Section 206AB and 206CCA Special Provisons for Deduction of Tax at Source (TDS) and Collection of Tax at Source (TCS) for Non-Filers of Income Tax Return

♦ The Finance Bill 2021, inserted two new section 206AB & 206CCA. The said section provide for higher rate of TDS/TCS to be applied for the non-filers of income tax return.

♦ TDS/TCS was already deducted or collected at higher rates u/s 206AA & 206CC respectively for “NON-FURNISHING OF PAN”.

♦ Now, let us learn the difference between the 206AA & 206CC:

| Tax is required to be deducted | Tax is required to be collected |

| (i) at the rate specified in the relevant provision of this Act; | (i) at twice the rate specified in the relevant provision of this Act; |

| (ii) at the rate or rates in force; or | (ii) at the rate of 5%: |

| (iii) at the rate of 20%: |

♦ Further, in line with the above sections 206AB & 206CCA have been proposed in Finance Bill, 2021.

♦ The section 206AB is applicable to specified person as defined in the provisions. The provision of sub-section (1) of 206AB provides for TDS rate to be applied if the amount is paid or credited to a specified person being higher of the below rates:-

-

- at twice the rate specified in the relevant provision of the Act; or

- at twice the rate or rates in force; or

- at the rate of 5%.

♦ The provision of sub-section (1) of section 206AB does not apply in case where tax is required to be deducted under 1942, 192A, 194B, 194BB,194LBC or 194N.

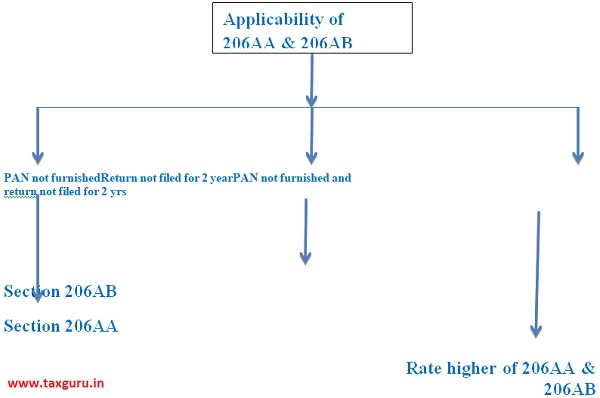

♦ Further, sub-section 2 of 206AB provides that where both the section 206AA & 206AB are applicable i.e. the specified person has not submitted PAN as well as not filed the Income tax return , the tax shall be deducted at higher rate amongst the both section respectively.

♦ “Specified Persons” means who satisfies the following conditions:

-

- A person who has not filed the Income Tax Return for two previous years immediately prior to the previous year in which tax is required to be deducted;

- The time limit of filing return of income under sub-section (1) of section 139 is expired; and

- The aggregate tax deducted at source or tax collected at source, as the case maybe, is Rs. 50,000 or more in each of the two previous years.

- However, the specified persons shall not include a Non-resident who does not have Permanent Establishment (PE) in India.

♦ Pictorial Chart for applicability of Section 206AA and 206AB.

Similarly, 206CCA is proposed to be inserted which provides for TCS rate were tax is required to be collect from the specified person being higher of the rates:

(i) at twice the rate specified in the relevant provision of the Act; or

(ii) at the rate of 5%.

Further, the sub-sections (2) & (3) of section 206CCA are similar to the provision of sub-sections (2) & (3) of section 206AB as explained above.