> APPLICABLE PROVISIONS UNDER COMPANIES ACT, 2013:

– Section 233

– Rule 25 of The Companies (Compromises, Arrangements and Amalgamations) Rules, 2016

> FAST TRACK MERGER CAN BE PROPOSED BETWEEN:

– Holding Company and its wholly owned subsidiary company

– Merger between two or more small companies

– Such other class or classes of companies as may be prescribed

**

– The wholly owned subsidiary company can be private/public/section 8 company

– Small Company “means a company, other than a public company, —

i. paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than ten crore rupees and

ii. turnover of which as per profit and loss account for the immediately preceding financial year, does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than one hundred crore rupees:

Provided that nothing in this clause shall apply to—

a) a holding company or a subsidiary company;

b) a company registered under section 8; or

c) a company or body corporate governed by any special Act;

> ADVANTAGES OF FAST TRACK MERGER:

– No requirement of NCLT approval

– Ease of doing business

– Less cost

– Less regulatory requirement needs to be followed

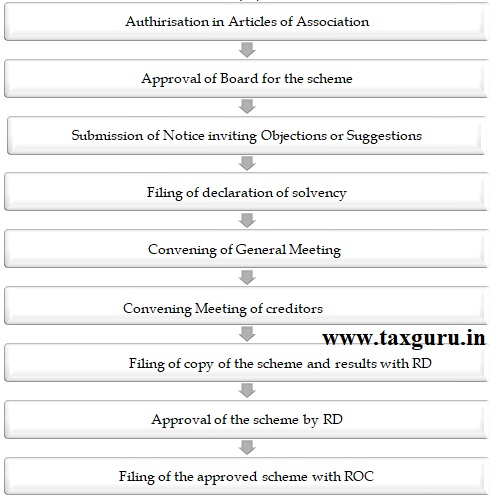

> STEPS INVOLVED IN FAST TRACK MERGER:

1. AUTHORISATION IN THE ARTICLES OF ASSOCIATION:

Articles of association of both transfer and transferee company should be authorized for the merger, if not, Articles of association needs to be altered first.

2. APPROVAL OF THE BOARD FOR THE SCHEME:

Both transfer and transferee company needs to prepare the draft scheme of the and the same should be approved by the members of the Board.

3. SUBMISSION OF NOTICE INVITING OBJECTIONS OR SUGGESTIONS:

Both transferor company and transferee company shall send the notice of proposed scheme in form CAA-9 to invite the objections and suggestions on the scheme to:

– ROC where the registered office of respective companies are situated

– Official Liquidator

– Or any other persons who is affected by the scheme

**

a. The objections/suggestions shall be sent within 30 days from the date of notice.

b. The notice inviting objection from ROCs in Form CAA 9 is to be filed in E-Form GNL-1.

4. FILING OF DECLARATION OF SOLVENCY:

Each company to file their respective Declaration of Solvency Statement (Form CAA-10) with the ROC and OL (Section 233(1)(c) read with Rule 25(2)). The Declaration of Solvency in Form CAA 10 is be to filed with the ROC physically.

5. CONVENING OF GENERAL MEETING:

Both the companies should consider the objections/suggestions received and shall also obtained the approval of members holding at least ninety per cent of the total number of shares.

6. CONVENING THE MEETING OF THE CREDITORS:

The companies shall obtain the approval of the creditors:

With meeting: scheme shall be approved by the majority representing 9/10th value of creditors or class of creditors of the respective companies.

Without Meeting: Such scheme shall be approved in writing by the majority representing 9/10th value of creditors or class of creditors of the respective companies.

NOTE:

– The notice for convening the creditors and members meeting shall be given 21 clear days before commencement of meeting.

– The notice of the meeting shall be accompanied by the following documents:

√ Copy of the proposed scheme

√ Explanatory statement as per Rule 6 (3) of The Companies (Compromises, Arrangements and Amalgamations) rules, 2016

√ Copy of the declaration of solvency

√ Both the company shall file the special resolution approved by the members and creditors with ROC in form MGT-14 along with prescribed fee.

7. FILING OF COPY OF THE SCHEME AND RESULTS WITH REGIONAL DIRECTOR:

Once the meeting is completed the both the companies needs to file the following details:

a. Approved scheme along with the results of the members and creditors meeting (in form CAA-11) within 7 days from the date of the conclusion of the meeting with the RD (Regional Director)

b. Approved scheme needs to be filed with RoC in form GNL-1. The form GNL-1 needs to be accompanied with the form CAA-11 filed with RD

c. Copy of the scheme and CAA-11 shall also needs to be deliver to Official Liquidator

The registrar and official liquidator shall communicate the objections/suggestion if any on the scheme within period of 30 days, if such communication is not received within the time it shall be presumed that there is no objection to the scheme.

8. APPROVAL OF THE SCHEME:

If the Regional Director does not receive any objections / suggestions the scheme from the Registrar of Companies / from official liquidator and RD is in the opinion that the scheme is in public interest / on the interest of the creditors, he will approve the scheme.

If the Regional Director after receiving the objections or suggestions or for any reason is of the opinion that such a scheme is not in public interest or in the interest of the creditors, it may file an application before the Tribunal within a period of sixty days of the receipt of the scheme under sub-section (2) stating its objections and requesting that the Tribunal may consider the scheme under section 232.

9. FILING OF APPROVED SCHEME WITH ROC

The order of approving the scheme shall be filed with RoC in form INC-28 within 30 days from the date of receipt of order.

FORM NEEDS TO BE FILED IN FAST TRACK MERGER

| S.NO | NAME OF THE FORM | PARTICULARS |

| 1. | CAA-9 | Notice of scheme inviting the objection/suggestion |

| 2. | CAA-10 | Declaration of solvency by both transferor and transferee company |

| 3. | CAA-11 | Filing the scheme of merger approved by the members and creditors |

| 4. | CAA-12 | Confirmation order by the RD for the scheme of merger |

DETAILS OF FORMS NEEDS TO FILED DURING THE FASTRACK MERGER

| S. NO | NAME OF THE FORM | PARTICULARS |

| 1. | GNL-1 | The notice inviting the objection/suggestion in form CAA-9 is needs to be filed in form GNL-1 by both transferor and transferee company |

| 2. | MGT_14 | Special resolution passed by both the company needs to be filed in form MGT-14 |

| 3. | GNL-1 | Filing the scheme of merger approved by the members and creditors in CAA-11 |

| 4. | RD-1 | Filing of scheme with RD |

| 5. | INC-28 | The order approving the scheme need to be filed with ROC in form INC-28 by the companies |