It is very much important to know the concept of ‘Time of Supply’ to know when the taxpayer is required to discharge tax on a particular supply. Section 12 to 14 of CGST Act, 2017 deals with the provisions of ‘Time of supply’. It says time of supply is determined with reference to the time when the supplier receives payment with respect to the supply as well as a few other references like issue of invoice, receipt of goods etc.

Time of supply = When the supplier receives payment

But in case, when advances are received for future supply, the determining factor for time of supply is different. In this write-up, we will discuss about the treatment for advances received for future supply.

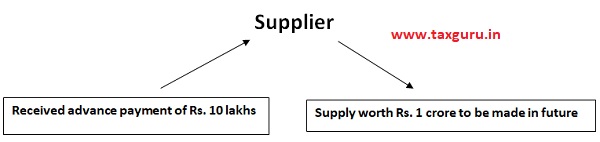

Section 12 of CGST Act, 2017 says, ‘’Supply’’ shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment. For example:

In the above example, Supplier had received the amount of Rs. 10 Lakhs for a supply worth Rs. 1 crore to be made in future. Here the time of supply for the advance payment of Rs. 10 Lakhs would be when the supplier received the advance, and for the balance amount of Rs. 90 lakhs, it shall be determined with reference to date of issue of invoice and other parameters.

In the above example, Supplier had received the amount of Rs. 10 Lakhs for a supply worth Rs. 1 crore to be made in future. Here the time of supply for the advance payment of Rs. 10 Lakhs would be when the supplier received the advance, and for the balance amount of Rs. 90 lakhs, it shall be determined with reference to date of issue of invoice and other parameters.

Therefore, in case of advance received for any supply, time of supply is fixed at the point when advance is received, irrespective of the fact whether the supply is made or not.

Time of supply = When the supplier receives advance payment

Exemption for Non-Composite dealers

GST Notification no. 66/2017 dated 15.11.2017 whereby all suppliers of goods who have not opted for composition scheme, have been exempted from the burden of paying GST on Advances received. For such categories of taxpayers, time of supply would arise only at the time of issue of invoice and they need to discharge GST liability accordingly.

But the supplier of services is required to pay GST at the time of receipt of advances.

For the categories of taxpayers who are required to discharge GST on Advances, the following would be relevant.

Issuing Receipt voucher

A registered person shall, on receipt of advance payment with respect to any supply of goods or services or both, issue a receipt voucher or any other document, evidencing receipt of such payment.

Contents of Receipt voucher:

(a) Name, address and GSTIN of the supplier,

(b) A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) Date of its issue;

(d) Name, address and GSTIN or Unique Identity number, if registered, of the recipient

(e) Description of goods or services;

(f) Amount of advance taken;

(g) Rate of tax (CGST, SGST, IGST, UT or CESS)

(h) Amount of tax charged in respect of taxable goods or services (CGST, SGST, IGST, UT or CESS)

(i) Place of supply along with the name of State and its code, in case of a supply in the course of inter-State trade or commerce;

(j) Whether the tax is payable on reverse charge basis; and

(k) Signature or digital signature of the supplier or his authorized representative.

What if the rate of tax or place of supply is not determinable at the time of receiving advance payment?

if the rate of tax is not determinable, the tax shall be paid at the rate of 18% and if the nature of supply is not determinable, the same shall be treated as inter-State supply and GST should be paid accordingly.

What if an advance payment has been made and a receipt voucher has also been issued, but supply is not made?

In such cases, the advance taken can be refunded and a refund voucher need to be issue.

Contents of Refund Voucher:

(a) Name, address and GSTIN of the supplier,

(b) A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year;

(c) Date of its issue;

(d) Name, address and GSTIN or Unique Identity number, if registered, of the recipient

(e) Number and date of receipt voucher issued in accordance with the provisions of rule 50;

(f) Description of goods or services in respect of which refund is made;

(g) amount of refund made;

(h) Rate of tax (CGST, SGST, IGST, UT or CESS)

(i) Amount of tax charged in respect of taxable goods or services (CGST, SGST, IGST, UT or CESS)

(j) Whether the tax is payable on reverse charge basis; and

(k) Signature or digital signature of the supplier or his authorized representative.

Every registered person shall keep and maintain a separate account of advances received, paid and adjustments made thereto.

References:

www.cbec.gov.in

Disclaimer: The entire contents of this article is solely for information purpose and have been prepared based on relevant provisions and as per the information existing at the time of the preparation. It doesn’t constitute professional advice or a formal recommendation. The author has undertaken utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify & confirm the updates from the genuine sources before acting on any of the information’s provided herein above.