Government of India

Ministry of Corporate Affairs

Office of the Registrar of Companies, Bihar-Cum-Official Liquidator, High Court, Patna

4th Floor, ‘A’ Wing, Maurya Lok Complex

Dakbunglow Road, Patna-800001

Order No. ROC/PAT/SCN/137/37324/2132-2139 Dated: 28.11.2022

Order for penalty for violation of section 137 of the Companies Act, 2013

MOONBEAM VINIMAY PRIVATE LIMITED

CIN: U52190BR2012PTC037324

Appointment of Adjudication Officer:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014- Ad. II dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (herein after known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

Company:-

2. Whereas, Company M/s. Moonbeam Vinimay Private Limited, ON: U52190BR2012PTC037324 (herein after known as Company) is a company incorporated on 28.03.2012 under the provisions of Companies Act, 1956/2013 in the state of Bihar and having its registered office situated at Hussain Chowk, Basbitti Road, Supaul, Bihar, 852131 India as per MCA website.

Facts about the case:-

3. Whereas, the company is in default for filing its Financial Statements for the financial years 2018-2019, 2019-2020 and 2020-2021 with the office of Registrar of Companies, Patna. Hence, this office has issued show cause notice for default under section 137 of the Companies Act, 2013 vide No ROC/PAT/SCN/137/ 37324/1294-1300 dated 30.08.2022.

4. Whereas, this office has not received any reply from the company and its directors. Hence, it appears that the provisions of Section 137 of the Companies Act, 2013 has been contravened by the company and its directors/ officers and therefore they are liable for penalty u/s 137(3) of the Companies Act, 2013.

Section 137(3) states that:- “If a company fails to file the copy of the financial statements under sub-section (1) or sub-section (2), as the case may be, before the expiry of the period specified therein, the company shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day during which such failure continues, subject to a maximum of two lakh rupees, and the managing director and the Chief Financial Officer of the company, if any, and, in the absence of the managing director and the Chief Financial Officer, any other director who is charged by the Board with the responsibility of complying with the provisions of this section, and, in the absence of any such director, all the directors of the company, shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of fifty thousand rupees”.

5. Whereas, this office had issued “Notice for Hearing” vide ROC/PAT/SCN/137/37324/1900-1906 dated 2110.2022 to the company and directors/officers in default to appear personally or through authorized representative under Rule 3(3), Companies (Adjudication of Penalties) Rules, 2014 on 14112022 at 12.00 PM and also to submit their response, if any, one working day prior to date of hearing i.e. 11.11.2022.

6. That, on the date of hearing, neither anyone appeared for hearing nor any reply has been received. As per MCA record, the company has not filed its Financial Statements for the financial years 2018-2019, 2019-2020 and 2020-2021 till date. Hence the Company and its directors/Officers in default are liable for penalty as per section 137(3) of the Companies Act, 2013.

ORDER

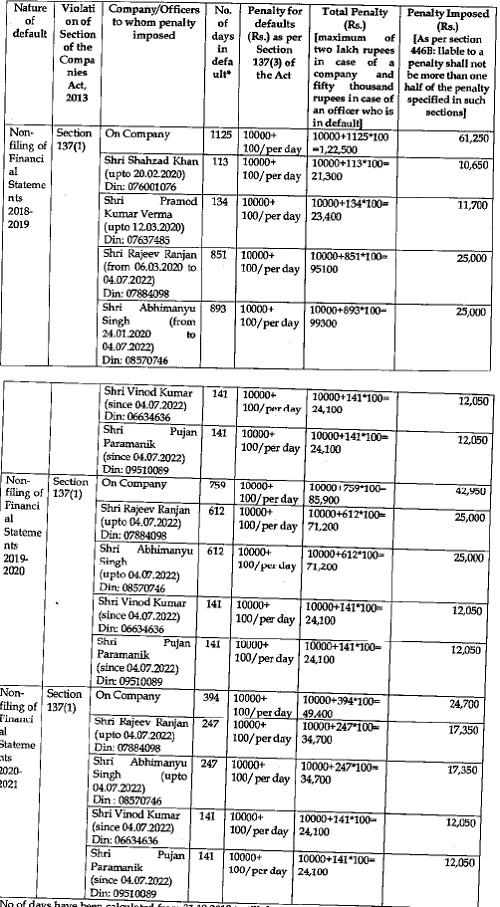

Having considered the facts and circumstances of the case, and after taking into account the factors above, I hereby impose a penalty on Company, and its Directors as per Table Below for violation of Section 137 of the Companies Act, 2013 for the financial years 2018-2019, 2019-2020 and 2020-2021

(* No of days have been calculated from 31.10.2019 to till date of order, i.e, 28.11.2022 for FY 2018-2019 and so on)

8. The noticee shall pay the amount of penalty individually for the company and its directors (out of own pocket) by way of e-payment (available on Ministry website mca.gov.in) under “Pay miscellaneous fees” category in MCA fee and payment Services within 90 (ninety) days of this order. The Challan/SRN generated after payment of penalty through online mode shall be forwarded to this office.

9. Appeal against this order may be filled in writing with the Regional Director (ER), Ministry of Corporate Affairs, Kolkata, within a period of 60 (sixty) days from the date of receipt of this order, in Form ADJ (available on Ministry website www.mca.gov.in) setting forth the grounds of appeal and shall be accompanied by a certified copy of this order {Section 454(5) and 454(6) of the Act read with Companies (Adjudication of Penalties) Rules, 2014).

10. Your attention is also invited to section 454(8) of the Act in the event of non-compliance of this order.

(Aparajit Banta)

Adjudicating Officer &

Registrar of Companies-Cum-

Official Liquidator Patna