Running a company smoothly is a difficult task! Handling finances and meeting various statutory compliances is no exception. Post – incorporation, a company must comply with various mandatory compliances under different laws. In case of non-compliance, strict penalties, interest, fines, and fees are imposed. As a quick reference, I have broadly listed major legal compliances that are required for a newly incorporated company, so you can start with compliance as early as possible.

I. Compliances under Companies Act, 2013

1. Declaration for Commencement of Business: Form INC -20A

- Time Limit: Within 180 daysfrom the date of incorporation.

- Consequences of non-compliance:

- Cannot commence business / borrow money.

- Additional fees (up to 12x of normal fees)

- Penalty for Company: INR 50,000

- Penalty for officers in default: INR 1,000 per day(max INR 1,00,000)

2. First Board Meeting

- Time Limit: Within 30 daysfrom the date of incorporation.

- At the first board meeting, the directors must disclose their interest in any company, firm or other association of individuals, by giving a notice in writing in Form MBP 1.

3. Appointment of Statutory Auditor and filing Form ADT-1

- Firstauditor to be appointed within 30 days from date of incorporation.

- Form ADT -1 is filed to intimate Registrar of Companies (RoC) about auditor appointment.

- Time limit to file Form ADT – 1 is 15 days from the date of appointment of the auditor.

- Form ADT-1 is optionalin case of appointment of first statutory auditor but

- Auditor for subsequentyears (for a term of 5 years) is appointed at an AGM and filing of Form ADT -1 (within 15 days of appointment) is

4. Issuance of share certificates

- Time Limit: Within 2 months from the date of incorporation.

- Consequences of non-compliance:

- Penalty for Company: INR 50,000

- Penalty for every officer in default: INR 50,000

5. Annual General Meeting

- Applicability: Every Company, other than One Person Company (OPC)

- Time Limit:

- First AGM: within 9 monthsfrom the close of the first financial year (FY) (i.e., 31st December)

- Subsequent AGM: within 6 monthsfrom FY end. (i.e., 30th September)

- The time gap between 2 AGMs should notbe more than 15 months.

- Notice: 21 clear days’ notice

- Documents to be laid before members in AGM: Financial statements along with Director’s Report.

- Consequences of non-compliance:

- Fine for Company: up to INR 1,00,000

- Fine for every officer in default: up to INR 1,00,000

- In case of continuing default:additional INR 5000 per day

6. Preparation of Annual Financial Statements and filing Form AOC -4

- Every Company needs to prepare and file its financial statements with RoC in Form AOC-4 every year.

- Time Limit:

- Companies other than OPC: 30 daysfrom date of AGM

- OPC: 180days from close of FY

- Consequences of non-compliance:

- Late fees: INR 100 per day+ additional fees for eForm.

- Penalty for Company: INR 10,000and in case of continuing default further penalty of INR 100 per day (maximum of INR 2,00,000)

- Penalty for MD & CFO/other officer: INR 10,000and in case of continuing default further penalty of INR 100 per day (maximum of INR 50,000)

7. Filing of Form MGT -7 (Annual Return)

- Applicability: Every Company

- Time Limit:

- Companies other than OPC: 60 daysfrom date of AGM

- OPC: 240days from close of FY

- Consequences of non-compliance:

- Late fees: INR 100 per day+ additional fees for eForm.

- Penalty for Company: INR 10,000and in case of continuing default further penalty of INR 100 per day (maximum of INR 2,00,000)

- Penalty for every officer: INR 10,000and in case of continuing default further penalty of INR 100 per day (maximum of INR 50,000)

8. DIN E-KYC (filing of Form DIR – 3 KYC)

- Applicability: Every person who is allotted a DIN and status of DIN is shown as ‘approved’

- Time Limit: 180 daysfrom the end of FY (i.e. 30th September of succeeding FY)

- Consequences of non-compliance:

- DIN is marked as ‘de-activated.

- To re-activate, Form DIR -3KYC to filed with fees of INR 5,000.

9. Others

- Board Meetings: Minimum 4 Board Meetings to be held every year with not more than 120 days’ gap between two meetings.

- Maintenance of all financial records – Bookkeeping and Accounting.

- Maintenance of secretarial documents like Notices, Minutes, Board and Shareholder Resolutions, statutory registers like Shareholder register, Related Party Transaction register etc.

- Filing of other forms like Form DPT -3 (for deposits taken, time limit: 90 days from the end of FY), MSME -1 (for transactions with MSME).

II. Compliances under Income-tax Act, 1961

1. Advance Tax

- Meaning: Income Tax needs to be paid in advance during the financial year instead of lump sum payment at year-end. This is known as pay tax as you earn.

- Applicability: if total tax payable (on estimated total income) for the financial year is ≥INR 10,000

- Amount payable and Due Date:

| Due Date | Advance Tax Payable (cumulative) |

| On or before 15th June | 15% of estimated total tax liability for that FY |

| On or before 15th September | 45% of estimated total tax liability for that FY |

| On or before 15th December | 75% of estimated total tax liability for that FY |

| On or before 15th March | 100% of total tax liability for that FY |

- Consequences of non-compliance (no payment/ short payment):

- Assessee (the company) deemed as ‘Assessee in default’ and recovery proceedings can be initiated.

- Interest u/s 234B:if payment of advance tax by Assessee (the company) is less than 90% of the total tax liability, then it will be liable for interest @ 1% p.m. or part of the month from 1st April till the date of payment of tax.

- Interest u/s 234C:if the advance tax paid in any instalment(s) is less than the prescribed percentage of instalment amount, interest is levied @ 1% p.m. for the period of default as illustrated in the table below:

| Instalment and Due Date | % of total tax payable (cumulative) | Int. u/s 234C levied if advance tax deposited is less than below % of total tax payable | Period of default |

| I – 15th June | 15% | 12% | 3 months |

| II – 15th Sept | 45% | 36% | 3 months |

| III – 15th Dec | 75% | 75% | 3 months |

| IV- 15th March | 100% | 100% | 1 month |

2. Tax Deduction at Source (TDS) and Tax Collection at Source (TCS)

A. Tax Deduction at Source (TDS)

-

- TDS compliances are one of the most important and any non-compliance leads to several detriments (tax deduction not given for payments made along with interest, fees and penalty being levied).

- TDS is not applicable on all payments, but only on specific payments and for amounts greater than threshold limits which are mentioned under the Income Tax Act (there are more than 30 specific payments). So, it is wise to check TDS applicability before making any payment.

- Most common payments that require tax deduction at source:

- Salary Payments (Sec 192)

- Payment to Contractors (Sec 194C)

- Payment to professionals/ freelancers (professional fees) (Sec 194 J)

- Payment of Commission or Brokerage (Sec 194H)

- Rent Payments (Sec 194-I)

- Payment to Non-Residents (Sec 195)

The complete list of payments subject to TDS, applicable rates, and threshold limits can be downloaded from – https://icmai.in/upload/Taxation/RATES_2020_21.pdf

- Compliancesattached to TDS and consequences of non-compliance:

(i) Monthly payment of TDS:Once tax is deducted, the deductor (payer) needs to deposit the TDS to the government monthly. TDS must be deposited using Challan ITNS-281. Below are the due dates for making payment of tax deducted:

| Tax deducted during | TDS to be deposited by |

| First 11 months i.e., April to Feb | 7th of the NEXT month |

| Last month i.e., March | 30th April |

-

- If tax was not deducted, simple interest @ 1% p.m. or part of the month is levied starting from the date on which tax was deductible till the date of deduction of tax.

- If there is a delay in depositing TDS, simple interest @ 1.5% p.m. or part of the month is levied for the period of default. This means even a delay of 1 day will attract interest for the whole month (i.e., 1.5% for the month)

-

- In case of failure to deduct or failure to pay the tax deducted, further legal consequences can be:

> Penalty equal to the amount of tax not deducted / not deposited can be levied.

> Can also lead to prosecutionleading to imprisonment ranging between 3 months to 7 years.

> Disallowanceof expenses – either 100% disallowance or 30% disallowance

(ii) Quarterly TDS Statements: A person who is required to deduct tax at source is required to file quarterly statements (returns) of TDS. There are different forms for different types of payments (Form 24Q – salary payments; Form 26Q – other than salary payments, Form 26QB – for purchase of immovable property; Form 27Q –payments other than salary to non-residents). Below are the due dates for TDS Statements:

| Quarter | Due date |

| Q1 (April to June) | 31st July |

| Q2 (July to Sept) | 31st October |

| Q3 (Oct to Dec) | 31st January |

| Q4 (Jan to March) | 31st May |

-

- Any delay in filing of TDS statements attracts fees of INR 200 per dayof default (however, fees shall not exceed the amount of TDS)

- Penalty can also be levied which can be in the range of INR 10,000 to INR 1,00,000.

- Issuance of TDS Certificates: It is the responsibility of every tax deductor to issue TDS certificates to the payee in the prescribed form. Frequency and time limit to issue different types of TDS certificates is given below:

| Form | Nature of payment covered | Frequency | Due Date |

| Form 16 | Salary payments | Annually | 15th June of next F.Y. |

| Form 16A | All other payments | Quarterly | Q1 – 15th Aug

Q2 – 15th Nov Q3 – 15th Feb Q4 – 15th June of next F.Y. |

| Form 16B | Immovable property purchase | Transaction dependent | Within 15 days of filing TDS return for the same |

-

- If TDS certificates are not issued within the time limit, a penalty of INR 100 per dayis levied.

B. Tax Collection at Source (TCS)

- In the case of TCS, the seller must collect an amount in addition to the sale value from the purchaser as tax and deposit the tax so collected with the government. Like TDS, there are specific transactions to which TCS provisions are applicable.

- Compliances attached to TCS and consequences of non-compliance:

(i) Monthly payment of TCS:Once tax is collected, the collector(seller) needs to deposit the TCS to the government monthly. The due date for depositing the amount of tax collected is 7 days from the end of the month in which tax was required to be collected.

-

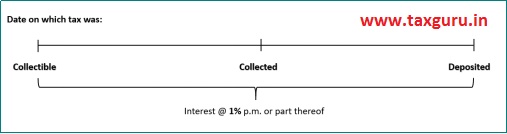

- If tax was not collected, simple interest @ 1% p.m. or part of the month is levied starting from the date on which tax was collectible till the date of deposit of tax.

-

- In case of failure to collect or failure to pay the tax collected, further legal consequences can be:

> Penalty equal to the amount of tax not collected / not deposited can be levied.

> Can also lead to prosecution leading to imprisonment ranging between 3 months to 7 years.

(iii) Quarterly TCS Statements: A person who is required to collect tax at source is required to file quarterly statements (returns) of TCS in Form 27D. Below are the due dates for TCS Statements:

| Quarter | Due date |

| Q1 (April to June) | 15th July |

| Q2 (July to Sept) | 15th October |

| Q3 (Oct to Dec) | 15th January |

| Q4 (Jan to March) | 15th May of next F.Y. |

-

- Any delay in filing of TCS statements attracts fees of INR 200 per dayof default (however, fees shall not exceed the amount of TCS)

- Penalty can also be levied which can be in the range of INR 10,000 to INR 1,00,000.

3. Computation of Total Income and Filing of Income – Tax Return

- Applicability: Every company registered in India must file Income Tax return irrespective of any income, profit, or loss. Even the dormant companies with no transactions are required to file the return.

- The companies file their Income Tax Return in ITR-6.

- Due Date:

- Companies to whom Transfer Pricingprovisions apply (TP Report): 30th

- Other Companies: 31st

- Consequences of non-compliance:

- Fees levied for delay in filing ITR

> ROI filed till 31stDecember: INR 5,000

> ROI filed beyond 31stDecember: INR 10,000

> If Total Income < 5 Lakhs: INR 1,000 (irrespective of date of filing return)

- Interest @ 1% p.m. or part thereof levied on amount of unpaid tax u/s. 234A (in addition to interest u/s. 234B)

- Certain losses of the past shall lapse and shall not be carried forward to next year.

- Ineligible to claim various deductions under chapter VI-A.

- Assessment proceedings, other penalties and prosecution can be initiated based on the circumstances of case.

4. Others

- Tax Audit u/s 44AB: If turnover exceeds a specified threshold amount (INR 1 crore / INR 5 crore depending on whether cash receipts/ cash payments are > 5% of total receipts/payments), tax audit is applicable and an audit report from CA is mandatory. In case of non-compliance / delay in filing tax audit report, a penalty of 5% of turnover(subject to maximum INR 1,50,000) is levied.

- Transfer Pricing: If transfer pricing provisions are applicable, transfer pricing report from an accountant is required & specified documents/ information has to be maintained. Failure to furnish transfer pricing report attracts a penalty of INR 1,00,000. Failure to maintain appropriate documentation attracts a penalty of 2%of the value of international transactions.

- Report/ Certificate from CA may be required for claiming few deductions/exemptions.

- Valuation Report from CA or merchant banker may be required in certain cases.

III. Compliances under Goods and Services Tax (GST) Act

1. Registration

- Voluntary Registration: Companies opt for voluntary registration, even though the turnover is below specified limits due to advantages like:

- Claim input tax credit (ITC) of taxes paid on purchases/procurements and can utilize the same for payment of taxes due on supply of goods or services.

- Most corporates prefer dealing with suppliers who are GST registered as it ensures seamless flow of ITC.

- Banks and financial institutions lend working capital loans at lower rates as they are in a better position to determine cashflows based on GST returns data.

- Registration on crossing specified Turnover:There are three limits of turnover mentioned i.e. INR 10 lakhs, INR 20 Lakhs and INR 40 Lakhs. The turnover limit applicable will depend upon the state of registration and whether the supply consists of goods only or services only or a combination of both.

- Compulsory Registration:Compulsory registration is required in certain cases such as inter-state suppliers, casual taxable persons, persons required to deduct TDS / collect TCS under GST, E-commerce operators, commission agents etc.

- Penalty of 100% of the tax due or INR 10,000– whichever is higher, is levied in case of failure to register under GST.

2. GST Returns and Payment

- Return filing is mandatory under GST. Even if there is no transaction, you must file a NIL return. There are various returns to be filed on a monthly/quarterly/annual basis depending on the nature of the business.

- The common returns are:

- GSTR -1 / IFF: for outward supplies of goods and services,

- GSTR -3B: self-declaration of all outward supplies made, input tax credit claimed, tax liability ascertained, and taxes paid.

- Tax liability has to be paid before filing GSTR -3B.

- Consequences of non-compliance:

- Cannot file a return if you do not file the previous month/quarter’s return. Hence, late filing of GST return will have a cascading effect leading to heavy interest, fees, and penalty.

- In case of delay in making payment of taxes due, interest @ 18% p.a. is levied.

- Delay in filing GST Returns attracts a late filing fee of INR 50 per day (max INR 5000)

3. Others

- Determining HSN/SAC and charging appropriate GST rate on supplies

- Proper invoicing of outward supplies / obtaining LUT for exports

- Maintenance of records for correctly claiming ITC (Reconciliation with GSTR -2A)

For any queries or assistance required on these compliances, you can reach me at cakaranthakkar@gmail.com. In case of any suggestions, please drop a comment below.

I found your article on post-incorporation tax and legal compliances for private limited companies very informative and helpful. It’s essential for any company to stay compliant with the various regulations and laws, and your article does an excellent job of highlighting the key areas that private limited companies need to focus on.

The checklist you’ve provided is quite comprehensive and covers all the important aspects, such as obtaining a PAN and TAN, registering for GST, filing annual returns, and conducting regular audits. As you mentioned, non-compliance with these regulations can lead to penalties and legal repercussions, so it’s crucial to stay on top of them. Your article provides valuable guidance for private limited companies and is a great resource for anyone looking to ensure compliance with various tax and legal regulations. Thank you for sharing your knowledge and expertise.

Very well explained Karan. Thanks for such a nice article.

nice article. it is very usefull