Summary: In GST law, the term “guarantee” is defined by the Indian Contracts Act, 1872 as a promise by one party to fulfill another’s obligation. Guarantees can be personal, bank, or corporate. Under the CGST Act, personal guarantees by directors to secure company credit are deemed a supply of service, even if provided without consideration, due to the related party provision. Corporate guarantees between related companies are also classified as supplies, with valuation rules specifying 1% of the guarantee amount or the actual payment, whichever is higher. Recent updates to CGST Rule 28 and RBI guidelines confirm that no GST is due if no payment is made for personal guarantees, while corporate guarantees are taxable. Reverse Charge Mechanism (RCM) does not typically apply to personal guarantees provided by directors as part of their employment duties. However, if a payment is involved or the guarantee is given outside of employment, RCM might apply. The applicable SAC code for guarantee services is 9971, with a GST rate of 18%.

MEANING OF GUARANTEE: –

Guarantee has not been defined in the GST Law. The reference is to be taken from the Indian Contracts Act, 1872. Guarantee is defined under Section 126 of the Indian Contracts Act, 1872. A guarantee is a promise made by one person to be responsible for the debt or obligation of another person.

The three parties to the contract are,

- The person who gives the guarantee (Guarantor).

- The person on whose behalf the guarantee is given (Principal Debtor). And

- The person to whom the guarantee is given (Creditor).

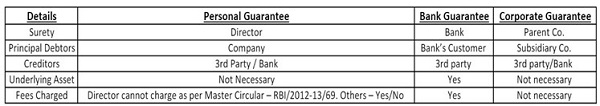

TYPE OF GUARANTEE: –

- Personal Guarantee.

- Bank Guarantee.

- Corporate Guarantee.

IS GUARANTEE COVERED UNDER THE DEFINITION OF SUPPLY?

Personal Guarantee: – As per Explanation (a) to section 15 of CGST Act, the director and the company are to be treated as related persons. As per clause (c) of sub-section (1) of section 7 of the CGST Act, 2017, read with S. No. 2 of Schedule I of CGST Act, supply of goods or services or both between related persons, when made in the course or furtherance of business, shall be treated as supply even if made without consideration. Accordingly, the activity of providing personal guarantee by the Director to the banks/ financial institutions for securing credit facilities for their companies is to be treated as a supply of service, even when made without consideration.

Corporate guarantee by one company to another Company: – Where the corporate guarantee is provided by a company to the bank/financial institutions for providing credit facilities to the other company, where both the companies are related, the activity is to be treated as a supply of service between related parties as per provisions of Schedule I of CGST Act, even when made without any consideration.

Corporate guarantee by Holding company to Its Subsidiary: – Similarly, where the corporate guarantee is provided by a holding company, for its subsidiary company, those two entities also fall under the category of ‘related persons’. Hence the activity of providing corporate guarantee by a holding company to the bank/financial institutions for securing credit facilities for its subsidiary company, even when made without any consideration, is also to be treated as a supply of service by holding company to the subsidiary company, being a related person, as per provisions of Schedule I of CGST Act.

VALUATION OF GUARANTEE: –

Personal Guarantee: –

Rule 28 of CGST Act, 2017: – CGST Rule 28 is about determining the value of goods or services when they are exchanged between related parties (like a company and its directors), except when an agent is involved. Normally, the value of these services is based on their “open market value” – what they would cost if bought or sold in the market.

RBI Guidelines on Personal Guarantees: – The Reserve Bank of India (RBI) has guidelines, vide Para 2.2.9 of its Circular No. RBI/2021-22/121 dated 9th November, 2021, for banks about when and how to take personal guarantees from people like directors or major shareholders of companies. The key point here is that directors or other important people in a company should not be paid for giving personal guarantees. The company and the guarantors must agree that no money will be paid, either directly or indirectly, for these guarantees.

Connection Between CGST Rule 28 and RBI Guidelines: –

- According to RBI’s guidelines, a company cannot pay its directors any money (like a fee or commission) for giving a personal guarantee to a bank.

- Since no payment can be made, there is no “open market value” for this service, because it’s not something that has a price.

- As a result, under CGST Rule 28, the value of this service (the personal guarantee) is considered to be zero.

- Because the value is zero, no GST (Goods and Services Tax) is due on this service.

Special Cases: – However, there might be situations where a director, who is no longer part of the company, continues to provide a guarantee because the new management cannot provide one. Or there might be other special cases where the company does pay the director or other key people for the guarantee. In these special cases, if any payment is made to the guarantor, the value of the service for tax purposes would be the amount of that payment, and GST would be applicable on that amount.

In summary: –

If no payment is made to a director for giving a personal guarantee, the service has no market value, so no GST is due.

If a payment is made, then the value for tax purposes is the amount of that payment, and GST would apply.

Corporate Guarantee: –

A new rule (sub-rule 2) has been added to Rule 28 of the CGST Rules through a CGST notification (No. 52/2023) on October 26, 2023. This rule specifically deals with how to calculate the taxable value when a related person, like a holding company, provides a corporate guarantee (a promise to repay a loan if the borrower fails) to a bank or financial institution on behalf of another related person, like a subsidiary company. (After amended by CGST Notification No. 12/2024 – Central Tax_10.07.2024)

What does the new sub-rule (2) say?

1. Value of the Corporate Guarantee: –

- The taxable value of the corporate guarantee provided by one related person to another will be considered as 1% of the amount of the guarantee per year, or the actual amount paid (if any), whichever is higher.

- For example, if a holding company guarantees a loan of ₹10,00,000 for its subsidiary, the taxable value would be 1% of ₹10,00,000 per year, which is ₹10,000, unless the company is actually paying more than this amount for the guarantee.

2. Special Case for Input Tax Credit: –

- If the company receiving the guarantee (the recipient) can claim the full input tax credit (which means they can deduct the GST they paid from their own GST liability), then the value declared in the invoice will be accepted as the taxable value.

- This means that in some cases, the value on the invoice itself might be used directly for tax purposes if the company can claim the full tax credit.

3. In Summary: –

- When a company provides a corporate guarantee to a bank for a related company, the tax value will generally be 1% of the guarantee amount per year or the actual amount paid for the guarantee, whichever is higher.

- If the company that receives the guarantee can claim full input tax credit, the value on the invoice will be used for tax purposes.

This new rule ensures there’s a clear way to determine how much GST should be paid on such guarantees.

The new sub-rule (2) of Rule 28, which specifies how to determine the taxable value for corporate guarantees, does not apply when a director provides a personal guarantee to a bank or financial institution to secure loans or credit facilities for their company.

THE APPLICABILITY OF THE REVERSE CHARGE MECHANISM (RCM) ON A PERSONAL GUARANTEE PROVIDED BY A DIRECTOR TO A COMPANY CAN BE UNDERSTOOD AS FOLLOWS: –

1. Understanding Reverse Charge Mechanism (RCM): –

- Under RCM, the recipient of goods or services is liable to pay the GST instead of the supplier. Normally, the supplier collects and pays the tax, but under RCM, the responsibility shifts to the recipient.

2. Personal Guarantee Provided by Directors: –

- Directors may provide personal guarantees to banks or financial institutions to secure loans or credit facilities for the company.

- The question is whether this act of providing a personal guarantee is considered a “supply” of service under GST, and if so, whether the company (as the recipient) should pay GST under RCM.

3. Key Considerations: –

- Nature of the Activity: –

a) If the director provides the personal guarantee as part of their employment duties (i.e., they are an employee of the company and not engaged in the business of giving guarantees), this could be viewed as a service provided by an employee to the employer.

b) As per Schedule-III of the CGST Act, 2017, services provided by an employee to the employer in the course of or in relation to employment are not treated as a “supply” of goods or services. Therefore, such activities are not subject to GST.

- Supply in the Course of Business: –

a) For an activity to be taxable under GST, it must be done “in the course or furtherance of business” as per Section 7(1) of the CGST Act. Since directors are not in the business of providing personal guarantees, it can be argued that this activity does not qualify as a taxable supply.

- RCM Applicability: –

a) If the personal guarantee provided by the director is deemed not to be a “supply” under GST, then RCM would not apply, and no GST would be payable by the company.

b) However, if the guarantee is seen as a separate service provided by the director (not in their capacity as an employee), then it might be considered a taxable supply, and the company could be required to pay GST under RCM.

4. Practical Interpretation: –

- Most interpretations suggest that when a director provides a personal guarantee as part of their employment duties, it is not considered a taxable supply, and therefore, RCM does not apply. This is especially true if the guarantee is required as part of the director’s role and no separate consideration (payment) is given for providing the guarantee.

- However, if the director is compensated for providing the guarantee or if it is provided outside the scope of employment, the transaction might be treated differently, and RCM could potentially apply.

Conclusion: –

- RCM does not generally apply to personal guarantees provided by directors in their capacity as employees of the company, since these are not considered taxable supplies under the CGST Act.

- However, if there is any payment involved or the guarantee is provided outside the employment relationship, there might be a different interpretation, and RCM could apply. It is always advisable to consult with a tax professional to assess the specific circumstances.

SAC CODE: –

The Service Accounting Code (SAC) for a guarantee service falls under the broader category of financial services.

The specific SAC code for “Guarantee Services” is 9971. This category includes various financial services, including:997199 – Other financial services not elsewhere classified, which may include services related to guarantees.

GST RATE: –

18%