Mandatory Submission of E-Form MSME-1 with MCA by Specified Companies-As per the MCA Notification dated 22nd Jan, 2019.

Snippet of the Notification;

(1) This Order may be called the Specified Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order, 2019. (2) It shall come into force from the date of its publication in the Official Gazette.

2. Every specified company shall file in MSME Form I details of all outstanding dues to Micro or small enterprises suppliers existing on the date of notification of this order within thirty days from the date of publication of this notification.

3. Every specified company shall file a return as per MSME Form I annexed to this Order, by 31st October for the period from April to September and by 30th April for the period from October to March.

Amendment;

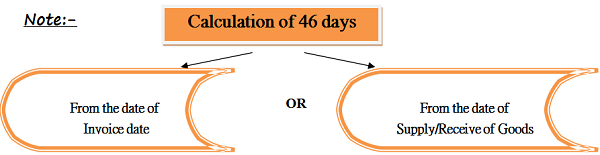

1. As per the above notification every specified company (Received Goods &/or Services ‘from’ MSME and whose payment is due or not paid within 46 days) dealing with MSME shall mandatorily file a return with MCA in e-form MSME-1.

2. Return

There are two types of return:

A) One Time Return (Due date to file-within 30 days of publication of these rules i.e. 20th February, 2019 from the notification date (i.e. 22nd January, 2019 + 29 days)

Information required to submit in One Time Return

* Total outstanding amount due as on 22.01.2019

* Particulars of Supplier (Financial years/particulars/Name/Pan No/Amount due/date from which the amount due etc.)

* Reasons for delay.

B) Half Yearly Return

Due date of filing of Half Yearly Return ~

* For half year period ‘October to March’ – 30th April

* For Half year period ‘April to September’ – 31st October

Clarification of 46 days

What to do if the company does not have any supplies from MSME ? Do we have to file NIL return ?

1. Whether MCA would extend time for filing MSME -1

2. We are in process of identity our suppliers who have registered under MSME or not . Whether Central Govt ( Udyog Vihar ) and State Govt , commerece and industry certificate is vaid as MSME ?

3. What happens if not filed , any disqualifcation in directors report

4. How to identity who are coming under MSME suppliers .

5. In case no amount is there due , should we file MSME form ?

We are not availing any MSME subsidiary, shall we file the FORM1

is it necessary to file with MSME

MADAM,

THE FORM HAS NOT BEEN RELEASED BY MCA. WILL THERE BE EXTENSION OF TIME FOR FILING?

if company receives goods and services from MSME and does not have dues outstanding more than 45 days, so will it come under Specified Company?

if our creditor is CA Firm and dues is more the 45 Days. then the company have to file MSME Form -1

Hello Ms. Jyoti,

For the purpose of Identification of MSME Creditors,

is there a prescribed format for a declaration cum confirmation from the Creditors that they fall under MSME (Micro & Small) category.

Would request you to share an adequate format for the above confirmation/declaration which fulfills the responsibility of a corporate with respect of filing of Form MSME I.

Thanks & regards!

Hi,

Is possible to register in MSME for Trading concern and in which NIC code has to file the registration

What to do if the company does not have any supplies from MSME ? Do we have to file NIL return ?

What about LLP

What is specified company

Can you provide what is SPECIFIED COMPANY for this purpose