Decoding MCA E- Form PAS -6 Terms, Reporting Period, Moratorium Period with Draft Certificate

– Reconciliation of Share Capital Audit Report on half yearly basis.

♦ Introduction:

MCA vide General Circular G.S.R. 376(E). dated 22nd May, 2019 has came up with Reconciliation of Share Capital Audit Report (Half-yearly) pursuant to sub-rule Rule 9A (8) of Companies (Prospectus and Allotment of Securities) Rules, 2014 and has issued Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2019 which shall with effect from 30th September, 2019.

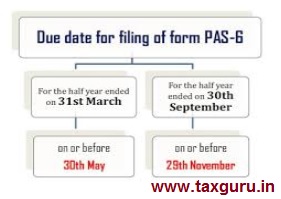

1. Every unlisted public company governed by this rule shall submit Form PAS-6 to the Registrar with such fee as provided in Companies (Registration Offices and Fees) Rules, 2014 within 60 days from the conclusion of each half year

2. Shall be duly certified by a company secretary in practice or chartered accountant in practice only.

3. All information shall be furnished for the hall year ended 30th September and 31st March in every financial year for each ISIN separately

4. In view of COVID-19 pandemic, Companies has faced difficulties to send notices through postal or courier services.

5. Non Applicability:

a) a Nidhi

b) a Government company or

c) a wholly owned subsidiary

♦ An Analysis of MCA E-form PAS-6:

Details / Information required:

1. CIN

2. ISIN – All information shall be furnished for the half year ended 30th September and 31st March in every financial year for each ISIN separately.

3. Details of Capital of Company –

a) issued capital number of shares along with percentage of total issued capital.

b) Total number of shares which are held in dematerialised form or physical form.

4. Details of changes in share capital during the half-year under consideration

5. Details of Shares held by: promoters, directors and KMPs

6. total no. of demat requests, if any, confirmed after 21 days and the total no. of demat requests pending beyond 21 days with the reasons for delay

7. Details of Company Secretary of the Company, if any

8. Details of CA/CS certifying this form

Attachments to the E-form PAS -6

No Mandatory Attachment.

♦ Pre-requisite for Filing MCA E-form PAS-6

1. Enter the number and date of board resolution authorizing the signatory to sign

2. Ensure the eForm is digitally signed by the Director, Manager, CEO, CFO or Company Secretary.

3. The person should have registered his/her DSC with MCA

4. Disqualified director is not allowed to sign the form.

5. In case the person digitally signing the e-Form is Company Secretary – Enter valid membership number in case of other than Section 8 company. In case of Section 8 company and if designation selected as ‘company secretary’, either membership number/ PAN shall be entered.

♦ Processing Type

The form will be processed in STP mode.

♦ Due date for filing the form:

> Availability of Form:

Form PAS-6 shall be available for filing as e-Form w.e.f 15th July 2020.

> Due date: 13th September 2020 as per Circular

As per MCA General Circular No. 16/2019 dated 28th November, 2019 the time limit for filing Form PAS-6 without additional fees for the half-year ended on 30.09.2019 will be 60 days from the date of deployment of this form on the website of the Ministry.

Link: https://taxguru.in/company-law/extension-date-filing-form-pas-6.html

♦ Period of Reporting:

– half year ended 31.03.2020

MCA has issued last General Circular No. 16/2019 on 28th November, 2019 related to period of Reporting, i.e. half year ended 30.09.2020.

Language of the Circular:

the time limit for filing Form PAS-6 without additional fees for the half-year ended on 30.09.2019 will be sixty days from the date of deployment of this form on the website of the Ministry.

It means after availability of the MCA – form PAS-6, the period of reporting will be:

a) half-year ended on 30.09.2019

b) half-year ended on 31.03.2020

bur practically the form is not taking period for the Half Year ended 30.09.2019. Hence Filing for the first time shall be done for half-year ended on 31.03.2020.

- Can we file MCA E-form PAS -6 after the 60 days at present without additional fees / penalty?

MCA has issued General Circular No. 11 /2020, F No.2/1/2020-CL-V dated 24.03.2020 regarding Special Measures under Companies Act, 2013 (CA-2013) and Limited Liability Partnership Act, 2008 in view of COVID-19 outbreak and point no. 1 clearly stated that:

No additional fees shall be charged for late filing during a moratorium period from 01sr April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry.

Link: https://taxguru.in/company-law/covid-19-special-relief-measures-companies-llp.html

In view of the above we can say that, MCA E – form PAS – 6 can be filed after 13th September 2020, that is after 60 days of deployment till 30th September, 2020 under moratorium period.

Draft Certificate by practicing professional

I declare that I ————— (PCS / PCA) have been duly engaged for the purpose of certification of this form. It is hereby certified that I have gone through the provisions of the Companies Act, 2013, the Depositories Act, 1996 and rules/regulations made thereunder for the subject matter of this form and matters incidental thereto and I have verified the above particulars (including attachment(s)) from the original records maintained by the Company (name of the company) which is subject matter of this form and found them to be true, correct and complete and no information material to this form has been suppressed. I further certify that:

a) The said records have been properly prepared, signed by the required officers of the Company and maintained as per the relevant provisions of the Companies Act, 2013 and the Depositories Act, 1996 and were found to be in order;

b) All the required attachments have been completely and legibly attached*to this form;

c) It is understood that I shall be liable for action under Section 448 of the Companies Act, 2013 for wrong certification, if any found at any stage.

Signature

Chartered Accountant in Practice / Company Secretary in practice

(whether Associate or Fellow)

Membership No. & CP No.

UDIN:

Note: This e-form has been taken on file maintained by the Registrar of Companies through electronic mode arid on the basis of statement of correctness given by the filing company. Attention is also drawn to provisions of Section 448 which provide for punishment for false statement and certification.”

****

Disclaimer: The contents of this article are for information purposes only and do not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Well drafted, for more technical FAQs, visit my article on PAS-6.