Case Law Details

Open Text Corporation India Private Limited vs. ACIT (ITAT Hyderabad)

The assesse is engaged in providing software services. During the year under consideration the impugned segment of Arm’s Length Price (ALP) adjustment pertains to interest on receivables only.

The Hon’ble ITAT deleted the transfer pricing adjustment on account of interest on receivables due to failure of revenue authorities to find out even a single comparable in assessee’s segment charging interest in uncontrolled market conditions.

This is historical judgement wherein transfer pricing addition is deleted due to non availability of comparable company.

FULL TEXT OF THE ORDER OF ITAT HYDERABAD

These assessee’s twin appeals ITA Nos.329/Hyd/2020 and 2098/Hyd/2018 for AYs.2013-14 & 2014-15 arise against the CIT(A)-4, Hyderabad’s order(s) dated 27-02-2020 in appeal No. 10021/18-19 / DCIT,Cir-1(2) / CIT(A)-4 / Hyd / 19-20, and DCIT, Circle-16(2), Hyderabad’s assessment dt.31-08- 2018 framed in furtherance to Dispute Resolution Panel (DRP)- 1, Bengaluru’s directions dt. 27-06-2018, in F.No.85 / DRP-1 / BNG / 2018-19, involving proceedings u/s.143(3) r.w.s.92CA(3) r.w.s. 144C(5) of the Income Tax Act, 1961 [in short, ‘the Act’]; respectively.

Heard both the parties. Case files perused.

2. It transpires at the outset that this assessee’s appeal ITA 329/Hyd/2020 for AY.2013-14 suffers from 57 days delay stated to be attributable to the reason(s) beyond its control as per condonation petition/affidavit. No rebuttal has come from the departmental side. The impugned delay is condoned therefore.

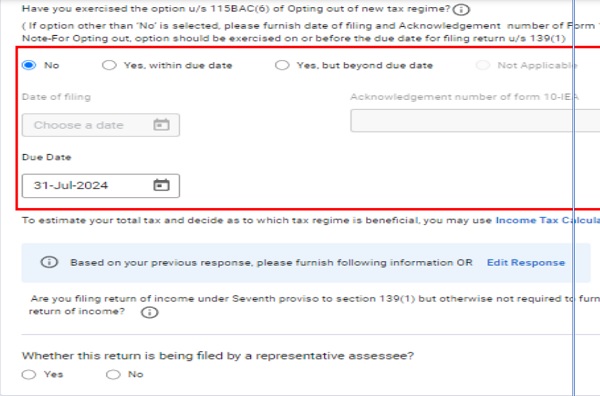

3. There is no dispute between the parties that the assessee is engaged in providing software services so far as the impugned segment of Arm’s Length Price (ALP) adjustment is concerned since we are concerned with the correctness of ALP adjustment pertaining to interest on receivables only. It has further come on record that learned lower authorities have adopted LIBOR+200 as the relevant rate for computing the impugned ALP as against going by the SBI’s term deposit rates in latter AY.2014-15.

Learned counsel’s first and foremost argument before us is that the learned lower authorities herein have erred in law and on facts in treating such an interest on receivables which was nowhere charged or accrued as an international transaction. We find no merit in the instant first argument since the legislature has included interest on receivables as forming an international transaction u/s. 92B, Explanation-(c) inserted in the Act vide Finance Act, 2012, w.e.f.0 1-04-2002 whereas we are in AY.2013-14 and 20 14-15 only (supra).

Coupled with this, the hon’ble Madras high court’s recent decision PCIT Vs. M/s.Redington (India) Ltd., (TCA Nos.590 and 591 of 2019, dt. 10-12-2020) (Madras High Court) has already held the foregoing statutory explanation to be applicable with retrospective effect since clarificatory in nature. We thus decline the assessee’s instant first and foremost legal argument.

4. Next comes the correctness of the impugned ALP adjustment on receivables on merits. Learned CIT-DR vehemently argued before us that the lower authorities have adopted LIBOR and SBI domestic deposit rates (supra) whilst making the impugned ALP adjustment. He further sought to invite our attention to the case records wherein the TPO(s) adopted the credit period of 30 days after taking into consideration the corresponding agreements with the concerned parties. He fails to dispute the most clinching fact that the said agreements compiled in the corresponding tabulations nowhere indicate as to whether the assessee had charged any interest on its receivables beyond the prescribed period at all which ran upto almost a year. There is further no independent comparable adopted by the lower authorities in the very segment which could support the Revenue’s stand that it is the Comparable Un-controlled Price (CUP); a direct method, applicable here. We hold in this factual backdrop that the learned lower authorities have erred in law and on facts in making the impugned ALP adjustment(s) in both these assessment years; as the case may be. The same are directed to be deleted therefore. We make it clear before parting that we have deleted the impugned ALP adjustment on account of learned lower authorities’ failure in adopting even a single comparable in assessee’s segment indicating charging of interest in un-controlled market conditions.

No other ground has been raised before us.

5. These two assessee’s appeals are allowed in above terms. A copy of this common order be placed in the respective case files.

Order pronounced in the open court on 16th November, 2021