Important Terms for Real Estate Accounting

-Direct Cost

-Indirect Cost

-How to Book Sales.

-Revenue Recognition

-Closing Stock

What is Direct Cost ?

- A Guidance note issued by The ‘Institute of Chartered Accountants of India’ has clearly defined the Direct cost;

- A cost which is directly incurred on the specific project is called as direct cost or construction cost, examples are

(a) land conversion costs, betterment charges, municipal sanction fee and other charges for obtaining building permissions;

(b) site labour costs, including site supervision;

(c) depreciation of plant and equipment used for the project ;

(d) costs of moving plant, equipment and materials to and from the project site;

(e) costs of hiring plant and equipment;

(f) costs of design and technical assistance that is directly related to the project;

Exclusion from Direct Cost ?

(a) General administration costs;

(b) selling costs;

(c) research and development costs;

(d) depreciation of idle plant and equipment;

(e) cost of unconsumed or uninstalled material delivered at site; and

(f) payments made to sub-contractors in advance of work

Costs that may be attributable to project activity in general and can be allocated to specific projects

(a) insurance;

(b) costs of design and technical assistance that is not directly related to a specific project;

(c) construction or development overheads; and

(d) borrowing costs.

How to Recognise Revenue?

As per Guidance note project Revenue to be recognise only if following conditions are satisfied;

1. All critical approvals necessary for commencement of the project have been obtained. These include, wherever applicable:

(i) Environmental and other clearances.

(ii) Approval of plans, designs, etc.

(iii) Title to land or other rights to development/ construction.

(iv) Change in land use

2. Stage of completion reaches 25%.

3. At least 25% of the saleable project area is secured by contracts or agreements with buyers.

4. Atleast 10 % of the total revenue as per the agreements of sale or any other legally enforceable documents are realised at the reporting date in respect of each of the contracts

Illustration

| Total Salable Area of the project- | 20,000 sq. ft |

| Estimated Project cost(Including land cost of Rs.300 Lakhs)- | Rs. 600 Lakhs |

| Cost incurred till 31.03.2019- Land cost Rs.300 Lakhs | Rs. 360 Lakhs |

| Total area sold till 31.03.2019 | 5,000 sq. ft |

| Sale consideration as per agreement of sale | Rs. 200 lakhs |

| Amount Realised till 31.03.2019 | Rs. 50 lakhs |

| % of completion of work | 60% of Total Project cost and 20% of construction cost |

Illustration II

| Total Salable Area of the project- | 20,000 sq. ft |

| Estimated Project cost(Including land cost of Rs.300 Lakhs)- | Rs. 600 Lakhs |

| Cost incurred till 31.03.2019- Land cost Rs.300 Lakhs | Rs. 390 Lakhs |

| Total area sold till 31.03.2019 | 5,000 sq. ft |

| Sale consideration as per agreement of sale | Rs. 200 lakhs |

| Amount Realised till 31.03.2019 | Rs. 50 lakhs |

| % of completion of work | 65% of Total Project cost and 30% of construction cost |

Answer

The entity would be able to recognise revenues at the end of the accounting period. The revenue recognition and profits would be as under:

Revenue recognised Rs. 130 Lakhs

(65 % of Rs. 200 lakhs being the fair value of receivable)

Proportionate cost (5000 sft./20,000 sft.) X 390 Rs. 97.50 Lakhs Income from the project Rs. 32.50 Lakhs Work in progress to be carried forward Rs. 292.50 Lakhs

An overview on “MAHA RERA”

What is Real Estate ?

Real estate is the property, land, buildings, air rights above the land and underground rights below the land. The term real estate means real, or physical, property. “Real” comes from the Latin root res, or things. Others say it’s from the Latin word rex, meaning “royal,” since kings used to own all land in their kingdoms.

- Types of Real Estate- a) Residential Real Estate

b) Commercial Real Estate

c) Industrial Real Estate

d) Land

RERA

- Meaning of Real Estate

- Important terms in Real Estate

- Real Estate Regulatory Authority.

- Why RERA?

- Coverage of RERA

WHY RERA ?

- To keep controls and overview on Real Estate projects.

- To protect consumer(Home Buyer) interest.

- To bring some sort of system while developing real estate project.

- Avoid misuse of money to be received from Home Buyers.

Difference between Builders & Developers

What is Real Estate ?

Real estate is the property, land, buildings, air rights above the land and underground rights below the land. The term real estate means real, or physical, property. “Real” comes from the Latin root res, or things. Others say it’s from the Latin word rex, meaning “royal,” since kings used to own all land in their kingdoms.

- Types of Real Estate- a) Residential Real Estate

b) Commercial Real Estate

c) Industrial Real Estate

d) Land

- RESIDENTIAL REAL ESTATE-— includes both new construction and resale homes. The most common category is single-family homes. There are also condominiums, co-ops, townhouses, duplexes, triple-deckers, quadplexes, high-value homes, multi-generational and vacation homes.

- COMMERCIAL REAL ESTATE — includes shopping centers and strip malls, medical and educational buildings, hotels and offices. Apartment buildings are often considered commercial, even though they are used for residences. That’s because they are owned to produce income.

- INDUSTRIAL REAL ESTATE includes manufacturing buildings and property, as well as warehouses. The buildings can be used for research, production, storage and distribution of goods. Some buildings that distribute goods are considered commercial real estate. The classification is important because the zoning, construction and sales are handled differently.

- LAND includes vacant land, working farms and ranches. The subcategories within vacant land include undeveloped, early development or reuse, subdivision and site assembly. Here’s more at Land Broker Transactions.

Important Terms In Real Estate

- Land-As discussed Above, an Immovable property.

- Land Owner- A person who owns the land with clear title.

- Builder/Developer-As discussed Above

- Proposed plan- A plan which was designed by Architect is proposed or submitted to concern authorities (Ex. BMC, MMRDA etc) to get it sanction in order to carry out construction activities.

- Sanction plan- A proposed plan which is sanction by concerned authorities after due diligence is called sanction plan and hence construction activities will be carried out as per sanction plan.

- Commencement Certificate-After proposed plan get sanctioned concern authority issues a certificate in order to carry out actual construction Activities is called Commencement certificate. Please note that work should commence as per terms and conditions mentioned in CC.

- Carpet Area: Carpet area is the area that can be used to spread a carpet inside the house.

It is the net usable area of the apartment. It includes the thickness of the internal wall but excludes balcony or terrace. Technically, the distance between inner walls is carpet area. Also, it will include staircase only if it is inside the apartment, but balcony, lift, lobby, etc. will not include in carpet area. - Built Up Area: Built-up area is the carpet area plus the area covered by walls. The built up area includes balconies, terraces (with or without roof), mezzanine floors and other detachable habitable areas such as servant room, etc. You should also know that walls which are shared with other units are factored in at 50 per cent while other walls are computed fully.

- Super built up area: Built up Area+ Common Area.

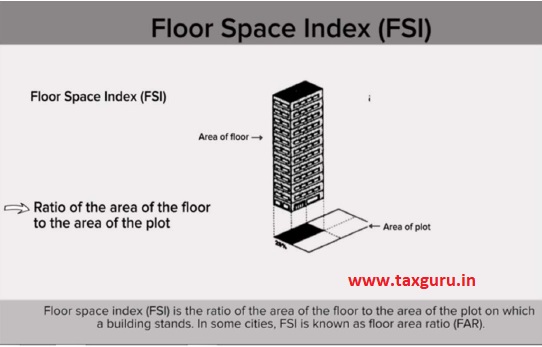

FSI (Floor Space Index): FSI = Floor Space Covered in all floors / Area of the plot

- Let say, your zone FSI is 1.5 for special buildings. Now you can build (2000*1.5) 3000 Sq.ft covered area on your It can be either 2 floors of 1500 sq.ft or 3 floors of 1000 sq.ftwithoutaffecting other municipal rules.

- Completion Certificate: It is the certificate issued by local authority or concern authority which is proofthat construction activities has been completed as per sanction plan.

- Occupancycertificate: It isthe certificate issued bylocalauthorityor concern authoritywhich is proof that building is readyto occupy.

- TDR (Transferable Development Rights) : Itis the rights given to the builder or developer in consideration or in exchange of area given by builder or developer to the government or other governmental authorities in order to carry out public services.

- Engineer: a person who holds professional degree to keep an eye on the development work. he ensure that work is carrying out as per sanction plan and he also ensures that quality of work is not harmful to the environmentas well as homebuyer.

Real Estate Regulatory Authority

- It is a board or authority established under the act passed by parliament of India as on 10th March 2016 with main intention of to protect home-buyers as well as help boost investments in the real estate industry. This act came in force from 1st may2016.

- Applicability:The Real Estate Act makes it mandatory for all commercial and residential real estate projects where the land is over 500 square metres, or eight apartments.

- Is it applicable to on going projects? – Yes, provided CC is not received.

- What next to do once we know the applicability? – we have to get project registered under RERA through its website within 30 days of start of project-

https://maharerait.mahaonline.gov.in/.

- What if not register?: There is penalty upto 10% of project cost.

- List of Documents to get registered:

| Status | Document |

| Proprietor | KYC, Copy of Legal Title report, joint development agreement, Certificate of encumbrances, Sanction Plan, Proposed Plan, FSI Details, Proposed Number of Buildings to constructed, Number of Parking, Engineer, Architect and CA certificate, Form B, details of Designated Bank A/c, expected project completion Date, Draft Allotment letter and Agreement for sale. |

| Partnership Firm | KYC of all Partners, Copy of Legal Title report, joint development agreement, Certificate of encumbrances, Sanction Plan, Proposed Plan, FSI Details, Proposed Number of Buildings to constructed, Number of Parking, Engineer, Architect and CA certificate, Form B ,details of Designated Bank A/c ,Draft Allotment letter and Agreement for sale. |

| Company | KYC of all directors, Copy of Legal Title report, joint development agreement, Certificate of encumbrances, Sanction Plan, Proposed Plan, FSI Details, Proposed Number of Buildings to constructed, Number of Parking, Engineer, Architect and CA certificate, Form B, Details of Designated Bank A/c, Draft Allotment letter and Agreement for sale. |

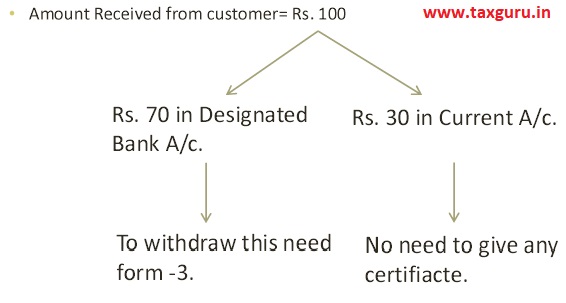

Designated Bank Account

- As per RERA act every Promoter who get himself registered under RERA needs to open a separate bank account called “Designated Bank Account”. Out of all the money received from home buyer promoter needs to deposit 70% of such amount in designated bank a/c. he can retain 30% amount to carry out admin cost. To withdraw 70% amount promoter need to submit CA certificate in form 3.

Mode of operation of designated bank A/c.

- Open 3 bank accounts:

FAQ’s On Designated Bank A/c

- Do I need to deposit Taxes collected from customer in this A/c?

- Is Designated a/c is like Escrow A/c?

- Do I need to give CA certificate on every withdrawal?

- For what purpose I can use money withdraw from designated A/c?

- What if project is completed and excess money is still in bank A/c?

Compliances to be done by promoter

- Quarterly update on project status by updating it on MAHA RERA Website.

- Uploading documents(CA ,Engineer & Architect Certificate) on website.

- Quarterly uploading of form 2A where the engineer supervising the project construction will have to certify that the quality of the construction is as per national building code norms.

- Yearly Audit within 6 months from the end of the year( Form 5 to be issued by statutory Auditor).

Joint Development Agreement

Key Highlights of RERA

- Compulsory registration for builder (Promoters)

- If failed to get registered within time allow-penalty upto 10% of the project cost.

- No advertisement allow to do for project without RERA number.

- Once the plan get sanction from approved authorities builder can not amend the plan unless and until he received consent from 2/3rd allotees of the project. Important to note that count of 2/3rdallotees does not include flats owned by Promoters, multiple flats owned by single owner.

- Promoter is abide to provide all the facilities as mention in broacher, any false information may lead to penal cause to promoter.

- Promoter make sure that he form a society for flat owners and also make sure

that he takes care of project for next 5 years even after completion the project. - Promoter compulsory enter into an Agreement of sale with buyer once he received amount which is more than 10% of flat cost. also need to register AOS by paying full stamp duty.

Precautions to be taken by Home Buyer

- Check RERA registration before booking of flat.

- Do not pay more than 10% of flat cost as booking or allotment money unless entering into agreement with builder.

- Ask for all requisite documents from builder viz. Title report, proposed and sanctioned plan, Layout plan, commencement certificate etc.

- Home buyer should check that agreement of sale or sale deed is as per Model

- He should visit site on regular basis.

- Ask for interest amount from builder for delay in giving possession.

- If any discrepancy found in project work, buyer reserved all the rights to lodge complain against promoter by paying nominal fees of Rs. 500/-.

Real Estate Agents

- This act is applicable to real estate agents also. An agent can not carry out any agency activity without getting himself register under RERA.

- Fees for registration is Rs. 10,000/- for Individuals and Rs.1,00,000/- for others.

- Documents for registration-

- KYC

- ITR of last 3 Years.

- Authenticated copies of all letter heads.

- Rubber stamp.

- Images proposed receipt to be used.

Statistic

- Chairman- Mr. Gautam Chatterjee

- Total Number of Projects in Maharashtra- 20,801

- Projects registered and completed- 4,074

- Projects registered but not completed- 16,556

- Projects yet to be registered- 171 ******************************************************************

- Total number of complaints received by RERA- 6,710

- Order passed- 4,325

- In process- 2,385

In the ERA of RERA don’t take chances instead take precautions since RERA has imposed penalty on 1716 promoters for delayed registration of project which is Amounted to Rs. 19 crores approx.

RERA REGISTRATION FEES PAID OF 2.50 LACS

BY COMPANY

BEING AN AGENT

WHAT WILL BE ACOOUNTING ENTRY

rera Cartifacted fess in which group and how to entry in tally prime

It’s Direct cost and group it as development cost paid to professional

Very detailed explanation..thanx

the developer has sale flat but party has given the advance before sailing by developers

Not understood your query

Can customers do audit or investigation of builders designated accounts ? since there’s endless delay by builder for flat and there’s no sign of amenities

Do I need to deposit Taxes collected from customer in RERA A/c?

Payment of RERA Registration Fee is based on Area of Land. So Fees should be paid on Land Area or Built -up Area i.e total of each floors of flat.?

What if the project gets delayed due to situations like current lock down ?

Thanks for sharing this wonderful content. Keep it up.

Waiting for more article’s from you.

Very nice articles…

Brief explanation given..