Introduction

The Employees’ Provident Fund Organisation (EPFO) is among the world’s largest social security organizations, known for providing social security coverage to the organized sector. As part of their initiative to further enlighten employers and employees about their rights, duties, and the services offered by the EPFO, the organization has rolled out two guide booklets. This article dives deep into understanding these guides and their significance.

Origin & Purpose of the Guides

The Guide Booklets for both Employees & Employers were officially launched on the 70th Foundation Day of EPFO, i.e., 15th November 2022. These guides were not merely meant as a formality, but they were meticulously curated to offer a comprehensive understanding of the EPFO services. The purpose is clear: to inform and educate about the rights, duties, and FAQs concerning the EPFO’s offerings.

Content & Availability

The booklets are available in multiple languages including English, Hindi, and various regional languages, making it accessible for a diverse group of readers across the nation. For easy accessibility, they are hosted on the EPFO website:

Promotion & Awareness

The EPFO, understanding the importance of these guides, has taken active measures to ensure that they reach the intended audience. Various officials, ranging from the ACC (HQ & Zones) to the RPFCs, have been advised to promote these guides during seminars, webinars, meetings, and more. It’s a step towards ensuring that both employers and employees are well-informed and can make the best use of the EPFO services.

Why is this Important for Employers?

For employers, especially of newly covered establishments, the guide is a welcome toolkit. It not only sheds light on the EPFO and its vast reach but also emphasizes the partnership between the organization and employers. With the rise of digital initiatives, understanding these processes is crucial. All functions – from registration to payments – are now online, emphasizing the importance of this guide in today’s digital age.

Conclusion

The introduction of these guide booklets by EPFO signifies their commitment to transparency, education, and overall welfare of the employers and employees. These guides act as a bridge, filling the knowledge gap and ensuring smooth operations between employers, employees, and the EPFO. It’s a commendable step that highlights the essence of the organization’s mission: ensuring a robust social security cover for the nation’s workforce.

******

EMPLOYEES’ PROVIDENT FUND ORGANISATION

MINISTRY OF LABOUR & EMPLOYMENT. GOVERNMENT OF INDIA

Head Office

Bhavishya Nidhi Bhawan, 14. Bhikaiji Cama Place, New Delhi-110066

Website: https://www.epfindia.gov.in

No.:49296/C&PR_2021(IV)Website-FAQ-Updation-Part(1)

Date: 16-08-2023

To

All ACC(HQ) & ACC (Zones)

All RPFC-I & RPFC-II (In-charge of ROs)

Subject: Dissemination of Employees’ & Employers’ Guides – reg

Madam/Sir,

Guide Booklets for Employees & Employers were prepared by Vigilance Division (Head Office) and PDNASS and launched on the 70th Foundation Day of EPFO i.e. 015 November 2022.

2. The booklets are prepared in such a way as to guide members, employers etc. about EPFO services and their rights and duties including Frequently Asked Questions. The soft copies of the Guides in English. Hindi and Regional Languages were already shared vide email dated 12.01.2023.

3. The Guides are also uploaded on the EPFO website. The links for the Guides are provided below:

> Employers’ Guide: https://www.epfindia.gov.in/site_docs/PDFs/MiscPDFs/Employer_Information_Booklet.pdf

> Employees’ Guide: https://www.epfindia.gov.in/site_docs/PDFs/MiscPDFs/Employees_Information_Booklet.pdf

4. You are requested to inform the employers and members about these Guides in all the possible ways and on all occasions of interactions like seminars, webinars, meetings, NAN 2.0 etc.

Yours faithfully.

Alok Yadav

Regional P.F. Commissioner- 1(C&PR)

Copy to:

1. web-admin – to upload on the website

2. RPFC-IS – for information

3. e-office – to upload on e-office

4 Hindi Division — for translation

INFORMATION BOOKLET

For the employers of the newly covered establishments Employees’ Provident Fund Organization Ministry of Labour & Employment (EPFO)

Welcome

Dear Employer,

EPFO warmly welcomes you to one of the world’s largest social security organization.

EPFO as you would know is responsible for offering social security coverage to the organized sector workforce touching millions of lives. It offers its members a myriad of services, which includes provident fund, insurance and pension both for members and their families.

EPFO has over 6.42 crore contributory members making it one of the largest financial entities in the country. The total corpus of EPFO stood over ₹17 lakh crores. In terms of asset size, it ranks 8th among all sovereign pension funds and 16th among all pension funds of the world.

We are happy to enter into a partnership with you for ensuring adequate social security cover for the nation’s workforce. For this, it is necessary that you are aware of the various benefits provided for the members and the requirements to be fulfilled at your end so that the common objective of employee well-being can be achieved. As a part of ease of doing business, all the functions including registration, inspection and payments are made online and physical interaction is discouraged.

In order to support both the employers and the employees in their interaction/interface with EPFO information booklets have been prepared for both the employers and the employees. This toolkit can be used as a ready reckoner for this purpose.

EMPLOYERS – A VALUABLE PARTNER IN NATION BUILDING

RETURN OF OWNERSHIP

Form 5A

Form 5A of EPF is a return of Ownership which is normally submitted to the EPFO at the time the company is covered by EPF Schemes for the first time. This form shows owners/partners or Directors of the company who is responsible for the conduct of the business of the company. In form 5A details of employers only is given though the company may be managed by the Manager or any the person

Online process

- After registration and allotment of PF code employers to submit online Form 5A using your establishment login credentials. ->Establishment->Form 5A duly attested by DSC/e-sign. FORM 5A contains details of ownership and branches of establishment, if any and other vital details like Bank A/C number, Mobile Number, Email Id etc.

- Form 5A Return should be updated as and when there is a change in ownership, name of the establishment, Address, Bank Account, Mobile Number, E-mail, etc.

- You can obtain a sub code number for a branch, if required and the same may be furnished in Form 5A.

- To obtain sub code number for branch unit, the same may be furnished under Branch/Division details and subsequently furnish the details in Establishment -> Branches (Form 2A).

DSC & E-SIGN

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates.

E-Sign is an online electronic signature service that can facilitate an Aadhaar holder to digitally sign a document. An Aadhaar holder can now sign a document after Biometric/One Time Password authentication thus requiring no paper-based application form or documents.

DSC Online process

DSC (USB Token) to be registered through establishment login->Establishment->DSC/e-sign -> Digital Signature Registration to generate and download the request letter in establishment letter head duly signed by the DSC holder and submit to the concerned PF office in duplicate for approval. (Revoke option for de-registration of DSC/E-Sign).

E-Sign Online process

E-SIGN to be registered through establishment login->Establishment-> DSC/e-sign -> e-sign Registration and select “Click here to register e-sign of a person whose DSC is already registered” to generate and download the request letter in establishment letter head duly signed by the DSC holder and submit to the concerned PF office in duplicate for approval.

E-SIGN to be registered for Non DSC holder, select -> e-sign Registration and furnish the required details (i.e., name as per Aadhaar, designation, gender, Date of Birth and VID number) to generate and download the request letter in establishment letter head duly signed and submit to the concerned PF office in duplicate for approval.

AUTHENTICATING TRANSACTION USING DSC & E-SIGN

All transactions or requests need to be approved by Digital Signature Certificate(DSC)/e-sign

DSC is provided by authorised vendors whereas e-sign is a AADHAR based facility for enabling authentication.

Important Notes

For renewal of DSC, the above said method should be followed.

– Revoke means de-registration of DSC/E-Sign. In case the revoke button is pressed erroneously, follow the methods as on prepage to reregister DSC/e-Sign again.

– For using DSC, Computer/Laptop should be configured with the support of Mozilla Firefox version 48.0 along with latest Java (32 bit). Further, add the following exceptional sites at Control

Panel – > Java Security Tab.

https://unifiedportal-emp.epfindia.gov.in/Employer_digital_signature.php-https://unifiedportal-emp.epfindia.gov.in/epfo/activity/

https://unifiedportalemp.epfindia.gov.in/epfo/activity/viewMemberActivitySummary/

https://unifiedportalemp.epfindia.gov.in/epfo/digitalSignature/certificate/getOption

https://unifiedportalemp.epfindia.gov.in/epfo/digitalSignature/certificate/getOption.php

https://unifiedportalemp.epfindia.gov.in/epfo/owner/digitalSignature/certificate/getOption

https://unifiedportal-emp.epfindia.gov.in/

CREATING UAN

- Provision to create new UAN for employees is available under Member -> Register-Individual.

- Obtain self-declaration in Form 11 (to be retained by the employer for future reference) from each member with copies of KYC documents.

- If the employees already having a UAN, the same can be mapped to the current establishment by selecting “YES” in Previous Employment/UAN. The details of employees’ name, date of birth and gender should match with the provided in AADHAAR

- After creation of UAN, the Aadhaar KYC should be approved through DSC/e-sign through Member -> Approve KYC pending for Digital Signature

- Registration of Bulk employees also available in Member -> Register-Bulk

- Establishment can also make use of Member Location Mapping feature available in the portal to map or link each employee locations, in case the establishment has branches. For this branches in Form 5A should be furnished

UAN & KYC SEEDING

SEEDING OF KYCs:

- Ensure that for employees who are already having a UAN, their mandatory KYC details i.e., Aadhaar and Bank account are linked with their UAN. The option for linking KYCs in bulk with UAN is available under Member -> KYC BULK.

- Individual employee can also seed KYCs through their member interface and the same may be pending at Member -> Approve KYC seeded by member. The same may be approved with DSC/e- sign.

- Guidelines for Seeding of Mandatory KYCs with UAN explained in detail on page 16-18 of this document

UPDATING EMPLOYEES’ DETAILS AND KYC

UPDATING UAN

- By using establishment login employers shall be able to update your employee details and file their KYC details also.

- It is necessary that the profile of all employees enrolled by the establishment is complete in all respects and is also updated periodically whenever required. If there are missing details, it can use Missing details option under the Menu Member for filling the details.

- Establishments should mark date of Exit in respect of employees who have left their employment.

- Active members list is available in the login to check the member’s details along with their UAN and KYC details.

- Member must be facilitated to activate his UAN through the Employee portal

- Establishments can verify the members AADHAAR Card to compare the member’s Name, Gender, Date of Birth recorded in it with that available in the database under the ‘Active Members Details’

- Mismatch of details can be set right by asking the member to raise a request online through Employee Portal

- Approval needs to be done by DSC/e-sign.

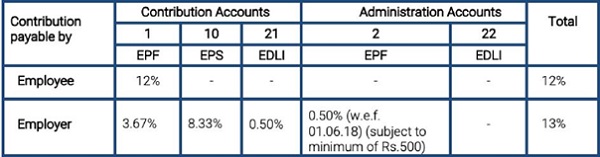

CONTRIBUTIONS TO THE FUND

PRESENT RATES

- Contribution is to be made mandatorily in respect of employees whose salary is Rs.15000 p.m or lower. However, other employees who are paid higher can become members on a voluntary basis.

- An employee can contribute more than 12% of Rs 15,000 if they wish to do so. However, there is no obligation that the employer has to match the employee’s contribution.

- To become members on a voluntary basis and to pay contribution on higher wages, a joint request from both employer and employee is required.

IMPORTANT NOTES

- Monthly contribution shall be paid by the employer by filing ECR under Payment – >ECR/RETURN filing on or before 15th of every month.

- Monthly contribution shall be paid through ONLINE only.

- Contribution is rounded to the nearest rupee for each employee.

- In case the establishment is exempted under EDLI Scheme, (no need to remit under A/c.No.21)

- Inspection charges @ 0.005% on total wages, subject to minimum of Rs.1/- is payable in A/c.No.22.

- Non-remittance of PF contribution deducted from employees’ wages shall be construed as Criminal breach of Trust, punishable under section 405/406 of Indian Penal Code.

CONTRIBUTIONS UNDER EPF, EPS & EDLI

EPF, (A/c.No.1)

- Contributions are payable on maximum wage ceiling of Rs.15,000/-

- The employee can pay at a higher rate (wages above Rs.15,000) and in such case employer is not under any obligation to pay at such higher rate.

- To pay contribution on higher wages, a joint request from both employer and employee is required [Para 26(6) of EPF Scheme]. In such case employer has to pay Administrative charges in A/c.No.2 on the higher wages. (wages above Rs.15,000/-).

- For an International Worker, wage ceiling of Rs.15,000/- is not applicable on contribution

EPS, (A/c.No.1o)

- Pension contribution is payable by employer only.

- Pension contribution should not be recovered from employee.

- Pension contribution not to be paid when:

- An employee crosses 58 years of age and is still in service (EPS membership ceases on completion of 58 years).

- An EPS pensioner is drawing Reduced Pension and re-joins as an employee.

- In both the cases, the pension contribution (8.33%) is to be added to the employer’s share (3.67%) of PF. i.e., total employer’s share (12%) goes to PF only.

- In case an employee who is not existing EPF/EPS member joins on or after 01.09.2014 with wages above Rs.15,000/-, no need to pay pension contribution and the total employer’s share (12%) goes to PF only.

EDLI, (A/c.No.21)

- EDLI Contribution (in A/c.No.21) to be paid on up to maximum wage ceiling of Rs.15,000/- even if PF is paid on higher wages.

- EDLI Contribution to be paid even if member has crossed 58 years of age and pension contribution is not payable. This is to be paid as long as the member is in service and PF is being paid.

- Monthly contribution shall be paid by the employer through the portal https://unifiedportal-emp.epfindia.gov.in/epfo/ on or before 15th of every month.

- ECR format available in Payment -> ECR Upload -> click ECR Help File.

MEMBER CLAIMS

MEMBER PROFILE

- Ensure that all the employees who are enrolled under EPF, their member profile is updated. If any missing details are there, employer can use missing details option under Member Menu to complete it. This will facilitate the members in availing seamless service.

PF CLAIMS

- Ensure that all claims are filed by the employees through online mode only to ensure speedy settlement.

- To enable filing of online claims UAN of the members have mandatory KYCs of Aadhaar and bank account.

TRANSFER CLAIMS

- Whenever a member submits transfer claim through online, it has to be forwarded to concern EPFO field office immediately. Such transfer claims pendency can be viewed by the employer under Online Services -> Transfer Claims in the establishment portal.

- If the member submits manual transfer claim in Form – 13, the employer has to promptly attest and forward the Claim to EPF Office.

WHAT IF CONTRIBUTIONS ARE NOT MADE?

- Provident fund benefits which makes them financially secure in their old age and provide them aid in times of need.

- Pension benefits in the form of monthly members pension besides widow/ widower pension, children pension, Orphan pension, Dependent/ Parents pension. The minimum pension is Rs 1000 as of now.

- Insurance benefits linked to the member’s PF accumulations in case of death in harness.

WHAT IF CONTRIBUTIONS ARE NOT MADE?

Rates of PD and Interest

|

Period of Default |

Rates of Damages | Rate of Penal Interest |

| Less than 2 months | 5% | Simple interest at the rate of 12% per annum for each day of the default or delay in payment of contribution. |

| 2 months and above but less than 4 months | 10% | |

| 4 months and above but less than 6 months | 15% | |

| 6 months and above | 25%

(It may correspondingly go up to 100%) |

- As a part of ease of doing business and digitization of all services, e-inspection notice is available in the employer portal for the default period. Employers need to submit response within specific time period or else necessary legal action would be initiated against the establishment.

- The damages shall be calculated to the nearest rupee, 0.50 paise or more to be counted as the nearest higher rupee and fraction of a rupee less than 0.50 paise to be ignored.

- In order to avoid this additional liability, the employer should ensure that remittances within the stipulated time, i.e., on or before 15th of every month through ECR.

- For remittance of Penalty use Payments -> ECR/RETURN filing -> Direct Challan -> Challan Entry -> Select Miscellaneous charges challan wherein Penal Damages for 14B dues and Miscellaneous for 7Q dues.

- In addition to penal damages and penal interest failure to remit contributions may result in prosecution and other penal actions.

- Deduction of PF contribution from the wages of employee and fail to remit the same is criminal breach of trust and actions shall be initiated invoking the relevant provisions of Indian Penal Code.

CLOSURE OF PF CODE

Documentation required

In case of winding up of business or for any other reason, the establishment ceases to exist, employer may apply for deregistration of the establishment. Request for deregistration may be accompanied by relevant supporting documents like Dissolution deed, Surrender of Government licenses, copy of Cancellation of Rental Agreement. if any. This has to be done promptly, so that the establishment is not flagged as non-complying establishment.

CONTINUE PF CODE WITHOUT MEMBERS

Even if there are no eligible employees for making PF contributions and the establishment wants to keep the EPF Code, they are directed to pay Rs.75/- per month as the prescribed minimum Administrative Charges in A/c.No.2 through Payments-> ECR/RETURN filing -> Direct Challan -> Challan Entry -> Select Administrative/inspection charges challan under establishment portal.

DUTIES AND RESPONSIBILITIES

DUTIES AND RESPONSIBILITIES OF THE EMPLOYER

- Enroll all eligible employees for the social security benefits in the establishment.

- In case, engaging services of contract employees, ensure they are covered directly under you or through a contractor.

- In case the contractor has his/her PF code ensure that the same is updated in the Principal Employer Portal and ensure compliance.

- Kindly note that non enrolment defeats the very purpose of the Act and Schemes and gives rise to a disgruntled and insecure workforce which will be costly in the long run.

- This is in addition to the various penal actions that would follow.

- Do not enroll individuals who are not associated with your establishment as members by making false declarations.

- In all cases where the employer himself does not transact the business and relies on others including the Authorised Signatory for doing the same, utmost caution must be exercised as the establishment/employer will be held responsible for all acts of omission and commission.

- Take steps to educate your employees about the various schemes and their benefits, in particular the KYC details and nomination details of your employees are always upto date. This shall enable the members or dependents to claim the PF benefits without any hassle.

- Maintain confidentiality of your establishment’s login credentials and do not share them with unauthorized persons.

DUTIES AND RESPONSIBILITIES OF THE EMPLOYER

- Assist the members to file online claim whenever they are in need of withdrawing from their PF accounts on account of various reasons permissible under the scheme like illness, housing, marriage, education etc.

- When the employee leaves employment assist in either filing transfer claim or filing final withdrawal claim of leaving employment on retirement.

- Assist your employee’s family members to claim the EDLI benefits and widow or widower pension and children pension in case of unfortunate demise of your employee.

- Please transact all PF related business only through the official website:

Prayaas is an endeavor to release Pension to the eligible EPS members on the day of Superannuation. Special efforts are being taken by field offices to educate the members of the EPS 1995 who are due to superannuate within 3 months along with their employers so that they can submit pension claims completed in every respect and EPFO can issue PPO on the day of superannuation to such members.

Cooperation and support of the employers is solicited to make this noble endeavor successful.

- Assist the members to file online claim whenever they are in need of Documentation

withdrawing from their PF accounts on account of various reasons required

permissible under the scheme like illness, housing, marriage, education etc.

- When the employee leaves employment assist in either filing transfer claim or filing final withdrawal claim of leaving employment on retirement.

- Assist your employee’s family members to claim the EDLI benefits and widow or widower pension and children pension in case of unfortunate demise of your employee.

- Please transact all PF related business only through the official website:

GUIDELINES FOR SEEDING OF MANDATORY e-KYCs

PREPARATORY WORK BY THE EMPLOYER

- Updating the missing members details through “establishment login -> Dashboard –> Missing details”.

- For left employees, to mark Date of Exit through “establishment login -> Member -> Member Profile -> search UAN -> mark Date of Exit” and approve the same through “Member -> Approvals- >Approve”. For bulk uploading use “establishment login->Member -> Exit-Bulk”.

- Downloading Active Members List to check the live members’ details along with UAN, KYC details through “establishment login -> Dashboard -> Active Members details” in Excel format.

ACTIVATION OF UAN: [BOTH EMPLOYER & MEMBER]

- If the member’s mobile number reflected against his UAN in Active Members List, it meant that the said UAN is already activated/registered.

- If not, the member’s mobile number should be activated through “Member e-Sewa -> Important Links -> Activate UAN”. *Required data for activation: UAN, Name & Date of Birth as per active members list, own mobile number, email id (optional)]

- After activation of UAN, member will get the password and the same will be reset in “Member e- Sewa” login as desired by the member.

- In case the password is forgotten, the member has to use “Forget Password” option in “Member e-Sewa”.

- Member has to click option “YES” to get the password to the registered mobile number.

- In case the registered mobile number is not in use/misplaced, the member has to click “NO” to get the password to the new mobile number subject to the following conditions:

- If the KYCs Aadhaar & PAN had already seeded, password may be obtained through new mobile number.

- If not, the member has to seed the Aadhaar or PAN through their employers as mentioned below.

SEEDING OF MANDATORY e-KYCs

GUIDELINES FOR SEEDING OF MANDATORY e-KYCs

SEEDING OF AADHAAR WITH UAN: [BOTH EMPLOYER & MEMBER]

- Verify member’s Aadhaar Card having Date of Birth in full form i.e., DD/MM/YYYY. If not in full form, download e-Aadhaar card from UIDAI portal or obtain fresh e-Aadhaar card from Aadhaar enrolment centers (or) e-Sewa centers.

- Compare member’s name, Date of birth & Gender with Aadhaar Card and Active Member details.

- In case of any mismatch in Name, Date of Birth and Gender, the member can apply correction request through ONLINE:

- Member can furnish the required details through “Member e-Sewa login> Manage -> Modify Basic Details” for correcting the same.

- In case Date of Birth mismatch is more than 1 year, please upload anyone of the following mandatory proof for his correct date of birth i.e., Birth Certificate, School leaving certificate, 10th Mark Sheet, Passport, Service Certificates issued by the Govt.

- Employer can approve the same thro “Establishment login -> member -> Bulk Process modify basic details request” with Digital Signature (DSC)/e-sign. On approval, the same will be automatically forwarded to concerned Field (EPFO) office.

- After approval made by the field office, the Members’ Aadhaar will be automatically seeded with their UAN After correction made by Field Office

KYCs Uploading : (By Member)

- The member can seed the Aadhaar through ONLINE using “www.epfindia.gov.in -> online services -> eKYC Portal”.

- (For this processing, OTP will be sent to the registered mobile number in Aadhaar)

- The member can seed the KYCs Aadhaar & Bank through “Member e-Sewa – > Manage – > KYC -> Add KYC -> Aadhaar & Bank -> SAVE” and the same may be approved by the employer through “establishment login-> member – > Approve KYC seeded by member – > Approve with DSC/e-sign”.

SEEDING OF MANDATORY e-KYCs

GUIDELINES FOR SEEDING OF MANDATORY e-KYCs

KYCs Uploading/Approving : (By Employer)

The employer has to enter the KYCs data through:

Establishment login -> member ->member profile -> search UAN -> KYC -> Add KYC -> Aadhaar & Bank-> SAVE” and approve the same through “Member -> Approve KYC seeded by member -> Approve with DSC/e-sign”.

Pending KYCs for approval/Member basic details for approve & reject functionality / approval of KYC seeded at the time of member registration are shown in establishment login -> HOME PAGE as ALERT’S.

After completion of the KYCs seeding, the same will be reflected in Member e-Sewa portal and the employer can also view the same in Active member list.

CONNECT WITH EPFO

|

Facilitation centers at the field offices are the service of all stakeholders Social media handles: Twitter at @socialepfo Facebook at /socialepfo |

UMANG Mobile app, Helpdesk: 1800118005 www.epfindia.gov.in

Dedicated portals www.epfigms.gov.in, www.pgportal.gov.in |

Technical issues about Member Interface-memberfeedback@epfindia.gov.in

Technical issues about Member Interface- memberfeedback@epfindia.gov.in |

*****

Information booklet For the EPF members

WORKERS – AN EQUAL PARTNER IN NATION BUILDING

BENEFITS AVAILABLE TO THE EMPLOYEES

- As a member, you join EPF Scheme 1952 which is an attractive investment instrument guaranteeing considerable corpus at the time of retirement. Contribution to this scheme is made by you and also by your employer.

- You also become a member of Employees Pension Scheme 1995 and become eligible for receiving pension in your old age. You do not pay a single rupee towards contribution and the entire contribution is made by the employer and Government of India.

- In addition, you automatically become a member of the Employees Deposit Linked Insurance Scheme 1976 wherein insurance in the form of an amount linked to your PF balance is made available in the unfortunate event of death while in service.

Every member is allotted a single permanent UNIVERSAL ACCOUNT NUMBER (UAN) which can be used for availing benefits during his lifetime service.

Member should activate their UAN with Mobile Number and seeding the mandatory KYCs i.e., Aadhaar, Personal Bank Account Number and PAN with respective UAN.

SMS alerts after employer remits member’s monthly contribution.

To avail this facility member should link their mobile number with UAN

SMS facility to know the PF balance in the member’s preferred language.

Member can send SMS as EPFOHO <UAN> <LAN> to 7738299899 from the registered mobile number.

A member can track his PF account through his Mobile Phone by using UMANG App.

Facility to give a Missed Call to 9966044425 from his registered mobile number to know the PF balance and the KYCs linked with his UAN.

BENEFITS UNDER EMPLOYEES PROVIDENT FUND

|

Condition |

Service tenure | Withdrawal Amount | Other Limitations |

| Construction/ Purchase of house | The employee should have completed 5 years membership | The amount that can be withdrawn is limited to 24 times the monthly salary for purchasing house site or 36 times the monthly salary in case of purchase of house and construction of house | Applicable for purchase/construction in the name of the PF account holder and his/her spouse |

| Medical treatment | No limitation | An amount equal to the employee’s share with interest or 6 times his monthly salary, whichever is lower can be withdrawn. | The PF account holder can apply for withdrawal for treatment of self, his/her parents, spouse or children. |

| Withdrawal

within one year |

The employee should be due to superannuate in one year | 90% of the amount can be withdrawn | Applicable only within 1 year of retirement |

| Renovation of house | The employee should have completed 5 years membership | An amount equal to 12 times the monthly salary can be withdrawn | Applicable for house in the name of the PF account holder and his/her spouse |

| Wedding’ Post Matriculation education | The employee should have completed 7 years membership | 50% of the employee’s contribution with interest can be withdrawn | Applicable for wedding expenses of self, siblings and children and for education of children |

Other benefits/facilities available to the members

- Facility for applying Partial / Final Settlement of PF through Online Portal / UMANG

- EPF e-Passbook available on the go.

- PF account can be accessed by the member online from anywhere at any time.

- A facility for Auto Transfer of PF accumulations while changing the jobs.

- Rates of interest declared for PF savings is way higher than the Fixed Deposits/Public Provident Fund.

- Member can voluntarily contribute to the EPF Scheme not exceeding his PF wages in addition to his statutory monthly contribution.

EMPLOYEES PENSION SCHEME (EPS) & EMPLOYEES DEPOSIT LINKED INSURANCE SCHEME (EDLI)

Benefits to the members under EPS

- Member no need to contribute for this Scheme.

- Guaranteed Pension for every eligible member and their family in this Scheme.

- Minimum Monthly Member Pension is Rs.1,000/- p.m. (eligible service of 10 years & on attainment of 58 years of age)

- Lump sum benefit called withdrawal benefit if the member leaves employment or retires before completion of 10 years’ service calculated on the basis of his wages and the number of years of membership. Alternately scheme certificate can be issued which contains the record of present and past service which can be added together making members eligible for pension if total of 10 years service is achieved.

- It is preferable to opt for scheme certificates in lieu of withdrawal benefit if the member desires to avail pensionary benefit at the time of retirement.

- Minimum Disabled Monthly Pension is Rs.250/- p.m.(Contributed at least for 1 month)

- Widow/Widower Monthly Pension is 50% of the Member Pension or Rs.1,000/- whichever is higher.

- Children Monthly Pension (Maximum of 2 children upto the age of 25 years) is 25% of Widow/Widower Pension or Rs.250/- whichever is higher.

- Disabled Child Pension is 25% of Widow Pension or Rs.250/- whichever is higher till the life-time of the disabled child.

- Orphan Monthly Pension (without Parent) is 75% of the Widow Pension or Rs.750/- whichever is higher. (Maximum of 2 orphans upto the age of 25 years)

- Nominee Monthly Pension is equal to Widow Pension or Rs.1,000/- whichever is higher.

- Dependent Parent Monthly Pension is equal to Widow Pension or Rs.1,000/- Whichever is higher.

Benefits to the members under EDLI

- Member no need to contribute for this Scheme.

- From 15.02.2018 onwards, the Assurance Benefit to the legal heirs of the deceased

member shall not be less than Rs.2,50,000/- and not exceeding Rs.7,00,000/-.

Other important information’s

- Option to draw Early Pension is available if not employed after 50 years of age

- Facility to file “e-Nomination” is available online which is like a ‘Will’ for the legal

- A member may opt to get extra 4% of pension by deferring pension payment beyond 58 till attainment of 60 years of age.

- By submitting a Joint Declaration with employer, employees earning higher wages can also benefit by joining the fund.

FILING e-NOMINATIONS

On becoming a member of Employees’ Provident Fund (EPF)/Employees’ Pension Scheme (EPS), it is mandatory for the members to nominate their nominees conferring the right to receive the PF amount that stands to their credit and the Pension benefits in the event of his death. In order to facilitate the filing of nomination instead of submission of Form-2 (physical) the members can file Aadhaar based e – Nomination.

The steps to be followed by the members to furnish their nominees details through online: “Kindly use Desktop version of Mozilla Firefox 58.0+ browser for using this facility”

1.Member’s mobile number should be linked with his Aadhaar.

2. Log on to EPFO’s website, https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and enter your UAN (Universal Account Number) and password to login.

3. Click on “View” tab and then click on “Profile” option to upload your profile photo (less than 100 kb) in jpg/jpeg format and update all the required details including permanent/current

4. Then go to click on “Manage” tab and then click on “E-nomination” option.

5. Details like UAN, Name, Date of birth, Gender, Name of the Father/Husband, Marital Status, Permanent/Current Address, Date of Joining in EPF and Date of Joining in EPS appear on the screen. On verification of the said details, click “Proceed” option.

6. Now, click on “Yes” to update family declaration. Members can nominate more than one nominee and also distribute the amount in (%) percentage that may stand to his credit in the Fund amongst his/her nominees at his/her own discretion.

7. Go to “add family details” and add the details of people you want to nominate. You need to enter the Aadhaar Number, Name & date of birth as per Aadhaar, Relationship, Address of the nominee, Bank account details and upload the photo (less than 100 kb) of the nominee, then click “Save family details.” If the nominee is a minor, please furnish the details of the Guardian i.e., name of the guardian, relationship and address. You can also add more than one nominee by clicking on “Add Row”.

8. Go to “nomination details” and declare the total amount of share in percentage (%) among your nominees. In case, you would like to nominate only one person as your nominee then you can declare 100% as share.

9. Click on “save EPF nomination” box.

10. Now, click on “e-sign” button and enter your Virtual id number (VID) of Aadhaar to generate OTP, which will be sent to the registered mobile number, which is linked in your Aadhaar card.

11. The Aadhaar e-sign facility helps in approving the e-nomination form. Enter the OTP (onetime password).

12. After this, e-nomination gets registered with the EPFO. A readily available nomination in the system enables to easily file the Pension Claim and in the event of the demise to the member his/her nominee will be able to file online claim based on the OTP on his/her Aadhaar Linked Mobile. One doesn’t need to apply any physical document to the employer or ex-employer after the online nomination is done.

e-NOMINATION (FORM-2) & FORM-11 (DECLERATION FORM)

It is mandatory for the Employees who are joining a EPF covered establishment to submit Form-11 (Self-declaration) and Form-2 (Nomination). Employer is also bound by this provision to take these two declarations.

Now, e-Nomination has replaced the Form-2. Hence, Member must file this in his login and submit the copy to employer for record.

Further, employers shall also ensure submission of Form-11 by every person taken into employment, wherein the details of the past employment with UAN, PF account number, Possession of Scheme certificate in respect of past employment, whether he is an International worker, KYC details, etc., are furnished beforehand.

Form-11 is the important document to decide the membership status in Employees’ Pension Scheme 1995. The Form-11 copy should be maintained by the employer and shall be produced as and when required by the Regional P.F. Commissioner for verification. Format of Form-11 is available in the official website (www.epfindia.gov.in -> Miscellaneous -> Downloads -> Return Form -> Form-11) or use this link:

https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form11Revised.pdf

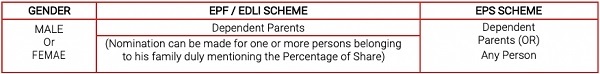

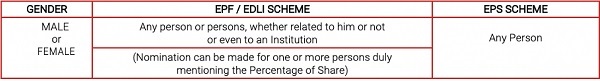

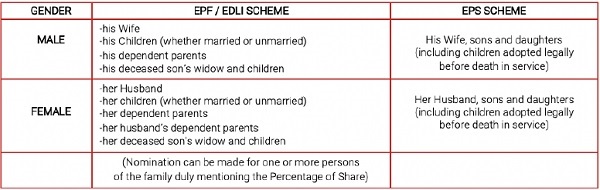

ELIGIBLE NOMINEES

Nominees are very important in all Savings, Insurance & Pension Schemes as they get their share of PF accumulations/EDLI and the Pension benefits in case of death of the member.

There are two types of Nominees for EPF and Pension Schemes based on member’s marital status. (Generally, EPF nominees are entitled to receive EDLI benefits. Please note that EDLI benefits will be given on death occurred “while in Service” only.)

The steps to be followed by the EPF/EPS members to furnish their nominees details online:

If the member is a Bachelor / Spinster having “Family”:

If the member is a Bachelor / Spinster having “No Family”:

If the member is a Married Person:

- If a member has a family at the time of making a nomination, it shall be in favour of one or more persons belonging to his family for EPF/EDLI Schemes and any nomination made by such member in favour of a person not belonging to his family shall be INVALID.

- A fresh nomination shall be made by the member on his marriage and any nomination made before such marriage shall be deemed to be INVALID.

- At the time of making a nomination, if the member has no family, the nomination may be in favour of any person or persons but if the member subsequently acquires a family, such nomination shall forthwith be deemed to be INVALID and the member shall make a fresh

- Members may nominate their nominees any number of times through e-Nomination in member portal and the latest nomination only will be VALID.

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.1. What is Universal Account Number (UAN)?

UAN is 12-digit number provided to each member of EPFO. The UAN acts as an umbrella for the multiple Member IDs allotted to an individual. This number acts as a pivot to link multiple Member Identification Numbers (Member Id) allotted to a single member under single Universal Account Number. UAN duly seeded with KYC detail. This enables the member to avail various online services directly without the need for any intermediation by the employer.

Q.2. What is KYC?

Know Your Customer or KYC is a one-time process which helps in identity verification of subscribers by linking UAN with KYC details. The Employees / Employers need to provide KYC details viz., Aadhaar, PAN, Bank etc., for unique identification of the employees enabling seamless online services.

Q.3. How can the employer generate UAN for newly joined employees not having UAN?

The employer has to login to EPF employer portal using the User ID and password and follow the below given steps: [ Link: https://unifiedportal-emp.epfindia.gov.in/epfo/ ]

- Go to “Member” section.

- Click on the “Register Individual”. Check the previous employment as “NO”.

- Enter the employee’s details and KYC details such as PAN, Aadhaar, Bank details, etc.

- Approve all details in the “Approval” section.

- A new UAN is generated by EPFO and the employer can link the PF account with UAN of the employee.

Q.4. How can an employee generate his UAN on his own?

An employee can generate his UAN by visiting the unified member portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/no‑ auth/citizen Registration/view Registraton? and clicking on “Direct UAN Allotment by Employees”. A valid Aadhaar number with registered mobile is pre-requisite to avail this facility. Employee has to provide employment details to obtain UAN.

Q.5. How can a member know his UAN?

- Visit unified member portal.

- Enter mobile number as per EPFO records.

- Click on the “Get Authorization Pin” option.

- A Pin will be sent to your mobile number registered with EPFO and enter the Pin.

- Enter the details such as name, Date of Birth as per EPFO records and select any one of Aadhaar, PAN, Member Id and furnish the details then click “Show my UAN”.

(Link:https://unifiedportal-mem.epfindia.gov.in/memberinterface/noauth/uanservice/home?_HDIV_STATE_=20-7- D5AA3A488FD3A31C9F7099F41F121148 ]

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.6. How can a member activate his UAN?

- Visit EPF Member Portal and click on “Activate UAN” OR UAN Activation under Employee Centric Services of EPFO on UMANG APP

- Select any one of the following – UAN, Member ID, Aadhaar or PAN.

- Fill additional details such as Name, Date of Birth, Mobile Number and Email ID and click on “Get Authorization PIN”

- An authorization PIN will be sent to the mobile number registered with EPFO

- Enter this PIN and click on “Validate OTP and Activate UAN”

- UAN will be activated and password will be sent to member’s mobile. Now the member can log in to unified member portal using his UAN and password.

[Link: https://unifiedportal-mem.epfindia.gov.in/memberinterface/]

Q.7. Can one mobile number be linked with multiple UANs?

One mobile number can be used for registration with one UAN only.

Q.8. How to activate UAN via offline mode?

UAN registration and activation is done only online.

Q.9. Can contractual employees register their UAN and avail online facilities?

Both contractual, as well as direct employees, can avail UAN facilities online after registration and activation.

Q.10. In which format I should create my UAN password?

The password should be alphanumeric, have minimum 1 Special Character and 8 – 25 character long. Special characters are: ! ® # $ % ^ & * ( ) Sample Password : abc®1973

Q.11. What can I do if my UAN is not seeded with Aadhaar?

Member can himself seed UAN with Aadhaar by visiting member portal. Thereafter the employer must approve the same to complete the linkage. Alternatively, member can ask his employer to link Aadhaar with UAN. The member can use “e-KYC Portal” under Online Service available on home page of EPFO website or e-KYC service under EPFO in UMANG APP to link his/her UAN with Aadhaar without employer’s intervention.

Q.12. My UAN was generated during the initial days of the launch of UAN facility. My employer erroneously linked it with wrong Aadhar number. How can I correct the same?

Member has to apply for correction to Regional office of EPFO where his EPF account is maintained through submission of joint request.

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.13. How can I seed my KYC details with UAN?

- Login to your EPF account at the unified member portal

- Click on the “KYC” option in the “Manage” section

- You can select the details (PAN, Bank Account, Aadhar etc) which you want to link with UAN

- Fill in the requisite fields

- Now click on the “Save” option

- Your request will be displayed in “KYC Pending for Approval”

- Once employer approves the details the message will be changed to “Digitally approved by the employer”

- Once UIDAI confirms your details, “Verified by UIDAI” is displayed against your Aad haar.

Q.14. How can I seed my Bank account details?

- Login to your EPF account at the unified member portal

- Enter your bank account number and IFSC code.

- The details have to be approved by your employer.

- Once approved the bank account gets seeded.

Q.15. Can I change my already seeded Bank account number?

Yes. The bank account number can be updated any number of times by following the steps mentioned above. However, the bank account details cannot be changed during pendency of any claim with EPFO.

Q.16. What precautions should I take while seeding Bank account number? You should seed active bank account to which you are either an individual or joint holder with your spouse. Also ensure that the bank account does not have a deposit cap greater than your withdrawal benefit.

Q.17. I have changed my job. Should I activate my UAN again?

UAN has to be activated only once. You do not have to re-activate it every time you switch jobs.

Q.18. Do I have to pay any fee for UAN registration?

No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Q.19. Can I activate UAN through SMS or mobile app?

You cannot activate UAN through SMS. However, you can activate UAN through Umang App. To download Umang app, please visit Google Play store.

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.20. What are the documents required for change in Date of Birth of EPF members?

Any of the following documents may be accepted as valid proof of date of birth:

- Birth certificate issued by the Registrar of Births and Deaths

- Any School / education related certificate

- Certificate based on the service records of the Central / State Government

- Passport

- Any other reliable document issued by a Government department.

- In the absence of proof of date of birth as above, Medical certificate issued by Civil Surgeon after examining the member medically and supported with an affidavit on oath by the member duly authenticated by a competent court.

- Aadhaar / e-Aadhaar: The change in date of birth shall be accepted as per Aadhaar /eAadhaar upto a maximum range of plus or minus three years of the date of birth recorded earlier with EPFO.

Q.21. What are the facilities given to members through UAN driven Member Portal?

The UAN driven Member Portal facilitates the following to members:

A. Services:

- Self-generation of Universal Account Number

- E-Nomination

- Change in Name, Date of Birth, Gender

- Enter KYC details

- Seamless Transfer of PF Accumulation from Previous Employment Advance claim for outbreak of Pandemic (Covid-19)

- Aadhaar based online claim submission

- Entry of date of exit from service

B. Information:

- Download Passbook

- Download UAN Card

- Check eligibility for online transfer claim

- PF contributions & balance by sending SMS to 7738299899 in 10 languages

- PF account details by missed call on 011-22901406

Q.22. Do I need to upload documents on the EPFO Portal?

No, you are not required to upload documents on the EPFO Portal. Just the name as per the document and the document number must be specified.

Q.23. What are the minimum details which are required to be linked with UAN for availing online services?

Mobile, Aadhar and Bank account number.

Q.24. Is linking PAN with UAN beneficial for availing online services?

Yes, if you link your PAN number with UAN then you can avail tax benefits on EPF withdrawal.

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.24. Is linking PAN with UAN beneficial for availing online services?

Yes, if you link your PAN number with UAN then you can avail tax benefits on EPF withdrawal.

Q.25. My name is same in PAN card and Aadhaar card but I am not able to link it with my UAN.

The name as per Aadhaar and PAN must be same as that in PF records for KYC to be successfully completed. Please note that the name as printed on PAN card may be different from that in the Income Tax database. In such a case you must enter the name as per IT database to get it successfully linked with UAN. If there is a name mismatch then a name change request can be raised.

Q.26. What to do if my employer is not approving KYC?

In case your employer is not approving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organization. If no one is responding to your request you can approach EPF Grievance via http://epfigms.gov.in.

Q.27. How do I know that KYC updated by me is approved by the employer?

The status will be shown against updated KYC document on the same page. The system will also trigger SMS on your register mobile number.

Q.28. My employer erroneously entered wrong PAN and Bank account details?

You can login to your member portal and update the PAN and Bank account details yourself. The same will be digitally approved/updated by the employer.

Q.29. My employer has not updated my date of exit despite lapse of two months after leaving job. How can I update my date of exit?

- Visit Member Unified Portal

- Enter UAN, Password and CAPTCHA.

- Go to Manage and Click Mark Exit

- Choose ‘PF Account Number’ from ‘select employment’ drop down

- Enter ‘Date of Exit’ and ‘Reason of Exit’

- Click on option ‘Request OTP’ and enter OTP sent on your Aadhaar linked Mobile Number

- Select the Checkbox

- Click ‘Update’

- Click ‘OK’

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.30. How to change my UAN linked mobile number?

After login into the Member Interface of Unified Portal, there is a provision in “Member Profile” section to change your mobile number.

Q.31. Can I apply online claim if my mobile is not linked with Aadhaar?

No, you cannot submit online claim if your mobile is not linked with Aadhaar. At the time of claim submission, OTP is sent to Aadhaar linked mobile only.

Q.32. What to do if my Aadhaar is not linked with mobile?

Please visit your nearest Aadhaar Service Centre. For more details you can visit official website of UIDAI https://uidai.gov.in.

Q33. What to do if I forgot my password?

Please click on “Forgot Password” at Member Interface of Unified Portal. Provide your UAN with CAPTCHA. System will send the OTP on your mobile which is seeded with UAN and you can reset the password.

Q.34. What to do if I forgot my password and my registered mobile with UAN has also changed?

Please click on “Forgot Password” at Member Interface of Unified Portal. Provide your UAN with CAPTCHA. System will ask whether OTP is to be sent on registered mobile or some other mobile. System will ask to enter your basic details (Name, DOB and Gender). After successful matching of basic details system will ask to provide your Aadhar or PAN. If KYC details are matched system will ask new mobile number and OTP will be sent to the new mobile. After successful verification of OTP, you can reset your password.

Q.35. What is to be done in case I change the job and join somewhere else?

You need to simply declare your UAN with your subsequent employer.

Q.36. Which claims that can be filed online?

You can file Withdrawal, Advance, and Pension claim (after e-Nomination) online through EPFO Member Portal or through Umang app.

Q.37. How can I view/download my passbook?

First of all, you need to login to the UAN Member Portal with your UAN and password. Then go to the menu ‘Download’ and select ‘Download Passbook’. A link provided to download PDF of this passbook.

Q.38. How can I view/download my UAN card?

You need to login first with your valid UAN and password. Then go to ‘Download’ Menu and select an option ‘Download UAN Card’. PDF of UAN card can be downloaded.

FEW IMPORTANT FREQUENTLY ASKED QUESTIONS

Q.39. I am not able to see the Passbook or Passbook is not available?

In case you are working in an Exempted establishment then your passbook will not be available in the UAN portal. You may contact your establishment to get the PF statement.

Q.40. Two UAN allotted to me. What should I do?

In case two UAN are allotted to you, this could be because of not filling of Date of Exit by your previous employer in ECR filing and / or you have applied for transfer of service in your current establishment. In such a case, it is suggested to immediately report the matter to your employer and through email to EPFO (uanepf@epfindia.gov.in) by mentioning, both -your current UAN and your previous UAN(s). After due verification, the previous UAN(s) allotted to you will be blocked and the current UAN will be kept active.

Q.41. Why I am not able to link / list previous member IDs pertaining to me? As the details are matched with previous Member ID w.r.t. current Member ID and if there is any deviation in name etc. it will not allow for link / list Member ID.

Q.42. How to change Name and DOB in EPFO records as per Aadhaar Card?

- Enter UAN, Password and CAPTCHA.

- Click Sign-in

- Click Manage and then Click Modify Basic Details

- Enter Aadhaar, Name and DOB as per Aadhaar. Click Save/Submit. Click “Yes”.

- Inform your Employer to approve your Name Change Request.

Visit Member Unified Portal as mentioned in https://unifiedportalmem.epfindia.gov.in/memberinterface/

Q.43. What are the services available through umang app?

UMANG APP is the only official APP through which EPFO services should be availed. The following services are available through UMANG APP:

- View Passbook

- Online Claim filing

- Claim tracking

- UAN Activation

- UAN Allotment

- Jeevan Pramaan Submission

- Download Pension Payment Order

WHAT ARE YOUR DUTIES & RESPONSIBILITIES?

- Keep track of your PF accumulations from time to time.

- Activate your UAN immediately on becoming a member to avail online services

- Keep your password confidential and never share with anyone on any account.

- Never share your OTP (One time password) received in your mobile while transacting with EPFO to anyone

- Always remember that you are responsible for maintaining the confidentiality of your login credentials.

- Point out any discrepancy in the monthly deposits made by the employer into your PF account.

- Bring to notice any technical difficulty in accessing the member portal to your employer and EPFO

- Never treat your PF account as a bank account for taking care of your financial needs. It is meant for long term wealth creation with the objective of ensuring financial security in your old age. Therefore, advances from your account should be taken only if necessary and only on the specified contingencies or reasons provided for in the scheme.

- Whenever you change jobs, please ensure transfer of your PF accumulations and also your service rendered into the new pension account.

- If you were allotted more than a single UAN for whatsoever reasons kindly take steps to merge them into the latest UAN by filing transfer applications. This shall help in having all your PF accumulations in one place and also ensuring that you have more than the minimum required number of years ( 10 years) for becoming eligible to receive pension.

- Beware of fake websites and phishing mails which seek to steel your passwords or PF accumulations. Kindly note that https://www.epfindia.gov.in is the only official website of EPFO and UMANG is the only official app.

- Seed your UAN with KYC documents like Aadhaar, bank account and verify that your name, father’s name, date of birth and gender are same in all documents to avail services of EPFO.

- In case of any discrepancy get it corrected through your employer

- File your e-nominations to enable your family to get the benefits in case of any untoward incident.

- Do not hesitate to raise your grievances at the official website of EPFO through EPFiGMS (Employees Provident Fund Internet Based Grievance Management System)

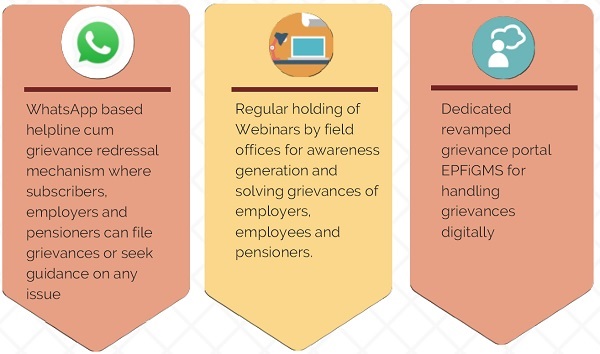

WHAT CAN YOU DO IF YOU HAVE A GRIEVANCE OR A COMPLAINT?

- In case any member has a complaint /grievance , he is welcome to raise the issues to EPFO for which there are multiple means available :

- The member can file a grievance in EPFiGMS (https://epfigms.gov.in/).

- The filing is done through a simple mobile OTP based method and once a grievance is registered, a registration number is generated which can be used for tracking the status of resolution of the grievance.

- The system allows for escalating the grievance to the next higher authority if the member is dissatisfied with the response.

- Strict timelines are prescribed for resolution of the grievance

- In addition to EPFiGMs, grievance can also be registered at CPGRAMS which is a Government of India initiative.

- He may also write to the office concerned at the official E-mail ids which are available in the public domain at EPFO’s website https://www.epfindia.gov.in/site_en/Contact.php.

- For enhancing members’ engagement with EPFO, Nidhi Aapke Nikat which is a monthly programme is held on 10th of every month in every EPFO office wherein members are welcome not only to raise their grievances but also to put forward their suggestions or give feedback.

CONNECT WITH EPFO

|

Facilitation centers at the field offices are the service of all stakeholders |

UMANG Mobile app, Toll free call centre, www.epfindia.gov.in Dedicated portals www.epfigms.gov.in, www.pgportal.gov.in | Social media handles: Twitter at @socialepfo Facebook at /socialepfo |

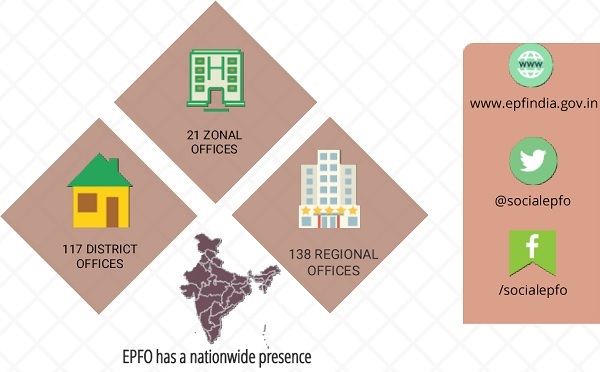

RESPONSIBILITY CENTERS

The responsibility centers in these offices reach out to all stakeholders and ensure extension of the Social Security services

I like so much. Because I know my rights how to get my benefits through grievance portal. Thank s.