SECTION 248 OF COMPANIES ACT, 2013 DEALS WITH POWER OF REGISTRAR TO REMOVE NAME OF COMPANY FROM REGISTER OF COMPANIES

Removal of name from register of companies may be :

(1) By Registrar

(2) By the Company on its own

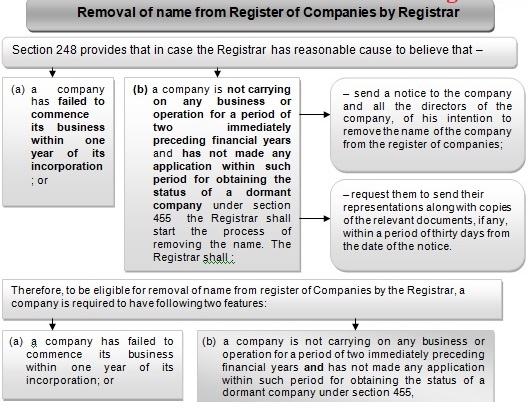

Removal of Name from Register of Companies by Registrar

Procedure of Removal of Name of a Company from Register of Companies by Registrar on suo-moto basis

(Rule 3 of Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016)

The Registrar of Companies may remove the name of a company from the register of companies in terms of sub-section (1) of section 248 of the Act.

1. The Registrar shall give a notice in writing in Form STK 1 which shall be sent to all the directors of the company at the addresses available on record, by registered post with acknowledgement due or by speed post.

2. The notice shall contain the reasons on which the name of the company is to be removed from the register of companies and shall seek representations, if any, against the proposed action from the company and its Directors along with the copies of relevant documents, if any, within a period of thirty days from the date of the notice.

Removal of name from Register of companies by the company on its own:

Procedure of Removal of Name of a Company from Register of Companies by Registrar on application made by the company

(Rule 4, 5, 6 of Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016)

1. An application for removal of name of the company under sub-section (2) of section 248 shall be made in Form STK-2 along with the fee of Ten thousand rupees.

2. It shall be signed by a director duly authorised by the Board in their behalf.

3. Where the director concerned does not have a registered digital signature certificate, a physical copy of the form duly filled in shall be signed manually by the director duly authorised in that behalf and shall be attached with the Form STK 2 while uploading the form.

4. It shall be certified by a Chartered Accountant or Company Secretary or Cost Accountant, in whole time practice, as the case may be.

5. Every application shall accompany a no objection certificate from appropriate Regulatory Authority concerned in respect of following companies:-

a) companies which have conducted or conducting non-banking financial and investment activities as referred to in the Reserve Bank of India Act, 1934 (2 of 1934) or rules and regulations thereunder;

b) housing finance companies as referred to in the Housing Finance Companies (National Housing Bank) Directions, 2010 issued under the National Housing Bank Act, 1987 (53 of 1987);

c) insurance companies as referred to in the Insurance Act, 1938 (4 of 1938) or rules and regulations thereunder;

d) companies in the business of capital market intermediaries as referred to in the Securities and Exchange Board of India Act, 1992 (15 of 1992) or rules and regulations thereunder;

e) companies engaged in collective investment schemes as referred to in the Securities and Exchange Board of India Act, 1992 (15 of 1992) or rules and regulations thereunder;

f) asset management companies as referred to in the Securities and Exchange Board of India Act, 1992 (15 of 1992) or rules and regulations thereunder;

g) any other company which is regulated under any other law for the time being in force.

6. The application in Form STK 2 shall be accompanied by –

a) indemnity bond duly notarised by every director in Form STK 3.

b) a statement of accounts containing assets and liabilities of the company made up to a day, not more than thirty days before the date of application and certified by a Chartered Accountant. (It is to be noted that UDIN is required on SOA)

c) An affidavit in Form STK 4 by every director of the company.

d) a copy of the special resolution duly certified by each of the directors of the company or consent of seventy five per cent of the members of the company in terms of paid up share capital as on the date of application,

e) a statement regarding pending litigations, if any, involving the company.

- It should be noted that if the person is a foreign national or non-resident Indian, the indemnity bond, and declaration shall be notarised or appostilised.

Rule 7 of Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016)

–

Download Formats relevant to Striking Off Name of Companies under Companies Act, 2013.

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.