Companies (Prospectus and Allotment of Securities)Rules,2014

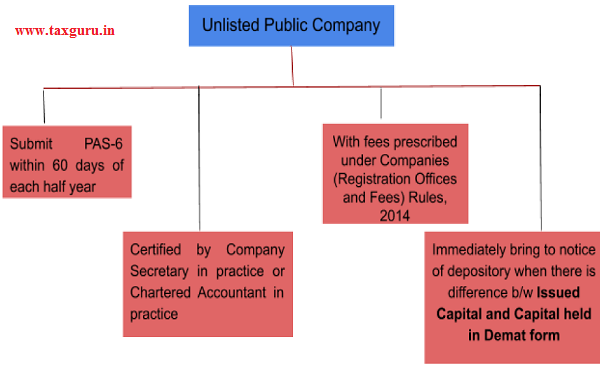

Reconciliation of share capital audit on half yearly basis (PAS-6) and its applicability

Provision: Pursuant to Rule 9A of of Companies (Prospectus and Allotment of Securities) Rules, 2014 as amended vide Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019.

Rule 9A of Companies (Prospectus and Allotment of Securities) Rules, 2014 :

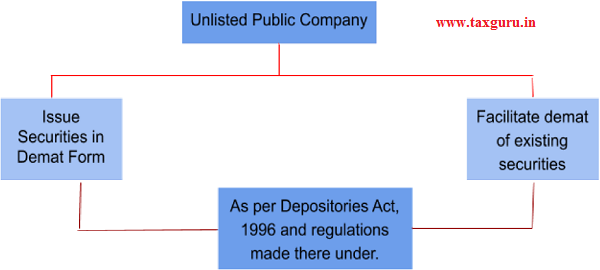

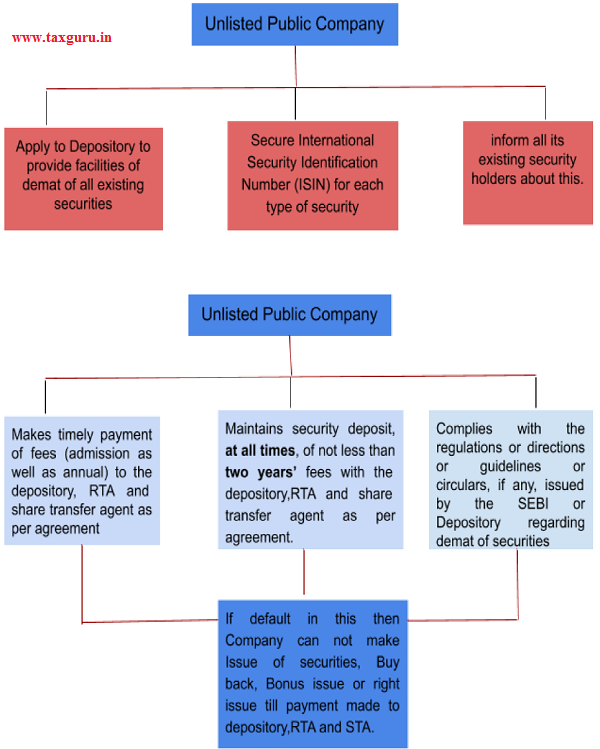

◊ Every Unlisted public Company before making:

- Issue of securities

- Buy Back

- Right Issue

- Bonus Shares

Shall ensure that entire holding of Promoters, Directors and KMP has been in Demat form.

◊ Security holder of Unlisted public Company shall ensure that

- If intends to transfer security on or after 2.10.2018 then securities shall be in demat form.

- Subscribe any security on or after 2.10.2018 whether by Private Placement or Bonus Issue or Right Issue then all existing securities are in demat form.

◊ Except as provided provisions related to :

- Depositories Act,1996

- SEBI (Depositories and participants) Regulations, 2018

- SEBI (Registrars to issue and Share Transfer Agent) Regulations,1993, Shall apply mutatis mutandis on demat of shares of Unlisted Public Company.

◊ Grievances under these rules shall be filed before IEPF Authority and IEPF Authority can initiate any action against a depository, Participant, RTA and STA after consultation with SEBI.

◊ This rule shall not apply to unlisted Public Company which is:

- Nidhi Company

- Government Company

- Wholly Owned Subsidiary

CS Aashima Goyal

Email id: aashimagoyal61@gmail.com