It’s a common question amongst many professionals now-a-days that If a form is approved by ROC under STP mode, whether SRN can be Cancelled for such form and Whether AOC-4/MGT-7/ any other form filed by Company can be cancelled and revised?

In this editorial author shall discuss provisions under companies Act relating to correcting the defects and cancelling the approved e-form or provisions of revisions of AOC-4 or any other e-form.

Extract of law:

As per Rule 10(6) of The Registration of Offices and Fees Rules, 2014, in case the Registrar finds any e-form or document filed under Straight Through Process as defective or incomplete in any respect, he shall at any time suo-motu or on receipt of information or compliant from any source at any time, treat the e-form or document as defective in the electronic registry and shall also send a notice pointing out the defects or incompleteness in the e-Form or documents attached, at the e-mail address (latest updated) of the person or the company which has filed the document, calling upon the person or company to file the e-Form or document afresh along with fee and additional fee, as applicable at the time of actual re-filing, after rectifying the defects or incompleteness within a period of thirty days from the date of the notice.

Note:

As per Rule 10(6), if any form is approved through STP mode and ROC comes to know about any defect in the form (Suo Moto, on receipt of any information or complaint from any source), then having power to mark that form as Defective in its record.

Therefore, it is clear that once a form approved through STP mode under rule 10(6) ROC having power to make it defect

Whether AOC-4/MGT-7/ any other form filed by Company can be revising?

This is very common question amongst the professionals / corporates that whether a form e.g. AOC-4 filed with ROC having any clerical mistake in form can be cancel and revised or not.

Once the form AOC-4 filed on MCA Portal, the portal does not allow us to file revised form. If we try to upload the form, it shows an error that “from has already been filed for the said financial year”.

Now the issue arise that how do we revise the form?

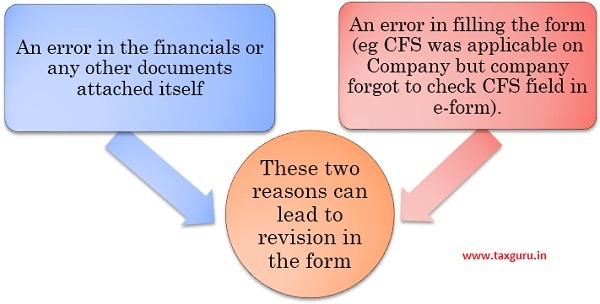

Let us understand the types of errors. The errors can be of two types as shown below:

Now let us discuss what can be done-

Point 1: An error in the financials or any other documents attached itself

As per provisions of Section 131, if company wants to make any amendment in financial statement or board report along with annexure then it is required to take approval for the same from NCLT.

Therefore, without approval of NCLT, ROC can’t allow to revise form if there is any change (even clerical change) in Financial Statement and Directors’ Report.

Point 2: An error in filling the form (eg CFS was applicable on Company but company forgot to check CFS field in e-form).

As per rule 10(6), if there is any error/omission in ‘filling’ of information in e-form, in such situation company can approach ROC to allow them to file revise form. Process of the same mentioned below:

STEP 1: Company shall prepare an application mentioning the reason for revision of form.

STEP 2: Director and professional will digitally sign the form, prepare an affidavit and oath about the change in form. (Affidavit should be on stamp paper as discussed below)

STEP 3: Company shall file such application along with original copy of affidavits with concerned ROC.

STEP 4: ROC shall analyze the application and if satisfied with the reason mentioned in application, mark the form as defective that has been earlier filed in its record.

STEP 5: Once form is marked as defective in records of ROC, Company shall be able to file the revised form on MCA Portal.

STEP 6: Company shall file revised form with additional fees.

Author – CS Divesh Goyal, GOYAL DIVESH & ASSOCIATES Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com).

In case of such revision what happens to the fee paid earlier for the Form AOC 4 in the first instance

please help me how to corrrect AGM date in AOC-4 it was wrongly entered. While filing MGT-7 through error

I feed the wrong due date of AGM in form AOC-4 ….now while filling MGT_7 it is showing error. I came to know that Mumbai ROC has stopped processes of Cancellation of AOC-4 . Do any one can guide me what i can do now. Can i attach a clarification regarding same with MGT_7

Facing the same issue. We filed Form GNL-1 and its been more than 1 month and still not approved. Not sure if we have to file any other application to ROC for making the AOC4 defective.

I have Filed ADT 1 with worng AGM date . now how to revised or change

MGT 7 was filed with wrong AGM Date. The form is approved STP. AOC 4 filing is pending. Is there any way to correct the AGM date.

Also note when trying to upload another MGT 7 then it gives error that put same date of AGM as mentioned in earlier MGT 7

hello sheetal, i am also facing same error, how u have corrected this plz advice (9810174337), plz whatsapp if call not connected

i have filed aoc 4 with wrong attachment, now how to revised or change

I have filed AOC 4 on 01-12-2020. Receipt generated with SRN. But status still remains pending approval. On raising a ticket MCA says to contact ROC concerned. Is not AOC 4 under STP approval.

I HAVE FILED AOC-4 WITH WRONG DUE DATE OF AGM, NOW HOW TO REVISED/CHANGE.

I AM ALSO MENTIONED THE WRONG DATE OF THE AGM, NOW I WANT TO REVISE THE FORM, HOW TO GET THE DEFECTIVE OF AOC-4