Introduction:

After the merger of two big Telco’s namely Vodafone & Idea, the combined entity looked strong with over 35% market share in the wireless telecom market (being the largest player in the market in terms of market share). But the merger did not yield benefits to the combined as expected owing weak financial position of the combined entity and customers leaving VI over fears of the closure of the company.

This article covers the current status of the combined entity in all aspects and strategies adopted by it to revive the company and compete with two biggest competitors namely Jio & Airtel.

Current Business Situation:

Business segments in which the company operates can be classified into two viz. Telecom and Broadband services. Each of the markets includes wired as well as wireless service segments. The current situation of each business segment is explained in detail below:

i. Wireless Telecom Services:

Post-merger, the combined entity was the market leader in this segment with over 418 Mn customers accounting for more than 35% market share. But the market share of the combined entity continued to fall from then owing to financial weakness & doubts about the closure of the business.

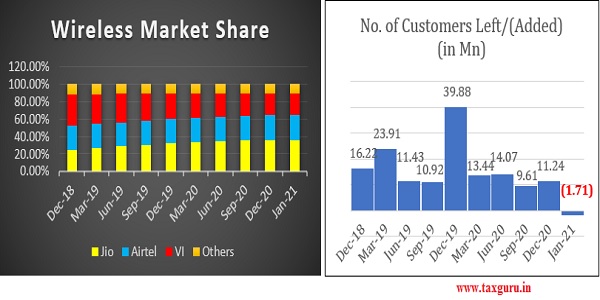

Market share of all entities and details of the number of customers left are pictographed below:

Market share of the combined entity has reduced from 35.61% in Dec-18 to 24.58% in Jan-21 whereas its competitors Airtel & Jio has increased their market share from 28.93% to 29.62% and 23.82% to 35.30% respectively in the same period.

As shown above, customers continued to leave the company post-merger, and the company has lost around 10 Mn customers in each quarter. After the creation of provision for AGR Dues in the Sep-19 quarter, the company has posted more than Rs.50,000 Crore loss which increased doubts as to the closure of the business. This caused around 40 Mn customers leaving the organization in the Dec-19 quarter. VI saw customer addition for the first time since its merger in Jan-21 due to its offers explained below in detail.

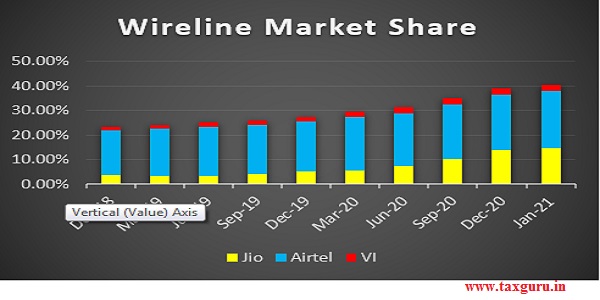

ii. Wired Telecom Services:

This is a very small market (accounts for 1.73% of wireless market subscriber base) with a majority of the customers in this market are owned by two PSUs namely BSNL & MTNL. In Dec-18, two PSUs accounted for 67.24% of the customers. Their share in Jan-21 reduced to 49.29% since other players in the market strived for increasing their market share as shown in the below image.

The total number of subscribers of this market has reduced from 21.87 Mn in Dec-18 to 20.08 Mn in Jan-21 accounting for a reduction of 8.18% of the market.

As shown here, Jio (from 3.46% to 14.70%) & Airtel (from 18.49% to 23.12%) increased their market share drastically whereas VI has increased its share only from 1.26% to 2.54% since the expansion was only on account of Vodafone’s operations as Idea has no market in this segment. Considering the reduction of the number of subscribers and market share by two PSUs combined, it seems that increased market share was majorly on account of the reduction of market size.

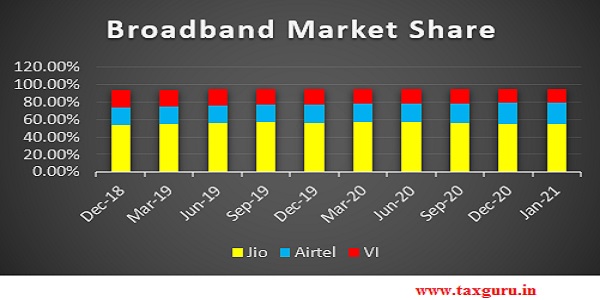

iii. Broadband services:

After the merger, VI has a considerable market share of 20.81% but post-merger, the company’s market share has reduced to 16.20% while Jio was able to maintain its market share and Airtel was able to increase its market share as shown below:

During Dec-18 to Jan-20, the market has increased from 518.55 Mn to 757.61 Mn with Jio increasing its market share from 54.02% to 54.51% evidencing the fact that its market is increasing at the same speed as that of the market.

Airtel has increased its market share from 19.33% to 24.37%. Customer’s breakup of wired & wireless markets is not available for this segment.

Current Financial Situation:

i. Summary of AGR Dues Order & Its impact on VI:

– VI needs to pay Rs.5,000 Cr in FY21 & Rs.6,800 Cr from FY 22 to FY 31 which accounts for 111% of its annualized EBITDA.

– ARPU of VI should be increased by 27% to offset the cash flow hit of AGR.

– In the next two FYs, VI needs to pay around Rs. 28,900 Crore including spectrum as well as non-spectrum dues and interest thereon.

– VI should opt for a tariff hike late by 3QFY20 to ensure timely payments but the same is now postponed to 1QFY 21.

[Source: Jefferies Equity Research Report]

ii. Financial Status of the Company:

Q-o-Q & Y-o-Y comparison of financial results of the company & analysis thereon are explained below:

| Particulars | Q3-FY21 | Q2-FY21 | Q-o-Q | Q3-FY20 | Y-o-Y |

| Revenue | 10,894 | 10,791 | 0.95% | 11,089 | -1.76% |

| EBITDA | 4,286 | 4,152 | 3.22% | 3,421 | 25.31% |

| EBIT | -1,538 | -1,876 | -18.03% | -2,457 | -37.40% |

| PAT | -4,532 | -7,218 | -37.21% | -6,439 | -29.61% |

| CAPEX Spent | 970 | 1,040 | -6.73% | 3,330 | -70.87% |

| Net worth | -31,243 | -26,700 | 17.02% | 17,623 | -277.29% |

| Borrowings | 1,04,537 | 1,05,214 | -0.64% | 1,01,047 | 3.45% |

| ARPU | 121 | 119 | 1.68% | 109 | 11.01% |

– Average Revenue Per User (ARPU) increased in both QoQ & YoY but revenue did not increase in the same proportion owing to customers leaving the company and change in customer mix between 2G, 3G & 4G.

– The company is able to maintain good EBITDA margins but could not convert the same into PAT owing to huge depreciation and interest costs. This led to lower CAPEX for its growth.

– Despite Negative PAT, the company is able to generate positive operating cash flows which helped the company to repay its finances and investments to some extent. This is evidenced by the decreasing trend of the company’s borrowings.

Strategies Adopted by the Company:

Strategies adopted by the company can be divided into those adopted for increasing customer base, ensuring financial support to improve financial position. Each of these is explained in detail below:

i. For increasing customer base:

To retain its customers/to stop its customers from leaving the network, the company has to primarily give an assurance about its exitance and should offer new benefits to its customers. Vodafone-Idea was co-presenting sponsor of IPL 2020 for an undisclosed amount. This spending in an uncertain time confirmed about company’s survival and increased the brand image of the company.

To increase connection speed and customer satisfaction, VI added 12,000 4G FDD sites by reforming the 2G/3G spectrum to expand its 4G capacity. In the recent auction, the operator has purchased 11.80MHz 4G spectrum for Rs.1,993.40 Crore. VI has offered the following benefits to its existing/new customers:

– VI started to give free data between 12 AM & 6 AM for certain plans.

– VI is the first network to offer weekend data rollover offer whereby the user accumulates unused data on weekdays and gets an option to use the same on weekends.

– To increase its customer base, VI offered a free portability option with free data and calls for a certain period.

– VI is offering plans with higher data and other benefits when compared to other networks. One thing to be remembered here is the network operator is planning for a tariff hike post which, offers may not be as benefitting as now.

ii. For ensuring financial support to improve financial position:

– On 4th September 2020, the Board of Directors of the company approved fundraising up to Rs.15,000 Crore as equity and up to Rs. 15,000 Crore in form of debt with an upper cap of Rs.25,000 Crore. Implementation of this plan is delayed owing to the low share price and a difference in the company’s valuation.

– It is believed that equity dilution at the current market price does not do justice to the intrinsic value of the business. Hence, the company is planning to raise Rs.10,000 Crore in form of non-convertible debentures.

– VI’s plan to raise funds through a consortium of prospective lenders led by Oak Hill failed to owe funding terms and furnishing of guarantees in case of payment defaults.

– On 19th November 2020, the company has sold its stake (11.15%) in Indus Tower on account of its merger with Bharti Infratel for cash consideration of Rs.3,760 Crore.

– Bharti Airtel & Vodafone Idea appealed to Supreme Court over recalculation of AGR dues and repayment terms.

Conclusion:

Looking at financial position alone, the revival of the company does not seem viable. But customers trend (i.e., number of customers added/left each quarter) and increasing ARPU and future possible investments, the revival of the company seems viable subject to external market conditions and support from SC and competitor’s action. This article does not promote/demote any products of any company and the information provided here is for informative purposes only and does not market any products/services of any company.