GOVERNMENT OF INDIA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES.

GUJARAT. DADRA 6 NAGAR NAVELI

ROC Bhavan, Opp. Rupal Park

Nr. Ankur bus stand, Naranpura, Ahmedabad (Gujarat)-380013.

57 MIkur 0.1. Sta1d. 59.2471718 21470.0bel (Gt..) – 380013

Tel. No 079-27418531, Fax– 079-27438377

Website: www.mca.gov.in E-mail: roc.ahmedbad@mca.gov.in

BEFORE THE ADJUDICATING OFFICER

REGISTRAR OF COMPANIES, GUJARAT, DADRA & NAGAR HAVELI

No. ROC-GI/AK ORDER/ SUN PHARMA/ Sec.454/ 2023-24/456

Dated: 28 April 2023

ORDER FOR PENALTY UNDER SECTION 454 OF THE COMPANIES ACT, 2013 READ WITH COMPANIES (ADJUDICTION OF PENALTIES) RULES, 2014 AND COMPANIES (ADJUDICATION OF PENALTIES) AMENDMENT RULES, 2019 FOR VIOLATION OF SECTION 143(3) OF THE COMPANIES ACT, 2013 READ WITH RULES MADE THEREUNDER AND AS-18 AND IND-AS 24.

IN THE MATTER OF

M/s. SUN PHARMACEUTICAL INDUSTRIES LIMITED

(L24230G11993PLC019050)

Date of Hearing: 28/03/2023 & 11/04/2023

Present :

1. Shri R.C. Mishra, ICLS (ROC), Adjudicating Officer

2. Shri. Neelambuj, ICLS (AROC), Presenting Officer

3. Ms. Mansi Gokhle, ICI.S (Trainee Officer)

4. Shri Prince Kumar, ICLS (Trainee Officer)

Company/ Officers/ Authorised Representative etc.:

1. Mr. Rajesh K. Iliranandani, Partner of M/s Deloitte Haskins & Sells LLP, Chartered Accountant appeared

2. Mr. Manoj H. Dama, Partner of M/s Deloitte Haskins & Sells 1.1,P, Chartered Accountant appeared

3. Ms. Prachi Dhanani, Advocate for M/s Deloitte Haskins & Sells LLP, Chartered Accountants appeared

Appointment of Adjudication Authority:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A- 42011/112/2014-Ad.II dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 31.03.2014) for adjudging penalties under the provisions of Act.

Company/any other Person in default

2. M/s. Deloitte Haskins & Sells LLP, Chartered Accountant, was appointed as Statutory Auditors for FY 2014-15, FY 2015-16 and FY 2016-17 by ADT-1 submitted through e-form GNL-2 vide SRN C25090713, dated 09/10/2014 by the Board of Directors of M/s. SUN PHARMACEUTICAL INDUSTRIES LIMITED (SPIL), which is a company registered under the provisions of the Companies Act, 2013 in the State of Gujarat, having CIN: L24230GJ1993PLC019050 and presently having its registered office situated at “SPARC, Tandalja, Vadodara-390012, India”.

Fact about of the case and Show Cause Notice.

3. The Inquiry of M/s. SUN PHARMACEUTICAL INDUSTRIES LIMITED under Section 206(4) of the Companies Act, 2013 ordered by Ministry of Corporate Affairs in the affair of the company covering Financial Years 2014-15, 2015-16, 2016-17 and 2017 In connection to the Inquiry, the Inquiry Officer has issued Show Cause Notice vide this office letter No. ROC-GJ/ADJ/U/S 454/SUN PHARMA/2022-23/5472 TO 5474, dated 10.11.2022 to the Statutory Auditor of the company for FY 2014-15, FY 2015-16 and FY 2016-17 to M/s Deloitte Haskins & Sells LLP, Chartered Accountants, in respect of not reporting M/s Aditya Medisales Ltd as related parties as per the requirement of IND-AS-24/AS-18 in Financial Statement of the company of FY 2014-15, 2015-16 and 2016-17 respectively.

Reply of Auditor and personal Hearing.- 28/03/2023

4. In respect of the aforesaid notice, Deloitte Haskins & Sells LLP, Chartered Accountant submitted their written reply vide their letter dated 27/03/2023, which is taken on record. In respect of the Adjudication notice, they had present before the Adjudicating Authority on 28th March, 2023 for physical hearing. Ms. Prachi Dhanani, Advocate for M/s Deloitte Haskins & Sells LLP, Chartered Accountant has kept reliance on written reply as under;

a. As per the perusal of office notice dated 10th November, 2022, your good office have considered the Forensic Audit Report of the SEBI and the SEBI order dated 21/01/2020 as substantial evidence in support of the alleged violation levlled against me. It therefore appears that your good offices have placed heavy reliance on the aforesaid documents. I have however not been provided with the copies of the aforesaid documents along with your letter. You will appreciated that it is imperative that I be provided with copies of the Forensic Audit Report and the SEBI Order to effectively respond to the allegation of violation contained in your letter dated 10th November, 2022 more so given the fact that the letter does not explain the basis for concluding that M/s Aditya Medisales Ltd is a Related Party of the company under AS-18/IND-AS-24. Without prejudice to the fact that there has been no non-compliance and/or violation by client much less the violation/non-compliance alleged in your letter dated 10. November. 2022, you will appreciated that non-availability of the aforesaid material and relevant information will impair my ability effectively respond to the allegation made against my client in this regard. Nevertheless, I have provided my response below to the best of my ability and reserve my right to supplement the same with any additional submission at a later stage, if so required and deemed necessary.

b. As regards imposing a penalty under Section 143(15) of the Act for alleged noncompliance of Section 143(12)of the Act, I wish to state that Section 143(12)of the Act deals with the reporting obligation of the auditor. As per the said provision, if an auditor of a company in the course of the performance of his duties as auditor, has reason to believe that an offence of fraud involving such amount or amounts as may be prescribed, is being or has been committed in the company by its officers or employees, the auditor is required to report the matter to the Central Government within the time and in the manner as I state that your letter dated 10th November 2022 does not explain the basis on which you have e reasonable cause to believe that there has been non-compliance of Section 143(12) of the Act.

c. It is further submitted that:

i. The Company’s Board of Directors is responsible for the matters stated in Section 134(5) of the Act with respect to the preparation of the financial statements that give a true and fair view in accordance with the Ind AS/ Accounting Standards and other accounting principles generally accepted in India. This responsibility also includes maintenance of adequate accounting records in accordance with the provisions of the Act for safeguarding the assets of the Company and for preventing and detecting frauds and other irregularities; selection and application of appropriate accounting policies; making judgments and estimates that are reasonable and prudent and design, implementation and maintenance of adequate internal financial controls, that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error, A declaration to this effect has been made in the Annual Reports of the Company in the Directors’ Responsibility Statement of the respective years.

ii. The Company’s Audit Committee is responsible for the matters stated in Section 177 of the Act including examination of the financial statements, approval or any subsequent modification of transections of the a company with related parties and evaluation of internal financial controls and risk management systems-

iii. Schedule IV to the Act, Code for Independent Directors, inter alia, requires the Independent Directors to satisfy themselves on the integrity of the financial information and that financial controls and the systems of risk management are robust and defensible.

iv. Our responsibility as an Auditor is to conduct the audit in accordance with Standards Auditing (5A) specified under Section 143(10) of the Act for forming and expressing opinion on the financial statements that have been prepared by the management with oversight of those charged with

d. I shall now respond to office letter dated 10. November 2022. Needless to state that the below response is without prejudice to my contention that nothing stated in your letter dated 10° November 2022 is admitted or should be deemed to have been admitted by my client for lack of traverse, and all the non-compliances stated therein against my client are denied.

e. The duty, as statutory auditors of the Company, has been duly discharged by ensuring compliance with SAs specified under Section 143 (10) of the Act, particularly SA 550 dealing with “Related Parties” which outlines the procedures to be performed by an auditor with respect to related party relationships and transactions to fulfill the objectives specified in the said Standard.

Appropriate and relevant procedures laid down in SA 550. including, inter alia, the following key procedures, have been performed as part of the statutory audit:

i. Obtained an understanding of related party relationships and transactions.

ii. Obtained an understanding of the control environment, relevant to mitigating the risks of material misstatement associated with related party relationships and transactions including: (i) obtaining Related Party Transaction Policy approved by the Board of Directors in line with the requirements of Section 188 of the Act read with Rules made thereunder and Regulation 23 of the SEBI(Listing Obligations and Disclosure Requirements) Regulations 2015 and subsequent amendments thereto (ii) Reports of External firms of Chartered Accountants to the Audit Committee, generally, on a quarterly basis certifying that all the Related party transactions have been entered Into at an arm’s length price and in the ordinary course of business.

iii. As part of the planning process. made inquiries with the management regarding the risk of fraud.

iv. Obtained and read the minutes of meetings of the Audit Committee, Board of Directors and shareholders and noted that the identification of related party relationships and transactions have been reviewed by the Audit Committee and the Board of Directors.

v. Obtained and examined the declarations under Section 184 of the Act in Form MBP- 1, made by the Directors of the Company to the Company giving notice of their nature of interest or concern or shareholding in any other companies. body corporate, firm, or other association to identify any entities in which any of the Directors are interested.

vi. Noted that the significant transactions and arrangements with identified related parties have been appropriately authorized and approved by the Board of

vii. Obtained and examined list of major equity shareholders holding more than 5% in the Company to identify shareholders holding more than 20% in the Company.

viii. Perused the investment schedule of the Company to identify entities in which the Company is holding more than 20% equity investment.

ix. Noted that the identified related party relationships and transactions have been appropriately disclosed and the financial statements.

x. Obtained appropriate written representations from management, confirming that all the related parties and the transactions with such related parties, have been identified and adequately disclosed in the financial statements.

It should be noted that the related party disclosures in the financial statements are based on the requirements of the accounting standards i.e.. AS 18 and Ind AS 24. Based on the aforesaid audit procedures performed by our client as statutory auditors, perusal of the declarations provided by the Directors in Form MOP 1, and information and explanations provided during the course of the statutory and it of the Company, M/s. Aditya Medisales Limited was not identified as a related party within the meaning of AS-18 and Ind AS-24.

Further post March 2017, Consequent to a scheme of amalgamation filed with the Hon’ble National Company taw Tribunal in relation to Aditya Medisales Limited, in anticipation of the Scheme becoming elective and consequently M/s. Aditya Medisales becoming a related party of the Company, the Company had obtained shareholders’ approval under the provisions of Section 188 of the Act during the annual general meeting held on 26th September 2017.

It observed that in the financial statements of the Company for Fy 17 18, signed by another auditor Aditya Medisales limited has been disclosed as a related party (under the head Others, -entities in which KMP or relatives of KMP have control or significant influence). A perusal of the same however indicates that the sales made to Aditya Medisales Limited in FY 16 17 have not been disclosed as a related party transaction in the corresponding figures for FY 16-17. Thus, the succeeding statutory auditor has also confirmed that the related party relationship did not exist in the prior year. Had this relationship existed in FY 16-17, then this would have necessitated a restatements contemplated in Ind AS 8 Accounting policies. Changes in Accounting Estimates and Error.

f. In light of the above, I humbly submit that the duty cast upon my client under the relevant Standards of Auditing and Reporting Framework has been duly and fully complied with and there has been no non-compliance and/or violation committed by my client, much less the violation/non-compliance alleged in office letter dated 10th November 2022. Consequently. I pray that the allegation of noncompliance/ violation of the provision of the Act levelled against my client be dismissed and no penalty ought to be levied against my client. Further, please note that office letter dated 10th November 2022 stated that the notice is being issued to the company and its officers/directors to show cause as to why penalty under the relevant provision should not be imposed on the Company and its Directors/officers in default. In this regard, besides from the reasons already stated hereinabove, which indicate that there has been no violation of the applicable provisions of the Act and therefore no penalty ought to be imposed on my client. I would like to clarify that I am neither an officer nor a director of the Company.

Presenting Officer Submission:-

5. The Presenting officer in this regard submitted that the power and duty of the Statutory Auditor defined u/s 143 of the Companies Act, 2013 and as per sub-section (1) of section 143 of the Companies Act, 2013, every auditor of a company shall have a right of access at all times to the books of account and vouchers of the company, whether kept at the registered office of the company or at any other place and shall be entitled to require from the officers of the company such information and explanation as he may consider necessary for the performance of his duties as auditor.

Provided that the auditor of a company which is a holding company shall also have the right of access to the records of all its subsidiaries and associate companies in so far as it relates to the consolidation of its financial statements with that of its subsidiaries and associate companies.

Also section 143(3) provides that the auditor’s report shall also state—

a. Whether he has sought and obtained all the information and explanations which to the best of his knowledge and belief were necessary for the purpose of his audit and if not, the details thereof and the effect of such information on the financial statements;

b. whether, in his opinion, proper books of account as required by law have been kept by the company so far as appears from his examination of those books and proper returns adequate for the purposes of his audit have been received from branches not visited by him;

c. whether the report on the accounts of any branch office of the company audited under sub-section (8) by a person other than the company’s auditor has been sent to him under the proviso to that sub-section and the manner in which he has dealt with it in preparing his report;

d. whether the company’s balance sheet and profit and loss account dealt with in the report are in agreement with the books of account and returns;

e. whether, in his opinion, the financial statements comply with the accounting standards;

f. the observations or comments of the auditors on financial transactions or matters which have any adverse effect on the functioning of the company;

g. whether any director is disqualified from being appointed as a director under subsection (2) of section 164;

h. any qualification, reservation or adverse remark relating to the maintenance of accounts and other matters connected therewith;

i. whether the company has adequate internal financial controls with reference to financial statements in place and the operating effectiveness of such controls;

j. such other matters as may be prescribed.

6. The Presenting Officer further stated that as per para (3) of the AS-18 described the related party relationship as under;

(a) enterprises that directly, or indirectly through one or more intermediaries, control, or are controlled by, or are under common control with, the reporting enterprise (this includes holding companies, subsidiaries and fellow subsidiaries);

(b) associates and joint ventures of the reporting enterprise and the investing party or venturer in respect of which the reporting enterprise is an associate or a joint venture;

(c) individuals owning, directly or indirectly, an interest in the voting power of the reporting enterprise that gives them control or significant influence over the enterprise, and relatives of any such individual;

(d) key management personnel and relatives of such personnel; and

(e) enterprises over which any person described in (c) or (d) is able to exercise significant influence This includes enterprises owned by directors or major shareholders of the reporting enterprise and enterprises that have a member of key management in common with the reporting enterprise.

7. The Presenting Officer further submitted that as per the definition as stated in AS-18 of –

– Related party– parties are considered to be related if at any time during the reporting period one party has the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions.

– Related party transaction– a transfer of resources or obligations between related parties, regardless of whether or not a price is charged

– Significant influence – participation in the financial and/or operating policy decisions of an enterprise, but not control of those policies.

– Key management personnel – those persons who have the authority and responsibility for planning, directing and controlling the activities of the reporting enterprise

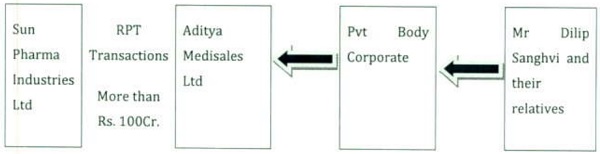

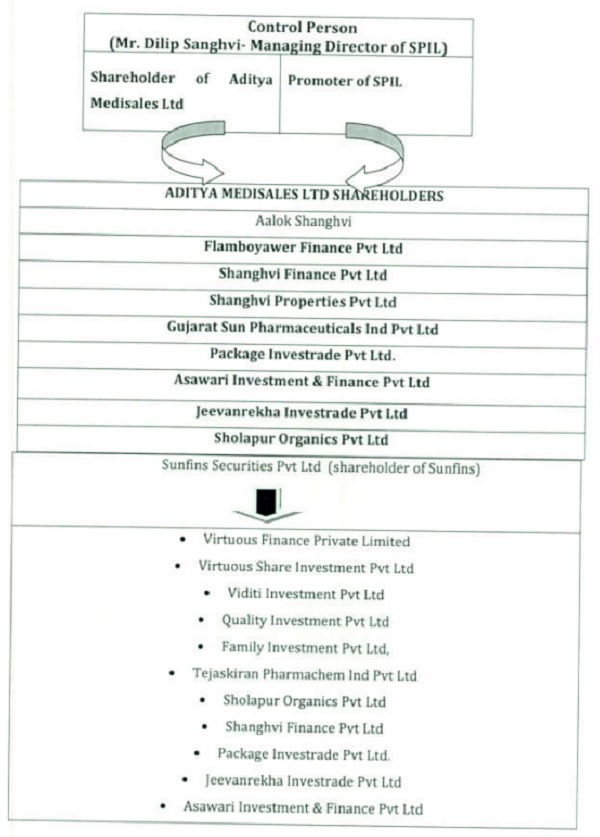

8. The Presenting Officer further stated that although the shareholder of the Aditya Medisales Ltd is Body Corporates, but the main control person of all the said body corporates is Managing Director of SPIL Shri Dilip Sanghvi and their family members as under;

| Shareholder of Aditya Medisales Ltd | Relation with SPIL | |

| Aalok Shanghvi | Relative of Mr. Dilip Shanghvi | |

| Flamboyawer Finance Pvt Ltd | Mr. Dilip Shanghvi, Mrs Kumud Sanghvi, Navjivan Rasayan Gujarat Pvt Ltd | |

| Shanghvi Finance Pvt Ltd | ||

| Shanghvi Properties Pvt Ltd | Mr. Dilip Shanghvi,

Mrs Vibha D. Shanghvi |

|

| Gujarat Sun Pharmaceuticals Ind Pvt Ltd | ||

| Package Investrade Pvt Ltd. | Family Investment Pvt Ltd, Solares Therapeutic Pvt Ltd Bonaire Exports Pvt Ltd Nirmit Exports Pvt Ltd | All the shareholder of these companies are body corporates which is controlled by Mr Sanghvi and its Family. |

| Asawari Investment & Finance Pvt Ltd | Alrox Investment & Finance Pvt Ltd- Controlled by Mr. Dilip Sanghvi and Family

Airborne Investments & Finance Pvt Ltd- Controlled by Mr. Dilip Sanghvi and Family Bridgestone Investment & Finance Pvt Ltd- Controlled by Mr. Dilip Sanghvi and Family Deeparadhana Investment & Finance Pvt Ltd- Controlled by Mr. Dilip Sanghvi and Family Mackinon Investments & Finance Pvt Ltd- Controlled by Mr. Dilip Sanghvi and Family Mr Dilip Sanghvi |

|

–

| Jeevanrekha Investrade Pvt Ltd | Family Investment Pvt Ltd, Vidhi Investment Pvt Ltd.

Quality Investments Pvt Ltd Telaskiran Pharmachem Ind Pvt Ltd |

All the shareholder of these companies are which is controlled by Mr Sanghvi and its Family. |

| Sholapur Organics Pvt Ltd | Bonaire Exports Pvt Ltd Nirmit Exports Pvt Ltd | All the shareholder of these companies are body corporates which is controlled by Mr Sanghvi and its Family. |

| Sunfins Securities Pvt Ltd | Virtuous Finance Private Limited Virtuous Share Investment Pvt Ltd VIM Investment Pvt Ltd Quality Investment Pvt Ltd Family Investment Pvt Ltd,

Telaskiran Pharmachem Ind Pvt Ltd Sholapur Organics Pvt Ltd Shanghvi Finance Pvt Ltd Package Investrade Pvt Ltd. Jeevanrekha Investrade Pvt Ltd Asawari Investment & Finance Pvt Ltd |

All the shareholder of these companies are body corporates which is controlled by Mr Sanghvi and its Family |

The Presenting Officer stated that it has been established that Managing Director of SPIL -Mr Dilip Sanghvi has control on Aditya Medisales lad. These all the above companies only create a layer between Sun Pharma and Aditya Medisale to hide the direct control of Mr. Dilip Sanghvi.

Hence, the Aditya Medisales fall under the criteria of Related Party as per the AS-I8 para (3) and definition as stated in aforesaid para 6 & 7. Further, the related party transaction of Sun Pharmaceutical Industries Ltd with Aditya Medisales Ltd is exceed from Rs. 100 Cr which is material and significant transaction. Hence, it is duty of Statutory Auditor to check the significant transactions.

9. The Presenting Officer opposed the contention of the Auditor that this office only rely on SEBI The Presenting Officer stated that Inquiry u/s 206(4) of the Companies Act, 2013 is independently carried by this office under the instruction of the Ministry of Corporate Affairs and violations reported accordingly. As slated by the official of the Auditor that this office has not provided any Forensic Audit of the company or SEBI order in this regard. As the Forensic Audit report is confidential in nature and received from the SEBI. Hence, this office only shown the said report to the Auditor to understand the seriousness of the matter.

Adjournment of matter as per the request of the Auditor

10. After making of aforesaid submission. the authorized representative of Statutory Auditor seek adjournment of the matter to go through the SEBI order/report etc.

11. As per their request, the matter has been adjourned for further hearing on 11/04/2023.

Hearing of the matter on 11/04/2023

12. Advocate of the Statutory Auditor of the company made additional submission on 10th April. 2023 via email which has been taken on record by this office.

In the said additional submission they submitted as under;

a. The Statutory Auditor of the company submitted that this office relying on the Settlement Order of the SEBI dated 11/02/2021 passed by SEBI pertaining to the issue regarding Aditya Medisales Ltd being RPT of the company before amalgamation. In this regard, it is submitted that as is ex-facie evident form the SEBI order dated 11/02/2021 the company filed the settlement application without admitting or denying the finding of fact and conclusions of laws by SEBI. I therefore respectfully submit that the company’s act of entering into a settlement does not and cannot amount to admission of the alleged violation by the company. This is further negated by the fact that the company, as I understand, is denying the fact that AML was a related party prior to the scheme of amalgamation.

b. Upon a perusal of the extract of the SEBI Reports, I note the same is not a forensic audit report as stated in the said letter dated 10th November, 2022. However, I also not that the SERI Report refers to a Forensic Audit Report dated 16th September, 2019 prepared by the forensic auditors a copy of which has not been shared with me. I therefore crave leave to file further detailed submission, if necessary, upon receipt of the above Forensic Audit Report.

c. The Statutory Auditor stated that the role of Statutory Auditor is different from various point of view from Forensic Auditor.

d. The statutory Auditor further stated that the they have relied and confirmed from the declaration submitted by the director of the company in form MBP-I and explanation provided by the company time to time in this regard.

e. They have further stated that the Aditya Medisale Ltd become the Related Party of the Sun Pharmaceutical Pet Ltd after the date of Amalgamation of Sanghvi Finance Private Ltd with other companies in year 2017-18.

f They have further stated that the FY 2017-18 is signed by the another Auditor of the company. However they have also not made any comment regarding AML as related party in FY 2016-17.

g. They have further submitted that during process they have not found any concern regarding reliability, genuineness and correctness of the information/documents provided by the management.

h. The Auditor of the company stated that there are no substance of fraud.

i. The Auditor of the company has opposed the Show Cause Notice/Adjudication Notice, dated 10/11/2022 and request for issue a different Show Cause Notice for further argument in the

Argument made by the Presenting Officer

13. The Presenting Officer strongly opposed the contention submitted by the Statutory Auditors by submitting that the Statutory Auditor of the company play a crucial role while conducting audit and submission of their report. In this case, the statutory auditor has made omission of reporting of RPTs and it is negligence of their duty. The Presenting Officer has further stated as under,

a. The inquiry of the subject company is based on Whistle Blower Complaint in respect of Related Party Transaction, Money Diversion from Sun Pharmaceutical Industries Ltd to Aditya Medisales Ltd and other group companies. In the said matter, the Serious Fraud Investigation Office (SF10), Ministry of Corporate Affairs also made research and shared a Market Research and Analysis Report (MRAU) to this office in year 2019. Accordingly, the Inquiry into affairs of the company is independently directed by the Ministry of Corporate Affair to this office to investigate the Related Party Transaction matter of the Sun Pharmaceutical Industries Ltd. with Aditya Medisales Ltd covering the FY 2014-15 to FY 2017-18 and the omission of reporting of Related Parties Transaction (RPTs) and violation of the Companies Act, 2013.

b. As per the Whistle Blower complaint, a Separate Investigation made by the SEBI. The SERI Settlement Order no SO/VV/AA/2020.21/4163, 4164, dated11/02/2021 stated as under;

“Two whistle blower complaints were received by the Securities and Exchange Board of India (SEW), wherein allegations were made against Sun Pharmaceutical Industries Limited(hereinafter referred to as the ‘Applicant’ / ‘SPIV) and its wholly owned subsidiary, Sun Pharmaceutical Laboratories Ltd (hereinafter referred to as SPLL’), alleging that SPIL and SPLL had been diverting funds through Aditya MedisalesLtd (hereinafter referred to as ‘AML), its sole distributor in India. Further, it was alleged that transactions with AML were ongoing for several years, however, AML was disclosed as a related party of SPIL only in FY 2017-18. In view of the same, forensic audit was conducted in the matter followed by investigation .5E81 observed during investigation that AML was a related party of SPIL even before the scheme of amalgamation. However, the relevant compliance(s) pertaining to related parties, as required under the following provisions of SEBI (Listing Obligation and Disclosure Requirements) Regulations, 2015(hereinafter referred to as ‘SEBI (LODR) Regulations, 2015’), were not made by SPIL (with respect to AML).

i) Prior approval of the audit committee for transactions with AML, as required under regulation 23(2) of SERI (LODR) Regulations, 2015, was not obtained.

(ii) Considering that the transactions with AML would have qualified as material related parry transactions, it required approval of shareholders under regulation 23(4) of SERI (LODR) Regulations, 2015, which was not obtained.

(iii) Disclosure of related parry transactions with AML in the Annual Reports for FY 2015-16 and FY 2016-17, as required under regulation 34(3) read with schedule V of 5E81 (LODR) Regulations, 2015. was not made.

(iv) In view of the same, it was observed that SPIL had violated regulation 23(2), 23(9) and 34(3) of SEM (LODR) Regulations, 2015″

c. The Presenting officer further stated that the Forensic Audit made by the SEBI is an additional confirmation regarding Related Party Transaction of Sun Pharma with Aditya Medisales Ltd.

d. Aditya Medisales Ltd is sole distributor of the SPIL since long in India. All the goods manufactured by SPIL sold within India were sold through AML.

e. As per the shareholding of the SPIL available at stock exchange, Aditya Medisales Ltd. is promoter company of the SPIL since year 2001.

f. Viditi Investment Pvt. Ltd., Tejaskiran Pharmachem Industries pvt. ltd. Family Investment Private Limited, Quality Investments pvt. ltd. Virtuous Finance Private Limited, Virtuous Share Investments Private Limited, Sholapur Organics Private Limited, Jeevanrekha lnvestrade Pvt. Ltd., Package Investrade Pvt. Ltd., Shanghvi Finance Private Limited, Asawari Investment And Finance Private Limited, Flamboyawer Finance Private Limited, Sanghvi Properties Private Limited, Gujarat Sun Pharmaceutical Industries Pvt Ltd, Nirmit Exports Private Limited and Unimed Investments Limited are the promoter company of the SPIL since long. (before Year 2017) which is also shareholder of the AML. The relevant para of the scheme is as under:

Hence, from the above it has been confirmed that the promoter of the SPIL and Shareholder are the AML are the same. The shareholder of this promoter companies is Managing Director of SPIL-Mr Dilip Sanghvi and their family members. Therefore, it has been confirmed that the SPIL and AML are Related party before the Merger of Sanghvi Finance Ltd.

g The Presenting Officer further stated that as per the merger filed by the company before NCLT, the company itself confirmed that the all the 22 Transferor companies li.e.41)Alrox Investment and Finance Private Limited, (2)Airborne Investment and Finance Ltd., (3)Bridgestone investment and Finance Ltd., (4) Deeparadhana investment and Finance Ltd, (S)Mackinon Investment and Finance Ltd., (6)Solares Therapeutic Private Limited, (7)Bonoire Exports Private Limited, (8)Nirmit Exports Private Limited, (9)Viditi Investments Private Limited, (10)Teloskiron Pharmachem Industries Private Limited, (11)Family Investment Private Limited, (12)Quality Investment Private Limited, (13)Virtuous Finance Private Limited, (14)Virtuous Share Investments Private Limited, (15)Pockage Investrade Private Limited, (16)leevanrekha Investrade Private Limited, (17)Sholapur Organics Private Limited, (18)Asowari Investment & Finance Private Limited, (19)Virtuous Securities & Braking Private Limited, (20)Sunfins Securities Services Private Limited, (21)Meghgango Finvest Private Limited, (22)Privilege Trading Private Limited) and Transferee Companies (Sanghvi Finance Pvt Ltd) is connected with the Mr. Dilip Sanghvi.

C. RATIONALE OF THE SCHEME

The Transferor Companies and the Transferee Company are all part of Dilip Shanghvi family promoted Group. Also, the Transferor Companies are directly indirectly wholly owned subsidiaries of the Transferee Company In order to consolidate and effectively manage the Transferor Companies and the Transferee Company is a single entity. which will provide several benefits including synergy, economies of scale, attain efficiencies and cost competitiveness, it is intended that the Transferor Companies be amalgamated with Transferee Company the Scheme of Amalgamation would inter alia achieve the following benefits.

h. Presenting Officer, further stated that as the AML is sole distributor and Promoter Deloite Haskins & Sells LLP, Chartered Accountant was the statutory of the company from more than 20 years (w.e.f. FY 2005-06 to FY 2016-17). Therefore, the statement of Auditor that they are not aware about the fact and showing the difference excuses in shadow of different provision of the act and stating that the forensic auditor and statutory auditor is different is not considerable.

i. The Presenting officer further stated the provision of section 2(76) of the Companies Act, 2013 as under;

(v) a public company in which a director or manager and holds is a director or holds along with his relatives, more than two per cent. of its paid-up share capital;

(vi) anybody corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager;

Therefore, Mr Dilip Sanghvi, who hold more than 2% holding of AML (directly/indirectly) is related party of SPIL as per section 2(76) read with AS-18.

Accordingly, it has been confirmed from the MCA record, Shareholding of AML, SPIL shareholding at Stock Exchange, Submission made by the company before NCLT that the AML was related party of the subject company before merger in year 2017 as per the provision of section 2(76), section 188, AS-18 and SEBI (LODR), 2015.

The Presenting Officer stated as per the Rule 3(3) of the Adjudication of Penalties, the Adjudication Notice is necessary to contain the maximum penalty amount which is given u/s 143(15) of the Companies Act, 2013 for violation of section 143 of the Companies Act, 2013 which is Rs. 25 Lakh for listed company in case of instance of Fraud. The Presenting Officer further submitted that the Adjudication Officer has power u/s 454 of the Companies Act, 2013, where no specific penalty and punishment is provided in the act to impose penalty u/s 450 of the Companies Act, 2013 and the Statutory Auditor will covered under any other person as per the said provision of the law.

The Presenting Office submitted that, M/s Deloitte Haskins & Sells LLP, Chartered Accountant is liable to penalize under Section 450 of the Companies Act, 2013 in respect of non-comply of his duty as defined u/s 143 (3) of the Companies Act, 2013.

ORDER

14. After hearing the matter in detail, the Adjudicating Authority has given due regard to the following factors while passing the order, namely;

a. The amount of disproportionate gain or unfair advantage, whenever quantifiable, made as a result of default.

b. The amount of loss caused to an investor or group of investors as a result of the default.

c. The repetitive nature of default.

15. Having the considering, the submission made by the Presenting Officer, counter submission made by the Auditor and aforesaid facts & circumstances, the undersigned has reasonable cause to believe that the Statutory Auditor of the company has failed to discharge their duty as per the provisions of Section 143(3) of the Companies Act, 2013 read with relevant Accounting Standards. The Auditor of the company is in default are liable for penalty as per provision of Section 450 of the Act being any other person as per the said provision of the law.

16. Having considered the facts and circumstances of the case and submissions made by Presenting Officer and counter submission made by the Statutory Auditors and after taking into accounts the facts & circumstances above, I hereby imposed a penalty on Auditors Firm as per table below for violation of section 143(3) of the Companies Act, I am of the opinion that penalty is commensurate with the aforesaid default for not discharging their duty.

Penalty on Auditors Firm for default.

| For Financial Year | Name of Auditor’s Firm | Penalty as per Section 450 of the Companies Act, 2013 (in Rs.) | Maximum ‘ Penalty

(in Rs.) |

Penalty Imposed (Rs.) |

| FY 2014-15 | Deloitte Haskins & Sells LLP, Chartered Accountant |

10,000 +1000/.

per day |

50,000/- | 50,000/- |

| FY 2015.16 | Deloitte Haskins & Sells LLP, Chartered Accountant |

10,000 +1000/-

per day |

50,000/- | 50,000/- |

| FY 2016-17 | Deloitte Haskins & Sells LLP, Chartered Accountant |

10,000 +1000/-

per day |

50,000/. | 50,000/- |

17. The noticee shall pay the amount of penalty by way of e-payment available on Ministry website www.mca.gov.in under “Pay miscellaneous fees” category in MCA fee and payment Services under Rule 3(14) of Company (Adjudication of Penalties) (Amendment) Rules, 2019 within 60 days from the date of receipt of this order and copy of this adjudication order and Challan/SRN generated after payment of penalty through online mode shall be filed in INC-28 under the MCA portal without further reference.

18. Appeal against this order may be filed in writing with the Regional Director, North Western Region, Ministry of Corporate Affairs, ROC BHAVAN, OPP. RUPAL PARK, NR. ANKUR BUS STAND, NARANAPURA, AHMEDABAD (GUJARAT)-380013 within a period of sixty days from the date of receipt of this order, in e-form AD) (i.e. Memorandum of Appeal) setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454(5) & 454(6) of the Companies Act, 2013 read with the Companies (Adjudicating of Penalties) Rules, 2014 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019].

19. Your attention is also invited to Section 454(8)(i) and 454(8) (ii) of the Companies 2013, which state that in case of non-payment of penalty amount, the company shall be punishable with fine which shall not less than Twenty Five Thousand Rupees but which may extend to Five Lakhs Rupees and officer in default shall be punishable with Imprisonment which may extend to Six months or with fine which shall not be less than Twenty Five Thousand Rupees by which may extend to one Lakhs Rupees or with both.

The adjudication notice stands disposed of with this order.

R.C. Mishra, (ICLS)

Registrar of Companies & Adjudicating Officer

Gujarat, Dadra & Nagar Haveli