chapter 7. Sub-note 3 provides that heading 07.12 covers all dried vegetables of the kinds falling in headings 07.01 to 07.11, other than:

(a) dried leguminous vegetables, shelled (heading 07.13);

(b) sweet corn in the forms specified in headings 11.02 to 11.04;

(c) flour, meal, powder. flakes, granules and pellets of potatoes (heading 11.05);

(d) flour, meal and powder of the dried leguminous vegetables of heading 07.13 (heading 11.06).

Heading 07.13 covers dried leguminous vegetables— shelled, whether or not skinned or split and Peas (Pisum sutivum) specifically is covered under sub-heading 10. This heading covers leguminous vegetables of heading 07.08 which have been dried and shelled, of a kind used for human or animal consumption (e.g., peas, chickpeas, Adzuki and other beans, lentils, broad beans, horse beans, guar seeds), even if intended for sowing (whether or not rendered inedible by chemical treatment) or for other purposes. They may have undergone moderate heat treatment designed mainly to ensure better preservation by inactivating the enzymes (the peroxides in particular) and eliminating part of the moisture; however, such treatment should not at affect the internal character of the cotyledon. The dried leguminous vegetables of this heading may be skinned or split. This heading excludes flour, meal and powder of dried shelled leguminous vegetables which are covered under heading 11.06.

Explanatory notes to chapter 1 I provide that heading 11.06 covers flour, meal and powder of the dried leguminous vegetables of heading 07 .13, of sago or of roots or tubers of heading 07.14 or of the products of Chapter 8. Further, sub-heading 1106.10 covers flour, meal and powder of the dried leguminous vegetables of heading 07.13. This heading includes the flour. meal and powder made from peas, beans or lentils; they are mainly used for prepared soups or purees. However, this heading does not cover soups and broths (whether in liquid, solid or powder form), with a basis of vegetable flours or meals which are covered under heading 21.04.

Explanatory notes to chapter 21 provide that heading 21.04 covers soups and broths and preparations therefor; homogenised composite food preparations.

2104.10 – Soups and broths and preparations therefor

2104.20 – Homogenised composite food preparations

It further provides that this category includes:

(1) Preparations for soups or broths requiring only the addition of water, milk, etc.

(2) Soups and broths ready for consumption after heating.

These products are generally based on vegetable products (vegetables, flour, starches, tapioca, pasta, rice, plant extracts, etc.), meat, meat extracts, fat, fish, crustaceans, molluscs or other aquatic invertebrates, peptones, amino acids or yeast extract. They may also contain a considerable proportion of salt. They are generally put up as tablets, cakes, cubes, or in powder or liquid form.

Since, the subject goods being protein powder/concentrates and a more specific heading 2106.10 provides for protein concentrates and textured protein substances, the said sub-heading also needs to be looked into.

5. Chapter 21 covers miscellaneous edible preparations. Further, the sub-note 4 to chapter notes state that heading 21.06 provides for food preparations not elsewhere specified or included.

2106.10 – Protein concentrates and textured protein substances

2106.90 -Other

Provided that they are not covered by any other heading of the Nomenclature, these heading covers:

(A) Preparations for use, either directly or after processing (such as cooking, dissolving or boiling in water, milk, etc.), for human consumption.

(B) Preparations consisting wholly or partly of foodstuffs, used in the making of beverages or food preparations for human consumption. The heading includes preparations consisting of mixtures of chemicals (organic acids, calcium salts, etc.) with foodstuffs (flour, sugar, milk powder, etc.), for incorporation in food preparations either as ingredients or to improve some of their characteristics (appearance, keeping qualities, etc.) (see the General Explanatory Note to Chapter 38).

However, the heading does not cover enzymatic preparations containing foodstuffs (e.g., meat tenderisers consisting of a proteolytic enzyme with added dextrose or other foodstuffs). Such preparations fall in heading 35.07 provided that they are not covered by a more specific heading in the Nomenclature.

The heading includes, inter alia:

(1) Powders for table creams,

(2) Flavouring powders for………………….

(3) Preparations based on butter ………………..

(4) Pastes based on sugar, etc.

(5) Natural honey enriched with bees’ royal jelly.

(6) Protein hydrolysates consisting mainly of a mixture of amino-acids and sodium chloride, used in food preparations (e.g., for flavouring); protein concentrates obtained by the elimination of certain constituents of defatted soya-bean flour, used for protein-enrichment of food preparations; soya-bean flour and other protein substances, textured. However, the heading excludes non-textured defatted soya-bean flour, whether or not fit for human consumption (heading 23.04) and protein isolates (heading 35.04).

6. Chapter 35 covers al buminoidal substances, modified starches, glues and enzymes. The heading 35.04 covers peptones and their derivatives; other protein substances and their derivatives, not elsewhere specified or included; hide powder, whether or not chromed.

This heading covers:

(A) Peptones and their derivatives.

(1) Peptones are soluble substances obtained when proteins are hydrolysed or submitted to the action of certain enzymes (pepsin, papain, pancreatin. etc.). They are usually white or yellowish powders and. being very hygroscopic, they are normally packed in airtight containers. Peptones may also be in solution. The main varieties are meat peptones, yeast peptones, blood peptones and casein peptones. They are used in pharmacy, in food preparations, for bacterial cultures, etc.

(2) Peptonates are derivatives of peptones. They are used principally in pharmacy; the most important are iron peptonates and manganese peptonates.

(B) Other protein substances and their derivatives, not covered by a more specific heading in the nomenclature, including in particular:

(1) Glutelins and prolamins….. being cereal proteins.

(2) Globulins, e.g., ….. (but see exclusion (d) at the end of the Explanatory Note).

(3) Glycinin, the main soya protein.

(4) Keratins obtained from hair, nails, horns, hoofs, feathers, etc.

(5) Nucleoproteids, being proteins combined with nucleic acids, and their derivatives.

(6) Protein isolates obtained by extraction from a vegetable substance (e.g., defatted soya bean flour) and consisting of a mixture of proteins contained therein. The protein content of these isolates is generally not less than 90 %.

7. Chapter 21 as discussed above covers miscellaneous edible food preparations or homogenised composite food preparations. Heading 2106.10 specifically includes protein concentrates and textured protein substances. Chapter 35 on the other hand covers albuminoidal substances, modified starches, glues, enzymes etc. Further, heading 35.04 covers peptones and their derivatives; other protein substances and their derivatives, not elsewhere specified or included; hide powder, whether or not chromed. The sub-note (B)(6) to the heading 35.04 provides for inclusion of protein isolates obtained by extraction from a vegetable substance and consisting of a mixture of proteins contained therein which is generally not less than 90 %. The flowchart provided by the applicant doesn’t provide complete information about the manufacturing process of the subject product. As per the information available on open sources, pea protein is obtained through a gentle water-based isolation process without the use of chemical solvent. It includes dry and liquid phases. First, during a dry process, the outer shell of the pea (essentially consisting of insoluble fibres) is removed by mechanical action. After grinding and milling, a flour retaining soluble fibres, starches and proteins, vitamins and minerals is obtained. Being water-soluble, pea proteins are therefore easily separated from fibre and starch by wet filtration and centrifugation. The next stage of the process is to precipitate the protein to its isoelectric point. It is then finally dry sprayed. The obtained isolate has a protein content of about 85 to 90%. It is marketed as such or can be modified to optimize its technical or nutritional properties through extrusion process. This allows to get pea protein crisp or texturized. Pea protein isolate is different from pea protein because of the chemical process it goes through to turn peas into pea protein isolate. Pea protein is simply the protein content found in peas, while pea protein isolate refers to the extracted protein created through a chemical process (described above) that separates protein from other elements of peas. Because of this characteristic, pea protein isolate is technically a processed food. However, the submitted flow chart doesn’t show any chemical process being carried out through the manufacturing process. Since, the protein content of the subject product, as per the product specification sheet, is less than 90 %, cannot be termed pea protein isolate to qualify to be classified under heading 35.04.

8. As per the GRI, classification of goods shall be governed by the following principles:

1. The titles of Sections, Chapters and sub-chapters are provided for ease of reference only; for legal purposes, classification shall be determined according to the terms of the headings and any relative Section or Chapter Notes and, provided such headings or Notes do not otherwise require, according to the following provisions:

2. (a) Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished, provided that, as presented, the incomplete or unfinished articles has the essential character of the complete or finished article. It shall also be taken to include a reference to that article complete or finished (or falling to be classified as complete or finished by virtue of this rule), presented unassembled or disassembled.

(b) Any reference in a heading to a material or substance shall be taken to include a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to goods of a given material or substance shall be taken to include a reference to goods consisting wholly or partly of such material or substance. The classification of goods consisting of more than one material or substance shall be according to the principles of rule 3.

3. When by application of rule 2(b) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) The heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to be regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) Mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to (a), shall be classified as if they consisted of the material or component which gives them their essential character, in so far as this criterion is applicable.

(c) When goods cannot be classified by reference to (a) or (b), they shall be classified under the heading which occurs last in numerical order among those which equally merit consideration.

4. Goods which cannot be classified in accordance with the above rules shall be classified under the heading appropriate to the goods to which they are most akin.

9. I have considered all the materials placed before me for the subject goods. I have gone through the submissions made by the applicant during personal hearing as well as the materials submitted through e-mail subsequently. In the absence of any comment from the jurisdictional Principal Commissioner/ Commissioner of Customs, on the impugned subject matter, I proceed to render an advance ruling based on the information supplied by the applicant and also information available on the open sources. As per the explanatory notes the sub-note (B)(6) to the heading 35.04 provides for inclusion of Protein isolates obtained by extraction from a vegetable substance and consisting of a mixture of proteins contained therein which is generally not less than 90 %. And as discussed in para 7 supra the subject product does not meet the criterion for classification under heading 3504. Further, the subject product is more akin to the description provided under 2106.10 -Protein concentrates and textured protein substances which merit classification under sub-heading 2106 1000 in view of the rule 4 of GRI.

10. In view of my aforesaid discussions, I rule that pea protein merit classification under subheading 21061000 of the first schedule of the Customs Tariff Act, 1975.