“Discover the new, hassle-free method to download CSI files for TDS returns without logging in.”

Recently the income tax department has issued a new way to download CSI file for TDS returns without logging in to income tax portal , The steps are as follows.

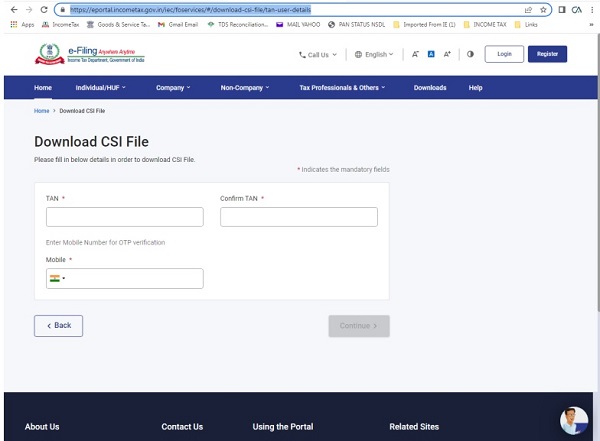

1. Go to https://www.incometax.gov.in/iec/foportal/

2. Fill in the requisite details and then submit.

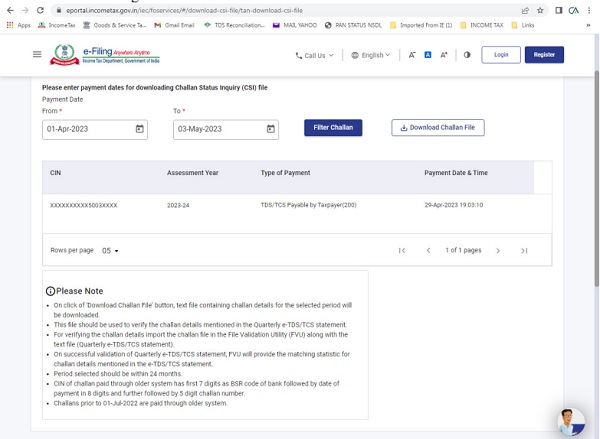

3. Choose the date range and then download the CSI file

PLEASE NOTE:

- On click of ‘Download Challan File’ button, text file containing challan details for the selected period will be downloaded.

- This file should be used to verify the challan details mentioned in the Quarterly e TDS/TCS statement.

- For verifying the challan details import the challan file in the File Validation Utility (FVU) along with the text file (Quarterly TDS/TCS statement).

- On successful validation of Quarterly e TDS/TCS statement, FVU will provide the matching statistic for challan details mentioned in the TDS/TCS statement.

- Period selected should be within 24 months.

- CIN of challan paid through older system has first 7 digits as BSR code of bank followed by date of payment in 8 digits and further followed by 5 digit challan number.

- Challans prior to 01″Jul”2022 are paid through older system.

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Thanks a lot for the info. It was useful for me.

Keep up the good work!