The appointment of a Director is not only an important management requirement but also a process requirement that must be met by every company. Under the Companies Act, only one person may be appointed as a Director; a company, organization, firm, or other body with legal capacity cannot be appointed as a Director.

Page Contents

Requirement of Directors

In terms of Section 149 (1) of the Companies Act, 2013 each company will have at least three directors in the case of a Public Company, two directors in the case of a Private Company, and one Director in the case of a One-Person Company (OPC). A company may appoint fifteen directors, however, a company may exceed the number of directors’ more than fifteen directors after a Special Resolution passed at a general company meeting.

According to Section 152(2) of the Companies Act, 2013 every director shall be appointed at the general meeting of the company, unless otherwise is not expressed in this act.

Terms of Appointment

The following are the conditions for the appointment of the Directors-

- Only a natural person may be appointed as a Director.

- A person may not be appointed as a director unless he or she has a Director ID number (DIN).

- The person will receive a Digital Signature Certificate (DSC) from the accrediting authority for appointment as director.

- Every person nominated for appointment as a director must submit his or her DIN and declaration that he or she is eligible for appointment as a director under the Companies Act, 2013.

- Everyone will give their consent to serve as a director on Form DIR-2 before or after his or her appointment.

- A person may not be eligible for appointment as a director, if he or she does not qualify under subsection (1) of Section 164 of the Companies Act, 2013.

- One cannot hold directorship of more than twenty companies at one time including any other directorate position. In addition, the maximum number of public companies for which a person may be appointed as director should not exceed ten.

Qualifications of Directors

The Companies Act, 2013 has not yet determined any educational or professional qualifications of directors. Also, the Act does not place qualifications for directors. Therefore, unless a company article contains a provision for that, the director does not have to be a shareholder unless he wishes to be one voluntarily. But articles usually provide for a small portion of eligibility.

Company articles provide that every director should have a certain number of shares. Such shares are known as qualification shares. The director must receive, within two months of being appointed, the required number. If a director is not appointed as a director he or she will not be obliged to obtain eligible shares. And in a short period than two months of appointment, he cannot be compelled to obtain share qualifications. The eligible share price cannot be more than five thousand rupees unless the nominal value of the name exceeds the share value. The director may only own shares and not share any warranties. A director may suffer if he fails to obtain his eligible shares as instructed. He can suffer in two ways:

- His office may become vacant.

- He will be liable to pay a fine if he continues to serve as a director. The director is required to hold the shares himself.

Disqualifications

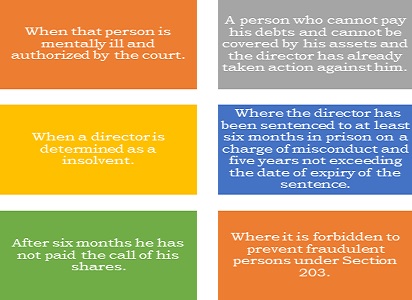

Minimum qualifications for members are set out in Section 274. A person may not be appointed as a director in the following circumstances:

If a private company is not a subsidiary of a public company it may continue to add to the disqualifications. In other words, a public company and its subsidiaries cannot add to or extend any other disqualifications.

Appointment of Directors at General Meeting

In terms of section 152 (2), every director shall be appointed by the company at a general meeting unless the Act provides otherwise.

- Appointment of directors if it is a private company – If it is a private company if the documents are silent on the appointment of directors, or does not dispense for the directors’ appointment other than a general meeting, directors must be appointed at the general meeting by shareholders.

- Rotation Manner- Section 152 (6) (c) provides that the first annual general meeting of a public company to be held after the date of the general meeting at which the first directors are elected and after that at all subsequent annual meetings retire in rotation as liable, If their number is not three or any multiple of three, a number close to one-third will be retired from office.

- The directors who retire at the general meetings being held at intervals annually must be those who have been in office for a long term from the last appointment, but among the people who become directors on the same day, those who are to retire must, if they fail and subject to any agreement between them, are determined by lot [Section 152 (6) (d)]].

Final words

A strong five-year policy serves as an excellent way to allow someone with the necessary qualifications to represent the company. However, the provision of an appeal due to withdrawal is provided under the law and a remedy period of 30 days is available for the unsuitable director to rectify any filing errors.

Under what provisions the Concept of Qualification of Shares is governed under the Companies Act, 2013? I think it was there in 1956 act but has been removed from 2013 act. Please confirm.