Case Law Details

D.S. Brothers Vs Durga Marketing Pvt. Ltd. (NAA)

The brief facts of the case are that an application was filed by the Applicant No. 1 before the Standing Committee on Anti-profiteering, under Rule 128 of the CGST Rules, 2017 alleging profiteering by the Respondent in respect of the supply of “Duracell Battery AA/6” (hereinafter referred as the product) supplied by the Respondent. Applicant No. 1 had alleged that the Respondent did not reduce the selling price of the product when the GST rate was reduced from 28% to 18% w.e.f. 15.11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017 and the price of the product remained the same and thus the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the price, in terms of Section 171 of the CGST Act, 2017.

We have carefully considered the Reports filed by the AP, submissions of the Respondent, and other material placed on record and it has been revealed that the Central Government, on the recommendation of the GST Council, had reduced the GST rate on the “primary cells & primary Battery” (HSN-8506) from 28% to 18% w.e.f. 15.11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017, the benefit of the same was required to be passed on to the recipients by the Respondent as per the provisions of Section 171 of the CGST Act, 2017.

From the above facts and discussion, it is evident that the Respondent did not reduce the selling price of the products mentioned above when the GST rate was reduced from 28% to 18% w.e.f. 15.11.2017 and hence, the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the prices, in terms of Section 171 of the CGST Act, 2017 and therefore, he has contravened the provisions of Section 171 of the CGST Act, 2017.

Based on the above facts, it is established that the Respondent has acted in contravention of the provisions of Section 171 of the CGST Act, 2017, and has not passed on the benefit of reduction in the rate of tax to his recipients by commensurate reduction in the prices. Accordingly, the profiteered amount is determined as Rs. 1,57,200/- as per the provisions of Rule 133 (1) of the CGST Rules 2017. The Respondent is therefore directed to reduce the prices of his products as per the provisions of Rule 133 (3) (a) of the CGST Rules, 2017, keeping in view the reduction in the rate of tax so that the benefit is passed on to the recipients. Accordingly, the Respondent is required to deposit the profiteered amount of Rs. 1,57,200/- along with the interest to be calculated @ 18% from the date when the above amount was collected by him from the recipients till the above amount is deposited in terms of Rule 133 (3) (b) of the CGST Rules, 2017. Since the recipients, in this case, are not identifiable, the Respondent is directed to deposit the amount of profiteering of Rs. 1,57,200/- along with interest in the CWFs of the Central and concerned State Governments as per the provisions of Rule 133 (3) (c) of the CGST Rules, 2017 in the ratio of 50:50 along with interest @ 18% till the same is deposited.

The Respondent has made a payment of Rs. 95,585/- through demand draft No, 145728 dated 21.01.2020 into the account of Consumer Affairs Department, Rajasthan and Rs. 95,585/- through demand draft No. 145729 dated 21.01.2020 into the Central Consumer Welfare Fund which has been taken on record. Since the Respondent has paid the entire profiteered amount of Rs. 1,57,200/- along with interest @ 18% of Rs. 39,969/-, thus, he is apparentaly not liable for imposition of penalty under the provisions of Section 171 (3A) of the CGST Act, 2017.

FULL TEXT OF ORDER OF NATIONAL ANTI-PROFITEERING APPELLATE AUTHORITY

1. The present Report dated 18.12.2019 had been received from the Applicant No. 2 i.e. the Director-General of Anti-Profiteering (DGAP) after a detailed investigation under Rule 129 (6) of the Central Goods & Service Tax (CGST) Rules, 2017. The brief facts of the case are that an application was filed by the Applicant No. 1 before the Standing Committee on Anti-profiteering, under Rule 128 of the CGST Rules, 2017 alleging profiteering by the Respondent in respect of the supply of “Duracell Battery AA/6” (hereinafter referred as the product) supplied by the Respondent. Applicant No. 1 had alleged that the Respondent did not reduce the selling price of the product when the GST rate was reduced from 28% to 18% w.e.f. 15.11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017 and the price of the product remained the same and thus the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the price, in terms of Section 171 of the CGST Act, 2017.

2. Applicant No. ‘I had relied upon two invoices issued by the Respondent as per the details contained in the table given below:-

Table

| S.No | Name of the product supplied |

Pre GST rate revision on 15.11.2017 | Post GST rate revision on 15.11.2017 |

The difference in INR |

||||

| Invoice No. & Date | GST rate (%) | Price excluding GST (Base Price) |

Invoice No. & Date | GST rate (%) | Price excluding GST (Base Price) | |||

| A | B | C | D | E | F | G | H | I=H-E |

| 1 | Dura Cell | R004221 dated 01.11.2017 | 28% | 548.44 for 4 Pcs.= 137.11 | R-004826 dated 15.11.2017 | 18% | 148.73 | 11.62 |

3. The Standing Committee on Anti-profiteering examined the aforesaid reference in its meeting and forwarded the same to the DGAP for detailed investigation in terms of Rule 129 of the Rules.

4. The DGAP on receipt of the application issued a Notice under Rule 129 of the CGST Rules, 2017 on 12.07.2019 calling upon the Respondent to submit his reply as to whether he admitted that the benefit of reduction in the GST rate w.e.f. 15.11.2019, had not been passed on to his recipients by way of commensurate reduction in price and if so, to suo moto determine the quantum thereof and indicate the same in his reply to the Notice as well as furnish all documents in support of his reply. The Respondent was also allowed to inspect the non-confidential evidence/information which formed the basis of the said Notice which the Authorised Representative of the Respondent availed of on 23.07.2019.

5. Applicant No. 1 also was allowed to inspect the non-confidential documents/reply furnished by the Respondent, which he did not avail of. The period of the investigation is from 15.11.2017 to 30.06.2019.

6. In response to the Notice dated 12.07.2019, the Respondent submitted his replies vide letters/e-mails dated 22.07.2019, 23.08.2019, 17.10.2019, 22.10.2019. 13.11.2019 and 11.12.2019, vide which he submitted the following documents/information:

(a) GSTR-1 & GSTR-3B returns for the period from November 2017 to June 2019.

(b) Details of invoice-wise outward taxable supplies for the period July 2017 to June 2019.

However, the Respondent did not make any submissions/ contentions in respect of the alleged profiteering.

7. Based on the above-mentioned documents filed by the Respondent, the DGAP submitted that the main issues for determination were whether the rate of GST on the product supplied by the Respondent was reduced from 28% to 18% w.e.f. 15.11.2017 and if so, whether the benefit of such reduction in the rate of GST had been passed on by the Respondent to his recipients, in terms of Section 171 of the CGST Act, 2017.

8. The DGAP observed that the Central Government, on the recommendation of the GST Council, had reduced the GST rate on the “primary cells & primary Battery” (HSN-8506) from 28% to 18% w.e.f. 11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017. As per the invoice of the Respondent, the product falls under HSN 8506.

9. The DGAP, before enquiring into the allegation of profiteering has examined Section 171 of the CGST Act, 2017 which governs the anti-profiteering provisions under GST which provides that any reduction in prices. Thus, the legal requirement was abundantly clear that in the event of the benefit of ITC or reduction in the rate of tax, there must be a commensurate reduction in the prices of the goods or services. Such reduction could only be in terms of money so that the final price payable by a recipient gets correspondingly in absolute terms reduced commensurate with the reduction in the tax rate or benefit of input tax credit (ITC). This was the only legally prescribed mechanism to pass on the benefit of ITC or reduction in the rate of tax to the recipients under the GST regime and there was no other method that a supplier could adopt to pass on such benefits.

10. The DGAP also stated that to determine as to whether the Respondent had commensurately reduced the price of the products supplied by him in terms of Section 171 of Central Goods & Services Tax Act, 2017, the details of supply of all products were analysed and it was observed that the base prices of most of the products supplied by the Respondent had been increased by him despite the reduction in the tax rate which came into force w.e.f. 15.11.2017. For example, in the case of Duracell Battery, the data of a particular item i.e., DURA-9V/1 sold during the period of 01.11.2017 to 14.11.2017 (pre-GST rate reduction) were taken and an average base price (without GST) was obtained on dividing the total taxable value by total quantity of this item sold during the period of 01.11.2017 to 14.11.2017. The average base price of this item was compared with the actual selling price of this item sold during post-GST rate reduction i.e. on or after 15.11.2017 as has been illustrated in the table given below:

Table

(Amount in Rupees)

| Sr. No. | Description | Factors | Pre Rate Reduction (Before 15.11.2017) | Post Rate Reduction (From 15.11.2017) |

| 1. | Product Description | A | DURA-9V/1 | |

| 2. | Period | 01.11.2017 to 14.11.2017 |

||

| 3. | The total quantity of the item sold | C | 4 | |

| 4. | Total taxable value | D | 600.98 | |

| 5. | Average base price (without GST) | E=D/C | 150.25 | |

| 6. | GST Rate | F | 28% | 18% |

| 7. | Commensurate Selling price (post Rate reduction) | G=E*1.18 | 177.29 | |

| 8. | Invoice No. | H | R-004914 | |

| 9. | Invoice Date | 1 | 16.11.2017 | |

| 10. | Total quantity (above invoice) | J | 2 | |

| 11. | Total Invoice Value | K | 376.93 | |

| 12. | Actual Selling price (post rate reduction | L=K/J | 188.46 | |

| 13. | Difference (Profiteering) | M=L-G | 11.17 | |

| 14. | Final Profiteering | N=M*J | 22.34 | |

From the above table, it was clear that the Respondent did not reduce the selling price of the “DURA-9V/1” when the GST rate was reduced from 28% to 18% w.e.f. 15.11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017, and hence he had profiteered an amount of Rs. 22.34/- on a particular item and thus the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the price, in terms of Section 171 of the CGST Act, 2017. Based on the above calculation as illustrated in table supra, profiteering in the case of all impacted goods of the Respondent has also computed similarly. However, the average base price for other items/types of products would be different from the item as shown in Table above, and accordingly, profiteering has been calculated item-wise.

11. The DGAP has also submitted that the Respondent was requested to reconcile the turnover reported in the GST returns with the turnover of Duracell battery reported in his submissions. The Respondent vide email dated 11.12.2019 submitted HSN wise turnover from November 2017 to March 2017 and informed that the difference in the sale of Duracell battery amounting to Rs. 1,40,880/- had been reconciled in his annual return.

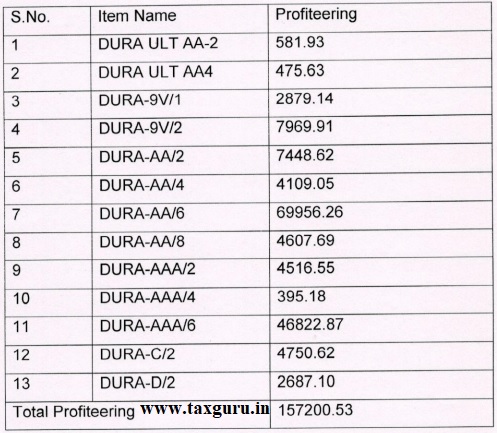

12. The DGAP has observed that perusal of the invoices made available by the Respondent indicated that the Respondent had increased the base price of the product when the rate of GST was reduced from 28% to 18% w.e.f. 15.11.2017. Based on the aforesaid, pre and post-reduction GST rates and the details of outward taxable supplies (other than zero-rated, nil rated and exempted supplies) of the product during the period 11.2017 to 30.06.2019, as furnished by the Respondent, the amount of net higher sales realization due to increase in the base price of the impacted good, despite the reduction in the GST rate from 28% to 18% or in other words, the profiteered amount comes to Rs. 1,57,2001-. The DGAP also furnished the details of the computation of the profiteered amount in the Annex-12 of his Report. The profiteered amount has been arrived at by comparing the average of the base price of the product sold during the period 01.07.2017 to 14.11.2017, with the actual invoice-wise base prices of the products supplied by the Respondent during the period from 15.11.2017 to 30.06.2019. The excess GST so collected from the recipients was also included in the aforesaid profiteered amount as the excess price collected from the recipients also included the GST charged on the increased base price. The different items of Duracell Battery affected by this Notification and profiteering against each item is shown in the table given below:

Table

13. The DGAP also observed that the Respondent had supplied the product in the state of Rajasthan only.

14. The above Report was considered by this Authority in its meeting held on 24.12.2019 and it was decided to hear the Applicants and the Respondent on 13.01.2020.

15. Two personal hearings were accorded to the parties on 13.01.2020 and 22.01.2020 which were attended by the Respondent. During the course of the hearings, none appeared for the Applicant No. 1 and Sh. Manoj K. Singh, Authorised Representative appeared for the Respondent.

16. The Respondent filed his first written submissions on 11.01.2020 vide which he has accepted the above profiteered amount as computed by the The Respondent further requested to convey him the procedure for making payment of the profiteered amount, He also requested not to impose penalty on him.

17. The Respondent filed next written submissions on 22 01.2020 vide which he enclosed (a) Copy of challan of Rs. 98,585/- paid in favour of “Deputy Director Consumer Affairs Department, Rajasthan” by DD No. 145728 and (b) a copy of Original DD for Rs. 98,585/- paid in favour of “Pay & Accounts Officer (Consumer Affairs)”, payable at New Delhi by DD No. 145729. He had also enclosed the calculation of interest amount computed by him.

18. The documentary evidence regarding payment of the profiteered amount furnished by the Respondent was supplied to the DGAP for verification. The DGAP vide letter dated 19.03.2020 submitted that the Deputy Director, Rajasthan Government has informed vide letter dated 03.2020 that payment of amount vide demand draft No. 1452728 dated 21.01.2020 for Rs 98,585/- of Allahabad Bank has been deposited in the account of Consumer Affairs Department, Rajasthan vide P.D. Account No. 3980 dated 29.01.2020 by the Respondent. The DGAP vide letter dated 25.06.2020 stated that Sr. Accounts Officer Pay and Accounts Office, Department of Consumer Affairs, vide letter dated 19.06.2020 has confirmed the receipt of payment of the above-mentioned amount.

19. We have carefully considered the Reports filed by the AP, submissions of the Respondent, and other material placed on record and it has been revealed that the Central Government, on the recommendation of the GST Council, had reduced the GST rate on the “primary cells & primary Battery” (HSN-8506) from 28% to 18% w.e.f. 15.11.2017, vide Notification No. 41/2017 Central Tax (Rate) dated 14.11.2017, the benefit of the same was required to be passed on to the recipients by the Respondent as per the provisions of Section 171 of the CGST Act, 2017.

20. From the above facts and discussion, it is evident that the Respondent did not reduce the selling price of the products mentioned above when the GST rate was reduced from 28% to 18% w.e.f. 15.11.2017 and hence, the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the prices, in terms of Section 171 of the CGST Act, 2017 and therefore, he has contravened the provisions of Section 171 of the CGST Act, 2017.

21. Based on the above facts, it is established that the Respondent has acted in contravention of the provisions of Section 171 of the CGST Act, 2017, and has not passed on the benefit of reduction in the rate of tax to his recipients by commensurate reduction in the prices. Accordingly, the profiteered amount is determined as Rs. 1,57,200/- as per the provisions of Rule 133 (1) of the CGST Rules 2017. The Respondent is therefore directed to reduce the prices of his products as per the provisions of Rule 133 (3) (a) of the CGST Rules, 2017, keeping in view the reduction in the rate of tax so that the benefit is passed on to the recipients. Accordingly, the Respondent is required to deposit the profiteered amount of Rs. 1,57,200/- along with the interest to be calculated @ 18% from the date when the above amount was collected by him from the recipients till the above amount is deposited in terms of Rule 133 (3) (b) of the CGST Rules, 2017. Since the recipients, in this case, are not identifiable, the Respondent is directed to deposit the amount of profiteering of Rs. 1,57,200/- along with interest in the CWFs of the Central and concerned State Governments as per the provisions of Rule 133 (3) (c) of the CGST Rules, 2017 in the ratio of 50:50 along with interest @ 18% till the same is deposited.

22. The Respondent has made a payment of Rs. 95,585/- through demand draft No, 145728 dated 21.01.2020 into the account of Consumer Affairs Department, Rajasthan and Rs. 95,585/- through demand draft No. 145729 dated 21.01.2020 into the Central Consumer Welfare Fund which has been taken on record. Since the Respondent has paid the entire profiteered amount of Rs. 1,57,200/- along with interest @ 18% of Rs. 39,969/-, thus, he is apparentaly not liable for imposition of penalty under the provisions of Section 171 (3A) of the CGST Act, 2017.

23. As per the provisions of Rule 133 (1) of the CGST Rules, 2017 this order was required to be passed within a period of 6 months from the date of receipt of the Report furnished by the DGAP under Rule 129 (6) of the above Rules. Since the present Report has been received by this Authority on 18.12.2019 the order was to be passed on or before 06.2020. However, due to the prevalent pandemic of COVID-19 in the country, this order could not be passed before the above date due to force majeure. Accordingly, this order is being passed today in terms of the Notification No. 55/2020-Central Tax dated 27.06.2020 issued by the Government of India Ministry of Finance (Department of Revenue), Central Board of Indirect Taxes & Customs under Section 168 A of the CGST Act, 2017.

24. A copy of this order be sent to the Applicants and the Respondent free of cost. File of the case be consigned after completion.