SEBI (SAST) Regulations, 2011 provides that whenever an acquirer acquires the shares/voting right in excess of the threshold or control over the Target Company as prescribed under Regulation 3, 4 and 5 of SEBI Takeover Regulations, then the acquirer is required to make a public announcement of offer to the shareholders of the Target Company. However, Regulation 10 of SEBI (SAST) Regulations, 2011 provides the automatic exemption from the provisions of making open offer under Regulation 3 and 4.

Regulation 10(1)(a) provides the automatic exemption from the provisions of Regulation 3 and 4 where the acquisition of shares has been made through inter se transfer that is to say acquisition through inter se transfer is not subject to open offer if it complies with the conditions as specified in the said regulation.

Acquisition pursuant to inter se transfer of shares amongst qualifying parties, being-

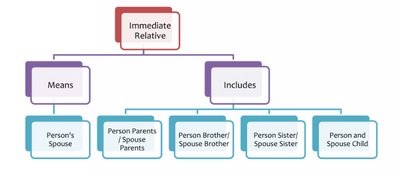

1. Immediate Relatives:

The term “Immediate Relative” is defined under Regulation 2(1) which provides that Immediate Relatives means any spouse of a person, and includes parent, brother, sister or child of such person or of the spouse.

2. Inter se transfer of shares between persons named as promoters in the shareholding pattern filed by the target company in terms of the listing agreement or these regulations for not less than three years prior to the proposed acquisition.

If there is any transfer of shares between persons shown as promoters in the shareholding pattern filed by the Target Company as per

- Listing Agreement or

- SEBI Takeover Regulations

for atleast 3 years prior to the proposed acquisition, then any transfer of shares between these promoters is exempt from Regulation 3 and 4 of SEBI (SAST) Regulations, 2011.

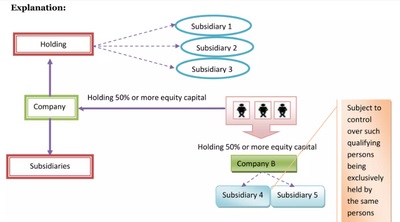

3. Acquisition pursuant to inter se transfer of shares amongst qualifying parties being:

- a company,

- its subsidiaries,

- its holding company,

- other subsidiaries of such holding company,

- persons holding not less than 50% of the equity shares of such company,

- other companies in which such persons hold not less than 50% of the equity shares, and their subsidiaries subject to control over such qualifying parties being exclusively held by the same persons.

4. Inter se transfer of shares amongst persons acting in concert for not less than three years prior to the proposed acquisition, and disclosed as such pursuant to filings under the listing agreement:

If there is any transfer of shares between persons shown as person acting in concert in the shareholding pattern filed by the Target Company as per listing agreement for atleast 3 years prior to the proposed acquisition, then any transfer of shares between these person acting in concert is exempt from Regulation 3 and 4 of SEBI (SAST) Regulations, 2011.

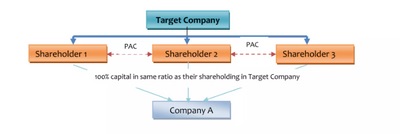

5. Inter se transfer of shares

- Between Shareholders of a target company who have been persons acting in concert for a period of not less than three years prior to the proposed acquisition and are disclosed as such pursuant to filings under the listing agreement, and

- Any Company in which the entire equity share capital is owned by such shareholders in the same proportion as their holdings in the target company without any differential entitlement to exercise voting rights in such company.

The Exemption is available subject to the compliance of the following conditions:

-

Pricing for the transfer:

If the shares of the Target Company are frequently traded– The acquisition price per share shall not be higher by more than 25% of the volume-weighted average market price for a period of 60 trading days preceding the date of issuance of notice for the proposed inter se transfer under regulation 10(5), as traded on the stock exchange where the maximum volume of trading in the shares of the target company are recorded during such period, and

The benefit of exemption will be available subject to such transferor(s) and the transferee(s) having complied with Chapter V i.e. Disclosure under Regulation 29- Disclosure of acquisition and disposal, Regulation 30- Continual Disclosure and Regulation 31- Disclosure of encumbered shares.

Reporting Requirements:

For the Inter-se transfer of shares under Regulation 10(1)(a) of SEBI (SAST) Regulations, 2011 the following pre and post-reporting requirements would be applicable:

Sr. no. |

Stage |

Relevant Law |

Disclosure Requirement |

Timelines |

By |

To |

| 1 | Pre-Acqusition Reporting | Regulation 10(5) of SAST Regulations | Intimation of details of the proposed acquisition | At least four working days prior to the proposed acquisition | Acquirer | Stock exchange where the shares of the Company are listed |

| 2 | Post-Acquisition Reporting | Regulation 29(2) of SAST Regulations | Disclosure of Aggregate shareholding and change in shareholding/voting right exceeding 2% | Within two working days of the such change | Acquirer & Seller |

1. Company 2. Stock exchange where the shares of the Company are listed |

| 3 | Post-Acquisition Reporting | Regulation 10(6) of SAST Regulations | Filing of report | Not later than four working days from the date of acquisition. | Acquirer | Stock exchange where the shares of the Company are listed |

| 4 | Post-Acqusition Reporting | Regulation 10(7) of SAST Regulations | Submission of report with supporting documents to the Board giving all details in respect of acquisitions, along with a non-refundable fee of Rs. 150,000 (Rupees One Lakh Fifty Thousand) by way of direct credit in the bank account through NEFT/RTGS/IMPS or by way of a banker’s cheque or demand draft | Within twenty-one working days of the date of acquisition. | Acquirer | Securities and Exchange Board of India (SEBI) |

Disclosure required under Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015:

| Sr. no. |

Relevant Law | Disclosure Requirement | Timelines | By | To |

| 1 | Reg 7(2)(a) of SEBI (Prohibition of Insider Trading) Regulations, 2015 | Disclose the number of securities acquired | Within two trading days of such transaction. | Buyer | Company |

| 2 | Reg 7(2)(a) of SEBI (Prohibition of Insider Trading) Regulations, 2015. | Disclose the number of securities disposed of | Within two trading days of such transaction. | Seller | Company |

| 3 | Reg 7(2)(b) of SEBI (Prohibition of Insider Trading) Regulations, 2015. | Notify the particulars of trading of both the acquirer as well as seller | Within two trading days of receipt of the disclosure from the acquirer & seller or from becoming aware of such information. | Company | Stock exchange where the shares of the Company are listed |

Conclusion: Inter se transfer of shares among qualifying parties offers exemptions from public offers under SEBI (SAST) Regulations, subject to strict conditions. Understanding these exemptions and complying with reporting requirements are crucial for stakeholders involved in such transactions.

***

Disclaimer: Though full efforts have been made to state the interpretations correctly, yet the author is not responsible / liable for any loss or damage caused to anyone due to any mistake / error / omissions.

Do write for any Queries/suggestions or Questions at cspriyapandey21@gmail.com

Well Written ,and crisp article but Priya can you clear that in the event of inter se transfer between promoters(s) by way of gift and total holding of one promoter breaching 25% will it require mandatory open offer ,secondly if it’s not the case then still donee has to comply with 10(5),(6) & (7)…

Very Informative.