The Prohibition of Benami Property Transactions Act, 1988

Introduction

The Benami Transactions (Prohibition) Act, 1988 came into force on 19th day of May, 1988. It extends to the whole of India except the State of Jammu and Kashmir. The act was only in paper and was not implemented for the reason for which it was enacted. And due to operational difficulties, non-formation of rules and relation, the Act could never come into force. And in order to curb the black money, the Government amend the Act as ‘The Benami Transactions (Prohibition) Amendment Act, 2016 ‘w.e.f 01/11/2016 (surprisingly few days before demonetization) by widening its scope by-

♦ broadening the definition

♦ establish adjudicating authorities & an Appellate Tribunal to deal with benami transactions &

♦ specifying the penalty for entering into benami transactions.

Objective

- To prohibits benami transactions and

- Provides for confiscating benami properties and for matters connected therewith & incidental thereto.

Key Terms under the Act

| Section | Area | Definition |

| 2(8) | Benami Property | Any property which is the subject matter of a Benami Transaction and also includes the proceeds from such property. |

| 2(26) | Property | Assets of any kind, whether movable or immovable, tangible or intangible, corporeal or incorporeal and includes any right or interest or legal documents or instruments evidencing title to or interest in the property and where the property is capable of conversion into some other form, then the property in the converted form and also includes the proceeds from the property; |

| 2(9) | Benami Transaction | A. a transaction or an arrangement:

a) Where a property is transferred to, or is held by, a person, and the consideration for such property has been provided, or paid by, another person, and b) The property is held for the immediate or future benefit, direct or indirect, of the person who has provided the consideration, except when the property is held by-

B. a transaction or an arrangement in respect of a property carried out or made in a fictitious name; or C. a transaction or an arrangement in respect of a property , where the owner of the property is not aware of, or, denies knowledge of such ownership; D. a transaction or an arrangement in respect of a property, where the person providing the consideration is not traceable or is fictitious. |

| 2(10) | Benamidar | A person or a fictitious person as the case may be, in whose name the Benami Property is transferred or held and includes a person who lends his name. |

| 2(12) | Beneficial owner | A person, whether his identity is known or not, for whose benefit the Benami Property is held by a Benamidar. |

| 2(24) | Person | Include- (i) an individual;

(ii) a Hindu undivided family; (iii) a company; (iv) a firm; (v) AOP or BOI, whether incorporated or not; (vi) every artificial juridical person, not falling under sub-clauses (i) to (v); |

Benami Transactions – Exemptions

‘Benami Transactions’ shall not include any transaction if followings conditions are satisfied:

- Possession of the property given to the person who has provided consideration but the person who grants possession continues to hold ownership.

- The contract has been

- Stamp duty has been

Prohibition on Re-Transfer of Property by Benamidar (Section 6)

- No person, being Benamidar shall re-transfer the Benami Property held by him to the Beneficial Owner or any other Person acting on his behalf.

- Where any property is re-transferred in contravention of the provisions of sub-section (1), the transaction of such property shall be deemed to be null and void.

- The provisions of sub-sections (1) and (2) shall not apply to a transfer made in accordance with the provisions of section 190 of the Finance Act, 2016 (28 of 2016).

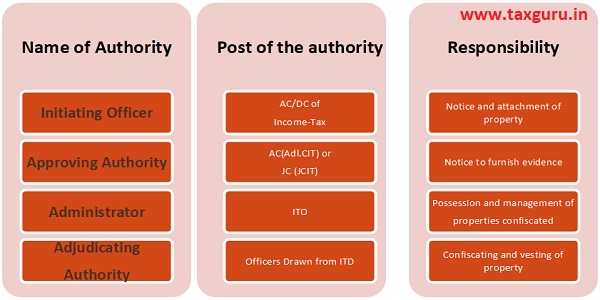

Authorities

CBDT has been entrusted with the responsibility of implementing the provisions of the Act.

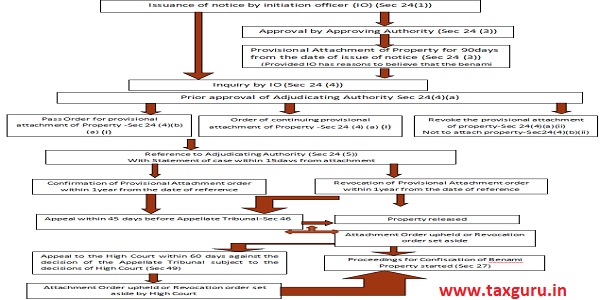

Process of Attachment of Property in Benami Transaction

Penalty

Punishment for commencing any Benami Transaction after the date of commencement of the bill which includes:

| Sl No | Section | Nature | Quantum of penalty + Imprisonment | |

| 1 | 53 | any person enters into a Benami Transaction to defeat the provisions of any law / to avoid payment of statutory dues / to avoid payment to creditors

(Not only the initiating person but also the person who abets, participates, advises for such a transaction is also liable for such penalty.) |

upto 25 % of FMV of the property | 1- 7 years |

| 2 | 54 | For providing False Information to any authority under this Act | upto 10 % of the FMV of the property | 6 months- 5 years |

Implications under Income Tax Act

| On Benamidar | Beneficial Ower |

|

|

Conclusion

With an aim to fight back for black money circulation in the economy, the Government is coming up with a series of measures to curtail them. And this act takes primacy place among them.

Proceedings under one act (either Benami Transactions (Prohibition) Amendment Act, 2016 or Income Tax Act,1961) will not save the person from the rigors of the other act. By making the Income Tax Authority as the nodal authorities for overseeing the provisions of the Act, the reach of the Act has been widened. With the latest data mining tools, it is possible to bit the transactions and persons to the face of the economy and making it challenging for the persons involved in the Benami transaction having a sound sleep for long.

KEEP AWAY FROM BENAMI TRANSACTIONS……………………

In case of any further query, suggestions, or ideas, please do comment below.

You can reach me at c.a.ankitha@gmail.com

DISCLAIMER: This article is for informational and educational purposes only. While every care has been taken in writing this article to ensure its accuracy at the time of publication, the Author assumes no responsibility for any errors which despite all precautions, may be found therein.