The Ministry of Corporate Affairs has vide its Notification dated 08.02.2019 amended the existing the Companies (Significant Beneficial Owners) Rules, 2018 by introducing the Companies (Significant Beneficial Owners) Amendment Rules, 2019.

The Companies (Significant Beneficial Owners) Amendment Rules, 2019 replaces all the provisions of the Companies (Significant Beneficial Owners) Rules, 2018 except Rule 5 (Register of significant beneficial owners) and Rule 6 (Notice seeking information about significant beneficial owners). It has further introduced Rule 2A which bestows responsibility upon the Reporting Company to find out about the SBO, identify the individual and cause such individual to make a declaration to the Reporting Company in Form No. BEN-1 (a Physical Form). This form shall be filed by the individual who is the SBO to the Reporting Company within 90 days from the commencement of these Rules (i.e., by 10th May, 2019) and for subsequent changes or acquiring the status of SBO, within 30days of such change or acquiring the SBO. In order to find out about the SBO, the Company shall send notice in Form No. BEN-4 to all its members(other than individuals) holding not less than 10% of the company’s shares/voting rights/right to receive/participate in the dividend or any other distribution payable in a financial year.

The amendment has increased the area covered by “significant beneficial owner”. Individuals holding directly or indirectly 10% voting rights and right to participate in 10% of distributable dividends, or any other distributions, have now been included in as SBO which is evident from the amended definition as laid down below:

According to Rule 2(h) of SBO Amendment Rules, 2019, “significant beneficial owner, in relation to a reporting company means an individual referred to in sub-section (1) of section 90, who acting alone or together, or through one or more persons or trust, possesses one or more of the following rights or entitlements in such reporting company, namely:

(i) holds indirectly, or together with any direct holdings, not less than ten per cent. of the shares;

(ii) holds indirectly, or together with any direct holdings, not less than ten per cent. of the voting rights in the shares;

(iii) has right to receive or participate in not less than ten per cent. of the total distributable dividend, or any other distribution, in a financial year through indirect holdings alone, or together with any direct holdings;

(iv) has right to exercise, or actually exercises, significant influence or control, in any manner other than through direct-holdings alone.

Breaking down the above definition, the Ministry has further explained the direct and indirect holding of the rights or entitlements by an individual.

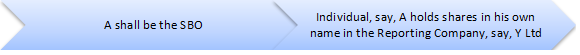

SBO BY DIRECT HOLDING OF RIGHTS OR ENTITLEMENTS BY AN INDIVIDUAL

1. An individual who holds shares in the reporting company representing such right or entitlement in his own name shall be taken to hold the rights or entitlements directly.

2. An individual who holds or acquires a beneficial interest in the share of the reporting company under section 89(2) and has made a declaration to the reporting company in MGT-5.

SBO BY INDIRECT HOLDING OF

RIGHTS OR ENTITLEMENTS BY AN INDIVIDUAL

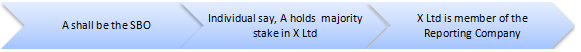

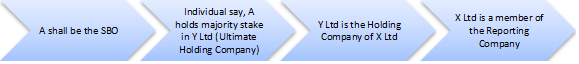

1. WHERE THE MEMBER OF THE COMPANY IS A BODY CORPORATE (whether incorporated/registered in India or abroad) [LLPs are not covered], an individual who holds:

- Majority Stake in that Member; or

- Majority Stake in Ultimate Holding Company of that Member.

is said to indirectly hold the right or entitlement in that company.

CASE I

CASE II

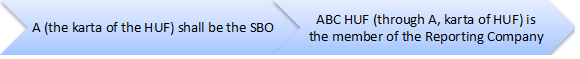

2. WHERE THE MEMBER OF THE COMPANY IS A HUF, an individual who is the Karta of the HUF shall be said to indirectly hold the right or entitlement in that company.

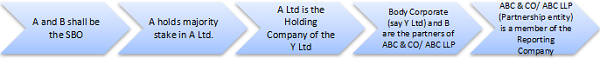

3. WHERE THE MEMBER OF THE COMPANY IS A PARTNERSHIP ENTITY [LLPs are covered], an individual who:

- is a partner of that partnership entity; or

- holds majority stake in the body corporate which is a partner of the partnership entity; or

- holds majority stake in the ultimate holding company of the body corporate which is a partner of the partnership entity.

is said to indirectly hold the right or entitlement in that company.

CASE I

CASE II

CASE III

4. WHERE THE MEMBER OF THE COMPANY IS A TRUST, an individual who is:

- a trustee, in case of a discretionary trust or a charitable trust;

- a beneficiary in case of a specific trust;

- the author or settler, in case of a revocable trust.

is said to indirectly hold the right or entitlement in that company.

5. WHERE THE MEMBER OF THE COMPANY IS A POOLED INVESTMENT VEHICLE/ENTITY CONTROLLED BY POOLED INVESTMENT VEHICLE, which is member State of the Financial Action Task Force on Money Laundering and the regulator of the securities market in such member State is a member of the International Organization of Securities Commissions, then the individual who is:

- a general partner of the pooled investment vehicle; or

- an investment manager of the pooled investment vehicle; or

- Chief Executive Officer (CEO), where the investment manager of such pooled vehicle is a body corporate or a partnership entity.

A individual is said to hold “majority stake” when the individual holds more than ½ of the Equity share capital or voting rights in the body corporate or right to receive/participate in more than ½ distributable dividend or any other distribution by the body corporate.

Subsequent to the amendment, the reporting company can also make an application to the Tribunal if case any person fails to give the information required by the notice in Form No. BEN-4, within the time specified therein.

Further, the area covered by the non-applicability of these rules have also been widened to include those share which is held by IEPF, Holding Reporting Company, Central Government, State Government or any local Authority, a reporting company or a body corporate or an entity – controlled by the Central Government or by any State Government or Governments, or partly by the Central Government and partly by one or more State Governments.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION

Madam,

we have a company in which a Trust hold 55% shares the trust is discretionary trust in which there are two trustee Say A and B.

one of the trustee say B is holding 35% share in the reporting company, while trustee A is not holding share directly in reporting company

Please advise who is SBO in this case.

further when we are filling the form we have mentioned the Trust Pan No. for CIN/FCRN or any other number in filling the details of SBO1

since both are trustee of Trust which is holding shares in reporting company while filling details in SBO2 when we mentioned the trust Pan number for SBO2 an error message is coming which say entered input shall be unique in all the regenerated blocks why this problem is cropping.

Can you please advise in case of discretionary trust details of all trustee are given or only one trustee is to be given

Hello Madam,

we have a company in which Trust hold share

Dear Sir/Madam,

Does SBO applicable, if holding Company is Body Corporate (Incorporated outside India)?

EXAMPLE:

Private Ltd Co Shareholder SH %age

Z Pvt Ltd Mr A 26%

Mrs B 24%

C Pvt Ltd 50%

C Pvt Ltd E Pvt Ltd 48%

F Pvt Ltd 45%

Indvidual 7%

E Pvt Ltd Mr X 60%

(same for F P. Ltd) Mr Y 40%

WHO FILE SBO? EXPLAIN?

One of the best articles on SBO Rules. Thank You.

Should not the last date of filing BEN-1 be 9th May 2019?

How to calculate the limit of 10%.

For example A ltd hold 90% stake in B Ltd and R an individual hold 20% stake in A Ltd then he is SBO or not.

Hi Mam

A small doubt. How did you arrive at the date of commencement of these rules as 10th May, 2019?

But the Rule 2 haven’t mentioned any specific date of commencement.

I HAVE READ SO MANY ARTICLES ABOUT COMPANIES (SIGNIFICANT BENEFICIAL OWNERS) AMENDMENT RULES, 2019 BUT SO FAR THIS IS THE BEST ARTICLE.

Holding company xyz is body corporate and listed in LSE and currently hold 99.99 percent in reporting Indian company zyx. Shareholding of xyz owned by Investment companies, banks and individuals. None of them holds more than 8% individually , Further decision making also done by Board not individuals , how to identify SBO

Rule 3 of said rules states that sbo shall file declaration within 90 days from the date of commencement of the rules.

and

Rule 2 state that these rules shall came into force on the date of publication in official gazzete.

you mentioned 10th may is the last. but the said rules is yet to be notified in official Gazzete.

please clarify.