OFFICE OF THE COMMISSIONER OF CUSTOMS, NS- I

JAWAHARLAL NEHRU CUSTOM HOUSE, NHAVA SHEVA,

TAL: URAN, DIST: RAIGAD, MAHARASHTRA-400 707.

F. No. S/22-Gen-20/2020-21 AM (I)/JNCH

Dated: 14.09.2020

STANDING ORDER NO. 31/2020

Sub: Turant Customs – All India roll-out of Faceless Assessment – regarding.

Attention of all the officers and staff of JNCH is drawn to Board’s Advisory No. 32/2020-Cus dated 13.09.2020 which is to be read with Board’s Circular 40/2020 – Customs dated 04.09.2020. Reference is also invited to JNCH Standing Order No. 20/2020 dated 03.08.2020 and JNCH Public Notice No. 95/2020, 96/2020 dated 31.07.2020 and 117/2020 dated 12.09.2020.

2. In pursuance of Board’s Circular 40/2020 – Customs dated 04.09.2020, the roll-out of Faceless Assessment at an All India level in all ports of import and for all imported goods has to be enabled by 31.10.2020. For imports made at this Custom House, the faceless assessment shall be extended beyond existing phase II (involving Group 2A) in the following phases –

a) phase III on 15.09.2020 for Group 5, 5A, 5B

b) phase IV on 01.10.2020 for Group 1, 2G, 2K, 3, 4, 6

c) phase V on 31.10.2020 for Groups 1A, 2, 2B, 2C, 2D, 2E, 2F, 2H, 2I, 2J.

Accordingly, the assessment with respect to goods of these Groups imported at Nhava Sheva will get assigned by the Customs Automated System to officers of Faceless Assessment Groups. .

3. The Board’s Instruction No 09/2020 – Customs dated 05.06.20 has already elaborated the procedure to be followed. Since different Customs locations across India now become part of the Faceless Assessment as per the roll-out plan, different facets of it in ICES are detailed below:

3.1 Identification of Customs site performing Faceless Assessment within each Zone of a National Assessment Centre (NAC) :- Board has decided to constitute total eleven (11) National Assessment Centres (NACs) for performing Faceless Assessment. The details are mentioned in the Annexure II of the Board’s Circular 40/2020 – Customs dated 04.09.2020. As a prerequisite, the Nodal Commissioners from each zone in the respective NAC are required to identify the Customs sites (FAG Sites) in their jurisdiction that will be performing Faceless Assessment for the corresponding group(s) associated with that NAC. An officer order designating the FAG sites and nominating the officers for the Faceless Assessment Group at the designated site may also be issued by the respective nodal Commissioner. DG Systems will ensure necessary activation of faceless assessment group at the designated site in the System.

3.2 Site and Role allocation :- For Faceless Assessment Group (hereinafter referred to as FAG) comprising of the officers who will be nominated for doing Faceless Assessment at identified sites as per S.No. 1 above, new roles have been created in ICES – VAO (for the appraiser of the FAG) and VDC (for the AC/DC of the FAG). Respective System Managers may allot VAO and VDC roles to the nominated officers at these sites. The group allocation for these officers can also be done from ADN role like it is done for other appraising roles.

3.3 Functionalities in VAO and VDC Roles :- The functionalities are similar to the existing Appraiser (APR) and AC-Appraising (ACL) roles. Query can be raised by faceless group, can be replied to online through ICEGATE, and amendments too can be filed online. Amendments filed before the completion of assessment will also come to the FAG for approval. Facility of eSanchit can be used for submission of all the relevant supporting documents. Functionalities other than assessment like Section 48 approval, Single Window Recall, Bond Management, OOC Cancellation etc. will continue to be with the port of Import only and will not be available in these new roles meant for faceless assessment.

3.4 Administrator Role :- Additionally, a new role with name VDN has been created which can be allotted to the JC/ADC in-charge of FAG. The option to push a Bill of Entry from FAG to Port of Import in exceptional circumstances as given in the Board’s Instructions is also available with the VDN role. The option to recall a Bill of Entry from FAG to the Port of Import is available in the ADN role at the Port of Import. Both, the recall as well as push, functionalities should be used only in exceptional scenarios and with due approval of the respective JC/ADC or (Pr) Commissioner as explained in the Board’s Instructions. Further, the facility to reallocate BEs from one officer to another officer is available in the VDN role. This facility will soon be made available in the VDC role also.

3.5 Examination :- As elaborated in the Board’s Instructions, the faceless BEs after First Check examination will come back to the FAG only for completion of assessment. However, any recall or reassessment after Second Check examination, the assessment will be done only at the port of Import. It has been noticed during the pilot run that the BEs are marked by the Examination officers at the Port of Import incorrectly to the Assessment Groups at times. The examination officers in respective Ports of Import should ensure that First Check BEs of FAG are marked back only to respective VAO/VDC after examination with detailed examination report to effectively assist the FAG in assessment. Similarly, if any BE is required to be sent back after Second Check examination, the same may be marked only to the assessment group at the Port of Import, i.e. APR as provided in instructions.

3.6 Turant Suvidha Kendra (TSKs) :- TSK has already been set up in JNCH vide P.N. No. 82/2020 dated 14.07.2020 with effect from 15.07.2020. The details of the TSK are as under:-

| Address | E-mail ID |

| EDI Service Centre, Ground Floor, JNCH, Nhava Sheva, Taluka: Uran, District: Raigad | tsk-jnch@gov.in |

The TSK, already operational at JNCH will also function as TSK for Bills of Entry pertaining to importation at Nhava Sheva, which are allocated by the Customs Automated System to one of the designated Faceless Assessment Groups.

3.6.1 TSK is a dedicated cell manned by Customs officers to cater to following functions:

i. Accept Bond or Bank Guarantee (BG) in respect of import of goods including import related to Export promotion schemes;

ii. Carry out any other verifications that may be referred by Assessment Groups;

iii. Defacing of documents/ permits licences, wherever required;

iv. Debit of documents/ permits/ licences, wherever required; and

v. Other functions determined by Commissioner to facilitate trade.

3.6.2 All types of bonds will be accepted by TSK such as:-

i. Provisional Assessment Bond

ii. Warehousing Bond

iii. End User Bond

iv. No use bond

v. Letter of Undertakings

vi. SVB Bond

vii. Re-export/Re-import Bond

viii. Test Bond

ix. Project Import Bond

x. Bond for availing Concessional Duty/ Notification Benefits

xi. NB

xii. Bonds pertaining to License Section- DEEC/EPCG/MEIS/SHIS

xiii. Any other Bond

3.7 Monitoring :- Pendency reports and dashboards in the System have been made available in the COM role for the Commissioners to monitor pendency and processing of Bills of Entry assigned by the System to the FAG in their jurisdiction. A Virtual Dashboard is also provided where status of BEs pertaining to their jurisdiction but assigned to FAG at any port can be seen. Status reports are available in VDN and VDC roles also for the officers under FAG to take action accordingly.

4. Constitution of National Assessment Centres (NACs) :

In pursuance of CBIC Circular No. 40/2020-Customs dated 04.09.2020 vide para 5.4, Chief Commissioner of Customs, Mumbai Zone-II has nominated Principal Commissioner/Commissioner Nhava Sheva I (email id: commr-ns1@gov.in), Nhava Sheva III (email id: commr-ns3@gov.in) and Nhava Sheva V (email id: commr-ns5@gov.in) as nodal Principal Commissioners/ Commissioners vide JNCH Public Notice No. 113/2020 dated 10.09.2020. Nodal Commissioners are administratively responsible for monitoring and ensuring speedy and uniform assessments of the Bills of Entry assigned by the System to the officers of the respective Faceless Assessment Groups specified above in their jurisdiction. For this, the CBIC Circular Nos. 28/2020-Customs dated 05.06.2020, 34/2020-Customs dated 30.07.2020 and Circular No. 40/2020-Customs dated 04.09.2020 , and Instruction No. 09/2020-Customs dated 05.06.2020 provide self-contained guidance which shall be taken as Standing Order for the officers concerned including in the Faceless Assessment Groups which would consist of Appraisers / Superintendents and Assistant / Deputy Commissioner and be supervised by Joint / Additional Commissioner under the overall control and monitoring of the Commissioner.

4.1 Responsibilities of NAC: The NACs have a critical role in the successful implementation of Faceless Assessment. In addition to their existing work, the NACs need to work in a coordinated manner to ensure that all assessments are carried out in a timely manner and there is no delay or hold up of the Bills of Entry. The NACs would also examine the assessment practices of imported goods across Customs stations to bring about uniformity and enhanced quality of assessments. The important responsibilities of the NACs shall include the following:

I. Monitor the assessment practice for enhancing uniformity of classification, valuation, exemption benefit and compliance with import policy conditions.

II. Assess the application of Compulsory Compliance Requirements (CCRs) and ensure uniform practices in accordance with the relevant statutes/Legal provisions.

III. Study audit objections and take corrective actions regarding assessments, wherever necessary and provide inputs to the concerned ports of import.

IV. Analyse the RMS facilitated Bills of Entry pertaining to Chapters falling under their purview and advise the DGARM regarding possible interventions or review of risk parameters.

V. Liaise with Principal Commissioner/Commissioner of Customs at ports of import about interpretational issues pertaining to classification, valuation, scope of exemption notifications and trade policy conditions.

VI. Interact with sectoral trade and industry for inputs, and on issues relating to assessment.

VII. Function as a knowledge hub or repository for that particular Chapter(s);

VIII. Examine the orders/appellate orders in relation to assessment practices pertaining to goods assigned to each Faceless Assessment Group and provide inputs to the Commissionerates for uniformity of assessment orders before legal fora.

IX. Constitute Working Groups for matters relating to:

a) Monitoring for timely assessment of Bills of Entry

b) Valuation and related issues

c) Classification and related issues

d) Restrictions and prohibitions and Co-ordination with PGAs

e) Communication and Outreach for departmental officers and trade.

f) Any other matter relevant to timely and uniform assessment, as may be decided.

4.2 Co-ordination among NAC Commissioners: Since the Nodal Principal Commissioners/ Commissioners are spread across different geographical locations, following co-ordination measures may be institutionalised at the initial phase, which will go a long way in bringing efficiency to the functioning of NACs:

I. Continuous assessment – Ensure that verification of the assessment is not held up if there is an official holiday for the members of the FAG 4 in a particular location. This could be done by having this work done at multiple locations.

II. Daily Web meeting – The Working Groups may virtually meet for a short duration every day at a scheduled time to review timeliness of assessment, identify bottlenecks and take measures to remove difficulties. The link shall be made available to the Chairman, Member Customs, Zonal Member(s) and Joint Secretary (Customs), CBIC and the Co-convenors of concerned NAC, to enable participation in the online meeting room.

III. Weekly web meeting – The Working Groups may have a web meeting for a short duration once a week at a scheduled time to review classification, valuation, exemption notifications, prohibitions and restrictions in order to identify divergent practices and ensure uniformity.

IV. Monthly web meeting by Co-convenors: The Co-convenors of the NAC shall have a web meeting, at least once in a month to review the functioning of the NACs.

4.3 Co-ordination of NACs with Other Directorates: NACs shall also coordinate with:

I. Directorate of Revenue Intelligence (DRI) and Directorate General of GST Intelligence (DGGI) related to management of alerts undertaken by the NAC.

II. Directorate General of Valuation (DGoV) to enhance expertise related to sensitive commodities handled. DGoV shall also appoint nodal person for every NAC for better co-ordination.

III. Directorate General of Analytics and Risk Management (DGARM) to provide feedback and enhance risk assessment and accuracy of CCR Instructions.

IV. National Academy of Customs and Indirect Taxes (NACIN) to hold capacity building sessions for departmental officers.

V. Directorate General of Taxpayer Services (DGTS) to enhance outreach measures to the taxpayers by providing content, faculty for holding webinars, workshops etc.

VI. Directorate General of Audit (DG Audit) and Audit Commissionerates related to audit objections and feedback.

VII. Directorate General of Systems and Data Management (DG Systems) in regard to System issues and enhancements.

VIII. Any other formations in CBIC to fulfil the stated objectives.

5. It is to be noted that the Faceless Assessment Groups are required to develop as expert groups and eventually as National Assessment Centers. Hence the FAG has to pool up the knowledge and make a repository of all the information relating to the assessment of goods under the particular Chapter. Accordingly, the following instructions are issued to the officers posted in Faceless Assessment Group in Mumbai Customs Zone-II:

i. A virtual dashboard has been provided to the Commissioner and all senior officers of CBIC to monitor and expedite clearance of bills of entry by the FAG. All the officers working in FAG are expected to quickly assess the bills of entry. Detailed reasons for keeping the assessment pending beyond live hours is expected to be furnished by the ADC/JC in charge to the Commissioner on a daily basis.

ii. Total compliance to the RMS instructions appearing on the screen of FAG officers is expected. The instructions cannot be ignored by the officers, wherever, the RMS instructions are not related to the imported goods in a bill of entry, the same shall be recorded in the BE and also in a register and a periodic report shall be submitted to the Commissioner.

iii. Description of the item imported is the key for proper assessment of the commodity. PAG officers shall ensure that the item imported is properly declared along with full details about it to ensure proper classification and eligibility for notification benefit. Complete details about the product including capacity/ratings of imported goods alongwith specific brand name etc. should be declared. These are just indicative aspects of a description and officers shall encourage importers and Customs Brokers to properly declare every item in the Bill of entry in consonance with the CTH, end use and the exemption notification claimed. if any. Officers shall keep track of all such instances where in the descriptions are falling short of the requirements and report the same for issuing a monthly bulletin advising the importer and Customs brokers to provide complete descriptions in the future, failing which necessary action can be initiated against them under the Custom Act, 1962.

iv. The officers shall study the present assessment practice concerning major commodities in the Groups being imported at customs station and being assessed by them as FAG Officers, and ensure uniformity in classification, valuation, exemption benefit, and compliance with import policy conditions. The FAG Officers shall make use of WCO Explanatory Notes, Classification decisions. Classification Opinions available on WCOs open source website.

v. The Group has to list out the demands raised under Section 28 against an importer for a product under FAG by DRI or any other agency apart from audit objections on classification, exemptions, etc. relating to the goods covered under the group during the last five years and ensure that the assessment is done after considering the precedents contained in the said cases/audit objections.

vi. The FAG has to maintain the Valuation Circulars issued by DGOV in respect of goods covered under the Group and ensure the valuation in line with the alerts issued in this regard. Access to NIDB should be taken by FAG officers and resort to verification of valuation and classification of an imported product in the national import database.

vii. The FAGs are also required to analyse the orders/appellate orders, case laws/decisions relating to classifications, exemptions and valuation issues in respect of the goods covered under the groups and ensure application of such case laws which have attained finality for uniformity and consistency. Administration shall provide dedicated Excus package to FAG officers.

viii. FAG should list out all antidumping duty notifications of the Chapter for ready reference and update it periodically. Every Bill of entry sent by RMS for verification shall be scrutinized keeping in mind the antidumping notifications applicable and ensure that the product description, COO/COE and the transport documents are not mis declared to avoid anti-dumping duties.

ix. The information mentioned at clause ii to vi should be kept in soft copies as a resource for reference by all FAG officers. This knowledge base shall be shared periodically with FAGs of corresponding groups.

x. The FAG should not routinely resort to return the Bill of Entry to Port Assessment Groups in terms of para No. 5.3.2 of Instruction No. 9/2020 dated 05.06.2020. In every case a Bill of Entry has to be returned to PAG, the same shall be done with due approval of Addl./Joint Commissioner in file bringing out the reasons for resorting to para no. 5.3.2.1. (a) and (c). In respect of any other exceptional circumstances due approval of Commissioner shall be taken before returning the bill to PAG.

xi. A fortnightly report of all such cases where the assessment is referred to PAGs by FAG is to be furnished together with reasons for each Bill of Entry to the Commissioner.

xii. FAGs are required to examine the documents uploaded in e-Sanchit properly and may ask for further documents by raising a query in the system. FAG may also raise a query to the importer concerning classification, exemption, or valuation. However, routine queries and piecemeal queries should be avoided. A query should be specific, unambiguous and genuine.

xiii. FAG officers may order first check examination to ascertain the classification, exemption claimed, or for any other reason. But as far as practicable first check examination be avoided. Specific instructions shall be given for examination in the second check procedure specifying that if the goods are not conforming to parameters ordered for examination, the shed may mark the Bill of Entry back to FAG. Wherever testing is required for assessment, FAG shall give complete details of parameters to be checked in the examination order so as to enable the shed officers in preparation of appropriate test memo.

xiv. Wherever the FAG does not agree with the self-assessment made by the importer, the same may be intimated to the importer by electronic mode and consent of the importer for re-assessment is obtained. If the importer does not agree with the proposed re-assessment, an opportunity shall be given for hearing in the virtual mode as per the Board’s instructions vide F.No. 390//Misc/3/2019-1C dated 27.04.2020. A speaking order has to be issued by the FAG within 15 days in terms of Section 17(5) of Customs Act, 1962.

xv. The Speaking order orders issued by the FAG shall be subject to review in terms of Section 129D (2) of the Customs Act, 1962. The review section of the office of Commissionerate shall process every order passed by the FAG for decision by the competent authority. If a decision is taken to file an appeal against such speaking order, then the FAG has to file and pursue such appeal, if any, by FAG before the Commissioner (Appeal) having jurisdiction over the port of Import. All subsequent follow up of the dispute shall be under the purview of FAG.

xvi. FAG in Mumbai Customs Zone-II shall create a @in mail id for the FAG Group for all communication. Strict compliance to para 5.1 of the instructions no 09/2020 dated 05/06/2020 in respect of exchange of communication is expected.

xvii. All communication with the other nodal Commissionerates shall be done with the approval of the Commissioner.

xviii. FAG shall report all such cases in which the self-assessment of the bills of entry was changed by the officers. A fortnightly report on all such cases shall be submitted to the Commissioner for onward communication with all Jurisdictional Port Commissioners and DGARM for further necessary action to insert possible interdiction.

xix. FAG has to maintain a Register in the form specified in Annexure-C, date wise and to furnish reports as mentioned thereunder to the Commissioner in respect of Sl. No. 2, 7 and 8 as per the format specified in Annexure C.

6. Commissioners in-charge of FAGs at JNCH shall co-ordinate to take all measures to ensure that Faceless Assessment is smooth and creates no disruption in the assessment and clearance of goods. The following important measures may be undertaken by the NAC before the launch:

I. The Customs locations within each Zone, performing Faceless Assessment may be identified. The volume of import and availability of adequate officers may be taken into consideration for such identification.

II. Nominate sufficient number of officers for the Faceless Assessment. The officers should be more than two at all levels, to ensure availability. To the extent possible, dedicated team of officers may be posted to the Faceless Assessment Groups.

III. Identify variations, if any, in assessment practices and harmonise them for application across FAGs.

IV. Take into account audit objections, judicial and quasi-judicial decisions accepted by the Department relating to the assessment of the goods to be handled by the Faceless Assessment Groups under the concerned NAC and circulate among the FAGs for uniformity of assessment.

V. Organize training on roles and functionalities in ICES related to Faceless Assessment including MIS Reports and Dashboards.

7. Further, Board has issued Notification No.85/2020-Customs (N.T.) dated 04.09.2020 by virtue of which the Commissioners of Customs (Appeals) are empowered to take up appeals filed in respect of Faceless Assessments pertaining to imports made in their jurisdictions even though the Faceless Assessment officer may be located at any other Customs station. To illustrate, Commissioners of Customs (Appeals) at Bengaluru would decide appeals filed for imports at Bengaluru though the Faceless Assessment officer is located at any other port of the country, say Delhi.

8. Detailed instructions/Procedures have been issued vide Public Notice cum Standing Order No.-96/2020 dated 31.07.2020 and 117/2020 dated 12.09.2020 and standing order No. 20/2020 dated 03.08.2020.

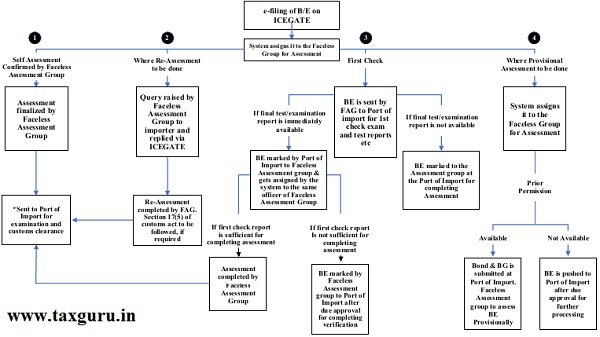

9. For ease of reference, workflow of the bill of entry in Faceless Assessment Group (FAG) is attached as annexure A and B to this Standing Order.

10. The procedure to be followed in ICES remains the same as was followed in the pilots for faceless assessment.

11. Faceless Assessment Group consisting of Appraisers/Superintendents and Assistant Commissioner/Deputy Commissioner and other concerned should comply with the above directions and those in the Board’s Instruction No. 09/2020-Customs dated 05.06.2020. In case of any inconsistency between this Standing Order and the Instruction No. 09/2020-Customs dated 05.06.2020, the Instruction No. 09/2020-Customs dated 05.06.2020 shall prevail.

12. Difficulty, if any, faced in implementation of the said Standing Order may be brought to the notice of the Addl. /Joint Commissioner (Appraising Main (Import)) through email on jnch@gov.in.

Sd/-

(Sunil Kumar Mall)

Commissioner of Customs (NS-I)

Copy to:

1. The Chief Commissioner of Customs, Mumbai Zone-II, JNCH.

2. The Commissioner of Customs, NS-G/II, NS-I/Audit, NS-III and NS-V, JNCH.

3. All Additional/Joint Commissioners of Customs, JNCH.

4. All Deputy/Assistant Commissioners of Customs, JNCH.

5. All Sections / Groups/FAG of NS-G, NS-I, NS-II /NS-III/NS- Audit/NS-V, JNCH.

6. AC/DC, EDI for uploading on JNCH website immediately.

Annexure A

| Sl No | SCENARIO | WORK-FLOW |

| 1 | First Check | Approved for First Check by Faceless Assessment Groups, goes to local shed (Port Verification Unit) for examination, comes back to Faceless Assessment Group for assessment. |

| 2 | Provisional Assessment | Where prior permission is available, Faceless Assessment Group to assess it. Bond and BG to be registered at local port of import. If no prior permission, BE to be sent to port of import for assessment. |

| 3 | Reassessment for valuation | Either through query and consent. Or in case First Check is given for valuation by CE etc., then like case 1. |

| 4 | Reassessment for Classification where testing is required |

If ordered by Faceless Assessment Group as first check, then test memo to be sent by port of import and send back the BE to Faceless Assessment Group with test report. Alternately, can be sent to port of import for provisional assessment |

| 5 | First check but for provisional assessment |

Approved for 1st Check by Faceless Assessment Group but assessment cannot be finalised by Faceless Assessment Group for want of further inputs/ test reports.

To be sent to port of import for provisional assessment. |

Annexure B

Annexure-C

Table- Form of Register to be maintained date wise.

Date:

| S.No. | Description | FAG |

| 1. | No. of BEs assessed by FAG | |

| 2. | No. of BEs in which the assessment is modified by FAG | |

| 3. | No. of BEs in 2 above in which the importer agreed with reassessment by FAG. | |

| 4. | No. of BEs in which speaking order is issued/under process | |

| 5. | No. of BEs in which query raised by FAG | |

| 6. | No. of BEs ordered for first check | |

| 7. | No. of BEs in which RMS instructions are not relevant | |

| 8. | No. of BEs returned to Port Assessment Groups by FAG |

- In respect of Sl. No. 2, List of BEs together with issue in brief to be furnished fortnightly to Commissioner together with remarks whether interdictions to be inserted in RMS as per following format.

| Sr. No. | BE No. and Date | Port of Import | Issue in brief for which assessment was modified | Suggested interdiction in RMS |

| 1. |

- In respect of Sl. No. 5 and 6, concerned ADC/JC, Mumbai Customs Zone-II, to review all BES and reasons for query/first check on a fortnightly basis.

- In respect of Sl. No. 7, fortnightly report along with details of each BE and issue in brief to be submitted to Commissioner as follows:-

| Sr. No. | BE No. and Date | Port of Import | RMS instructions are not relevant |

- In respect of Sl. No. 8, fortnightly report along with details of each BE and issue in brief to be submitted to Commissioner as follows:-

| Sr. No. | BE No. and Date | Port of Import | Reasons for which the BE is returned to PAG | Remarks |

| 1. |