In order to discourage cash transactions and move towards cash-less economy, a new Section 194N (Introduced via Union Budget 2019) has been inserted under Income-tax Act with effect from September 1, 2019 to provide for deduction of tax on cash withdrawals made by any person from his bank or post-office account.

Meaning of Section 194N

Section 194N is applicable in case of cash withdrawals of more than Rs. 1 crore during a financial year. This section will apply to all the sum of money or an aggregate of sums withdrawn from a particular payer in a financial year.

Further, while calculating the limit of Rs 1 Crore limit all accounts maintained by a person with one bank are to be considered. Which means,

Mr. Raju has withdrawn the following amounts from different branches for HDFC Bank.

- Rs 50 lakh from Branch A

- Rs 30 lakh from Branch B

- Rs 40 lakh from Branch C

- Rs 20 lakh from Branch D of Axis Bank

In this case as per provisions of section 194N 2% TDS would be deducted by HDFC Bank on Rs 20 lakh i.e. TDS @2% by HDFC Bank Rs. 40,000

The provisions under section 194N are not applicable in case payment is made to the following person:

> Government

> Banking company

> Co-operative society engaged in the business of banking

> Any business correspondent authorized by RBI

> Any white label automated teller machine (ATM) operator authorized issued by the RBI

> Any other person which central government may specify by the notification.

> As per recent notification (NN 70/2019) dated 20 September, 2019 – No TDS under section 194N shall be deducted on cash withdrawal made by

-

- Commission agents or

- Trader operating under Agriculture Produce Market Committee (APMC) for the purpose of making payments to the farmers on account of purchase of agriculture produce.

Point of TDS under Section 194N

TDS will be deducted by the payer while making the cash payment over and above Rs 1 crore in a financial year to the payee. If the payee withdraws a sum of money on regular intervals, the payer will have to deduct TDS from the amount, once the total sum withdrawn exceeds Rs 1 crore in a financial year. Further, the TDS will be done on the amount exceeding Rs 1 crore. For example, if a person withdraws Rs 98 lakh in the aggregate in the financial year and in the next withdrawal, an amount of Rs 2,50,000 is withdrawn, the TDS liability is only on the excess amount of Rs 50,000.

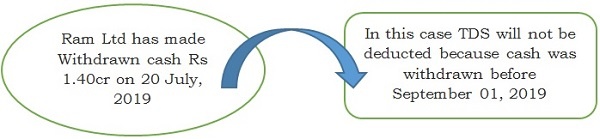

Section 194N is applicable from 01st September, 2019 hence any cash withdrawal prior to 01st September, 2019 will not be subject to TDS. However, cash withdrawal before 01st September, 2019 shall be counted for threshold of Rs 1 cr. Let’s understand this with a case:

Case 1

Case 2

The payer will have to deduct TDS at the rate of 2% on the cash payments/withdrawals of more than Rs 1 crore in a financial year under Section 194N.

Let’s understand the practical aspects of this section: –

Example1: – Mr. Mallya has saving and current account with a bank. The details of cash withdrawn from both the accounts are as follows:

| Date of cash withdrawn | Cash withdrawn from saving account | Cash withdrawn from current account |

| 01-04-2018 | 40,00,000 | 10,00,000 |

| 31-03-2019 | 70,00,000 | 60,00,000 |

| 01-04-2019 | 20,00,000 | 20,00,000 |

| 05-07-2019 | 5,00,000 | 10,00,000 |

| 31-08-2019 | 4,00,000 | 25,00,000 |

| 01-09-2019 | 50,00,000 | 45,00,000 |

| 01-03-2020 | 55,00,000 | 20,00,000 |

| 30-04-2020 | 1,20,00,000 | 5,00,000 |

| Total amount withdrawn | ||

| (a) In FY 2018-19 | 1,10,00,000 | 70,00,000 |

| (b) In FY 2019-20 | ||

| – Up to 31-08-2019 | 29,00,000 | 55,00,000 |

| – 01-09-2019 onwards | 1,05,00,000 | 65,00,000 |

| (c) FY 2020-21 | 1,20,00,000 | 5,00,000 |

Answer

| Financial Year | Cash withdrawn from | Total Cash withdrawn | Tax to be deducted | |

| Saving Account | Current Account | |||

| 2018-19 | 1,10,00,000 | 70,00,000 | 1,80,00,000 | Nil |

| 2019-20 | 1,34,00,000 | 1,20,00,000 | 2,54,00,000 | 3,08,000 |

| 2020-21 | 1,20,00,000 | 5,00,000 | 1,25,00,000 | 50,000 |

Example 2: – Suppose in the above example, Mr. Mallya has also withdrawn the following amounts during the year:

| Date of cash withdrawn | Cash withdrawn from saving account | Cash withdrawn from current account |

| 30-07-2019 | 1,00,00,000 | 50,00,000 |

| Total amount withdrawn | ||

| In FY 2019-20 | ||

| – Up to 31-08-2019 | 1,29,00,000 | 1,05,00,000 |

| – 01-09-2019 onwards | 1,05,00,000 | 65,00,000 |

Answer

| Financial Year | Cash withdrawn from | Total Cash withdrawn | Tax to be deducted | |

| Saving Account | Current Account | |||

| 2019-20 | 2,34,00,000 | 1,70,00,000 | 4,04,00,000 | 3,40,000 |

Although the amount of cash withdrawn from the Mr. Mallya’s bank accounts before September 1, 2019 exceeds Rs. 1 crore but no TDS will be deducted on such amount. TDS will be deducted only on the amounts which are withdrawn on or after September 1, 2019, i.e. Rs. 1,70,00,000 (1,05,00,000 + 65,00,000).

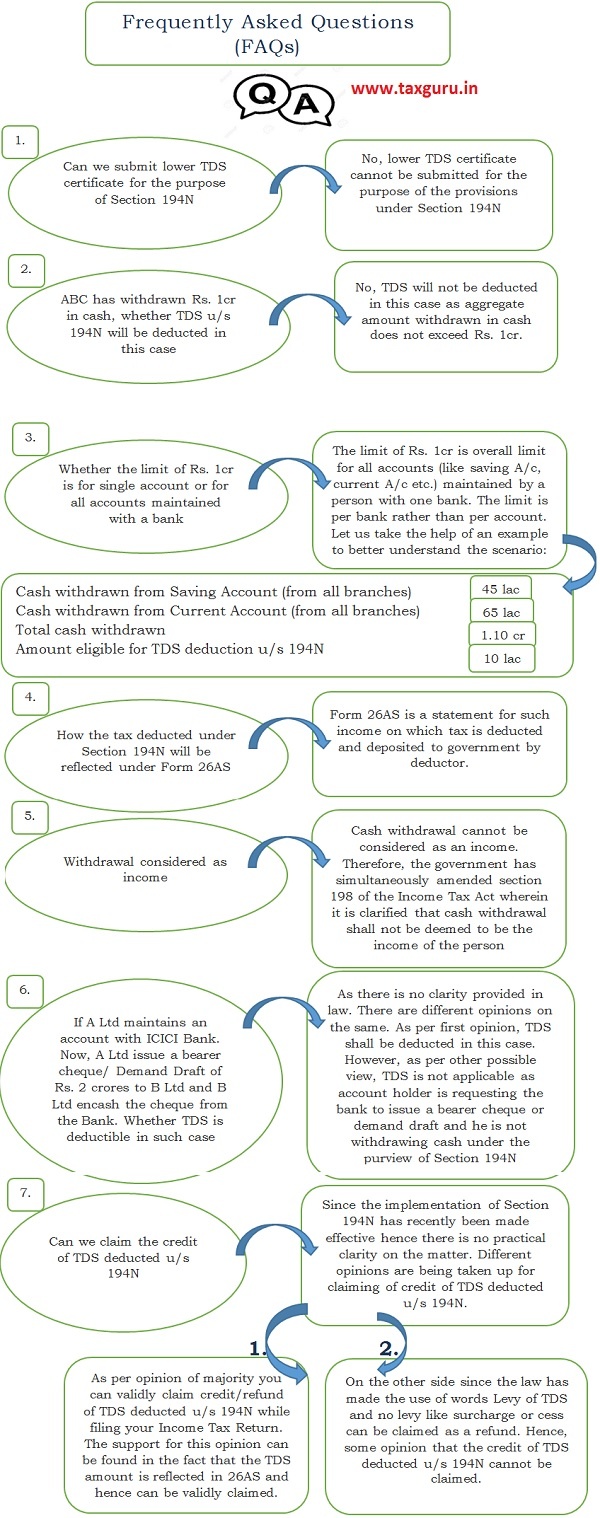

FAQs on Section 194N

Compiled by: –

CA Ayush Agarwal (9024695321, ayush7agarwal@gmail.com)

CA Piyush Agarwal (9024176761, Agarwal.piyush093@gmail.com)

Thanks Piyush and Aayush for sharing such stuff. Your knowledge is helping many.