Clarities on due dates and purpose of various IEPF E-Forms w.r.t. dividend and shares as per Companies Act, 2013

With the introduction of the following important notifications /amendments /circulars by Ministry of Corporate Affairs (MCA) with respect to Section 124 & 125 of the Companies Act, 2013 read with Investor Education and Protection Fund (IEPF) Authority (Accounting, Audit, Transfer And Refund) Rules, 2016, as amended relevant to the current structure of compliances for the said provisions:

| IEPF Authority (Accounting, Audit, Transfer and Refund) Rules, 2016 dated September 5, 2016

|

Details the manner of transfer of unclaimed dividend and/or shares to IEPF fund

|

| Notification for Section 124(1), (4), (6), (8) & (11) dated September 5, 2016

|

Provisions related to manner of administration of IEPF enforced

|

| IEPF Authority (Accounting, Audit, Transfer and Refund) Amendment Rules, 2017 dated February 28, 2017

|

Clarification on manner of transfer of shares to IEPF fund & Refund to claimants from fund

|

| General Circular No. 6/2017 dated May 29, 2017

|

Clarification regarding due date of transfer of shares to IEPF Authority

|

| IEPF Authority (Accounting, Audit, Transfer and Refund) Second Amendment Rules, 2017 dated October 13, 2017

|

Procedure of transmission of shares shall be followed by companies while transferring shares to IEPF

|

| IEPF Authority (Accounting, Audit, Transfer and Refund) Third Amendment Rules Dated May 22, 2018

|

Reporting of amount credited to the as required in Rule 6 to be done in IEPF-7

|

| Notification No. 07/05/2017 dated July 19, 2018

|

Revised Guidelines and Proforma for Verification Report to be submitted by Nodal Officers of Companies

|

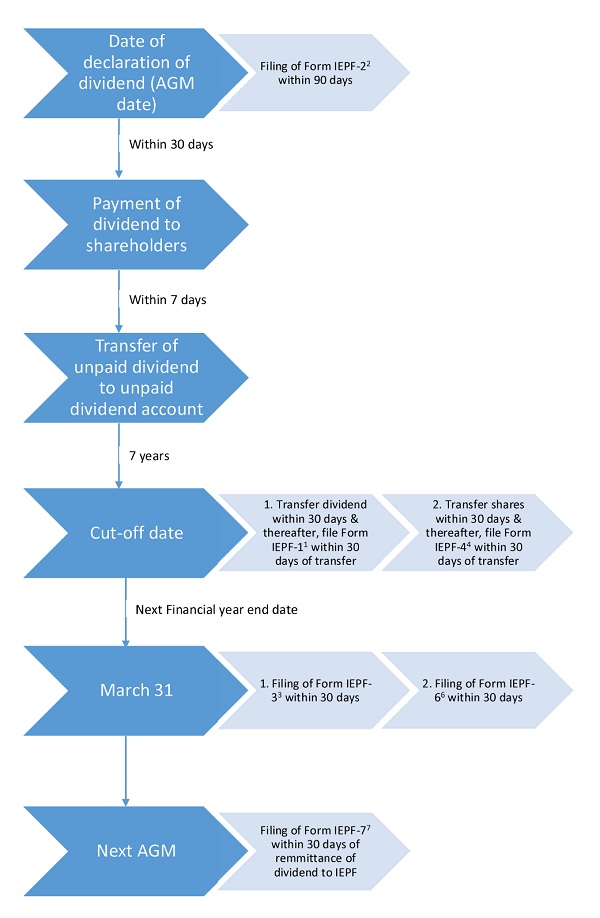

As per the above said notifications, circulars read with Section 124 & 125 and Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, following forms are required to be filed for the specified purpose:

IEPF-1 – For reporting the transfer of unpaid dividend, which remains unpaid or unclaimed for a period of seven years, within 30 days from the date of such transfer along with interest accrued, if any, and afterwards an excel sheet with complete break-up of dividend required to be uploaded and confirmed.

IEPF-2– For reporting of unclaimed amounts of dividend for the last 7 years including the dividend remained unclaimed & thereby transferred to unpaid dividend account as declared in current AGM and afterwards, excel sheets separately for each year with the complete break-up of dividend required to be uploaded and confirmed. Note that it is required to be filed every year regarding the dividend transferred to unpaid dividend account till their transfer to IEPF.

IEPF-3- For reporting of specific order of Court or Tribunal or statutory Authority or where shares are pledged or hypothecated under the provisions of the Depositories Act, 1996 restraining any transfer of such shares (whose reporting was otherwise to be made in IEPF-4) and payment of dividend (whose reporting was otherwise to be made in IEPF-1) and due to this the company was not able to transfer such shares which were otherwise due to be transferred.

IEPF-4- For reporting the transfer of shares, in respect of which dividend has not been paid or claimed for seven consecutive years or more, in the name of Investor Education and Protection Fund and afterwards, an excel sheet with the complete break-up of shares transferred required to be uploaded and confirmed.

IEPF-5– Individual claim by shareholders of shares & dividend that have been transferred to IEPF and reported by the Company in IEPF-4/IEPF-1.

IEPF-6– For stating therein the amounts due to be transferred to the Fund in the next financial year.

IEPF-7– For reporting dividend transferred directly to PNB account of IEPF Authority on such shares which have already been transferred to IEPF (as reported in IEPF-4). Note that it is required to be filed every year when there are any shares that are already transferred to IEPF Authority and Company declares dividend on such shares.

My father in law held some shares in Heritage. They are now with IEPF. The heirs have submitted the succession certificate and other supporting documents through the company. The process started 2 years ago, after a couple of clarifications and error rectifications, we still don’t know the status of the shares. The status on SRN status shows a blank. Meanwhile my mother in law is sick. The money from the sale of shares could have helped her. What is the process to get any update on the status of the shares. The company says that they have absolutely no idea.

You can file form IEPF-5 to claim those shares from IEPF Authority. Thereafter, send Form IEPF-5 alongwith attachments to RTA/Company. Company will take further actions for it.

As My share certificate of 100 each of L&T Financial Holding and Deepak Fertilizers and Petro Chemicals Limited along with Unpaid Dividend has been transferred to IEPF. Now I Wants to Claim the same. I am Having demat account with ICICI Direct.

Dear Sir,

The proceeds of unclaimed dividend and underlying shares transferred to IEPFA can be claimed by filing of online claim in Form IEPF-5. I offer my professional services to complete the entire claim process. I can be contacted at 9960281939 / 8999645910.

N.S.Kulkarni, Pune

(Retired Company Secretary)