This document is a notice issued by the Registrar of Companies, Gujarat, Dadra & Nagar Haveli, under the Ministry of Corporate Affairs, India. The notice pertains to the adjudication of a penalty against Starnet Real Estate Development Limited (formerly known as Starnet Software (India) Limited) for violation of Section 117 of the Companies Act, 2013.

The notice states that the company had passed a special resolution at an Extraordinary General Meeting on January 30, 2021, to alter the main objects clause of its Memorandum of Association. According to Section 117 of the Companies Act, 2013, the company was required to file the resolution within 30 days in the prescribed form (MGT-14). However, the company failed to file the form within the stipulated time and submitted it on November 17, 2021, with a delay of 261 days.

The company filed a suo-moto application, stating that the delay was inadvertent and due to the second wave of the COVID-19 pandemic. The company claimed there was no fraudulent intention or malafide motive.

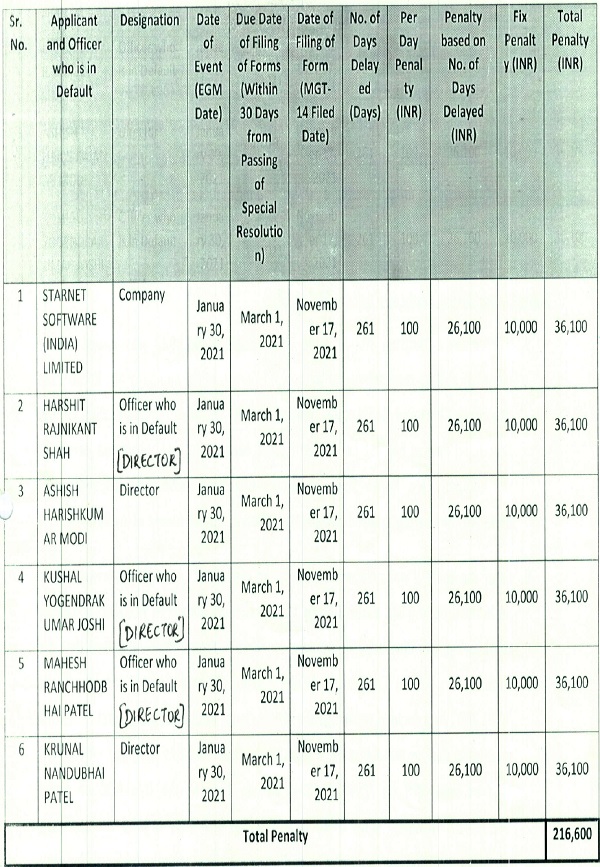

After issuing a show-cause notice and conducting a hearing, the Adjudicating Officer imposed a penalty on the company and its directors. The penalty is required to be paid individually by the company and its directors within 90 days of the order. Failure to pay the penalty within the specified period may result in further fines or imprisonment as per the provisions of the Companies Act, 2013.

The notice also mentions the option to file an appeal against the order with the Regional Director, North Western Region, Ministry of Corporate Affairs, within 60 days of receiving the order.

The document concludes with a warning that non-compliance with the order may lead to prosecution and additional penalties as per the provisions of the Companies Act, 2013.

The notice is addressed to Starnet Real Estate Development Limited and the directors involved in the case. Copies of the notice are also sent to the Ministry of Corporate Affairs and the Regional Director for information purposes.

Note: The summary provided is based on the information given in the document, and it may not include all the details or legal implications of the case.

GOVERNMENT OF INDA

MINISTRY OF CORPORATE AFFAIRS

OFFICE OF THE REGISTRAR OF COMPANIES,

GUJARAT, DADRA & NAGAR HAVELI

ROC Bhavan, Opp. Rupal Park,

Nr. Ankur Bus Stand, Nwanpura. Ahmedabad (Gujar t) 380013.

Tel. No.: 079-27438531, Fax : 079-27438371

Website : www.mca.gov in E-mail : roc.ahmedabad@mca.gov.in

SPEED-POST

DATED: 06/04/2022

BEFORE THE ADJUDICATING OFFICER

REGISTRAR OF COMPANIES, GUJARAT, DADRA & NAGAR HAVELI

IN THE MATTER OF ADJUDICATION OF PENALTY UNDER SECTION 454 (3) OF THE COMPANIES ACT 2013 READ WITH RULE 3 OF THE COMPANIES (ADJUDICATION OF PENALTIES) RULES, 2014 FOR VIOLATION OF SECTION 117 OF THE COMPANIES ACT, 2013 READ WITH RULES MADE THEREUNDER

IN THE MATTER OF STARNET REAL ESTATE DEVELOPMENT LIMITED

(U45100GJ2000PLC038987)

[FORMERLY KNOWN AS STARNET SOFTWARE (INDIA) LIMITED

(U72200GJ2000PLC038987) ]

Date of hearing- 30.03.2022

Present :

1. Shri M. K. Sahu (ROC), Adjudicating Officer

2. Gajanan Kate (AROC), Presenting Officer

3. Kavith .a Varadaraju, JTA

Appointment of Adjudication Authority:-

1. The Ministry of Corporate Affairs vide its Gazette Notification No. A-42011/112/2014-Ad.II dated 24.03.2015 has appointed the undersigned as Adjudicating Officer in exercise of the powers conferred under section 454 of the Companies Act, 2013 (hereinafter known as Act) read with Companies (Adjudication of Penalties) Rules, 2014 (Notification No. GSR 254(E) dated 31.03.2014) for adjudging penalties under the provisions of Act.

Company:

2. Whereas STARNET REAL ESTATE DEVELOPMENT LIMITED (herein after referre d to as “company”) is a company registered under the provisions of the Companies Act, 1956/2013 in the State of Gujarat, having CIN: U45100GJ2000PLC038987 and presently having its registered office situated at “Ganesh Corporate House,100 Feet Hebatpur – Thaltej, Road, Near Sola Bridge, off S.G. Highway, Ahmedabad. Gujrat. 380054. India.

3. The Company STARNET REAL ESTATE DEVELOPMENT LIMITED with CIN U45100GJ2000PLC038987 was earlier known as STARNET SOFTWARE (INDIA) LIMITED having CIN U72200GJ2000PLC038987. This office was in receipt of MGT-14 vide SRN T84067107 dated 02.03.2022 and INC-24 vide SRN T84875632 dated 07.03.2022 to change its name from STARNET SOFTWARE (INDIA) LIMITED to STARNET REAL ESTATE DEVELOPMENT LIMITED. Both the above e-forms were approved by this office on 15.03.2022 and 24.03.2022 respectively.

Fact about of the case:

4. The members of the Company have passed Special Resolution unanimously in accordance with section 13 and other applicable provision of the Act, if any at their Extra-ordinary General Meeting held on Saturday 30th January 2021 at the registered office of the Company pertaining to alter the main objects clause of Memorandum of Association of the Company in the manner described in the said resolution.

5. Pursuant to provisions of Section 117 of the Act, the aforesaid special resolution passed by the members of the company unanimously in accordance with section 13 and other applicable provision of the Act if any at their Extra-General Meeting held on Saturday, 30th January 2021, the said resolution was required to be filed within 30 days (i.e. on or before 01.03.20211 in the form MGT-14 thereof, however the company could not file the aforesaid form MGT-14 within stipulated time and the same was filed on 17/11/2021 vide SRN T59033126 with delay of 261 days.

6. The suo-moto application submits that the delay in filing the particulars of the Special resolution was inadvertently and without any malafide or wilful intention and due to second wave of covid-19. The applicants submits that there was no fraudulent intention or move.

7. Section 117 of the Companies Act, 2013:

1. (1) A copy of every resolution or any agreement, in respect of matters specified in sub-section (3) together with the explanatory statement under section 102, if any, annexed to the notice calling the meeting in which the resolution is proposed, shall be filed with the Registrar within thirty days of the passing or making thereof in such manner and with such fees as may be prescribed:

2. Provided that the copy of every resolution which has the effect of altering the articles and the copy of every agreement referred to in sub-section (3) shall be embodied in or annexed to every copy of the articles issued after passing of the resolution or making of the agreement.

3. (2) If any company fails to file the resolution or the agreement under sub-section (1) before the expiry of the period specified therein, such company shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of two lakh rupees and every officer of the company who is in default including liquidator of the company, if any, shall be liable to a penalty of ten thousand rupees and in case of continuing failure, with a further penalty of one hundred rupees for each day after the first during which such failure continues, subject to a maximum of fifty thousand rupees./.

Show Cause Notice, reply and personal Hearing:-

8. Thereafter, a “written Notice” vide email dated 17.03.2022 was issued to the company and its representative/ authorized person of the company Mr. Karan Shah Practicing Chartered Accountant , and a hearing was fixed for 23.03.2022. 0/ the Scheduled date of hearing i.e. on 23.03.2022, representative/ authorized person of the company Mr. Karan Shah, Practicing Chartered Accountant appeared and attended the hearing proceedings and requested for adjournment of the hearing.

9. Later the hearing was held on 30.03.2022 on request of Company’s representative/ authorized person Mr. Karan Dhiren Shah practicing Chartered Accountant. During the hearing, ltd. Chartered Accountant Mr. Karan Dhiren Shah submitted that the shareholders of the Company vide their extra ordinary General meeting dated 30.01.2021 had decided to change the object clause of the Company from IT reated matters to Real estate object. Mr. Karan Dhiren Shah has also clarified that relevant MGT-14 vide SRN no. T59033126 is already filed in the 0/o ROC on dated 17.11.2021. However since there is a delay of 261 days beyond the statutory permissible period the Company & its directors as the case may be have filed suo-moto adjudication application to make the default good.

However , the ltd CA. Mr. Karan Dhiren Shah has drawn the kind attention of the Adjudicating officer towards Sec 454 (3) of Companies Act 2013 and requested for minimum possible penalty. During argument it was conveyed that since the statute has filed Rs. 10,000 as fixed penalty & Rs. 100 per day for continuing offence and also fixed penalty the maximum cap Rs. 2,00,000. Using of discretion in that given case may not be appropriate

Order:

10. Under the aforesaid factual matrix, the adjudication application, submitted documents & additional information in the matter are perused, considered & taken on record. Accordingly taking into account of delay of 261 days and the company & 5 of its officers being in default and under the provisions of Section 117 (3) of Companies Act 2013 regarding violation of section 117 of Companies Act 2013, the penalty imposed is as under:

11. The noticee shall pay the amount of penalty individually for the company and its directors (out of own pocket) by way of e-payment (available on Ministry website mca.gov.in) under “Pay miscellaneous fees” category in MCA fee and payment Services within 90 (ninety) days of this order and the Challan/SRN generated after payment of penalty through online mode shall be filed in INC-28 to this office.

12. Appeal if any against this order may be filed in writing with the Regional Director, North Western Region, Ministry of Corporate Affairs, ROC BHAVAN, OPP. RUPAL PARK, NR. ANKUR BUS STAND, NARANAPURA, AHMEDABAD (GUJARAT)-380013 within a period of sixty days from the date of receipt of this order, in Form ADJ setting forth the grounds of appeal and shall be accompanied by the certified copy of this order. [Section 454 of the Companies Act, 2013 read with the Companies (Adjudicating of Penalties) Rules, 2014 as amended by Companies (Adjudication of Penalties) Amendment Rules, 2019] .

13. Please note that as per the provisions of Section 454(8) (i) of the Companies Act, 2013, where company does not pay the penalty imposed by the Adjudicating Officer or the Regional Director within a period of Ninety days (90 days) from the date of the receipt of the copy of order, the company shall be punishable with fine which shall not be less than twenty five thousand rupees but which may extend to five lakhs rupees. Further as per of Section 454(8) (ii) of the Companies Act, 2013, where an officer of a company who in default does not pay the penalty within a period of Ninety days (90days) from the date of receipt of the copy of the order, such officer shall be punishable with imprisonment which may extend to six months or with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees, or with both.

14. Your attention is also invited to section 454(8) of the Act in the event of noncompliance of this order which provides that in case of default in payment of penalty, prosecution will be filed u/s 454(8)(ii) of the Companies Act, 2013 at your own costs without any further notice.

The adjudication notice stands disposed of with this order.

(M. K. SAHU) (ICLS)

Registrar of Companies & Adjudicating Officer

Gujarat, Dadra & Nagar Haveli

Registrar of Companies & Adjudicating Officer

Gujarat, Dadra & Nagar Haveli.