INTRODUCTION: –

- Section 128A has been introduced as per the recommendations of the 53RD GST COUNCIL MEETING to allow for the CONDITIONAL WAIVER OF INTEREST, PENALTY, OR BOTH for tax demands raised under SECTION 73 OF THE CGST ACT for the financial years 2017-18, 2018-19, And 2019-20. It is effective from 1ST NOVEMBER 2024.

- Rule 164 was inserted through Notification No. 20/2024 dated 8th October 2024 (based on the recommendations of the 54TH GST COUNCIL MEETING). This rule prescribes the CONDITIONS for availing the benefits of Section 128A AND PROCEDURE for closure of proceeding under Section 128A. It also becomes applicable from 1ST NOVEMBER 2024.

- Notification No. 21/2024 dated 8th October 2024 provides the due dates for payment of tax under Section 73 to avail the benefits of Section 128A, as follows:

1. For Notices/Statements/Orders issued: – The due date is 31st March 2024.

2. For Redetermination of Tax Under Section 73 (1st Proviso): – The due date is 6 months from the date of the order of redetermination.

PURPOSE: –

- Encourage taxpayers to settle outstanding tax liabilities from earlier financial years (2017-18, 2018-19, and 2019-20) without the burden of penalties or interest.

- Facilitate quicker resolution of tax disputes under Section 73 by offering relief incentives, thus reducing litigation and compliance costs.

- Motivate taxpayers to pay their core tax liabilities promptly by offering relief from additional financial burdens, thereby improving tax collections for the government.

4. SCENARIOS: –

- Non-Payment of Tax.

- Short Payment of Tax.

- ITC wrongly availed.

- ITC wrongly availed & Utilised.

Except Erroneous refund.

CASES COVERED (SECTION 128A (1)): –

a) Notice / Statement issued u/s 73 but no adjudication order passed.

b) Adjudication order passed u/s 73, first appeal filed but no OIA passed.

c) OIA passed & an appeal filed before GSTAT but no tribunal order passed.

1st Proviso: – Notice issued u/s74 but order is passed or is to be passed u/s 73 on the direction of appellate authority or Court (S. 75(2))

2nd Proviso: – Revision in OIA or appeal by department before the first appellate authority or tribunal, if any additional tax determines.

PERIOD FOR WHICH RELAXATION IS PROVIDED: –

July 1, 2017, to March 31, 2020 (covering the financial years 2017-18, 2018-19, and 2019-20).

WHO IS PROPER OFFICER: –

- If Application is Filed in FORM GST SPL-01: – The proper officer would be the one responsible for issuing the order under Section 73 of the CGST Act.

- If Application is Filed in FORM GST SPL-02: – The proper officer would be the one responsible for recovery under Section 79 of the CGST Act.

ANALYSIS AND INTERPRETATION OF SECTION 128A: –

Key Points: –

Who is eligible? Taxpayers who have received tax notices or orders under Section 73 (Non fraud Case) or Sections 107 (Appeal to 1st appellate authority)/108 (Revisional authority’s power) related to the period from July 1, 2017, to March 31, 2020.

Main Benefits: If eligible taxpayers pay the full amount of tax within the specified time notified by the government, they will be exempt from paying interest and penalties on that amount.

THE FOUR MAIN SCENARIOS COVERED UNDER SECTION 128A (1) AND PAYMENT DUE DATE: –

- Scenario 1: Taxpayers who have received a notice under subsection (1) of Section 73 or a statement under subsection (3) of Section 73, but no order under subsection (9) of Section 73 has been issued.

Due Date: 31.03.2025 (Notification No. 21/2024-CT-08.10.2024).

- Scenario 2: Taxpayers who have received an order under subsection (9) of Section 73, but no order under subsection (11) of Section 107 or subsection (1) of Section 108 has been passed.

Due Date: 31.03.2025 (Notification No. 21/2024-CT-08.10.2024).

- Scenario 3: Taxpayers who have received an order under subsection (11) of Section 107 or subsection (1) of Section 108, but no order under subsection (1) of Section 113 has been passed.

Due Date: 31.03.2025 (Notification No. 21/2024-CT-08.10.2024).

- Scenario 4 (First Proviso of Section 128A): If a notice has been issued under Section 74(1) (which deals with cases involving tax evasion or fraud), and an order is issued or needs to be issued by the tax officer following the instructions given by an Appellate Authority, Tribunal, or court (as per Section 75(2)), then this notice or order will be treated the same as a notice or order mentioned in Scenario 1 or Scenario 2.

Due Date: Date ending on completion of six months from the date of issuance of the order by the proper officer redetermining tax under section 73 of the said Act. (Notification No. 21/2024-CT_08.10.2024).

In all these scenarios, if the taxpayer pays the full tax amount as per the notice or order, they will not be required to pay any interest or penalties.

CONDITIONS: –

The relief is available only if the taxpayer pays the full tax liability on or before the date notified by the government, based on the recommendations of the GST Council (54th Meeting of GST council held on 09.09.2024 recommended 31.03.2025 as the last date on or before which the payment of tax may be made by the registered person). All proceedings related to the said notice, statement, or order will be deemed concluded, subject to prescribed conditions.

SPECIFIC ACTION OCCURRENCE (SECOND PROVISO OF SECTION 128A): –

- An application is filed under Section 107(3) (appeal to the Appellate Authority by the authorized officer) or Section 112(3) (appeal to the Appellate Tribunal by the authorized officer).

- A central tax officer files an appeal under Section 117(1) (appeal to the High Court) or Section 118(1) (appeal to the Supreme Court).

- Any proceedings are initiated under Section 108(1) (revisional authority’s power).

And these actions are against an order referred to in Scenario 2 or Scenario 3, or against the directions given by the Appellate Authority, Appellate Tribunal, or court as mentioned in Scenario 4, then:

The taxpayer must pay any additional tax amount decided by the Appellate Authority, Tribunal, court, or Revisional Authority within Three Months from the date of their order. This means that if, after the appeal or proceedings, it is determined that the taxpayer owes more tax, they must pay this additional amount within three months.

Only when the taxpayer pays this additional amount within the given three months will the proceedings be considered finalized or concluded under this section. This ensures that all dues are fully paid before the case is considered fully settled.

NO REFUND CLAUSE: –

If a taxpayer has already paid interest and penalties before this scheme, they will not be eligible for a refund.

EXCLUSIONS: –

- This section does not apply if the amount payable is due to an erroneous refund.

- It also does not apply to cases where an appeal or writ petition filed by the taxpayer is pending before the Appellate Authority, Appellate Tribunal, or a court and has not been withdrawn by the taxpayer on or before the notified date.

FINALITY OF PROCEEDINGS: –

Once a taxpayer pays the specified amount under this section, no further appeals under Section 107(1) or 112(1) against the related orders will be permitted.

PROCEDURE (RULE 164): –

1. Application for Waiver of Interest/Penalty – Notice or Statement (Section 128A(1)(a)) (Scenario 1 in our Case).

- Eligible person:

A person eligible for waiver of interest, penalty, or both under clause (a) of sub-section (1) of section 128A.

- Form to be used:

FORM GST SPL-01 (to be filed electronically on the common portal).

- Details to be provided:

- Details of the notice or statement (as applicable).

- Details of payments made towards the tax demanded via FORM GST DRC-03.

2. Application for Waiver of Interest/Penalty – Orders (Section 128A(1)(b) & (c)) (Scenario 2 & 3 in our Case).

- Eligible person:

A person eligible for waiver of interest, penalty, or both under clauses (b) and (c) of sub-section (1) of section 128A.

- Form to be used:

FORM GST SPL-02 (to be filed electronically on the common portal).

- Details to be provided:

- Details of the order.

- Details of payments made towards the tax demanded.

Payment Provisions for Tax Demanded.

- 1st Proviso: Payment of the tax demanded under the order shall be made by crediting the amount in the Electronic Liability Register against the debit entry created by the order.

- 2nd Proviso: If the tax demanded was already paid through FORM GST DRC-03, the person must file an additional application in FORM GST DRC-03A (as per Rule 142(2B)).

- Purpose of FORM GST DRC-03A:

- To credit the amount paid via DRC-03 in the Electronic Liability Register against the debit entry for the said demand.

- This step must be completed before filing the application in FORM GST SPL-02.

3. Demand of Tax – Partially Due to Erroneous Refund and Partially for Other Reasons.

- Scenario:

If a notice, statement, or order under Section 128A (1) includes a tax demand that is:

-

- Partly due to erroneous refund.

- Partly due to other reasons.

- Condition for Filing Application:

- The application (under sub-rule (1) or (2)) can be filed only after full payment of the tax demanded.

- The payment must be made on or before the notified date under Section 128A (1).

4. Demand of Tax – Partially for Periods Covered and Not Covered under Section 128A (1).

- Scenario:

If a notice, statement, or order under Section 128A (1) includes a tax demand for:

-

- Partly for the period covered under Section 128A (1).

- Partly for another period not covered under Section 128A (1).

- Condition for Filing Application:

- The application (under sub-rule (1) or (2)) can be filed only after full payment of the tax demanded.

- The payment must be made on or before the notified date under Section 128A (1).

5. Amount Payable After Adjustments.

Payable Amount:

The amount payable under sub-rule (1) or (2) will be the remaining amount, after:

- Deducting the amount that is not payable under Section 16(5) or (6).

- Calculating the remaining payable amount in terms of the notice, statement, or order issued under Section 73 (as applicable).

6. Time Limit for Filing Applications under Sub-rule (1) or (2).

- General Time Limit:

- The application must be filed within three months from the notified date under Section 128A (1).

- Extended Time Limit for FORM GST SPL-02:

- If the application relates to cases under the first proviso to Section 128A (1) (i.e., redetermination by the proper officer under Section 73), the time limit is six months from the communication date of the redetermined order.

7. Withdrawal of Appeal or Writ Petition for Waiver Eligibility.

- Condition for Filing Application:

- The application under sub-rule (1) or (2) must be accompanied by documents proving the withdrawal of any appeal or writ petition filed before:

- Appellate Authority

- Tribunal

- Court

- The application under sub-rule (1) or (2) must be accompanied by documents proving the withdrawal of any appeal or writ petition filed before:

- If Withdrawal Order is Pending:

- If the withdrawal order from the concerned authority is not issued by the time of filing the application, the applicant must:

- Upload the withdrawal application/document (submitted to the Appellate Authority, Tribunal, or Court) along with the main application under sub-rule (1) or (2).

- Upload the withdrawal order on the common portal within one month of the issuance of the said order by the concerned authority.

- If the withdrawal order from the concerned authority is not issued by the time of filing the application, the applicant must:

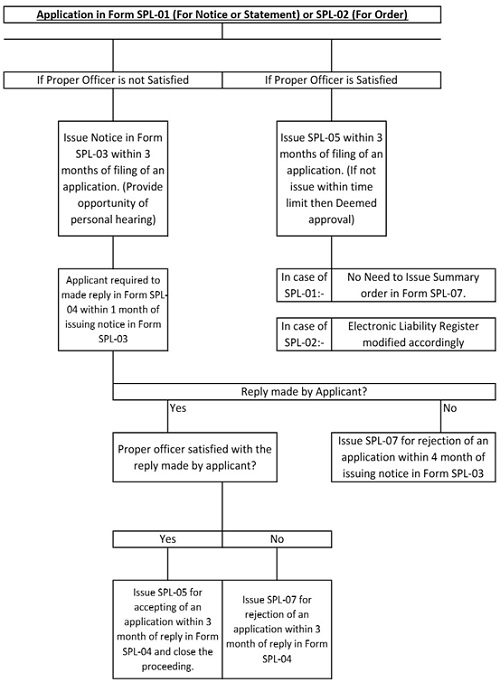

8. Notice (FORM GST SPL-03).

- When Issued:

- If the proper officer believes the application in FORM GST SPL-01 or SPL-02 is ineligible for waiver of interest, penalty, or both under Section 128A.

- Notice to Applicant:

- The officer must issue a notice in FORM GST SPL-03 on the common portal.

- Timeline for Issuing Notice:

- The notice must be issued within THREE MONTHS from the date of receipt of the application.

- Opportunity for Hearing:

- The officer must provide the applicant with an opportunity to be heard.

9. Reply to Notice by Applicant (FORM GST SPL-04).

- Timeline for Reply:

- The applicant must file a reply to the notice in FORM GST SPL-04 on the common portal.

- The reply must be submitted within ONE MONTH from the date of Receipt of The Notice.

10. Order for Acceptance of Application (FORM GST SPL-05).

- When Issued:

- If the proper officer is satisfied that the applicant is ELIGIBLE for waiver of interest, penalty, or both as per Section 128A.

- Order Issued in FORM GST SPL-05:

- The officer shall issue the acceptance order on the common portal.

- The order will conclude the proceedings under Section 128A.

11. Effect of Issuance of Order in FORM GST SPL-05.

- When Issued:

If the proper officer issues an order in FORM GST SPL-05 under sub-rule (10), the following shall apply:

-

- Cases related to FORM GST SPL-01 (Notice/Statement under Section 128A(1)(a)):

- No need to issue FORM GST DRC-07.

- The summary of order in FORM GST DRC-07 (as required under Rule 142(5)) will not be issued for the said notice or statement.

- Cases related to FORM GST SPL-02 (Orders under Section 128A(1)(b) or (c)):

- Electronic Liability Register Part II:

- Cases related to FORM GST SPL-01 (Notice/Statement under Section 128A(1)(a)):

Any liability created shall be modified accordingly in Part II of the Electronic Liability Register.

12. Issuance of Rejection Order in FORM GST SPL-07.

- When Issued:

- If the proper officer is not satisfied with the reply submitted by the applicant to the notice.

- Rejection Order:

- The officer shall issue an order rejecting the application in FORM GST SPL-07.

13. Timeline for Issuance of Order by the Proper Officer.

- If Notice in FORM GST SPL-03 is NOT Issued:

- The proper officer must issue the order under sub-rule (10) (FORM GST SPL-05) within THREE MONTHS from the date of receipt of the application in FORM GST SPL-01 or SPL-02.

- If Notice in FORM GST SPL-03 is Issued:

- The proper officer must issue the order under sub-rule (10) or sub-rule (12) (approval or rejection) within:

- THREE MONTHS from the date of receipt of the reply from the applicant in FORM GST SPL-04.

- FOUR MONTHS from the issuance date of the notice in FORM GST SPL-03, if no reply is received from the applicant.

- The proper officer must issue the order under sub-rule (10) or sub-rule (12) (approval or rejection) within:

- Explanation:

For applications under sub-rule (7) where the applicant has filed for withdrawal of an appeal:

-

- The time period between the filing of the application under sub-rule (1) or (2) and the submission of the withdrawal order will not be counted in calculating the time limits for above clause.

14. Deemed Approval if Order Not Issued on Time.

- If the proper officer does not issue an order within the time limits specified under sub-rule (13).

- The application in FORM GST SPL-01 or SPL-02 will be deemed to be approved.

- The proceedings will be deemed to be concluded.

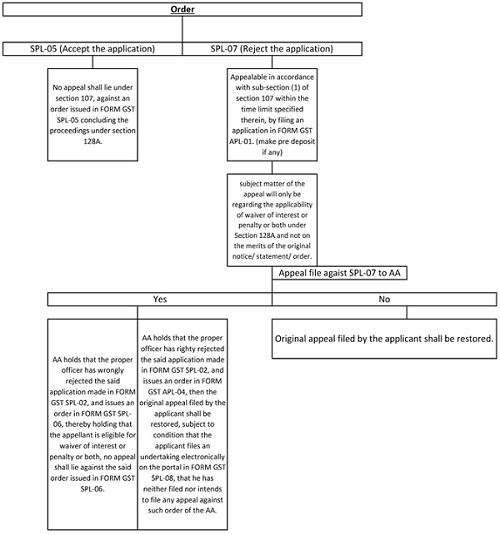

15. Restoration of Original Appeal and Appellate Authority Orders.

(a) Restoration of Original Appeal:

-

- If no appeal is filed against the order in FORM GST SPL-07 within the time specified in Section 107(1):

- The original appeal (if any) filed by the applicant against the order under Section 128A(1)(b) or (c) (Scenario 2 & 3 in our Case), which was withdrawn for filing the application in FORM GST SPL-02, shall be restored.

- If no appeal is filed against the order in FORM GST SPL-07 within the time specified in Section 107(1):

(b) Filing Appeal Against Rejection of Waiver Application:

-

- If an appeal is filed against the order in FORM GST SPL-07 for rejecting the waiver application:

(i) If the appellate authority finds that the proper officer wrongly rejected the application:

-

-

- The authority shall pass an order in FORM GST SPL-06 on the common portal, accepting the application and concluding the proceedings under Section 128A.

-

(ii) If the appellate authority finds that the proper officer rightly rejected the application:

-

-

- The original appeal (if any) against the order under Section 128A(1)(b) or (c) (Scenario 2 & 3 in our Case), which was withdrawn, shall be restored.

- The restoration is subject to the applicant filing an undertaking electronically in FORM GST SPL-08 within three months from the date of the order by the appellate authority in FORM GST APL-04.

- The undertaking must state that the applicant has neither filed nor intends to file any appeal against the appellate authority’s order.

-

16. Consequences of Non-Payment of Additional Tax Liability.

- If the taxpayer is required to pay an additional amount of tax under the second proviso to Section 128A (SPECIFIC ACTION OCCURRENCE in our case):

- If the additional payment is not made within the specified time limit:

- Any waiver of interest or penalty granted under the order in FORM GST SPL-05 or SPL-06 shall become void.

- If the additional payment is not made within the specified time limit:

17. Payment of Interest or Penalty Related to Erroneous Refund.

- If the taxpayer is required to pay any interest or penalty regarding demands for:

- Erroneous refund or

- Demands pertaining to periods not mentioned in Section 128A (1):

- The applicant must pay the specified amounts within THREE MONTHS from the date of issuance of the order in FORM GST SPL-05 or SPL-06.

- If the payment is not made within this period, the waiver of interest or penalty granted under Section 128A in the respective order will become void.

- Explanation:

- For issuing orders under these rules:

- If the waiver application relates to a notice/statement under Section 128A(1)(a), the proper officer for issuance will be as per Section 73.

- If the waiver application relates to an order under Section 128A(1)(b) or (c), the proper officer will be as referred to in Section 79 of the Act.

FORM SPL-05 & FORM SPL-06 SHALL BECOME VOID IN THE FOLLOWING CASES: –

1. Withdrawal of Appeal Order Not Filed Within One Month: –

- If the taxpayer had applied for withdrawal of appeal while filing Form SPL-02 but fails to file the withdrawal order within one month of accepting the withdrawal, then the SPL-05 or SPL-06 order shall become void.

2. Non-Payment of Interest/Penalty or Erroneous Refund Recovery: –

- If the taxpayer fails to pay interest or penalty related to a period not covered under Section 128A, or any demand related to an erroneous refund, within three months of the issuance of SPL-05 or SPL-06, then the order shall be deemed void.

3. Non-Payment of Additional Tax Liability in Departmental Appeal: –

- If the department files an appeal and it results in an additional tax liability, the taxpayer must pay this liability within three months of the order. Failure to do so will render SPL-05 or SPL-06 void.

–

CONCLUSION: –

Section 128A provides a mechanism for taxpayers to resolve their tax liabilities related to specific periods (from July 1, 2017, to March 31, 2020) without incurring interest and penalties, provided they adhere to the conditions outlined. It aims to ease the compliance burden on taxpayers while ensuring that the government efficiently collects outstanding taxes.