Corporate Social Responsibility in India: A Comprehensive Guide to Regulations and Frameworks

Abstract

Corporate Social Responsibility (CSR) has emerged as a critical element of business operations in India, encompassing a range of initiatives aimed at enhancing the positive influence of businesses on society and the environment. In compliance with the Companies Act of 2013, specific companies are legally obligated to allocate a portion of their profits towards CSR activities. This article explores the multifaceted nature of CSR, encompassing environmental sustainability, ethical business practices, and community development. Additionally, it provides insight into the relevant regulatory frameworks governing CSR activities in India, such as the Goods and Services Tax (GST), Income Tax, and Foreign Contribution Regulation Act (FCRA). By examining these various aspects of CSR, businesses can gain a more comprehensive understanding of their social and environmental responsibilities and the regulations that govern them.

Introduction

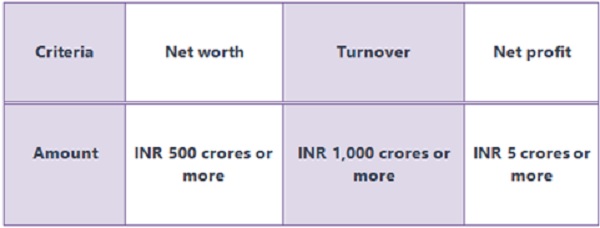

Corporate Social Responsibility (CSR) is a concept that has gained significant importance in India over the past few years. The Indian government introduced the CSR provisions in the Companies Act, 2013, mandating companies with a net worth of Rs. 500 crores or more, or a turnover of Rs. 1000 crores or more, or a net profit of Rs. 5 crores or more, to spend at least 2% of their average net profit of the preceding three years on CSR activities. This move has resulted in companies becoming more aware of their social and environmental impact and engaging in activities that benefit society and the environment.

In India, CSR activities cover a wide range of areas, including education, healthcare, environment, rural development, and poverty alleviation. Companies are investing in building schools, providing healthcare services, supporting sustainable agriculture, and promoting clean energy, among other initiatives.

CSR has become an integral part of the Indian business landscape, with companies leveraging their expertise, resources, and networks to address social and environmental issues. This has resulted in a significant positive impact on society, with several communities benefitting from these initiatives.

In this context, it is essential to understand the nuances of CSR in India, including the regulations governing CSR activities. This article provides an in-depth analysis of the concept of CSR in India, while also outlining the essential factors that businesses must take into account when initiating CSR initiatives.

Different Aspects of CSR

Corporate Social Responsibility (CSR) is a comprehensive approach that includes multiple components, such as supporting environmental sustainability, upholding ethical business practices, and contributing to the development of local communities. These elements represent the foundation of CSR and are critical to achieving a positive impact on society and the environment. To gain a better understanding of CSR and its implications, it is important to explore each of these aspects in greater detail.

Environmental Sustainability:

One of the crucial components of CSR is environmental sustainability. It involves taking steps to minimize a company’s environmental impact by implementing various initiatives, such as using renewable energy, minimizing waste, and preserving natural resources. For instance, businesses can adopt sustainable packaging practices that employ recyclable materials to lower their carbon footprint. Many organizations have already incorporated these types of environmentally friendly practices as part of their CSR programs to promote ecological responsibility and sustainability.

Ethical Business Practices:

Another crucial element of CSR is ethical business practices, which involves ensuring that a company operates transparently and with integrity. This can be achieved through implementing anti-corruption policies, promoting fair labor practices, and embracing diversity and inclusion. For instance, companies can adopt the United Nations Global Compact, a framework that outlines ethical and socially responsible practices for businesses to follow. This compact provides guidelines for businesses to operate in an ethical and sustainable manner, including protecting human rights, ensuring fair labor practices, and preventing corruption. By following these principles, companies can demonstrate their commitment to ethical behavior, which can enhance their reputation, and build trust with their stakeholders.

Community Development:

Community development is yet another vital aspect of CSR that emphasizes the importance of corporate involvement in the development of the surrounding communities. Companies can achieve this by supporting local initiatives, such as education and healthcare programs. For instance, businesses can fund school infrastructure development, donate to local hospitals, or provide job training programs to underprivileged youth. Additionally, many companies have established employee volunteer programs that enable their staff to participate in community service projects, such as building homes for the homeless or organizing food drives for low-income families. These programs not only benefit the community but also help employees to develop leadership and teamwork skills while contributing to a cause they care about.

Navigating the Regulatory Frameworks for CSR Activities in India

1. Understanding the CSR Framework and Reporting Requirements for Companies under the Companies Act, 2013:

The Corporate Social Responsibility (CSR) framework is established by Section 135 of the Companies Act, 2013, Schedule VII of the Companies Act, 2013 and the Companies (CSR Policy) Rules, 2014.

The Companies Act, 2013 specifies that companies fulfilling any of the following criteria in the previous financial year must comply with the Corporate Social Responsibility (CSR) provisions set out in Section 135(1) of the Act, along with the Companies (Corporate Social Responsibility Policy) Rules, 2014: net worth of INR 500 crores or more, turnover of INR 1,000 crores or more, or net profit of INR 5 crores or more. These companies are obligated to allocate at least 2% of their average net profit from the previous three years to CSR activities listed in Schedule VII of the Companies Act, 2013.

Section 135(1) of the Companies Act applies to all companies, including section 8 companies.

Section 135(2) of Companies Act, 2013 provides that any company that meets the CSR criteria must establish a Corporate Social Responsibility Committee of the Board, commonly known as the CSR Committee.

The CSR Committee must consist of a minimum of three directors. At least one of the three directors must be an independent director. If an independent director is not required, an unlisted public company or a private company may form its CSR Committee without independent director.

As per Section 135 (3) of Companies Act, 2013, the Corporate Social Responsibility Committee shall,—

(a) formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the company in areas or subject, specified in Schedule VII;

(b) recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

(c) monitor the Corporate Social Responsibility Policy of the company from time to time.

In accordance with rule 4 of the Companies (CSR Policy) Rules, 2014, companies can implement CSR activities through three modes:

i. Implementation by the company itself.

ii. Implementation through eligible implementing agencies as prescribed under sub-rule (1) of rule 4.

iii. Implementation in collaboration with one or more companies as prescribed under sub-rule (4) of rule 4.

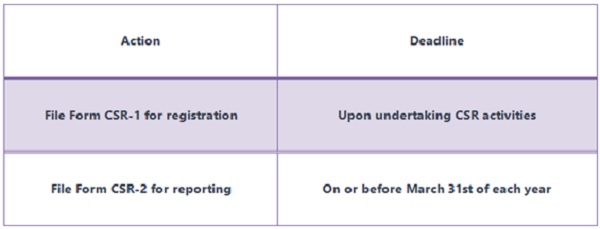

It is mandatory for a company intending to undertake a CSR activity to register themselves with the Registrar of Companies by filing the Form CSR-1 electronically.

Form CSR-1

Starting from April 1st, 2021, entities that work on projects related to Corporate Social Responsibility (CSR) are required to submit an electronic form called CSR-1 to register with the Central Government to ensure transparency and effective monitoring of CSR spending.

Section 135 of the Companies Act, 2013 and Rule 4(1) and Rule 4(2) of the Companies (CSR Policy) Amendment Rules, 2021 provides that entities engaged in CSR activities must register with the Central Government by filing the e-Form CSR-1 and shall be verified digitally by a Cost Accountant (CMA) in practice or Chartered Accountant (CA) in practice or a Company Secretary (CS) in practice.

Form CSR-2

CSR 2 is an electronic form that companies are required to file annually with the Registrar of Companies on or before March 31st for preceding Financial year to report their CSR activities to the government. It includes details such as the amount of money spent on CSR activities, the type of activity undertaken, and the beneficiaries. This form is applicable from February 11, 2022

CSR Reporting Requirements for Companies

Board’s reports for any financial year must include an annual report on CSR, which should have the specified particulars listed in Annexure I or Annexure II, as appropriate.

In the case of a foreign company, an annual report on CSR, with particulars listed in Annexure I or Annexure II, as applicable, should be included in the balance sheet filed under section 381(1)(b) of the Act.

Companies that have a CSR spending obligation of Rs. 10 crore or more on average must conduct an evaluation of the impact of their CSR projects. This evaluation must be done by an independent agency for projects that cost Rs. 1 crore or more and must be completed within one year of starting the evaluation.

The impact assessment report must be placed before the Board and attached to the annual CSR report. A company conducting an impact assessment may book CSR expenses for that financial year, up to 5% of the total CSR expenses for that year or Rs. 50 lakh, whichever is lower.

The type of independent agency for conducting the impact assessment of CSR projects is not specified in the given text. It could be any independent agency with expertise in evaluating the social, economic, and environmental impact of the projects.

The Board of Directors is required to make mandatory disclosure of the CSR Policy, approved CSR Projects, and composition of the CSR Committee on their website to ensure public accessibility.

2. Understanding GST Implications for Corporate Social Responsibility (CSR) Activities

ITC on CSR activities:

The Central Goods and Services Tax (CGST) Act has been amended through the Finance Bill 2023 to clarify that input tax credit (ITC) will not be available for goods or services used in activities related to Corporate Social Responsibility. This means that companies cannot claim a tax credit for the GST paid on goods or services used for CSR initiatives. Read the Clause 130 of the Finance Bill, 2023, which seeks to make the following amendment in section 17 (5) of CGST Act, 2017.

(b) in sub-section (5), after clause (f), the following clause shall be inserted, namely:-

“(fa) goods or services or both received by a taxable person, which are used or intended to be used for activities relating to his obligation under corporate social responsibility referred to in section 135 of the Companies Act, 2013;”.

Advance Ruling

Polycab Wires Pvt. Ltd. distributed electrical goods for free as part of their CSR activities to aid flood-affected people in Kerala. However, the AAR ruled that since the goods were given for free, the company cannot claim ITC under Section 17(5) of the KSGST and CGST Act.

GST exemption for charitable trusts or NGOs registered under Section 12AA of the Income-tax Act, 1961

Under the Income-tax Act, 1961, if charitable trusts or NGOs providing religious or charitable services are registered under Section 12AA, they are exempted from paying Goods and Services Tax (GST). However, certain services provided by charitable trusts or NGOs are taxable. These services include:

1) Sale of Goods that are sold by a charitable trust is taxable.

2) Services other than by way of conduct of religious ceremony which are not considered as charitable activities, as defined above.

3) Renting of premises for rentals above the threshold limits.

4) Services of sponsorship, GST will be applicable on Reverse Charge Mechanism.

5) Advertising rights during conduct of events/functions etc.

6) Donation for religious ceremony is received with specific instructions to advertise the name of a donor.

3. Understanding the Income Tax Implications for Corporate Social Responsibility (CSR) Activities

Eligibility of Expenditure towards CSR in Income Tax Act:

The Indian Income Tax Act, 1961, provides certain provisions regarding Corporate Social Responsibility (CSR) expenditure by companies.

According to Section 37(1) of the Income Tax Act, Explanation – 2, if a company spends money on corporate social responsibility (CSR) activities as outlined in Section 135 of the Companies Act 2013, it won’t be considered as an expense related to the company’s business or profession for income tax purposes. In simpler terms, the expenses related to CSR activities won’t be counted as a business expense for income tax purposes.

Overall, companies must ensure compliance with the provisions of the Companies Act, 2013, and Income Tax Act, 1961, while incurring CSR expenditure to claim tax benefits.

TDS applicability on CSR funds given to eligible implementing agencies as prescribed under sub-rule (1) of rule 4.

Non-Governmental Organizations (NGOs) are established to carry out charitable work and are not meant to operate for profit. When an NGO is registered under Section 12AA, it is recognized by tax authorities as a tax-exempt organization that has been set up for charitable purposes.

CSR (Corporate Social Responsibility) fund can be considered as a form of grant as it is a voluntary contribution made by a company towards social welfare initiatives. However, unlike traditional grants, CSR funds are usually tied to specific social causes or initiatives, and companies may have specific requirements or expectations from the NGOs or implementing agencies receiving the funds. Nevertheless, CSR funds are typically provided without the expectation of any commercial return, and they are intended to benefit the larger community rather than to generate profit.

Before an NGO receives a donation from a Company in the form of a grant, certain conditions may be attached, such as specific criteria for spending, limits on expenditure, and requirements for reporting on the usage of the grant. It’s important to note that even with such conditions, the grant should still be considered as a gift agreement, and not a professional service or consultant contract subject to TDS (tax deducted at source) and GST (Goods and Services Tax) compliance.

Even the earlier ‘Technical Guide to Service Tax’ issued by CBEC in 2012 makes it clear: “Conditions in a grant stipulating merely proper usage of funds and furnishing of account also will not result in making it a provision of service.”

So it needs to be understood, if a company provides funds from its Corporate Social Responsibility (CSR) initiative to a suitable implementing agency or NGO that is registered under Section 12AA for a specific purpose, with the goal of benefiting the wider community and not for profit-making purposes, then there should be no TDS (tax deducted at source) on the amount provided. However, if the funds provided involve a profit element, then TDS will be applicable.

4. FCRA Compliance Requirements for Corporates Involved in Corporate Social Responsibility (CSR) Programs

According to FCRA regulations Act 2010, an organization with more than 50% investment from foreigners, including foreign companies and FIIs, is classified as a foreign source.

Many companies in India may not be aware that FCRA regulations apply to their CSR efforts if they are carried out through an NGO or foundation.

Under the FCRA regulations Act 2010, companies that have over 50% investment from foreign sources are categorized as foreign sources themselves. This includes Indian companies such as Maruti Suzuki, ICICI Bank, HDFC, and others that meet the threshold of foreign investment.

As a result, companies must ensure that any NGO or organization they provide funds to is FCRA compliant, as required by law.

Conclusion:

To conclude, Corporate Social Responsibility (CSR) has become an integral part of the Indian business landscape, with companies increasingly aware of their social and environmental impact and engaging in activities that benefit society and the environment. The multifaceted nature of CSR encompasses environmental sustainability, ethical business practices, and community development. To navigate the regulatory frameworks governing CSR activities in India, companies must comply with the provisions set out in the Companies Act, 2013, and the Companies (CSR Policy) Rules, 2014. By examining the various aspects of CSR and understanding the regulations governing them, businesses can gain a more comprehensive understanding of their social and environmental responsibilities and their impact on society. Through CSR, businesses can leverage their expertise, resources, and networks to address social and environmental issues, resulting in a significant positive impact on society and the environment.

Reference:

- Corporate Social Responsibility under Companies Act, 2013,

- Foreign Contribution (Regulation) Act, 2010 – FCRA

- Mca.gov.in (FAQ On CSR Cell)

- Section 37(1) of the Income Tax Act

- The Economic Times

******

Author : CMA Md. Rehan, FCMA, M. Com, PGDIBO, DFA | M.No. 42017 | Partner at CKC LLP | (Practicing Cost Accountants) | E-Mail: cma.rehan@ckcllp.com

Great!! Beautifully written! The article shows meticulous gathering of information!!