♦ Who is liable to deduct TDS u/s 194Q?

Buyer will deduct TDS of seller

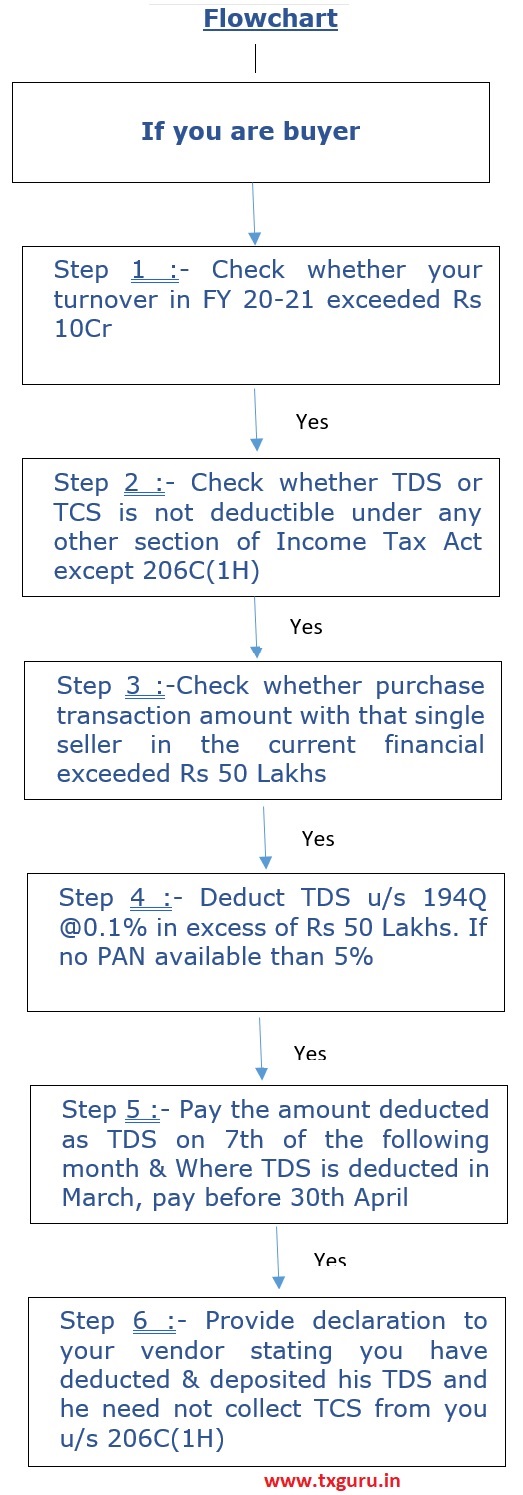

As per section 194Q, When a Buyer who is responsible for paying any sum to any resident seller for purchase of any goods of the value or aggregate of such value exceeding Rs.50 Lakhs during the year, he shall deduct TDS @ 0.10%, on amount exceeding Rs.50 Lakhs. In non-PAN/ Aadhaar cases, the rate shall be 5%.

TDS u/s 194Q = 0.1% of [Total Purchases (Minus) ₹ 50 Lakhs]

♦ From when does provision of section 194Q are applicable?

The provisions of section 194Q shall be applicable from 1st July 2021.

♦ To whom Section 194Q is applicable?

Section 194Q is applicable to those Buyer whose total sales, gross receipts or turnover from the business carried on by him exceed Rs.10 crore during the financial year immediately preceding the financial year in which the purchase of goods is carried out.

Which means for FY 2021-22, Buyer means person whose total sales, gross receipts or turnover from business exceeds Rs.10 crore in the FY 2020-21.

Also the threshold limit of Rs.10 crore as well as Rs.50 Lakhs shall be computed annually on PAN basis and not GSTIN basis

Note:- In computing the total turnover, the amount of GST shall be included.

♦ Who is liable to collect TCS u/s 206(1H)?

Seller will collect TCS from buyer

As per Section 206(1H) sellers of goods whose total sales, gross receipts or turnover from the business carried on by it exceed 10 crore rupees during the financial year immediately preceding the financial year shall be liable to collect such TCS at a rate 0.1% on consideration received from a buyer in a previous year in excess of 50 lakh rupees. In non-PAN/ Aadhaar cases, the rate shall be 1%.

TCS u/s 206(1H) = [Total Sale Receipt (Minus) ₹ 50 Lakhs]

♦ When situation arises wherein both sections become applicable then whether TCS u/s 206C(1H) is to be collected on receipt of sales consideration above 50 Lakhs or TDS u/s 194Q is to be deducted by the buyer on purchase of goods exceeding Rs.50 Lakhs?

Section 206C(1H) shall not apply if the buyer is liable to deduct TDS under any other provision of this Act on the goods purchased by him from the seller and has deducted such amount.

And Section 194Q says provisions of section 194Q shall not apply to a transaction on which––

(a) TDS under any of the provisions of this Act is deducted or

(b) TCS under the provisions of section 206C other than 206C(1H) applies.

So we can conclude that Section 194Q supersede Section 206C(1H), thus primary responsibility to deduct TDS is of buyer but if buyer fails to deduct TDS in this case will make Seller liable for TCS.

We would suggest you to obtain a declaration from buyer at the time of purchase itself stating that they would deduct and deposit TDS u/s 194Q.

♦ What if buyer fails to deduct TDS u/s 194Q?

As per Section 40a(ia) – If buyer fails to deduct and deposit TDS, purchase expenditure to the extent of 30% will be disallowed and shall be subject to Income Tax at applicable tax rate.

♦ Is TDS u/s 194Q applicable on Import Purchases as well?

No.

Since the provision of section 194Q, are applicable when a Buyer is responsible for paying any sum to any resident seller for purchase of any goods. TDS u/s 194Q is not to be deducted from Import purchases.

♦ Is TDS u/s 194Q applicable on purchase of capital goods?

“Goods” as per CGST Act 2017 means any kind of movable property other than services. Thus TDS u/s 194Q is applicable on purchase of capital goods.

♦ Whether TDS u/s 194Q is to be deducted on the total invoice value including the GST?

CBDT vide Circular No. 23/2017, dated 19-7-2017, has clarified that GST on services to be excluded while deducting TDS. However no such clarification is received about GST on goods. Also CBDT via its Circular No. 17, dated 29-09-2020 in respect of Section 206C(1H) has clarified to include GST on goods for collecting TCS. Thus we would recommend you to deduct TDS u/s 194Q on GST amount as well till the clarification is received from CBDT.

Case Studies

♦ Mr Ramesh has purchased goods from Mr Kamlesh worth Rs. 30 lakhs in FY 21-22 and Rs. 35 lakhs in FY 22-23 but Mr Ramesh paid the seller Rs. 60 lakhs with respect to the two purchases made by him in FY 22- whether TDS has to be deducted or TCS has to be collected? Note T/O of Mr Ramesh & Mr Kamlesh exceed the 10 crore in FY 20-21

-Mr Ramesh has not crossed the threshold limit of Rs. 50 lakhs, he is not liable to deduct TDS u/s 194Q.

However since Mr Kamlesh has received the amount exceeding the threshold limit of Rs. 50 lakhs, he has to collect the tax @0.1% on Rs 10 Lakhs (60-50), if all the conditions of section 206C(1H) are satisfied.

♦ Mr Ramesh has purchased goods from Mr Kamlesh worth Rs. 60 lakhs in FY 21-22 but Mr Ramesh paid the seller Rs. 30 lakhs FY 21-22, whether TDS has to be deducted or TCS has to be collected? Note T/O of Mr Ramesh & Mr Kamlesh exceed the 10crore in FY 20-21

-Mr Ramesh has to deduct TDS u/s 194Q on Rs 10 Lakhs (60-50) & it is advisable to Mr Kamlesh to obtain declaration from Mr. Ramesh stating he has deducted & deposited TDS u/s 194Q.

♦ Mr Ramesh has purchased goods from Mr Kamlesh worth Rs. 60 lakhs in FY 21-22 & paid the seller Rs. 60 lakhs FY 21-22, whether TDS has to be deducted or TCS has to be collected, However T/O of Mr Ramesh for FY 20-21 was Rs 5 crore & T/O of Kamlesh was Rs 15 crore.

– Since T/o of Mr Ramesh is below threshold limit & Mr Kamlesh has received the amount exceeding the threshold limit of Rs. 50 lakhs, he has to collect the tax @0.1% on Rs 10 Lakhs (60-50) u/s 206C(1H).

♦ Mr Ramesh has purchased goods from Mr Kamlesh worth Rs. 60 lakhs in FY 21-22 & paid the seller Rs. 60 lakhs FY 21-22, whether TDS has to be deducted or TCS has to be collected , However T/O of Mr Ramesh & Mr Kamlesh did not exceed the 10crore in FY 20-21

– No one is liable to deduct any tax

♦ Mr Ramesh has purchased goods from Mr Kamlesh worth Rs. 60 lakhs in FY 21-22 & paid the seller Rs. 60 lakhs FY 21-22, whether TDS has to be deducted or TCS has to be collected , Note T/O of Mr Ramesh & Mr Kamlesh exceed the 10crore in FY 20-21, but Mr Ramesh forgot to deduct & deposit TDS u/s 194Q

Mr Ramesh has to deduct TDS since his t/o crossed the threshold limit of Rs. 50 lakhs, but there is failure on his part for non-deduction

In such case Mr Kamlesh has to collect the tax @0.1% on Rs 10 Lakhs (60-50) as he received the amount exceeding the threshold limit of Rs. 50 lakhs.

SIR, IN MY VIEW TDS U/S 194 Q IS NOT DEDUCTIBLE IN CASE OF PURCHASE OF CAPITAL GOODS ABOVE VALUE OF rS.1000000 BECAUE TCS WOULD BE DEDUCTED BY THE SELLER.

Thanks so much sir, very simple and convenience way to understand. Keep it up.

First of all… A very simple and precise explanation of the provisions covering almost all aspects of the real world complications. But I would beg to disagree with you on the last scenario where you have mentioned that in case Sec 194Q is applicable but the buyer has not deducted TDS, then the seller should effect TCS on such receipt. I believe there is a point where if both Sec 194Q and Sec 206C(1H) are applicable, then sec 194Q shall prevail. So in that case if buyer defaults, he is liable for 30% penalty u/s 40i(ia).

nicely explained. thanks