The main reason behind incorporating the concept of significant Beneficial owner, is to catch those individuals whose name does not appears in the register of members and who holds the significant Beneficial Interest in a Company. For Proper reporting of beneficial interest MCA has notified Form No. BEN-1, BEN-2, BEN-3 and BEN-4.

Example 1 of Significant Beneficial Owner

1. Mr. A hold 60% shares in ABC Ltd.

In the above example, though Mr. A holds directly 60% shares in ABC ltd. But he is not known as Significant Beneficial Owner, Mr. A is a registered owner, not SBO.

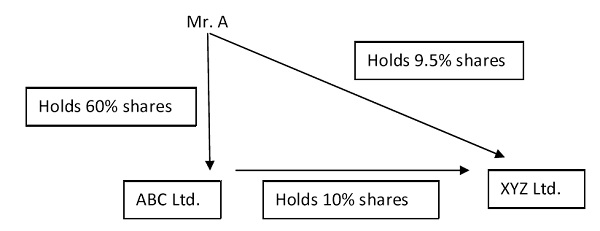

Example-2

In the above example, Mr. A is the SBO for XYZ Ltd. (Indirectly he holds 10*60% & Directly he holds 9.5% and also having majority stake of 60% in ABC ltd.)

Brief on BEN-1, BEN-2, BEN-3, BEN-4

Declaration of Significant Beneficial Owner, BEN-1

Within 90 days of the commencement of these rules, every individual who is a significant beneficial owner in a reporting company, shall file a declaration in Form No. BEN-1 to the reporting company.

In case of any change in ownership

In case of any change in the ownership, the significant beneficial owner has to file a declaration within 30 days of acquiring such significant beneficial ownership or any change therein.

Return of Significant Beneficial Owner, BEN-2

After receiving the declaration in BEN-1, the reporting Company shall file a return in Form BEN-2 with Registrar within 30 days from the date of receipt of such declaration.

Register of Beneficial Owner, BEN-3

BEN-3 is not a form which is to be filed, this is a Register of Beneficial owner holding Significant Beneficial Interest.

Register of Beneficial Owner, BEN-4

A Company shall give notice in Form No. BEN-4 to any person requiring him to furnish his beneficial interest. A company shall give notice, to any person (whether or not a member of the company) whom the company knows or has reasonable cause to believe—

(a) to be a significant beneficial owner of the company;

(b) to be having knowledge of the identity of a significant beneficial owner or another person likely to have such knowledge; or

(c) to have been a significant beneficial owner of the company at any time during the three years immediately preceding the date on which the notice is issued,

and who is not registered as a significant beneficial owner with the company as required under this section.

Application to the Tribunal

The company shall,—

(a) where that person fails to give the company the information required by the notice within the time specified therein; or

(b) where the information given is not satisfactory,

apply to the Tribunal within a period of fifteen days of the expiry of the period specified in the notice, for an order directing that the shares in question be subject to restrictions with regard to transfer of interest, suspension of all rights attached to the shares and such other matters.

| Other Matters:

The company may apply to the Tribunal in, for order directing that the shares in question be subject to restrictions, including – (a) restrictions on the transfer of interest attached to the shares in question; (b) suspension of the right to receive dividend in relation to the shares in question; (c) suspension of voting rights in relation to the shares in question; (d) any other restriction on all or any of the rights attached with the shares in question |

RESPONSIBILITIES OF REPORTING COMPANY & SBO

As per amended rules, a Beneficial significant owner (SBO) as well as a reporting company are required to comply with certain provisions.

PENAL PROVISIONS

| Nature of Violation | Penalty |

| If any person fails to make a declaration | Shall be punishable with:

imprisonment for a term which may extend to one year , Or fine which shall not be less than one lakh rupees but which may extend to ten lakh rupees, Or both |

| If a company fails to maintain register or denies inspection | the company and every officer of the company who is in default shall be punishable with fine which shall not be less than ten lakh rupees but which may extend to fifty lakh rupees |

| If any person wilfully furnishes any false or incorrect information | Penalised under section 447 |

Download Format of Form No. BEN-1, BEN-2, BEN-3 and BEN-4

| BEN-1 | Declaration by the significant Beneficial owner within 90 days from the date of the Companies (Significant Beneficial Owners) Amendment Rules, 2019, i.e from 1st july |

| BEN-2 | Return by the reporting company within 30 days of receipt of declaration. |

| BEN -3 | The reporting company is required to maintain register of all significant beneficial owners. |

| BEN-4 | Notice to be given by the reporting company to all the members other than individual seeking information related to the shares held. |

References:

Section 89/90 of Companies Act, 2013

The Companies (Significant Beneficial Owners) Amendment Rules, 2019

The Companies (Significant Beneficial Owner) Second Amendment Rules, 2019

Ekta Maheshwari is the Author of this Article, she is a Company Secretary by Profession. The author can be reached at csektamaheshwari14@gmail.com.

Good article! Brings lot of clarity

Date of commencement of amended rules, 2019 is 08.02.2019. So 90 days should be counted from that date. Such 90 days expires on 09.05.2019 so which date should be quoted Form BEN-1 ?

Informative article. I have one question though – Does one need to check the existence of beneficial interest under 89(10) which defined beneficial interest means the authority to exercise or cause to be exercised any or all of the rights attached to such share; or receive or participate in any dividend or other distribution in respect of such share. Is it considered that in case of a step down subsidiary, the shareholders of hold co cannot exercise the above rights w.r.t. subsidiary and hence beneficial interest is not applicable?