Partnership firm comprises two or more person (partners) coming together to carry on the business to share profit and to run the business collectively on mutually agreed terms and condition. These firms are governed by the Indian Partnership Act, 1932.

Section 4 of Indian Partnership Act,1932 defines “Partnership” as the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.

The registration of a partnership firm helps to take complete advantage with respect to legal rules. If a Partnership firm is not registered under the Indian Partnership Act 1932, then it cannot claim or sue against violation of acts by the other partner or third party. It is very easy to set up partnership firm with less compliance of statutory procedures.

Rules prescribed in the Indian Partnership Act, 1932

Section 58 of the Act- Registration– a firm may be registered at any time by filing an application with the Registrar of Firms of the area in which any place of business of the firm is situated or proposed to be situated.

Section 70-Penalty for furnishing of false particulars – Any person who signs any statement, amending statement, notice or intimation under this Chapter containing any particulars which he knows to be false or does not believe to be true or containing particulars which he knows to be incomplete or does not believe to be complete, shall be punishable with imprisonment which may extend to three months, or with fine or with both.

Checklist of details/Documents for formation of New partnership firm

| Sl No | Details required |

| A | Details of proposed partnership firm |

| 1 | Name of proposed partnership firm

A firm name shall not contain any of the following words – namely – “Crown”, “Emperor”, “Empress”, “Empire”, “Imperial”, “King”, “Queen”, “Rayal”, or words expressing or implying the sanction, approval or patronage of Government, except when the State Government signifies its consent to the use of such words as part of the firm name by order in writing. |

| 2 | Nature and Object of the business |

| 3 | Address of proposed Registered office along with supporting.

– In case of own building, utility proof (electricity bill, property tax receipt etc) -In case of rented property, rent agreement /NOC from owner. |

| 4 | Profit sharing ratio among partners |

| 5 | Capital proposed to be contributed by each partner |

| 6 | Salary/Remuneration payable to partners (if any) |

| 7 | Designating partners with powers, obligation and duties(if any) |

| 8 | Tax Implications |

| 9 | Follow up in case of retirement/ death of any partners |

| 10 | Duration of partnership |

| B | Personal details of all partners |

| 1 | Name of partners |

| 2 | Two latest passport size photo |

| 3 | Self-attested copies of ID proofs preferably PAN & Aadhar card/Passport/Driving License/Voters ID |

| 4 | Mobile number of partners |

| 5 | E-mail Ids of partners |

| 6 | Scanned image of signature of partner |

2. Drafting of Partnership deed

1) Preparing partnership deed.

2) Cost of stamp paper (in Kerala) for instrumentation of partnership deed- 5,000/- (Refer Sl no.43(a) of stamp schedule)

3. Registration of partnership (Form I)

Steps to register a partnership in EGROOPS.

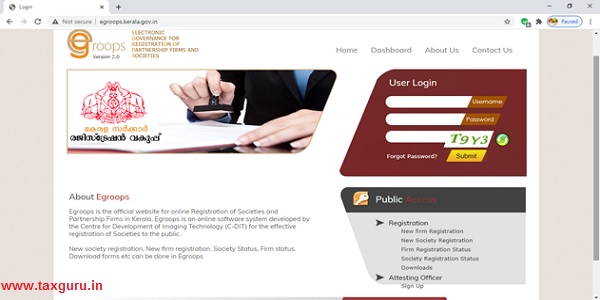

Step 1: Log on to the home page of EGROOPS- www.egroops.kerala.gov.in

Step 2:

Click on “New firm registration” button as shown on the right side of the EGROOPS homepage and fill in the required details as shown in the screen. User must be one among the partners of proposed partnership firm.

Step 3:

Once the data is filled & supporting are uploaded, click on the submit button and you will receive a system generated user Id and password.

Step 4:

Now, you need to login to the EGROOPS portal ( using the username and password provided in the 3rd step). Once you are logged in, click on Application for New Firm Registration available at the center of the page.

Step 5:

Here you need to provide the proposed name for the partnership firm and the address and partners details such as name, age, gender, guardian details in case of minor partner, address, mobile number, incorporation certificate (in case of company being partner) etc and attach passport size photo and ID proof on specified size and format.

The EGROOPS platform can accept four categories of partners, namely –

- Normal partner

- Power of attorney holder

- Minor partner (Name of the guardian to be provided) and

- Company (Name of representative to be provided).

Step 6:

On the successful updating of the partner and place of business information along with the requisite documents, you can pay online registration charges for the registration of partnership firm. The payment can be made online and offline too, through:

- Money order

- Cash payment

- e-Payment

Select the mode of payment you wish to opt and initiate the payment. After payment is made, the user will get a reference number to the registered mobile number and email Id, which have to be kept for future references.

Step 7:

- Once it is done, the applicant is required to get the application attested from an attesting officer who could be any Gazetted officer, a practising Advocate, Attorney, Vakil, Honorary Magistrate, practising Chartered Accountant, an Income-Tax practitioner or a Registered State Auditor.

# Note: In cases when the application gets rejected, the rejected application can be viewed by logging into the EGROOPS account and applicant will have to re-submit the application after rectifying the defect mentioned in Remarks button.

Step 8:

When the registration is successful, print the acknowledgement of Registration by clicking on “Print Acknowledgement”.

What is the responsibility of an attesting officer like advocate or ca?. Does he attest the signature of partners or the existence of a deed or reconstitution? Shall he be responsible under section 70? Pls explain

Read. Writing would have been much better if step 3 have been elaborated .Thanks.