Case Law Details

Infosys Ltd. Vs ACIT (ITAT Bangalore)

ITAT Bangalore held that addition of Special Economic Zone books profits while computing books profits under section 115JB of the Income Tax Act is unsustainable in law in terms of Special Bench of Delhi Tribunal decision in the case of ACIT vs. Vireet Investment (P) Ltd.

Facts- One of the issues in the present case is addition of SEZ book profits u/s 115JB. The only issue for consideration is whether the disallowance u/s 14A if any could be added for computing the book profits of the assessee.

Conclusion- Held that this issue is no longer res integra and the same stands settled by the decision of the Special Bench of Delhi Tribunal in case of ACIT vs. Vireet Investment (P) Ltd. We accordingly direct the AO to delete the disallowance added while computing book profits.

Further, it was submitted that disallowance made towards section 10AA was also added to the book profits while computing 115JB.

FULL TEXT OF THE ORDER OF ITAT BANGALORE

Present appeals are filed by assessee and revenue for A.Ys. 2007-08 to 2011-12.

2. It is submitted that following issues are common with A.Y. 2012-13 and facts and circumstances of these issues are also identical with that of A.Y. 2012-13. The Ld.DR did not object to the above submissions of the assessee. This Tribunal has considered the common issues in A.Y. 2012-13 in IT(TP)A No. 718/Bang/2017 by order dated 28/11/2022 in great detail. The view taken therein are applied mutatis mutandis for the years under consideration. For the sake of convenience and to put in summary manner, we are only referring to the relevant paragraphs wherein these issues have be considered and decided in the order dated 28/11/2022.

|

A.Y. |

Ground No. | Issue Contested in the Appeals | Covered by Paras of A.Y. 2012-13 |

| 2010-11

2011-12 |

15 to 18

2 to 6 |

Denial of deduction claimed under section 10AA totally amounting to 1472,93,64,010 in respect of 4 SEZ units viz., Chennai – Unit 1, Chandigarh, Mangalore – Unit 1 and Pune Unit 1.

Losses of Trivendrum SEZ unit amounting to Rs. 1,52,56,742 was not set off against other taxable income Erred in concluding that the 5 SEZ units have been formed by splitting up and reconstitution of an already existing business Deduction claimed u/s 10AA amounting to Rs.1920,38,02,954 in respect of profits of 5 SEZ units was denied. Erred in denying deduction in respect of profit of Trivandrum SEZ Unit – 1 and not giving effect to Hon’ble DRP directions. Erred in concluding that 5 SEZ units have been formed by splitting up and reconstruction of an already existing business and hence these SEZ units are not eligible for deduction under section 10AA. |

Ground nos. 2-5

Paras 6 to 6.15. Issue allowed in favour of assessee vide para 6.15 |

| 2010-11

(Dept. appeal) 2011-12 (Dept. appeal) |

2

2 to 4 |

Transfer pricing adjustment in respect of interest receivable from Infosys China Transfer pricing adjustment in respect of interest receivable from Infosys China and Infosys Brazil | Ground nos. 6-9 Paras 7-7.7 Issue is dismissed against revenue by upholding 6% interest rate computed by assessee. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

2 (Dept. appeal)

2 & 3 2 & 3 2 & 3 7 & 8 |

Disallowance under section 14A | Ground nos. 10-13 Paras 8-.8.8 The issue is remanded to the Ld.AO to compute the disallowance as per the directions. Assessee’s appeals partly allowed. Revenue’s appeal dismissed. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

2 & 3

4 & 5 4 & 5 4 to 6 9 to 11 |

Disallowance under section 40(a)(i) in respect of subscription charges paid / payable to M/s Forester Research and M/s Gartner No disallowance as there was no amount payable as on last day of previous year | Ground no. 25 Paras 12-12.8 Allowed in favour of assessee. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

7 to 10

9 to 12 9 to 12 7 to 9 12 to 14 |

Disallowance under section 40(a)(ia) / 40(a)(i) in respect of software expenses paid to residents and non residents No disallowance as there was no amount payable as on last day of previous year | Ground nos. 14-21 Paras 9 – 9.1 The issue is remanded to the Ld.AO to consider in accordance with the decision of Hon’ble Supreme Court in case of Engineering Analysis Centre of Excellence Pvt. Ltd. vs. CIT reported in (2021) 432 ITR 471 |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

4 to 6

6 to 8 6 to 8 3 (Dept. appeal) 6 (Dept. appeal) |

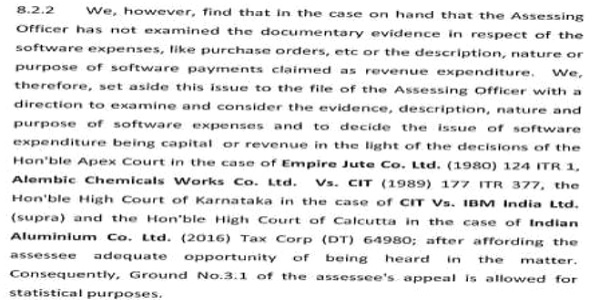

Disallowance of software expenses as capital expenditure Without prejudice, depreciation to be allowed at 60% instead of 25% Without prejudice, depreciation should also be allowed in respect of software expenses of earlier years held as capital in nature. | Ground nos. 22-24 Paras 11-11.7 The issue is remanded to the Ld.AO to verify the claim as per the decision of Hon’ble Supreme Court in case of Engineering Analysis Centre of Excellence Pvt. Ltd. vs. CIT reported in (2021) 432 ITR 471. In the alternative claim if at all needs to be considered, the directions in para 11.6 has to be followed.

Both revenue and assessee’s appeals allowed for statistical purposes. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 2011-12 |

11

13 13 10 15 16, 17 |

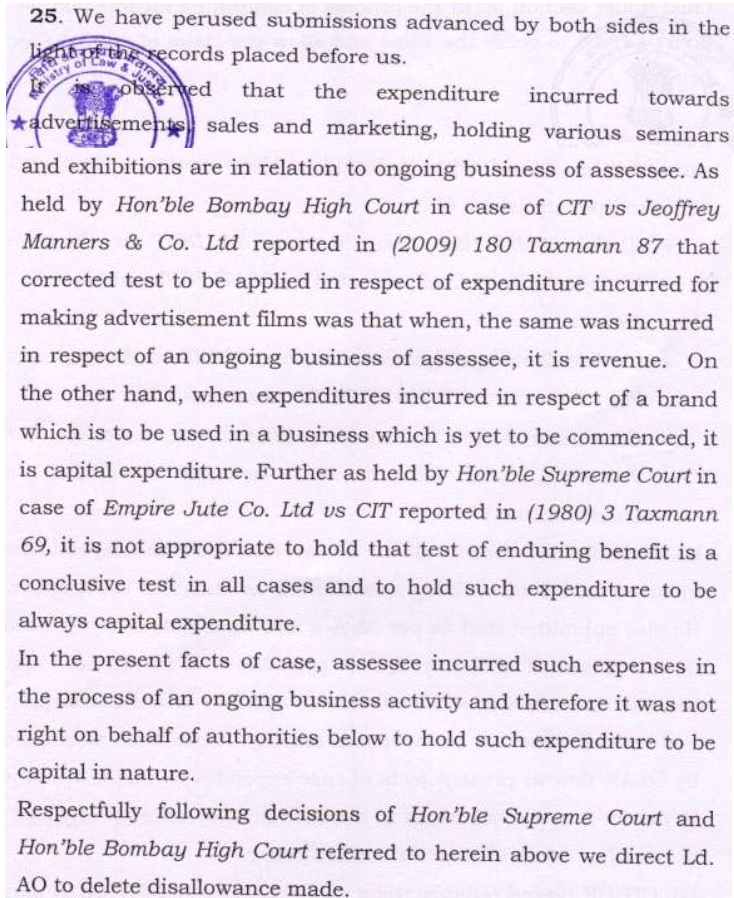

Disallowance of ‘brand building expenditure’ Percentage of total business revenues of 10A, 10AA(50%) and 10AA(100%) units wrongly computed by including other business income having no element of turnover and rounding off the said % to whole number instead of absolute % at two decimal points).

Consequential wrong allocation of disallowances |

Ground no. 25 Paras 12 – 12.8 The issue is allowed in favour of assessee by following the decision of Coordinate Bench of this Tribunal in case of Infosys BPO Ltd v DCIT in ITA No. 1367/Bang/2014 by order dated 27.09.2019 referred to in para 12.5 |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

12

14 14 4 (Dept. Appeal) 7 (Dept. Appeal) |

Disallowance of Commission paid to non resident agents

|

Ground no. 26 Paras 13.1 – 13.11 The issue is remanded to the Ld.AO to verify the claims in accordance with the directions of the Hon’ble Supreme Court in case of Engineering Analysis Centre of Excellence Pvt. Ltd. vs. CIT reported in (2021) 432 ITR 471.

Both revenue and assessee’s appeals allowed for statistical purposes. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

(Dept appeal)

4 & 5 2 & 3 2 & 3 7 & 8 8 & 9 |

Communication expenses and expenses incurred in foreign currency reduced from export turnover but not reduced from total turnover while computing deduction under section 10A and 10AA | Ground nos. 27-30 Paras 14-14.3

The issue is allowed in favour of assessee following the decision of Hon’ble Supreme Court in case of CIT v HCL Technologies Ltd reported in (2018) 93 taxmann.com 33. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

18 to 20

26 to 28 26 & 27 9 (Dept. appeal) 10 (Dept. appeal) |

Foreign currency expenses should not be reduced from export turnover while computing deduction u/s 10A. | Ground nos. 27-30 Paras 14 to 14.3

The issue is allowed in favour of assessee by following decision of Hon’ble Supreme Court in case of CIT v HCL Technologies Ltd reported in (2018) 93 taxmann.com 33. |

| 2009-10

2010-11 2011-12 |

24 & 25

13 18 |

Reduction of interest income on GLES deposit from profits of 10A and 10AA | Ground nos. 31-42 Paras 15 to 15.11 Dismissed as the same is not eligible for deduction u/s. 10A/AA. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

23 & 24

33 & 34 31 & 32 14 19 to 21 |

Reduction of deduction under section 10AA in respect of pure onsite revenue and deputation of technical manpower on an estimated basis | Ground nos. 41-42 Paras 16.1 to 16.11 Remanded to the Ld.AO to verify the documents filed by assessee and consider the claim in accordance with law. |

| 2011-12 | 13

(Dept. appeal) |

Deduction under section 80JJAA | Ground no. 43 Paras 17 to 17.7 Remanded to the Ld.AO to consider in accordance with principles laid down by Coordinate Bench of this Tribunal in case of SAP Labs India Pvt. Ltd. in IT(TP)A Nos. 623, 566/Bang/2016 for Assessment Year 2011-12 by order dated 29/11/2021 |

| 2007-08

2008-09 2009-10 2010-11 2011-12 2011-12

|

29

35 35 Addition al Gr. No 1 to 3 25 & 26 23 & 24 |

AY 2007-08 to 2011-12:-

Erred in not allowing foreign tax credit under section 90 in respect of income eligible for deduction under section 10A and 10AA as per the decision of the Jurisdictional High Court in the case of Wipro Ltd v DCIT[2016] 382 ITR 179 (Karnataka) Foreign tax credit and incremental deduction state tax paid claimed during the course of assessment not allowed |

Ground no. 54 Paras 23 to 23.6 The issue has been remanded to the Ld.AO to verify the FTC paid and to allow the claim u/s. 90 of the Act. Relied on Hon’ble Karnataka High Court in case of Wipro Ltd. vs. DCIT reported in 382 ITR 179. |

| 2007-08

2008-09 2009-10 |

30

36 36 |

Deduction for taxes paid to Local municipal authorities in Japan and Italian regional production tax paid in Italy which was not in the nature of ‘Income tax’ | Ground nos. 55-57, was not pressed by assessee for A.Y. 2012-13. |

| 2010-11

2011-12 |

19

22 |

TDS credit | Ground no. 53 Para 22.1. Remanded to the Ld.AO for verification and consideration in accordance with law. |

| 2007-08

2008-09 2009-10 2010-11 2011-12 |

32

38 38 20 31 |

Interest levied under section 234B and 234D | Consequential in nature. |

We have already tabulated hereinabove the issues that stands covered by the observations of the decision of Coordinate Bench of this Tribunal in assessee’s own case for A.Y. 2012-13 (supra) by order dated 28/11/2022 which is annexed to this order and marked as “Annexure – A”. For the sake of convenience and brevity, the relevant decision paragraphs which are identical and covered for the years under consideration has been mentioned hereinabove in the table. Accordingly, all the above grounds raised by assessee and revenue on common issues for the years under consideration vis-a-vis 2012-13 stands partly allowed as indicated hereinabove.

3. There are certain issues that are not common with A.Y. 201213 and are dealt with independently hereinbelow. The Ld.AR submitted that some of the issues arise in all the years under consideration which has been identified. As the facts and circumstances of these issues that are common to the years under consideration, they are principally decided commonly issue wise and shall apply mutatis mutandis for the assessment years wherever they are raised.

4. Disallowance of Building repair expenses

This issue has been commonly raised in following years.

| Assessment Year |

Ground Nos. | Appeal filed by |

| 2007-08 | 13 & 14 | Assessee |

| 2008-09 | 15 to 20 | Assessee |

| 2009-10 | 15 & 16 | Assessee |

| 2010-11 | 5 | Dept. |

| 2011-12 | 12 | Dept. |

4.1 The Ld.AR submitted that for all the years there was an adhoc disallowance of 10% by the Ld.AO. The Ld.AR submitted that the expenditure was incurred towards repairs and maintenance of building, maintain and preserve the existing assets in good condition, and it was not incurred to bring new asset into existence. The Ld.AR submitted that the expenditure did not result in increase in the capacity. The Ld.AR submitted that the expenditure was routine in nature and was less than 2% approximate of net book value of the buildings owned by the assessee.

4.2 The Ld.AR submitted that the DRP for A.Ys.2010-11 and 2011-12 on identical facts has allowed the building repair expenses as revenue in nature. He referred to the DRP directions for A.Y. 2010-11 at page 41, para 3.38.2 for A.Y. 2010-11 of the DRP direction wherein it is held that the disallowance made by the AO on an adhoc basis is bad in law. The DRP observed that the Assessing Officer has not brought on record any expenditure of capital in nature.

4.3 The Ld.AR placed reliance on the decision of Hon’ble Karnataka High Court in case of CIT v Mac Charles (India) Ltd reported in [2015] 233 Taxman 177 (Karnataka), wherein Hon’ble High Court held that, expenditure incurred on replacing flooring, false roofing, furniture, carpets and refurbishing of hotel rooms in tune with international standards without addition of extra floor space or extra room capacity was allowable as revenue expenditure. The Ld.AR thus submitted that in the present case also, the expenditure did not result in increase in the capacity or extra building space. He also submitted that the expenditure was not capable of enhancing the future benefits from the existing asset (buildings) beyond its previously assessed standard of performance. The Ld.AR submitted that the DRP gave factual observation that building repair expenses has been incurred in respect of existing assets and there is no change in facts and circumstances over the years. It is submitted that the disallowance is made only from AY 2007-08 to 2009-10 by the Ld.AO and for A.Ys. 2010-11 and 2011-12 the revenue is in appeal. The Ld.AR also submitted that for A.Y. 2012-13, the revenue has not preferred any appeal on this issue.

4.4 The Ld.DR relied on the orders passed by authorities below.

We have perused the submissions advanced by both sides in the light of records placed before us.

4.5 Hon’ble Bonbay High Court in the case of CIT vs. Oxford University Press reported in 108 ITR 166 has expounded that, the test for judging the nature of capital or revenue expenditure is to see whether as a result of expenditure what is being done is to preserve and maintain an already existing asset or whether as a result of expenditure a new asset or a new advantage is being brought into existence. The mere quantum of expenditure is not by itself decisive of the question whether it is in the nature of revenue or capital. Simply because of repair the life of building was prolonged for at least 15 years and it could not be said that the expenditure was in the nature of capital expenditure.

We further note that Hon’ble Supreme Court in the case of CIT vs. Kalyanji Mavji and Co. reported in 122 ITR 49, has held that, cost on repairs which are not current repairs can be allowed under section 37 (1). Section 30 and 31 are not a bar in this regard. In the present facts of the case, the Ld.AO has not identified any expenditure that has esulted in creation of a new asset. There is no basis for the to disallow adhoc 10% of the total expenditure incurred by the assessee of the building repairs.

From the above case law it is apparent that expenditure on repairs although prolonging the life and increasing durability of the asset is not necessarily of capital nature. Hence, in our considered opinion expenditure incurred by the assessee with regard to repairing/ renovating of existing make-up rooms have to be allowed as deduction as revenue expenditure, as they cannot be treated as capital expenditure meant for bringing into existence a new asset or a new advantage, and they are laid out wholly and exclusively for the purpose of business of the assessee.

We therefore direct the Ld.AO to allow this claim of assessee.

Accordingly, this ground raised by the assessee for AY 200718 to 2009-10 stands allowed and revenue appeal for AY 2010-11 & 2011-12 stands dismissed.

5. Taxability of Inducement fees

This issue is raised by assessee only for A.Y. 2009-10 in Ground nos. 28-30.

5.1 During the year, a sum of Rs. 32,48,98,842/- termed as ‘inducement fees’ was received for cancellation / lapse of proposed scheme of acquisition of Axon Group Plc. The appellant had incurred expenditure of Rs. 14,93,61,022/- towards the proposed acquisition, advisory, due diligence, legal charges etc. Excess of inducement fees received over expenditure incurred amounted to Rs. 17,55,37,820/- [32,48,98,842 less 14,93,61,022] and the same was treated as ‘capital receipt’ by the assessee and consequently the said sum was not offered to tax. During the assessment proceedings, the assessee was called upon by the Ld.AO to justify as to why the above sum of Rs.17,55,37,820/- is not chargeable to tax. The assessee, vide submissions dated 28.1.2013 explained in detail as to why the above net surplus of Rs. 17,55,37,820/- is a capital receipt and not chargeable to tax. It was explained that expenditure incurred on proposed acquisition was also not claimed as deduction and the said expenditure has been set off against the inducement fees received.

5.2 The Ld.AO considered the net surplus of Rs. 17,55,37,820/-as revenue receipt and assessed the same to tax. The Ld.AO was of the view that the assessee has been claiming expenditure on expansion of business, mergers and acquisitions as revenue in nature for the earlier years and consequently the net surplus of Rs. 17,55,37,820/- is chargeable to tax for the year under consideration. The Ld.AO also held that, the above sum cannot be regarded as part of profits of business so as to be eligible for deduction under section 10A and 10AA.

5.3 The CIT(A) held that the gross amount of Rs. 32,48,98,842 should be considered to be in the nature of non compete fees and should be brought to tax as business income. Having held as business income, the CIT(A) also held that, the inducement fees has no connection with the software development and export activities of the assessee and therefore the said receipt cannot be said to be part of the eligible profits of a unit for claiming deduction under section 10A and 10AA.

5.4 Before this Tribunal, the Ld.AR submitted as under:

During the FY 2008-09, the assessee was considering acquisition of Axon Group PLC, an IT services company listed in London having expertise in SAP consultancy. Infosys had proposed a bid price of 600 pence for every Axon share. As per the agreement, it was agreed that Axon will pay inducement fee of 1% of the consideration payable by Infosys for the Axon shares if –

1) a competing proposal is announced and subsequently completes before 31st January, 2009;

2) the Axon Directors do not recommend the Scheme or withdraw or adversely amend their recommendation and the Scheme subsequently lapses;

3) the Axon Directors fail to post the Scheme Document by 29th September, 2008 (or such later date as the Target and the Bidder may agree); or

4) Axon materially breaches its non-solicitation undertakings referred in the agreement.

5.5 He submitted that, the acquisition did not materialize and in accordance with the above clause, Axon had to make the payment of inducement fee of 1% of the consideration to Infosys. The Ld.AR submitted that, Axon made a payment of GBP 40,55,659/- (Rs.32,48,98,842/-) towards inducement fees and assessee already had incurred expenditure of Rs. 14,93,61,022/-towards the proposed acquisition by way of due diligence, advisory and legal charges etc. Thus the receipt of inducement fees resulted in a surplus capital receipt of Rs. 17,55,37,820/-.

It was submitted that the proposed acquisition transaction was a capital transaction and not a regular business transaction. In case, the acquisition would have materialized, the entire purchase price and incidental expenses would have been considered as investment in the books of the assessee. Accordingly, the amount received as inducement fees also was also a capital receipt. The incidental expenditure related to the acquisition transaction was also not claimed as revenue expenditure but adjusted against the inducement fees received and the net amount only was considered as capital receipt.

5.6 On the contrary, the Ld.DR submitted that the excess of expenditure incurred by assessee being Rs.14,93,61,022/- and the amount received by assessee from Axon being Rs.32,48,98,842/- is Rs.17,55,37,820/-. He submitted that this amount is in the nature of compensation received by assessee for the proposed acquisition that could not be concluded. He submitted that had this amalgamation to happen, assessee would have been enriched with a profit making apparatus that would have boosted the business structure of assessee. He thus supported the disallowance made by the Ld.AO.

5.7 We have perused the submissions advanced by both sides in the light of records placed before us.

The assessee was in the process of acquiring Axon Group Plc, an IT service company, listed in London having expertise in SAP consultancy. An agreement was entered into between the assessee and Axon, as per which Axon would have to pay 1% of the consideration payable by the assessee for acquiring Axon shares if the proposal does not materialise.

5.8 As the proposed acquisition failed, the assessee was in recipient of certain amount in connection to the cancellation/lapse of the proposed scheme of acquisition. It is submitted that the assessee had spent certain amount towards due diligence in the form of legal charges, advisory etc., of the proposed acquisition. The said expenditure was reduced from the total amount received by the assessee, and the balance was treated by the assessee as capital receipt that was not offered to tax.

5.9 We have considered the above receipt by the assessee, based on various provisions of the Act. The expenditure incurred by the assessee towards the due diligence, legal advices and payments for other professional services are to considered as business loss for the reason that the same did not culminate into a completed transaction.

5.10 In sofar as the excess amount received by the assessee over and above the expenditure is concerned, the same cannot be held to be exempt since this excess amount was received by the assessee for failure of the proposal for acquisition. The said amount is taxable in the hands of the assessee as revenue receipt. Therefore, in our considered opinion, section 28(ii)(e) of the Act, would come into play and the income received by the assessee would have to be certainly treated as profits and gain. 5.11 The next issue is whether the amount will qualify for deduction under section 10AA of the Act. The answer to this is in negative and against assessee. In our opinion, the money received by assessee does not arise out of the profits of the undertaking. We therefore do not find any infirmity in the view taken by the Ld.CIT(A) and the same is upheld.

Accordingly this ground of assessee stands dismissed.

6. Disallowance of foreign exchange fluctuation loss

This issue has been raised by assessee only for A.Y. 2008-09 in Ground nos. 21 & 22.

6.1 We have perused the submissions advanced by both sides in light of records placed before us.

When any entity enters into any transaction in foreign currency, it is exposed to exchange fluctuation risk on such transaction unless the same is hedged by the entity through hedging techniques like Forward Contracts, Currency Invoicing etc. The risk associated with such transactions may result into either Exchange Gain or Exchange Loss. The exchange fluctuations which are related to acquisition, installation, disposition of any capital asset, such fluctuations are only to be treated as Capital in nature.

6.2 The foreign exchange loss is due to the reinstatement of the accounts at the end of the financial year as well as loss incurred on account of exchange fluctuation on repayment of borrowings is similar to the interest expenditure and it is to be allowed as revenue expenditure u/s 37 of the I.T.Act, as per the accounting standard approved by the Institute of Chartered Accountants of India.

6.3 This issue is no longer res integra. Hon’ble Supreme Court in the case of CIT vs. Woodward Governor India Pvt. Ltd. reported in (2009) 312 ITR 254 has held that, the actual payment was not a condition precedent for making adjustment in respect of foreign currency transactions at the end of the closing year.

6.4 We also draw support from the decision of Hon’ble Mumbai Special Bench decision in case of DCIT vs. M/s. Bank of Bahrain and Kuwait reported in (2010) 41 SOT 290 wherein similar issue was under consideration.

The Hon’ble Special Bench observed and held as under:

“50. Therefore, this Accounting Standard mandates that in a situation like in the present case, since the transaction is not settled in the same accounting period, the effect of exchange difference has to be recorded on 31st March. Ld CIT D.R. has rightly pointed out that the expenses required to be charged against revenue as per accounting standard do not ipso facto imply that the same are always deductible for Income-tax purposes but at the same time its relevance does not, in any manner, gets mitigated. The Hon’ble Supreme Court in the case of Woodward Governor of India (P) Ltd.,((supra) with reference to working capital loan, which was also repayable after the end of accounting period, has held that loss occurred to the assessee, on account of fluctuation in the rate of foreign exchange, as on the date of the balance sheet, is an item of expenditure u/s.28(i) of the I.T.Act. Hon’ble Supreme Court observes as under:-“Under section 28(i), one needs to decide the profits and gains of any business which is carried on by the assessee during the previous year. Therefore, one has to take into account stock-in-trade for determination of profits. The 1961 Act makes no provision with regard to valuation of stock. But the ordinary principle of commercial accounting requires that in the profit and loss account the value of the stock-in-trade at the beginning and at the end of the year should be entered at cost or market price, whichever is the lower. This is how business profits arising during the year need to be computed. This is one more reason for reading section 37(1) with section 145. For valuing the closing stock at the end of a particular year, the value prevailing on the last date is relevant. This is because profits/loss is embedded in the closing stock. While anticipated loss is taken into account, anticipated profit in the shape of appreciated value of the closing stock is not brought into account, as no prudent trader would care to show increased profits before actual realization. This is the theory underlying the rule that closings stock is to be valued at cost or market price, whichever is the lower. As profits for income tax purposes are to be computed in accordance with ordinary principles of commercial accounting, unless such principles stand superseded or modified by legislative enactments, unrealized profits in the shape of appreciated value of goods remaining unsold at the end of the accounting year and carried over to the following year’s account in a continuing business are not brought to the charge as a matter of practice, though, as stated above, loss due to fall in the price below cost is allowed even though such loss has not been realized actually.”

Ld CIT D.R.’s submission is that this decision is with reference to monetary items as referred to in AS-11 and since forward foreign exchange contracts do not come within the monetary items, therefore, the said decision cannot be applied. However, we have already discussed in the concept of recognition of various events in financial statements and have noted that the assessee , in fact, has recorded net effect in its profit and loss account. Therefore, on this count, the department’s plea cannot be accepted. Thus, in view of the decision of the Supreme Court in the case of Chellapali Sugar Mills (supra), and also in view of decision of the the Hon’ble Supreme Court in the case of Woodward Governor India (P)Ltd., (supra), assessee’s plea deserves to be accepted.

51. Now, coming to the objection of ld CIT D.R. with reference to various decisions relied upon by ld counsel for the assessee on the ground that in the said decisions, the issue was relating to stock-in-trade but in the present case, there is no stock-in-trade. Admittedly, the assessee has not shown any closing stock of unmatured forward foreign exchange contracts as on balance sheet date and has only booked the profit and loss in that regard. There is no dispute that the foreign exchange currency held by the assessee bank is its stock-in-trade and as is evident from the hypothetical example considered earlier, the assessee had entered into forward foreign exchange contracts in order to protect its interest against the wide fluctuation in the foreign currency itself. Therefore, this contract was incidental to assessee’s holding of the foreign currency as current asset. Therefore, in substance, it cannot be said that the forward contract had no trappings of the stock-in-trade. Ld Counsel has rightly relied upon the decision of the Calcutta ITAT (SB) in the case of Shree Capital Services Limited,(supra) in this regard and, therefore, the various decisions relied upon by ld Counsel for the assessee as discussed in his submissions are applicable to the facts of the case.

52. Now coming to the argument of ld CIT (DR) with reference to the decision in the case of Indian Overseas Bank (supra), we find that the said decision was rendered with reference to taxing of notional profits and not with reference to anticipated losses, as is the case before us. The department is trying to draw analogy from the said decision but the said decision cannot be applied as the considerations are entirely different in regard to the issue relating to notional profits vis-à-vis anticipated losses. Profits are considered only when actual debt is created in favour of assessee but in case of anticipated losses, if an existing binding obligation, though dischargeable at a future date, is determinable with reasonable certainty, then the same is allowable.

53. Ld CIT D.R. has also heavily relied on the decision of the Hon’ble Bombay High Court in the case of CIT v. Kamani Metals and Alloys Ltd (supra). This decision, in our opinion, is of little help to the department inasmuch as the same has been rendered with reference to contract for purchase of raw material. The contracted price was more than the market price as the price went down and the material had not been received at the end of the accounting year. Under these facts, the Hon’ble High court held that notional loss claimed by the assessee on the balance sheet date was not allowable because there was merely the contract to purchase the material at a future date. Neither any payment was made by the assessee nor any material was received. This case, in our opinion, cannot be applied to the facts of the present case as in the present case, we are concerned about the anticipated loss booked by the assessee on account of foreign exchange rate fluctuation as on balance sheet date, which was in accordance with RBI guidelines as well as in accordance with AS-11. Moreover, a binding obligation arose the minute the contract was entered into. However, now the decision of the Hon’ble Supreme Court in the case of Woodward Governor India P. ltd (supra) covers the issue on account of variation in foreign exchange rate with reference to current assets. The facts in the case of CIT v. Kamani Metals and Alloys Ltd (supra) are more akin to such a situation where the assessee has simply ordered for purchase of material at a particular rate but the material has not been supplied by the seller by the end of the accounting period. No liability is accounted for in respect of such ordered goods because the basic elements of contract have not been fulfilled. In the present case, we have already observed that the forward contract is incidental to the foreign currency held by the assessee as stock-in-trade and, therefore, the decision in the case of CIT v. Kamani Metals and Alloys Ltd (supra) is clearly distinguishable on facts.

54. Ld CIT D.R. has also relied on the decision in the case of Eveready Industries (supra). The view expressed in the said decision also cannot be upheld in view of the decision of the Hon’ble Supreme Court in the case of Woodward Governor India P.Ltd (supra). The facts in the case of Indian Molasses’ case(supra) are entirely different. The said decision proceeded on the premise that till the date of retirement of Managing Director, the assessee company itself had dominion over the sum paid through trustees and insurance society and there was no irrecoverable liability created. Thus, the impugned amounts were treated as part of profits set apart to meet a contingency by the assessee without any corresponding liability being there as the liability was only contingent in nature. There cannot be any quarrel with the proposition that the liability in praesenti is an allowable deduction but a liability in futuro, which for the time being is only contingent, is not allowable. As already pointed out this principle is to be applied keeping in view the principles of prudence and applicable Accounting Standards. In our opinion, the complete answer has been given long back by the Hon’ble Supreme Court in the case of Bharat Earth Movers Ltd, 245 ITR 428 (SC), wherein, it was held that the provision made by the assessee for meeting the liability incurred by it under the leave encashment scheme proportionate with the entitlement earned by the employees of the company was entitled to deduction out of the gross receipts of the accounting year in which the provisions were made.

55. Ld CIT D.R. has also relied on the decision of the Hon’ble Calcutta High Court in the case of Bestobell India Ltd ((supra), which decision has been considered in detail by the Hon’ble Delhi High Court in the case of Woodward Governor India (P)Ltd (supra), wherein, it has been observed as under:-

“The revenue relied upon the decision of the Calcutta High Court in Bestobell (India) Ltd.,(1979) 117 ITR 789 in support of the submission that the increased liability on repayment of a loan borrowed in foreign exchange for business purposes as a result of exchange rate fluctuation would be a capital loss and not a trading loss. What weighed with the Calcutta High Court there appears to be that there was no outflow of funds during the year, as has been urged by the revenue before us. However, a closer scrutiny of the said decision indicates that the Calcutta High Court in this case relied upon its earlier judgement in Sutlej Cottons Mills Ltd v CIT (1971) 81 ITR 641. It will be recalled that the Hon’ble Supreme Court in Sutlej Cotton Mills Ltd v CIT(1979) 116 ITR 1 reversed the aforesaid decision of the Calcutta High Court on this point and held that such liability would be treated as a trading loss. In that view of the matter, the reliance placed by the revenue on the judgement of the Calcutta High Court in Bestobell (India Ltd., (1979) 117 ITR 789 appears misplaced.”

56. The controversy stands now resolved in view of the decision of the Supreme Court in the case of Sutlej Cotton Mills Ltd., 116 ITR 1 (SC), wherein, it has been held that fluctuation on account of foreign exchange rate is an allowable deduction and is not capital in nature. The observation of the Hon’ble Supreme Court is as under:-

“The law may, therefore, now be taken to be well settled that where profit or loss arises to an assessee on account of appreciation or depreciation in the value of foreign currency held by it, on conversion into another currency, such profit or loss would ordinarily be a trading profit or loss if the foreign currency is held by the assessee on revenue account or as a trading asset or as a part of circulating capital embarked in the business. But, if on the other hand, the foreign currency is held as a capital asset or as fixed capital, such profit or loss would be of capital nature(emphasis supplied)”

57. At the end we may further observe that when profits are being taxed by the department in respect of such unmatured forward foreign exchange contracts then there was no reason to disallow the loss as claimed by assessee in respect of same contracts on the same footing. In this regard, we may refer to the details furnished by assessee vide their letter dt. August 05, 2010 to establish that the Department has assessed the Bank in respect of the profit shown by the Bank on restatement of outstanding forward foreign exchange contracts for A.Ys.2002-03 and 2003-04. There is no dispute on this count and, therefore, we refrain from referring the details.

58. In view of the above discussion, we allow the assessee’s appeal for the following reasons:-

i) A binding obligation accrued against the assessee the minute it entered into forward foreign exchange contracts.

ii) A consistent method of accounting followed by assessee cannot be disregarded only on the ground that a better method could be adopted.

iii) The assessee has consistently followed the same method of accounting in regard to recognition of profit or loss both, in respect of forward foreign exchange contract as per the rate prevailing on March 31.

iv) A liability is said to have crystalised when a pending obligation on the balance sheet date is determinable with reasonable certainity. The considerations for accounting the income are entirely on different footing.

v) As per AS-11, when the transaction is not settled in the same accounting period as that in which it occurred, the exchange difference arises over more than one accounting period.

vi) The forward foreign exchange contracts have all the trappings of stock-in-trade.

vii) In view of the decision of Hon’ble Supreme Court in the case of Woodward Governor India (I) P.Ltd., the assessee’s claim is allowable.

viii) In the ultimate analysis, there is no revenue effect and it is only the timing of taxation of loss/profit.

59. We, accordingly, hold that where a forward contract is entered into by the assessee to sell the foreign currency at an agreed price at a future date falling beyond the last date of accounting period, the loss is incurred to the assessee on account of evaluation of the contract on the last date of the accounting period i.e. before the date of maturity of the forward contract.”

6.5 We direct the Ld.AO to carry out necessary verification in respect of the loss /gain incurred by the assessee for the years under consideration whether on account of Capital asset based on the principles laid down by Hon’ble Mumbai Special Bench in case of Bank of Bahrain and Kuwait (supra).

6.6 In the event the loss/gain is out of trading liability, no disallowance can be made. However, we make it clear that there cannot be double claim by the assessee; once in the year under consideration and on actual settlement of the bill in any subsequent year.

Accordingly, these grounds raised by the assessee stands allowed for statistical purposes.

7. Reduction of export turnover u/s. 10A on account of later realization of export turnover into India.

7.1 The Ld.AR submitted that this issue has been raised by assessee in the Assessment Years under consideration as under:

| Assessment Year | Grounds of appeal |

| 2007-08 | 15 to 17 |

| 2008-09 | 23 to 25 |

| 2009-10 | 17 to 19 |

| 2010-11 | 11 |

7.2 The Ld.AR submitted that assessee had late realization of export turnover into India during the Assessment Years under consideration. The Ld.AO denied the claim and held that the late realised export turnover cannot be reduced from the formula for computation of section 10A.

7.3 It is submitted that Hon’ble Bombay High Court in case of CIT vs. Morgan Stanley Advantage Services (P) Ltd. reported in (2011) 13 taxmann.com 166 in support of its contention.

On the contrary, the Ld.DR placed reliance on orders passed by authorities below.

7.4 We have perused the submissions advanced by both sides in the light of records placed before us.

The assessee had not received certain export proceeds within six months from the end of the relevant assessment year. As the exports were effected prior to 31st March of the relevant Financial Year for the AYs under consideration, the export proceeds ought to have been realised by 30/09/2004 for availing deduction u/s. 10A but the same was realised much later. We note that the assessee has furnished the details wherein the authorised dealers under FEMA have not taken any adverse action for late realisation of export turnover and neither declined nor rejected the application for late realisation of such export turnover.

We note that the authorities below have not verified any documents /evidences filed by the assessee. The question is, whether the extension of time for realisation of the export proceeds by the Competent Authority under FEMA can be said to be the approval granted by the Competent Authority under section 10A(3) of the Income-tax Act, 1961. This issue has been addressed by the Hon’ble Bombay High Court in case of Mogan Stanley( supra) by observing and held as under:

Explanation 1 to section 10A(3 ) clearly provides that the expression ‘competent authority’ in section 10A means the RBI or such other authority as is authorized under any law for the time being in force for regulating payments and dealings in foreign exchange. Admittedly, RBI is the competent authority under the FEMA which regulates the payments and dealings in foreign exchange. Thus, what section 10A(3) provides is that the benefits under section 10A(1) would be available if the export proceeds are realized within the time prescribed by the competent authority under the FEMA. In the instant case, the competent authority under the FEMA, namely, the RBI has granted approval in respect of the export proceeds realised by the assessee till December, 2004. Therefore, the approval granted by RBI under the FEMA would meet the requirements of section 10A. In other words, once the competent authority under the FEMA, which regulates the payments and dealings in foreign exchange, has approved realization of the export proceeds by the assessee till December, 2004, then it would meet the requirements of section 10A(3) and, consequently, the assessee would be entitled to the benefits under section 10A(1). [Para 8]

Moreover, in the instant case, the RBI which is the competent authority under the FEMA as also under section 10A, has neither declined nor rejected the application made by the assessee seeking extension of time under section 10A. Therefore, the decision of the Tribunal in holding that the approval granted under the FEMA constitutes a deemed approval granted by the RBI under section 10A(3) cannot be faulted. [Para 9]

The RBI being the competent authority under the FEMA as also under section 10A(3) in the facts of the instant case, the Tribunal was justified in holding that the assessee was entitled to the deduction under section 10A in respect of the export proceeds realized till December, 2004 for which approval has been granted by the competent authority under FEMA, namely, the RBI.

7.5 In the event there is an approval granted by the competent authority under FEMA, the claim of assessee deserves to be allowed. We therefore, direct the Ld.AO to verify the evidences and the documents in respect of the RBI approval and to consider the claim of the assessee in accordance with law in the light of the above ratio by Hon’ble Bombay High Court.

Accordingly this grounds raised by the assessee for the years under consideration stands allowed for statistical purposes.

8. Reduction of rental income from profits of 10A units

8.1 The Ld.AR submitted that this issue is common for following

A.Ys.

| AY | Ground No. |

| 2007-08 | 21 & 22 |

| 2008-09 | 29 & 30 |

| 2009-10 | 20 & 21 |

| 2010-11 | 12 |

8.2 The Ld.AR submitted that assessee had received rental income from its subsidiary companies that constituted income from incidental and ancillary activities that was subservient to carrying on the business of the assessee. The said rental income was claimed by the assessee as deduction u/s. 10A which was denied by the Ld.AO, based on the turnover of the SEZ units. The Ld.AR submitted that the rental income pertained only to STPI units and therefore it was an income that was generated out of the undertaking. It is the submission of the Ld.AR that the revenue is not doubting the origin of the rental income because the disallowance was made by the Ld.AO based on the turnover of these units. At the outset however, the Ld.AR submitted that this issue has been considered by Coordinate Bench of this Tribunal for A.Y. 2005-06 in assessee’s own case in IT(TP)A No. 102/Bang/2013. This Tribunal vide order dated 10/11/2017 considered the issue by observing as under:

“30. Ground No.9.

30.1 In this ground (supra), Revenue assails the order of the learned CIT (Appeals) in allowing the assessee’s claim for inclusion of rental income from Infosys BPO Ltd. and BSNL, Chennai as profits of the business in computing deduction under Section 10A of the Act, when these incomes were not derived from the export of computer software.

30.2 In the order of assessment, the Assessing Officer held that the aforesaid rental income from Infosys BPO Limited and BSNL, Chennai cannot be regarded as income derived from the business of export of software. On appeal, before the learned CIT (Appeals), it was submitted by the assessee that inter alia, the rental income received from its subsidiary, Infosys BPO Limited, was incidental to the business carried on by the assessee as it facilitated operations, transactions, policies and procedures. In respect of the letting out of space to BSNL, in Chennai, it was for the purpose of setting up of Mini Exchange to equip the assessee’s Chennai unit with telecommunication facilities. It was urged that the letting of space to Infosys BPO Limited and BSNL at Chennai were therefore incidental to the business carried on by the assessee and therefore eligible for deduction under Section 10A of the Act.

30.3.1 We have heard the rival contentions, perused and carefully considered the material on record. The issue as to whether interest income, income from sale of scrap, export incentive, rental income, etc. are eligible for deduction under Section 10A of the Act has been considered by the Hon’ble High Court of Karnataka in the case of Subex Ltd. Vs. ITO in ITA Nos.46 & 47 of 2009 dt.2.10.2014 held that rental income by virtue of sub-section (4) of Section 10 of the Act is deemed to be business of the undertaking for the purpose of extending the benefit of deduction under Section 10A of the Act. At paras 8 & 9 thereof, the Hon’ble Court, explaining the interplay of section 10A(1) and 10A(4) of the Act, has held as under :

8. As could be seen from the aforesaid provisions, the opening words of Section 10A of the Act assumes importance. It commences with the words “subject to the provisions of this section”. The opening words of sub section 4 of the Act clearly state that “for the purposes of [sub-sections (1) and (1A], the profits derived from export of articles or things or computer software shall be the amount which bears to the profits of the business of the undertaking”. If the assessee is entitled to deduction only profit derived under Section 10A(1) of the Act, the sub section (4) would be redundant. The sub section which came into effect on 01-04-2002 by Finance Act 2001 recognizes that the profits of the business of the undertaking would be, not only the profits and gains from the exports of articles or things or computer, in addition to that, the undertaking may have some other profits also, which is derived from business of the undertaking.

9. In the instant case, the assessee took the premises on lease. Assessee has paid a sum of Rs.43,38,350/- as rent from April 2002 to March 2003. It is shown as ‘business expenses’, as against the ‘expenses incurred’. The assessee has received a sum of Rs.17,27,385/- as rent receipt for the relevant period. Assessee is not the owner of the said premises. Assessee is carrying on the business of development of Software in Canada. The said premises was taken for the aforesaid business purpose. As a portion of the said premises was not used for business purpose, instead of keeping it vacant and suffering loss, it was rented out. Therefore, the said income derived from lease of the said premises constitutes “income from business”. Neither it would be ‘income from house property’ nor ‘income from other sources’. In view of the explanation used in sub Section (4) of Section 10A of the Act for the purpose of Sub section 1, the profit derived from export of articles or things or computer software shall be the amount which bears to the profits of business of the undertaking. Though the said profits are not derived from export of articles or things or computer software, by virtue of sub Section (4) it is deemed to be the profits of the business of the undertaking for the purpose of extending the benefit of exemption of payment of tax under Section 10A of the Act to a newly established undertaking in a free trade zone.

30.3.2 Similarly, the Hon’ble High Court of Karnataka in the case of Wipro Ltd. Vs. DCIT in its order reported in (2016) 382 ITR 179 before whom the substantial question of law No.16 for consideration was in respect of income from sale of scrap, export incentive, rent received, interest income and gain on exchange rate fluctuation. The Hon’ble Court held that these items were eligible for deduction under Section 10A of the Act. At para 166 thereof; the Hon’ble Court followed its own earlier order in the case of Wipro Ltd. in ITA No.507 / 2002 dt.25.8.2010, in respect of income from sale of scrap, export incentive and rent received to hold as under :

“166. This Court had occasion to consider the substantial questionof law in assessee’s case itself in ITA 507 . 2002 decided on 25.8.2010 while dealing with the income from sale of scrap, export incentive and rent received, answered the question in favour of the assessee ;and against the revenue.”

At para 169 thereof the Hon’ble Court held as under :

“169. As all these questions are decided and answered in favour of the assessee in the aforesaid case, this question of law is answered in favour of the assessee and against revenue.”

30.3.3 Respectfully following the decisions of the Hon’ble High Court of Karnataka in the case of Subex Ltd. Vs. ITO (supra) and Wipro Ltd. Vs. DCIT (supra), as discussed above, we are of the view that rental income received from Infosys BPO Limited and BSNL, Chennai cannot be excluded from the profits of the business of the undertaking while computing the deduction under Section 10A of the Act in the case on hand. Consequently, Ground No.9 of the revenue’s appeal is dismissed.”

8.3 There is nothing on record that is brought by the revenue in order to take a contrary view. Respectfully following the above view, we direct the Ld.AO to include the rental income received from the SEZ units for the purposes of computing profits u/s. 10A.

Accordingly, these grounds raised by assessee for the years under consideration stands allowed.

9. Addition of SEZ book profits u/s. 115JB

9.1 The next issue for A.Y. 2009-10 is addition of SEZ book profits u/s. 115JB. This issue is raised by the assessee in Ground nos. 33 & 34 for A.Y. 2009-10.

9.2 It is submitted that the Ld.AO added the 14A disallowance while computing the book profits of the assessee. The Ld.AR further submitted that the disallowance was made towards 10AA deduction was also added to the book profits while computing 115JB.

9.3 It is submitted that no reasons have been given in the assessment order as to why additions are made. On an appeal before the Ld.CIT(A), the taxable income was determined under the normal provisions of the Act. Therefore, the CIT(A) held that the present issue relating to computation of income under the MAT provisions has become academic and the issue does not require any specific adjudication.

9.4 Before us the Ld.AR submitted that the computation of book profits under section 115JB is dealt by Expl. 1 to section 115JB. The computation of book profit starts with net profit as per Profit and loss account. He submitted that the explanation provides for certain additions and deletions in computing the book profits. Subsection 6 of section 115JB provides that the provisions of this section shall not apply to the income accrued or arising on or after the 1st day of April, 2005 from any business carried on, or services rendered, by an entrepreneur or a Developer, in a Unit or Special Economic Zone, as the case may be. Subsection 6 of section 115JB was introduced by the Special Zones Act, 2005 with effect from 10.2.2006. Book profits of SEZ unit are exempt from MAT by virtue of section 115JB(6). He also relied on proviso to section 115JB(6) has withdrawn the MAT exemption in respect of profits of SEZ unit with effect from AY 2012-13 onwards. It is submitted that the said proviso is not applicable in the present case as the assessment years under consideration are A.Ys. 2007-08 to 2009-10. The Ld.AR thus submitted that the addition made by the assessing officer is bad in law.

9.5 The Ld.AR submitted that in the OGE to CIT(A) order, the Ld.AO do not make addition in respect of the difference between the deduction claimed by assessee u/s. 10AA and that allowed by the Ld.AO. The only issue that now survives for consideration is whether the disallowance u/s. 14A if any could be added for computing book profits.

On the contrary, the Ld.DR placed reliance on orders passed by authorities below.

We have perused the submissions advanced by both sides in the light of records placed before us.

9.6 This issue is no longer resintegra and the same stands settled by the decision of Hon’ble Special Bench of Delhi Tribunal in case of ACIT vs. Vireet Investment (P) Ltd., reported in (2017) 82 taxmann.com 415. We accordingly direct the Ld.AO to delete the disallowance added while computing book profits.

Accordingly, this ground raised by assessee stands allowed. 10. The next issue which is common are as under:

Issue 1 : Enhancement of income by CIT(A) in respect of new source which was not at all dealt by the learned AO in the assessment order is bad in law.

Issue 2 : Reduction of 50% of overseas revenues from licensing of Finacle software from export turnover of 10A units.

10.1 The above issues have been raised by assessee in following grounds of appeal for years under consideration.

| AY | Ground no. |

| 2007-08 | 25, 26, 27 & 28 |

| 2008-09 | 31 & 32 |

| 2009-10 | 22 & 23 |

10.2 The Ld.AR submitted that assessee was called upon during the assessment proceedings to explain how receipts from licensing of Finacle software are eligible for deduction u/s. 10A. In the details filed by the assessee, the Ld.AO noted that the Finacle software that was leased was developed way back in 1996 as BANCS 2000 which was remodelled and renamed as “Finacle”. The Ld.AO noted that the license fee received by the assessee from overseas was entirely claimed as deduction u/s. 10A pertaining to Infosys STP-II at Electronic City, Bangalore. While computing the deduction u/s. 10A, the Ld.AO invoked the provisions of section 80IA(8) r.w.s. 10A(7) and only allowed 50% of the license fee received from overseas for the purposes of profits of 10A unit.

10.3 Before the Ld.CIT(A), assessee filed various details to establish the difference between the two software and that the Finacle software was totally different and the observations of the Ld.AO that it was remodel of BANCS 2000 is factually incorrect. The Ld.CIT(A) from various submissions of assessee on the technical aspects of this software, observed that assessee has been continuously upgrading its banking software products and therefore he upheld the action of the Ld.AO in attributing only 50% of total revenue towards the earning of license fee. Before the Ld.CIT(A), assessee had also claimed that Ld.AO only reduced the said amount of 50% from the profits of the 10A in respect of reducing the same from export turnover of the unit. The Ld.CIT(A) after considering the relevant submissions of assessee directed the Ld.AO to reduce the 50% from the export turnover for computing deduction u/s. 10A of the Act. Before this Tribunal, the Ld.AR submitted that assessee is eligible for 100% claim of the license fee received. It was submitted that Finacle was a new generation core banking product which was successor to BANCS 2000. He submitted that this new product was actively pursued by banks with e-commerce strategy and therefore it was a product that was launched by assessee in the year 2000 which can be categorically observed from the financial reports of March 2000.

On the contrary, the Ld.DR relied on the observations of the authorities below.

We have perused the submissions advanced by both sides in the light of records placed before us.

10.4 It is an admitted fact that in a software development segment, once a software developed cannot be used in perpetually, the product has to undergo various changes in accordance with the demands of time and the business model. Product that gets outdated due to rapid change in the commercial requirement, deserves to be replaced with a new model. In the present facts of the case, the only dispute with the assessing officer is in respect of Finacle being a remodel of BANCS2000. It is not disputed that the said license fee generated out of licensing of Finacle software is eligible for deduction u/s. 10A. Whether there is a change in the product and whether there are new features that could categorise this Finacle software to be a new product has not been verified by the Ld.AO. Such technical analysis is definitely very difficult at the revenue’s end due to the lack of expertise. We therefore direct the Ld.AO to verify with the assistance of the assessee on a technical level to understand the difference in both these softwares. In the event, there is a difference in the products, assessee deserves 100% deduction on the license fee received from the overseas in respect of licensing the product. We direct the assessee to provide sufficient assistance to the Ld.AO in order to understand the product model to come to a just conclusion. Accordingly, these grounds raised by assessee for years under consideration stands allowed for statistical purposes.

11. Deduction under section 37 for the taxes on income paid to state revenue authorities of USA and Canada.

11.1 This issue has been raised by assessee in following Assessment Years.

| AY | Ground no. |

| 2007-08 | 31 |

| 2008-09 | 37 |

| 2009-10 | 37 |

11.2 We note that the main issue of the foreign tax credit and the additional foreign tax claimed by assessee in respect of state taxes paid has been already remanded to the Ld.AO with the direction to consider in the light of the decision of Hon’ble Karnataka High Court in case of Wipro Ltd. vs. DCIT reported in 382 ITR 179.

Accordingly, we hold this particular issue to be academic at this stage.

12. Additional foreign tax credit claim on account of assessed income and in respect of taxes reasonably expected to be paid in USA and Switzerland where audit/ assessment is under progress in relation to income of the previous year 2010-11.

12.1 This issue is raised by assessee for A.Y. 2011-12 in Ground nos. 32 to 34.

We have perused the submissions advanced by both sides in the light of records placed before us.

12.2 We note that this claim has been made by assessee in respect of taxes reasonably accepted to be paid in USA and Switzerland where audit and assessment was under progress in relation to income of previous year 2010-11.

12.3 The Ld.AO is directed to verify the same based on the documents / evidences filed by assessee. In the event, the taxes have been actually paid pertaining to the income for previous year 2010-11, in the respective countries, credit shall be granted as per section 90 of the Act.

Accordingly, this ground raised by assessee stands allowed for statistical purposes.

13. Assessee has filed an application for admission of additional ground for A.Y. 2011-12 wherein the deduction for education cess and secondary and higher secondary cess has been sought for. As this issue has been decided by Hon’ble Supreme Court against assessee, we dismiss this ground raised by assessee.

Accordingly, the additional ground raised by assessee stands dismissed.

Accordingly, the appeals filed by assessee as well as revenue stands partly allowed as indicated hereinabove.

In the result, the appeals filed by the assessee and revenue stands partly allowed as indicated hereinabove.

Order pronounced in the open court on 30th November, 2022.

ANNEXURE – ‘A’

Present appeal arises out of final assessment order dated 28/02/2017 passed by the Ld.ACIT, Circle – 3(1)(1), Bangalore for A.Y. 2012-13 on following grounds of appeal:

General and Legal Grounds

1. The order passed by the learned assessing officer and the directions of Hon’ble DRP to the extent prejudicial to the appellant is bad in law and liable to be quashed.

Grounds on denial of deduction claimed under section 10AA in respect of 4 SEZ units viz., Chennai – Unit 1, Chandigarh, Mangalore – Unit 1 and Pune Unit 1

2. The learned assessing officer has erred in denying deduction claimed under section 10AA in the return of income totally amounting to Rs. 2227,82,65,630 in respect of profits of 4 SEZ units viz., Chennai – Unit 1, Chandigarh, Mangalore – Unit 1 and Pune Unit 1.

3. The learned assessing officer has erred in denying deduction computed under section 10AA (after making certain disallowances) in the assessment order for the impugned reason that the 4 SEZ units viz., Chennai – Unit 1, Chandigarh, Mangalore – Unit 1 and Pune Unit 1have been formed by splitting up and reconstruction of the already existing business.

4. The learned assessing officer has erred in concluding that the 4 SEZ units have been formed by splitting up and reconstruction of an already existing business and hence these SEZ units are not eligible for deduction under section 10AA.

5. On the facts and in the circumstances of the case and law applicable, the 4 SEZ units viz., Chennai – Unit 1, Chandigarh, Mangalore – Unit 1 and Pune Unit 1 were not formed by splitting up and reconstruction of an already existing business and consequently these SEZ units are eligible for deduction under section 10AA.

Grounds on transfer pricing adjustment

6. The learned Assessing Officer has erred in making a reference to TPO for determining arm’s length price without demonstrating as to why it was necessary and expedient to do so and the Hon’ble DRP has erred in confirming the action of the learned AO.

7. The lower authorities have erred in making a transfer pricing adjustment of Rs. 84,04,827, passing the orders without demonstrating that the appellant had motive of tax evasion, not appreciating that no addition can be made under Chapter X as Transfer pricing adjustment under Chapter X is not included in the definition of ‘income’ u/s 2(24) or under Chapter IV of the IT Act, 1961. The orders passed by the lower authorities are therefore bad in law and liable to be quashed.

8. The learned assessing officer and transfer pricing officer have erred in making a transfer pricing adjustment of Rs 84,04,827 by adopting the average rate of interest on fixed deposits for a period exceeding 365 days calculated at 8.53% as internal CUP for the purpose of computing arm’s length price (ALP) adjustment in respect of interest income charged on loan given to Infosys Technologies (China) Co Ltd.

9. On facts and in the circumstances of the case and law applicable, the impugned transfer pricing adjustment is liable to be deleted in entirety.

Grounds on disallowance under section 14A

10. The learned assessing officer has erred in computing disallowance of Rs. 3,30,96,246 under section 14A of the Income tax Act, 1961 (“Act”) read with rule 8D(2)(iii) of the Income tax rules, 1962 (“Rules”) and erred in making net addition of Rs. 1,58,09,987.

11. The learned assessing officer has erred in invoking rule 8D(2)(iii) for the purpose of making disallowance under section 14A without demonstrating satisfaction in terms of subsection 2 of section 14A as to why the disallowance made by the assessee under section 14A amounting to Rs. 1,72,86,259 is not correct having regard to the accounts of the assessee.

12. Without prejudice, the learned assessing officer has erred in including investment in shares of Infosys BPO Limited for the purpose of computing disallowance under section 14A read with rule 8D(2)(iii) without appreciating the fact that there was no exempt dividends from the said company and further investment in the said company was not made with a view to earn dividend income.

13. On facts and in the circumstances of the case and law applicable, the impugned computation of disallowance and the net addition is liable to be deleted in entirety.

Grounds on protective disallowance under section 40/ 40(a)(i) in respect of subscription charges paid / payable to M/s Forester Research and M/s Gartner

14. The learned assessing officer has erred in making protective disallowance of expenditure incurred on subscription charges amounting to Rs. 2,82,09,462 and Rs. 3,17,31,606 under section 40/ 40(a)(i) which was paid / payable to M/s Forrester Research and M/s Gartner respectively.

15. On facts and in the circumstances of the case and law applicable, no disallowance should be made under section 40/ 40(a)(i) in respect of the subscription charges paid / payable to M/s Forester Research and M/s Gartner respectively.

16. Without prejudice to ground 9&10 above, the protective disallowance, if any, is to be limited to the amount of subscription charges payable to M/s Forester Research and M/s Gartner as on 31st March 2012 and no disallowance is to be made in respect of subscription charges actually paid during the relevant previous year.

Grounds on disallowance under section 40(a)(ia) / 40(a)(i) in respect of software expenses

17. The learned assessing officer has erred in disallowing software expenses paid/payable to residents and non residents amounting to Rs. 30,23,602 and Rs. 14,65,417 respectively [totaling to Rs.44,88,019] under section 40(a)(ia) / 40(a)(i) for not deducting tax at source in respect of the said payments under section 194J / 195 of the Income tax Act, 1961.

18. Without prejudice, software payments made to residents totally amounting to Rs. 30,23,602was not liable for TDS under section 40(a)(ia) in view of the 1st proviso to section 40(a)(ia) read with 1st proviso to section 40(a)(i).

19. On the facts and in the circumstances of the case and law applicable, software expenses of Rs. 30,23,602 and Rs. 14,65,417 respectively [totaling to Rs. 44,88,019]was not liable for disallowance under section 40(a)(i) / 40(a)(ia) of the Act.

20. In any case and without prejudice, disallowance under section 40(a)(ia), if any, should be restricted to Rs. 9,07,081 being 30% of Rs. 30,23,602 as the amendment to section 40(a)(ia) by the Finance (No. 2) Act, 2014 w.e.f. 1.4.2015 is beneficial in nature and hence retrospective.

21. In any case and without prejudice, the disallowance, if any, is to be limited to the amount of software expenses payable as on 31st March 2012 and no disallowance is to be made in respect of payments actually made during the relevant previous year.

Grounds on disallowance of software expenses as capital expenditure

22. The learned assessing officer has erred in disallowing software expenses of Rs 451,18,32,386as capital expenditure and erred in making net addition of Rs. 338,38,74,290. On facts and in the circumstances of the case and law applicable, the impugned disallowance of software expenses and the net addition is liable to be deleted in entirety.

23. In any case and without prejudice, the learned assessing officer has erred in allowing depreciation at 25% instead of 60%.

24. In any case and without prejudice, the learned assessing officer has erred in not allowing depreciation at 60% in respect of software expenses held as capital expenditure for the earlier years.

Grounds on disallowance of brand building expenses

25. The learned assessing officer has erred in treating brand building expenses of Rs. 81,79,53,112 as ‘capital expenditure’ and making net addition of Rs. 56,85,08,898. On facts and in the circumstances of the case and law applicable, brand building expenses should be fully allowed as deduction.

Grounds on disallowance of Commission paid

26. The learned assessing officer has erred in disallowing commission paid to foreign entities amounting to Rs. 23,68,35,533. On facts and in the circumstances of the case and law applicable, commission paid should be fully allowed as deduction.

Grounds on non reduction of communication expenses from total turnover while computing deduction under section 10AA

27. The learned assessing officer has erred in not reducing the communication expenses totally amounting to Rs.2,71,11,231 from total turnover while computing deduction u/s 10AA in respect of SEZ units at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur, for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, communication expenses should be reduced from total turnover also in computing deduction under section 10AA for the aforesaid units.

28. The learned assessing officer has erred in concluding that communication expenses totally amounting to Rs.12,48,70,626 should not be reduced from total turnover in computing deduction under section 10AA for the other SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore, for which deduction under section 10AA has not been allowed. On facts and circumstances of the case and law applicable, communication expenses should be reduced from total turnover also in computing deduction under section 10AA for the aforesaid units.

Grounds on non reduction of expenses incurred in foreign currency from total turnover while computing deduction under section 10AA

29. The learned assessing officer has erred in not reducing the expenses incurred in foreign currency totally amounting to Rs.358,08,30,087 from total turnover while computing deduction u/s 10AA in respect of the SEZ units at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur, for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, expenses incurred in foreign currency should be reduced from total turnover also in computing deduction under section 10AA for the aforesaid units.

30. The learned assessing officer has erred in concluding that expenses incurred in foreign currency totally amounting to Rs.1688,21,01,184 should not be reduced from total turnover in computing deduction under section 10AA for the other SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore, for which deduction under section 10AA has not been allowed. On facts and circumstances of the case and law applicable, expenses incurred in foreign currency should be reduced from total turnover also in computing deduction under section 10AA for the aforesaid units.

Grounds on reduction of interest income from GLES deposit from profits of SEZ units

31. The learned assessing officer has erred in reducing interest income from GLES deposits totally amounting to Rs.2,05,18,841 from profits of SEZ units at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur respectively, while computing deduction under section 10AA and for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, deduction under section 10AA should be allowed in respect of interest income from GLES deposits totally amounting to Rs. 2,05,18,841 in respect of the aforesaid units.

32. The learned assessing officer has erred in concluding that interest income from GLES deposits totally amounting to Rs. 8,66,54,955should be reduced from profits of SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore respectively while computing deduction under section 10AAand for which deduction under section 10AA has not been allowed. On facts and in the circumstances of the case and law applicable, interest income from GLES deposits totally amounting to Rs. 8,66,54,955 should be held as eligible for deduction under section 10AA in respect of the aforesaid SEZ units.

Grounds on reduction of interest income from loans given to employees from profits of SEZ units while computing deduction under section 10AA

33. The learned assessing officer has erred in reducing interest income from loans given to employees totally amounting to Rs.13,75,022 from profits of SEZ units at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur respectively, while computing deduction under section 10AA and for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, deduction under section 10AA should be allowed in respect of interest income from loans given to employees totally amounting to Rs.13,75,022.

34. The learned assessing officer has erred in concluding that interest income from loans given to employees totally amounting to Rs.58,06,978 should be reduced from profits of SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore respectively while computing deduction under section 10AA and for which deduction under section 10AA has not been allowed. On facts and in the circumstances of the case and law applicable, interest income from loans given to employees totally amounting to Rs.58,06,978 should be held as eligible for deduction under section 10AA in respect of the aforesaid SEZ units.

Grounds on reduction of receipts from sale of scrap from profits of SEZ units while computing deduction under section 10AA

35. The learned assessing officer has erred in reducing receipts from sale of scrap amounting to Rs.6,54,378 from profits of SEZ unit at Trivandrum while computing deduction under section 10AA and for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, deduction under section 10AA should be allowed in respect of receipts from sale of scrap amounting to Rs.6,54,378 relating to SEZ unit at Trivandrum.

36. The learned assessing officer has erred in concluding that receipts from sale of scrap totally amounting to Rs.63,78,336 should be reduced from profits of SEZ units at Chennai (Unit No 1), Chandigarh and Mangalore respectively while computing deduction under section 10AA and for which deduction under section 10AA has not been allowed. On facts and in the circumstances of the case and law applicable, receipts from sale of scrap totally amounting to Rs.63,78,336 should be held as eligible for deduction under section 10AA in respect of the aforesaid SEZ units.

Grounds on reduction of incentive receipts from Airlines from profits of SEZ units while computing deduction under section 10AA

37. The learned assessing officer has erred in reducing incentive receipts from Airlines totally amounting to Rs.76,176 from profits of SEZ unit at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur respectively, while computing deduction under section 10AA and for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, deduction under section 10AA should be allowed in respect of incentive receipts from Airlines amounting to Rs.76,176 relating to aforesaid SEZ units.

38. The learned assessing officer has erred in concluding that incentive receipts from Airlines totally amounting to Rs.3,21,709 should be reduced from profits of SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore respectively while computing deduction under section 10AA and for which deduction under section 10AA has not been allowed. On facts and in the circumstances of the case and law applicable, incentive receipts from Airlines totally amounting to Rs.3,21,709 should be held as eligible for deduction under section 10AA in respect of the aforesaid SEZ units.

Grounds on reduction of income in the nature of Inter Company cessation of trading liability while computing deduction under section 10AA

39. The learned assessing officer has erred in reducing income in the nature of Inter Company cessation of trading liability totally amounting to Rs.19,97,651 from profits of SEZ unit at Chennai (Unit 2), Trivandrum, Mysore, Hyderabad and Jaipur respectively, while computing deduction under section 10AA and for which deduction under section 10AA has been allowed. On facts and in the circumstances of the case and law applicable, deduction under section 10AA should be allowed in respect of income in the nature of Inter Company cessation of trading liability totally amounting to Rs.19,97,651 relating to aforesaid SEZ units.

40. The learned assessing officer has erred in concluding that income in the nature of Inter Company cessation of trading liability totally amounting to Rs.84,36,456should be reduced from profits of SEZ units at Chennai (Unit No 1), Chandigarh, Pune and Mangalore respectively while computing deduction under section 10AA and for which deduction under section 10AA has not been allowed. On facts and in the circumstances of the case and law applicable, income in the nature of Inter Company cessation of trading liability totally amounting to Rs.84,36,456 should be held as eligible for deduction under section 10AA in respect of the aforesaid SEZ units.

Grounds on reduction of deduction u/s 10AA in respect of pure onsite revenue

41. The learned assessing officer has erred in computing and reducing a sum of Rs.1,02,27,137 from deduction computed u/s 10AAfor the reason that 1.08% (pure onsite revenue) of 50.8% (onsite revenue percentage) with a profit margin of 10.59% relating to 5 SEZs [viz., Chennai (unit 2), Trivandrum, Mysore, Hyderabad and Jaipur in respect of which deduction under section 10AA has been allowed] are not eligible for deduction under section 10AA. On facts and in the circumstances of the case and law applicable, no reduction should be made from deduction computed u/s 10AA and the sum of Rs. 1,02,27,137 should be held as eligible for deduction under section 10AA of the Act.

42. Without prejudice, similar disallowance in relation to other SEZ units viz., Chennai (Unit No 1), Chandigarh, Pune and Mangalore, if any, is also not warranted and the same should be deleted in entirety.

Grounds on disallowance of deduction u/s 80JJAA: