Introduction of National Financial Reporting Authority (NFRA)-

In view of improving the quality of audit and ensure more transparency, the Central Government, pursuant to Section 132(1) of the Companies Act, 2013 constituted a body called ‘National Financial Reporting Authority’ to provide for matters relating to accounting and auditing standards under Companies Act, 2013.

The National Financial Reporting Authority shall perform its functions through such divisions as may be prescribed.

NFRA- Powers and Duties

1.Provides key recommendations for laying down the accounting & auditing policies and standards for companies in India

2. Continually monitor and ensure compliance with respect to accounting & auditing standards;

3. To monitor and observe the quality of service of the professions engaged in ensuring compliance as per the devised auditing standards and measures suggested by NFRA;

4. Perform other functions & duties that are vital to fulfilling the above tasks.

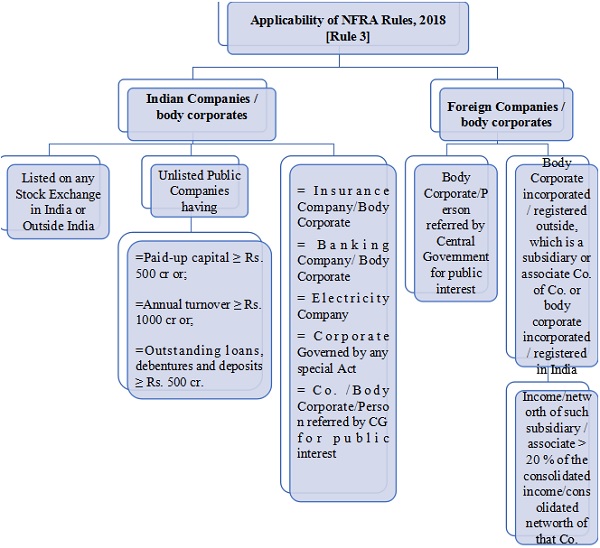

NFRA Applicability-

NFRA 1 & 2 Applicability-

NFRA 1

Every body corporate, other than a company as defined in clause (20) of section 2, formed in India and governed under this rule shall, within 15 days of appointment of an auditor under sub-section (1) of section 139, inform the Authority in Form NFRA-1, the particulars of the auditor appointed by such body corporate:

* As on date, no Body Corporate has been notified under Section 1 (4) (f) of the Companies Act, 2013.

# A foreign company which meets the condition stated in para 3(1)(e) and has business in India, needs to file NFRA-1 form w.r.t. its operations in India.

NFRA 1 – Key Requirements

In case of Indian Body Corporate:

1. PAN of Indian authorized individual

2. PAN of body corporate

3. DIN of Director / Membership No. of CS / PAN of Manager or CEO or CFO

4. Income tax PAN of auditor / audit firm

5. Membership number of auditor / auditor firm registration number

6. In case the auditor is appointed due to casual vacancy, then membership no. of auditor or registration no. of audit firm who/which vacated the office needs to be provided in the form.

7. Copy of written consent given by auditor & Copy of resolution passed by the body corporate

8. Digital Signature (DSC) of User (Director / Manager / CEO / CFO / Company Secretary)

In case of Foreign Body Corporate

1. Passport Number of foreign authorized individual

2. Registration number of foreign body corporate and name of provider of registration number.

NFRA 2

Every auditor referred to in rule 3 shall file a return with the Authority on or before 30th November every year in Form NFRA-2.

NFRA 2 – Key Requirements

1. Limited Liability Partnership Identification Number (LLPIN) or any other registration Number of the firm

2. Income Tax PAN of Auditor (for Indian firm)

3. Registration number of Auditor with the regulator/agency

Following are the details of the companies that need to be filled in:

i. Name of Company/Body Corporate

ii. CIN / PAN of Company /Body Corporate Or FCRN of the company or Identity number of body corporate

iii. Global Location Number of Company/Body Corporate (if applicable)

iv. Details of the Fees received by the Auditor from Company/Body Corporate

v. Currency Conversion rate (if fees received in Foreign Currency)

5. Network Registration Number of the auditor with ICAI

6. Details of the Partners of the auditor

7. Number of employees employed by the auditor

8. Digital Signature Certificate (DSC) of User

PENAL PROVISIONS

If a company or any officer of a company or an auditor or any other person contravenes any of the provisions of these rules, the company and every officer of the company who is in default or the auditor or such other person shall be punishable as per the provisions of section 450 of the Act.

| Company | Officer in default |

| Penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, maximum 2 Lakh rupees. | Penalty of ten thousand rupees, and in case of continuing contravention, with a further penalty of one thousand rupees for each day after the first during which the contravention continues, maximum 50K rupees. |

Quick Questions-

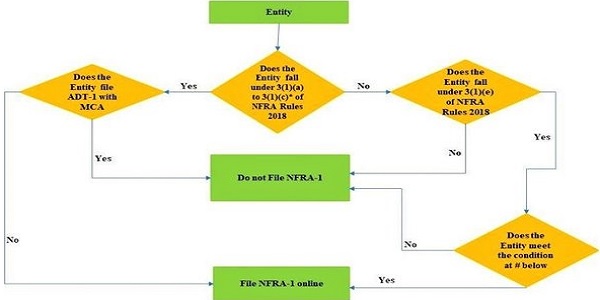

1. My Company is not covered within the Rule 3(1)(C), Rule 3(1)(d) or Rule 3(1)(e), but NFRA-1 registration page is giving only these three options. What shall I do?

Ans: Kindly refer to the Chart above. In case, NFRA-1 needs to be filed as per the chart above, kindly register for the same and file NFRA-1 online.

2. Do listed Companies need to file Form NFRA-1 or not?

Ans: Listed Companies would be Filing ADT-1 form with MCA and as such need not file NFRA – 1 form.

3. Where to find NFRA-1 form?

Ans: Please visit https://eformnfra1.nic.in/ and proceed with New User Registration/ Sign Up to begin the procedure.

4. Where to find NFRA-2 form?

Ans: Please visit https://eformnfra2.nic.in/ and proceed with New User Registration/ Sign Up to begin the procedure.

*****

Disclaimer: Though full efforts have been made to state the interpretations correctly, yet the author is not responsible / liable for any loss or damage caused to anyone due to any mistake / error / omissions

Do write for any Queries/suggestions or Questions at cspriyapandey21@gmail.com