Case Law Details

DCIT Vs Triton Hotels and Resorts Private Limited (ITAT Mumbai)

Income Tax Appellate Tribunal (ITAT), Mumbai, adjudicated appeals in the case of DCIT Vs Triton Hotels and Resorts Pvt. Ltd. The matter primarily pertained to unexplained expenditures assessed under Section 69C of the Income Tax Act for the assessment year (AY) 2020-21. Cross-appeals were filed by the assessee and the Revenue against the order of the CIT(A)-52, Mumbai, which partly confirmed and partly deleted additions made by the Assessing Officer (AO). These appeals were heard together for multiple assessment years to ensure uniformity.

The case stemmed from a search and seizure operation conducted under Section 132 of the Income Tax Act at Triton Group’s premises in July 2020. Among the key issues, the AO made additions based on two primary allegations: an unaccounted payment of ₹29.4 lakh to a designer, Randolph Grey Design Co. Ltd. (RGDCL), and unexplained cash transactions of ₹3.24 crore with Akbar Travels, UAE. The CIT(A) partially upheld these additions, affirming a smaller sum in both cases after considering the evidence and explanations provided by the assessee.

The ITAT ruled in favor of the assessee on several points. For the alleged payment to RGDCL, it was observed that the seized documents were not conclusively linked to the assessee, and no formal agreement existed during the disputed period. As the payment agreement with RGDCL was dated 2021, expenses for AY 2020-21 were deemed untenable, leading to the deletion of the ₹29.4 lakh addition. Similarly, the tribunal scrutinized Akbar Travels’ transactions and found the majority of the receipts accounted for as income. It upheld only a partial addition of ₹36.87 lakh out of ₹3.24 crore, aligning with the CIT(A)’s findings.

The ruling referenced precedents to emphasize the burden of proof required to link seized documents and unexplained expenditures to an assessee. The tribunal’s decision underscores the importance of substantiating allegations with clear evidence, especially in cases involving significant financial assessments under Section 69C.

FULL TEXT OF THE ORDER OF ITAT MUMBAI

I.T.A. No. 3122/Mum/2023 & I.T.A. No. 2485/Mum/2023, are cross-appeals by the assessee and the revenue preferred against the very same order of the ld. CIT(A)-52, Mumbai, dated 14/06/2023 pertaining to AY 2020-21.

I.T.A. No. 3143/Mum/2023, I.T.A. No. 3123/Mum/2023, I.T.A. No. 3144/Mum/2023, are three separate appeals by the revenue preferred against three separate orders of ld. CIT(A)-52, Mumbai, dated 14/06/2023 pertaining to AYs 2018-19, 2019-20 & 2021-22.

2. All these appeals were heard together and are disposed off by this common order for the sake of convenience and brevity. Since the underlying facts in the issues are common in the captioned appeals, for the sake of our convenience, we have heard the representatives on the facts of AY 2020-21 in ITA No. 2485/Mum/2023 and ITA No. 3122/Mum/2023.

3. Representatives of both the sides were heard at length. Case records carefully perused and the relevant documentary evidence brought on record, duly considered in light of Rule 18(6) of the ITAT Rules, 1963.

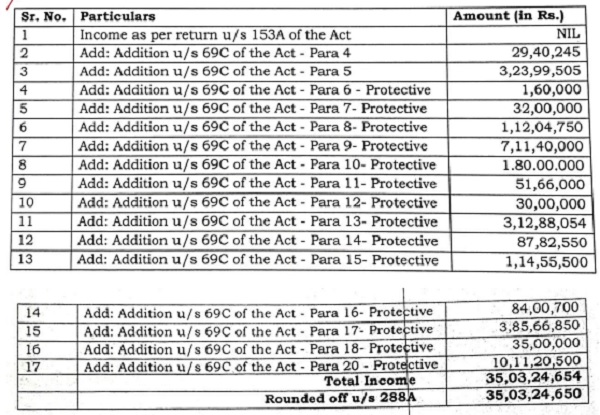

4. Briefly stated, the facts of the case are that a search and seizure action u/s 132 of the Act was carried out in the cases related to Triton Group on 13/07/2020 which included the assessee M/s. Triton Hotels & Resorts Private Limited. The statutory notices u/s 153A of the Act were issued and served upon the assessee pursuant to which the assessee filed its return of The return income of the assessee for the assessment year under consideration was assessed as under:-

5. It can be seen from the aforementioned chart of assessed income that, only two additions u/s 69C of the Act amounting to 29,40,245/- and Rs.3,23,99,505/- were made on substantive basis and all other additions were made on protective basis.

6. Before us, it has been fairly stated by the rival representatives that the additions made on protective basis have been deleted because corresponding addition on substantive basis have been confirmed by the Tribunal/or deleted by the Tribunal in the case of Vardha Enterprises Private Limited. The copy of the order of the Co-ordinate Bench in the case of Vardha Enterprises Private Limited in ITA Nos. 3142, 3140 & 3141/Mum/2023; AYs 2017-18, 2020-21 & 2021-22 and ITA Nos. 2435, 2436 & 2437/Mum/2023; AYs 2017-18, 2020-21 & 2021-22, order dated 22/11/2024, has been supplied which has been duly considered. In the present appeal by the assessee, we are concerned with only two additions which have been partly affirmed by the ld. CIT(A) u/s 69C of the Act.

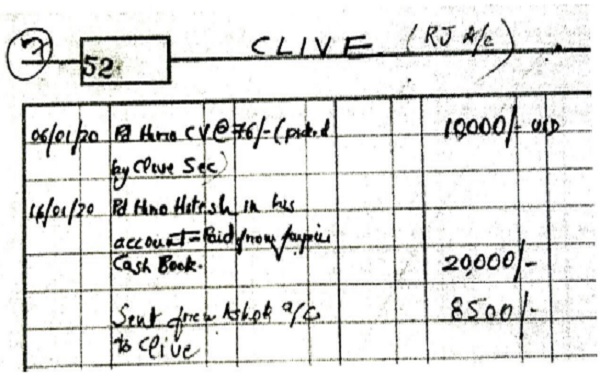

7. The first addition is in respect of payments made to Randolph Grey Design Co. Ltd. (hereinafter ‘RGDCL’), being interior designer, Clive Grey.

8. During the course of search and seizure proceedings, ledgers pertaining to the unaccounted payments made to RGDCL for hotel purchase have been found to be recorded and seized from the residential premises of Mr. Jiten Pujari. The scanned copy of the document is reproduced below:-

9. The AO was of the opinion that the aforementioned payments are unaccounted and the total payments come to US$ 38500 equivalent to Rs.29,40,245/-. The assessee was asked to provide complete details of the transactions and also provide the nature and source of In its reply, the assessee explained that the alleged payments have been found and seized from the residential premises of Mr. Jiten Pujari, who was maintaining the diaries and the assessee is not in a position to comment upon the contents of the same. It was brought to the notice of the AO that Mr. Jiten Pujari has confirmed that the said diaries were his personal diaries having nothing to do with the assessee. It was strongly contended that the name of the assessee is not found mentioned anywhere on the page.

9.1 The contention of the assessee did not find favour with the AO. The AO was of the opinion that the retraction filed by Jiten Pujari is clearly an afterthought and, therefore, no cognizance can be taken of the retraction statement and concluded that the assessee has failed to establish the source of expenditure amounting to Rs.29,40,245/- and made addition u/s 69C of the Act.

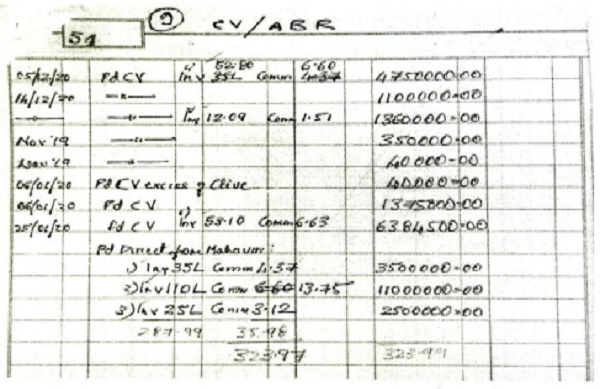

10. Proceeding further, based on another seized document being Annexure A-462, containing ledger account titled “CV/ABR”, which is as under:- 11. The aforementioned exhibit is the document retrieved from the mobile of Jiten Pujari and is a WhatsApp exchange between Mr. Jiten Pujari and one, Mr. Ratankant Sharma. The payment of Rs.47,50,000/- found to be duly recorded in the ledger account of “CV/ABR” on 05/12/2020. From a perusal of the invoice details, it is seen that such invoices have been raised by Akbar Travels. Further referring to the WhatsApp exchange, the AO formed a belief that bogus accommodation entries have been taken from Akbar Travels against which cash including commission totaling to Rs.3,23,99,505/- has been paid in AY 2020-21 as per the ledger “CV/ABR”. The assessee was asked to explain the nature of transactions and why it should not be treated as unexplained expenditure u/s 69C of the Act.

11. The aforementioned exhibit is the document retrieved from the mobile of Jiten Pujari and is a WhatsApp exchange between Mr. Jiten Pujari and one, Mr. Ratankant Sharma. The payment of Rs.47,50,000/- found to be duly recorded in the ledger account of “CV/ABR” on 05/12/2020. From a perusal of the invoice details, it is seen that such invoices have been raised by Akbar Travels. Further referring to the WhatsApp exchange, the AO formed a belief that bogus accommodation entries have been taken from Akbar Travels against which cash including commission totaling to Rs.3,23,99,505/- has been paid in AY 2020-21 as per the ledger “CV/ABR”. The assessee was asked to explain the nature of transactions and why it should not be treated as unexplained expenditure u/s 69C of the Act.

11.1 In its reply, the assessee explained that the basis has not been given to the assessee on which the AO has formed a belief that payments made to Akbar Travels, UAE, needs to be disallowed. It was further explained that Akbar Travels, UAE, being a travel agent makes payments to the assessee based on the rooms that it has booked in the hotel of the assessee. The assessee furnished copy of contract with Akbar Travels, UAE, bank statements highlighting receipts and copy of travel details/IDs of guests on sample basis. The submission of the assessee was rubbished by the AO who concluded by holding that the assessee has failed to establish the source of expenditure amounting to Rs.3,23,99,505/- and made addition u/s 69C of the Act.

11.2. Both the additions were challenged before the ld. CIT(A). Insofar as, payments made to RGDCL, the assessee strongly denied having formally engaged the said interior designer. The ld. CIT(A) observed that US$ 20000 paid on 16/01/2020, has been paid by M/s. Capri Hospitality Ltd., UAE and in absence of any material evidence to show that the said UAE entity has made payments on behalf of the assessee, such addition cannot be sustained and accordingly the ld. CIT(A) confirmed the addition to the extent of Rs.14,12,845/- and deleted the balance of Rs.15,27,400/- for which the revenue is in appeal.

12. We have carefully perused the findings of the CIT(A) qua the additions. The seized annexure being a scanned copy which is exhibited elsewhere, does not contain the name of the assessee anywhere. The said document was found and seized from the residential premises of Mr. Jiten Pujari. Therefore, the presumption is that the said document pertains to Mr. Jiten Pujari. As the name of the assessee is nowhere mentioned in the said document the presumption that it belongs to the assessee does not hold any water and most importantly it does not bear any signature neither of the AO nor of the assessee nor of any witnesses to suggest that it was impounded during the search proceedings.

12.1. We have carefully perused the design agreement entered between the assessee and RGDCL, the interior designer. The said agreement is made on 23/04/2021, which means that no agreement existed during FY 2019-20 relevant to AY 2020-21 under consideration. Since there was no operative agreement between the assessee and the said interior designer, there is no question of incurring any expenditure during the year under Further, the agreement between the assessee and the interior designer is for a sum of US$ 1,50,000 and as per the ledger account exhibited at pages 305 to 310 of the paper book, the payment started from 06/05/2021 which falls in FY 2021-22 relevant to AY 2022-23.

13. Considering the aforementioned facts in totality, we do not find any merit in the impugned additions made by the AO and further find no reason for partly confirming the addition by the ld. CIT(A). Therefore, the AO is directed to delete the entire addition of Rs.29,40,245/-. This ground is accordingly allowed and the related ground in the revenue’s appeal are dismissed.

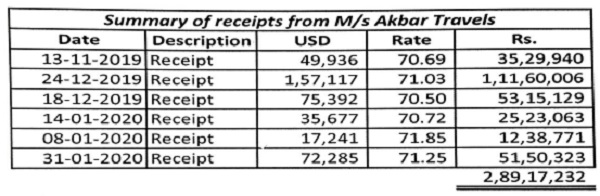

14. Coming to the addition of Rs.3,23,99,505/-, it was brought to the notice of the ld. CIT(A) that Akbar Travels, UAE, makes payment to the assessee for the rooms booked by them at the hotel of the assessee and the assessee has offered entire sum received from Akbar Travels, UAE, as its income. The ld. CIT(A) was convinced with the explanation of the assessee to the extent of Rs.2,89,17,232/-and deleted the same and confirmed the addition of Rs.36,87,273/-.

15. We have given a thoughtful consideration to the orders of the authorities below. Exhibit 132 of the paper book is the room rent agreement effective from 05/11/2019 to 31/03/2020, between the assessee and the travel agent Akbar Travels, UAE. Exhibit 137 is the statement of accounts of Akbar Travels, UAE, and page 283 as the summary of receipts from Akbar Travels, UAE, for the year under consideration, which is as under:-

16. It can be seen from the above that the aforementioned amount of Rs.2,89,17,232/- was received during the year under consideration and which was found to be recorded in the books of account for which the ld. CIT(A) gave part relief to the assessee.

16.1 We do not find any cogent reason given by the lower authorities for confirming the balance of Rs.36,87,273/-. As there is no basis for making the addition/partially confirming addition of the same, the AO is directed to delete the entire addition of 3,23,99,505/-. This ground is also allowed and the related grounds in the revenue’s appeal are dismissed.

17. Coming to the revenue’s appeal in I.T.A. No. 3122/Mum/2023, Ground Nos. 1 & 2 have already been dismissed as discussed hereinabove and as mentioned elsewhere, other additions were made on protective basis and the same have been either confirmed in M/s. Vardha Enterprises Pvt. Ltd. (supra) or deleted therein on account of duplicate addition. We do not find any error or infirmity in the findings of the ld. CIT(A) in deleting the protective addition of Rs.31,49,84,904/- as the same has been considered by the Co-ordinate Bench in the case of M/s. Vardha Enterprises Pvt. Ltd. (supra).

18. Accordingly appeal of the assessee is ITA No. 2485/Mum/2023 is allowed and appeal of the revenue in ITA No. 3122/Mum/2023 is dismissed.

19. Now, we take up the revenue’s appeal in ITA No. 3123/Mum/2023; AY 2018-19.

20. The first addition relates to the payment to RGDCL, interior designer. Facts on record show that the impugned addition was deleted and was considered in the hands of M/s. Vardha Enterprises Pvt. Ltd. and thereafter, the said addition was made in the hands of M/s. Vardha Enterprises Pvt. , which was considered by the coordinate bench in the case of M/s. Vardha Enterprises Pvt. Ltd. (supra), therefore, the ld. CIT(A) has rightly deleted the said addition from the hands of the assessee. No interference is called.

21. The second addition deleted by the ld. CIT(A) was of Rs.1 Crore, being payment to IEVO, Furniture, Udaipur. This addition is also considered in the case of M/s. Vardha Enterprises Pvt. Ltd. (supra) and since the transactions relate to M/s. Vardha Enterprises Ltd., the ld. CIT(A) deleted the addition from the hands of the assessee. We, therefore, do not find any reason to interfere with the findings of the ld. CIT(A). This ground is also dismissed.

22. The third addition deleted by the ld. CIT(A) is of Rs. 3,00,000/-. The underlying facts show that the AO has made the addition on the basis of the diary of Mr. Jiten Pujari. The ld. CIT(A) found that the said transactions related to M/s. Vardha Enterprises Pvt. Ltd. and since the transactions related to M/s. Vardha Enterprises Ltd., the addition was deleted from the hands of the assessee, therefore, we do not find any reason to interfere with the findings of the ld. CIT(A).

23. Accordingly, the revenue’s appeal in ITA No. 3123/Mum/2023; AY 2018-19, is dismissed.

24. Now, we take up revenue’s appeal in ITA No. 3143/Mum/2023; AY 2019-20.

25. The grievance of the revenue reads as under:-

“1. On the facts and in the circumstances of the case, Ld. CIT(A) erred in deleting addition of Rs.2,00,000/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to Sandeep Puntambekar.

2. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs.45.00,000/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to ‘Vajavat- Udaipur’.

3. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 1,07,80,000/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to Biosil Intl. Pte Ltd.

4. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 1,18,63.500/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment.

5. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 42,74,550 /- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to Randolph Gray Design Company Ltd. through Wander Baker on behalf of the assessee.

6. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 26,01,900/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to Belt Collins International(Singapore) Pte Ltd.

7. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 11,00,232/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made to KLD consulting Pte Ltd.

8. On the facts and in the circumstances of the case, CIT(A) erred in deleting additions, without appreciating the fact that the issue in whose hands the addition is to be made has not reached finality.”

26. We have carefully perused the assessment While making the additions, the AO was of the opinion that since transactions are related to M/s. Vardha Enterprises Pvt. Ltd. and since M/s. Vardha Enterprises Pvt. Ltd., has approached the Settlement Commission to save the interest of the revenue, similar additions were made in the hands of the assessee.

26.1 The impugned additions made by the AO were deleted by the ld. CIT(A) on the ground that the AO has himself admitted that the transactions related to M/s. Vardha Enterprises Pvt. Ltd.. Since all the additions have been considered in the hands of M/s. Vardha Enterprises Pvt. Ltd., which have been partly confirmed by the Co- ordinate Bench in the hands of M/s. Vardha Enterprises Pvt. Ltd., vide its order dated 22/11/2024 (supra), the deletion by the ld. CIT(A) from the hands of the assessee cannot be faulted with.

27. Accordingly, the revenue’s appeal in ITA No. 3143/Mum/2023; AY 2019-20 is dismissed.

28. Now, we take up the revenue’s appeal in ITA 3144/Mum/2023; AY 2021-22.

29. The grievance of the revenue reads as under:-

“1. On the facts and in the circumstances of the case, Ld. CIT(A) erred in deleting addition of Rs.8,00,000/- made u/s 69C of the L.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made (Ledger account titled “Sameer/Orise/Anki China*).

2. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 10,00,000/- made u/s 69C of the I.T. Act, without appreciating the fact that the assessee failed to explain the source of payment made (Ledger account titled “Udaipur-Fabir/Duvet ete.”).

3. On the facts and in the circumstances of the case, CIT(A) erred in deleting addition of Rs. 1,80,00,000/- made u/s 69C of the L.T. Act, without appreciating the fact that the assessee failed to explain the source of the same.

4. On the facts and in the circumstances of the case, CIT(A) erred in deleting additions, without appreciating the fact that the issue in whose hands the addition is to be made has not reached finality.”

30. We have carefully considered the orders of the authorities We find that the AO has made the addition on a protective basis in the hands of the assessee while the same has been added on a substantive basis in the hands of M/s. Vardha Enterprises Pvt. Ltd.. It was strongly contended before the ld. CIT(A) that the impugned additions have no linkage with the assessee and no such evidence has been brought on record to suggest that the impugned expenses have any relation with the assessee.

30.1 The ld. CIT(A) found that the AO himself as noted that M/s. Vardha Enterprises Pvt. Ltd., has failed to establish the source of expenditure and in such finding the ld. CIT(A) deleted the impugned additions from the hands of the assessee.

31. Since the AO himself has found these expenses relating to M/s. Vardha Enterprises Pvt. Ltd., we do not find any merit in making the impugned additions in the hands of the assessee on protective basis when the substantive additions have been identified in the hands of M/s. Vardha Enterprises Pvt. Ltd.. Therefore, the deletion of the same by the ld. CIT(A) cannot be faulted with.

32. Accordingly, the revenue’s appeal in ITA No. 3144/Mum/2023; AY 2020-21, is dismissed.

33. In the result, appeals of the revenue in T.A. No. 3123/Mum/2023, I.T.A. No. 3143/Mum/2023, I.T.A. No. 3122/Mum/2023, I.T.A. No. 3144/Mum/2023 are dismissed and the cross-appeal by the assessee in ITA No. 2485/Mum/2023, is allowed.

Order pronounced in the Court on 19th December, 2024 at Mumbai.