Brief Steps for Downloading of Transaction Based Report (TBR)

♣ Please check statement status under ‘Statement /Payment Tab’ before raising the request for TBR. Request for Downloading TBR can only be submitted when statement Status is either “Processed with Default” or “Processed without Default”.

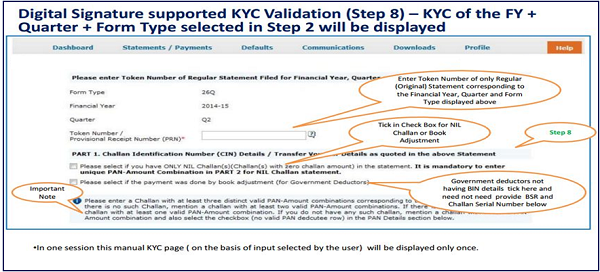

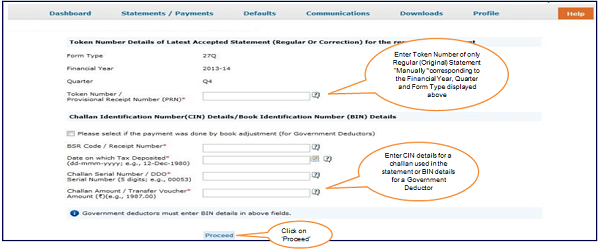

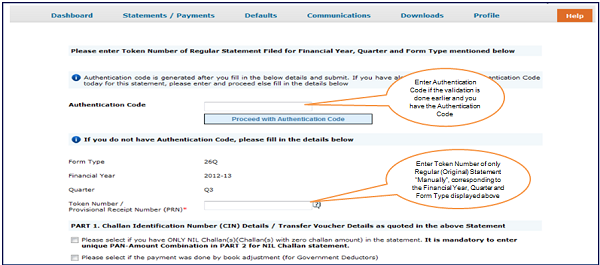

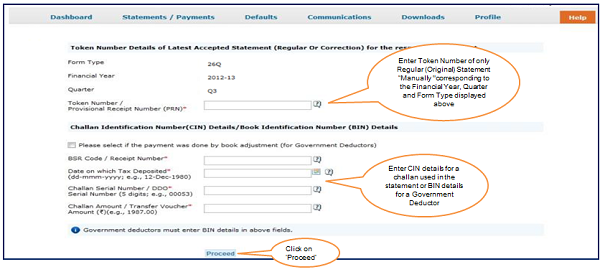

♣ Financial Year, Form type and Quarter for which KYC required will be auto populated on KYC screen. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed . Enter CIN/ Valid PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest correction statement filed by you(if any). Please DO NOT copy /paste the data.

♣ After providing correct KYC details, an authentication code will be generated, which is valid for same calendar day for same Financial Year, Form Type and Quarter

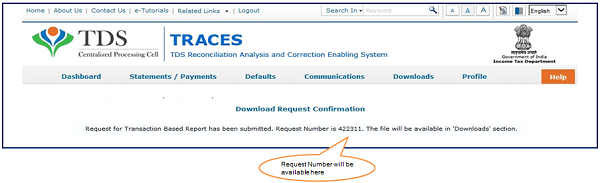

♣ On successful submission of the request, a unique Request number will be generated.

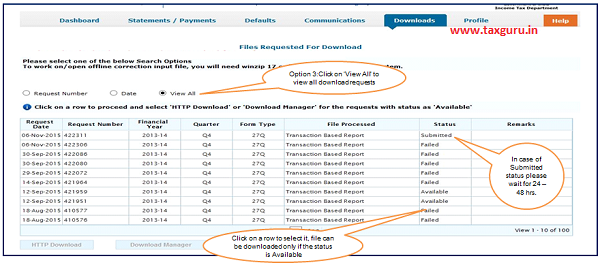

♣ The Form TBR will be available in “Requested Download”, Deductor can search for Form TRR by using:

a) Request Number

b) Date

c) View All.

♣ Details of Request Status:

a) Submitted : Successful submission, Request in processing.

b) Available : Transaction Based Report is available for Downloading.

c) Disabled : Duplicate request submitted for downloading.

d) Failed : User are advised to contact CPC (TDS).

e) Not Available : Pan is reported in TDS/TCS Statement .

Important Information on Transaction Based Report

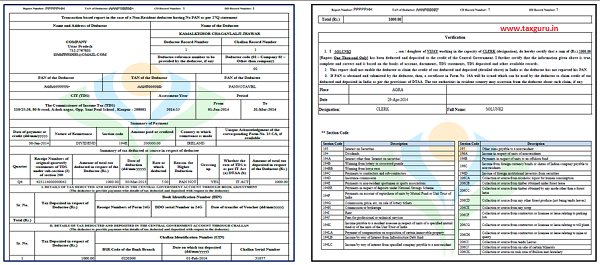

- Transaction based report provides with a summary of transactions in respect of Non Resident of India Deductees who‟s PAN could not be reported in TDS/TCS Statement due to non availability of PAN.

- The summary of transaction includes the following key information, beside others:

√ Nature of Remittance,

√ Amount Paid/Credited,

√ Country of Remittance,

√ Amount of tax deducted,

√ Reason for higher rate of deduction of tax(PAN not available).

- Transaction Based Report is available from FY 2013-14 onwards for the statements processed by TRACES.

- Deductor can download TBR by using HTTP Download or Download manager.

- Downloaded file will be in ZIP format. Do not Extract the File.

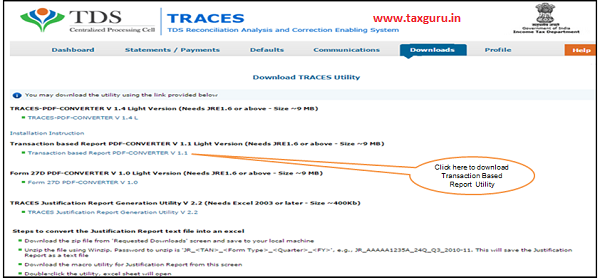

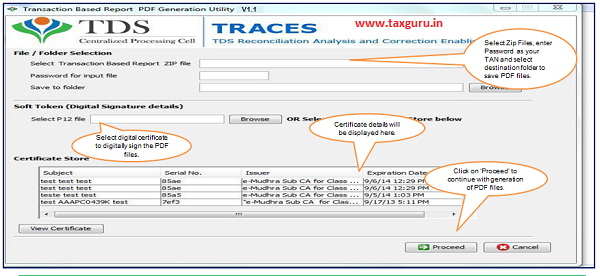

- Deductor need to convert the downloaded TBR zip file into PDF by using latest version of PDF convertor utility available on TRACES.

- Authorized person of Deductor is required taxguru.in to Sign TBR manually or by Using DSC.

- DSC can be placed on TBR using PDF Generation utility while converting Zip file into PDF.

- Password to open TBR is TAN number in Capital letters i.e. ABCD12345E.

Login to TRACES

Welcome Page

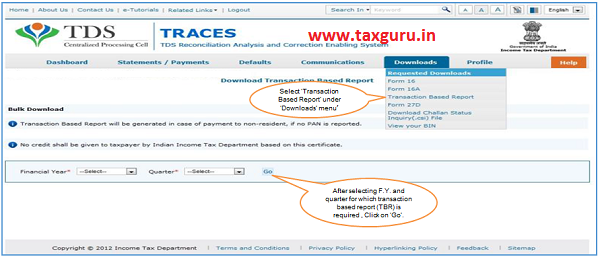

Downloading Report (contd.)

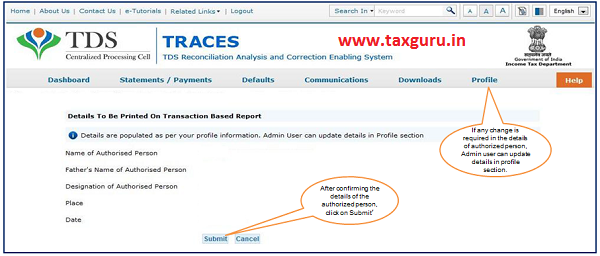

Details of Authorized person to be printed on Transaction Based Report

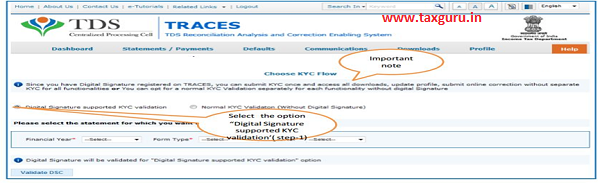

Digital Signature (Without KYC) contd.

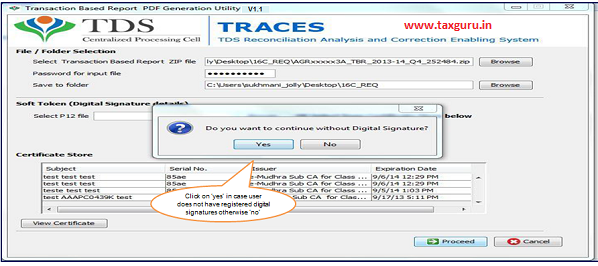

- Digital Signature Support KYC validation screen will appear only if Digital Signature is registered. Deductor can register/re register their Digital Signature in Profile. Please refer – Digital Signature Certificate Registration e-Tutorial for more information.

- Normal KYC Validation (without Digital Signature) – User can opt a normal KYC validation separately for each functionality without digital signature.

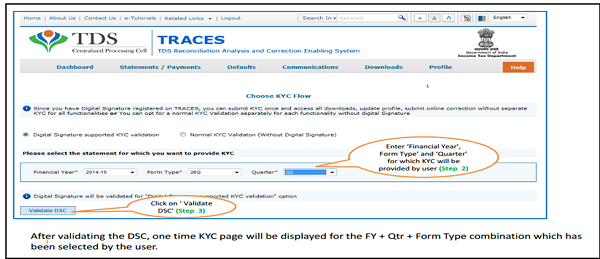

Digital Signature supported KYC Validation contd. (Step 2 & 3)

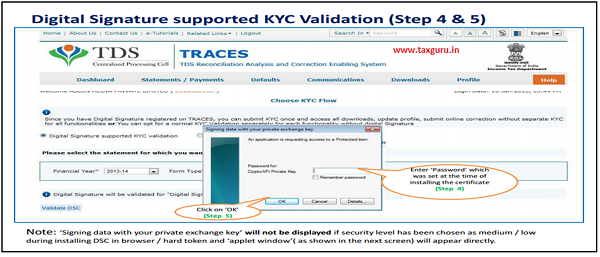

Digital Signature supported KYC Validation (Step 4 & 5)

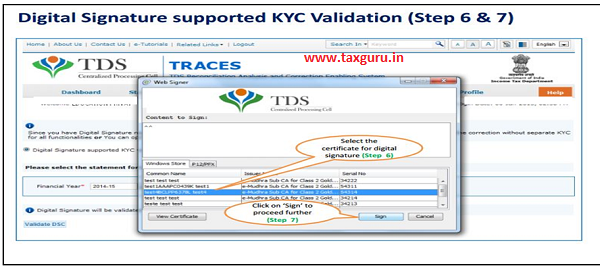

Digital Signature Supported KYC Validation (Step 6 & 7)

Digital Signature Supported KYC Validation ( contd.)

Token Number Details

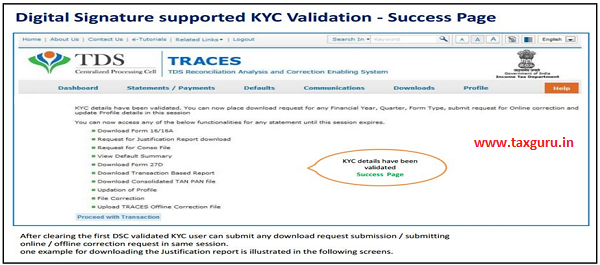

Digital Signature Supported KYC Validation – Success Page

In case of Normal KYC Validation- Token Number Details

In case of Normal KYC Validation (Contd.)

Request Number Screen

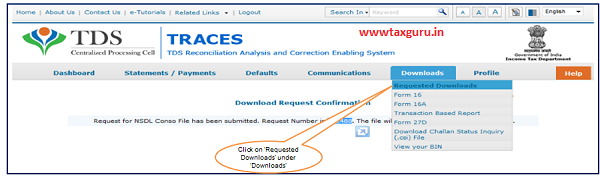

In order to check Request Status Click on Requested Downloads

- File will be available in „Requested Downloads‟

Check the Status of Request submitted

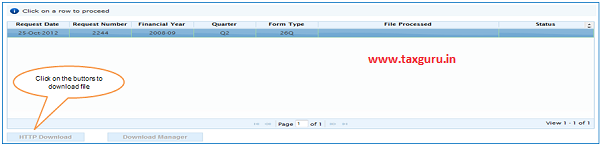

Click to Download File

- HTTP Download is useful to download small files. It will directly download file for the user

- Download Manager is useful to download large files and where internet bandwidth is slow.

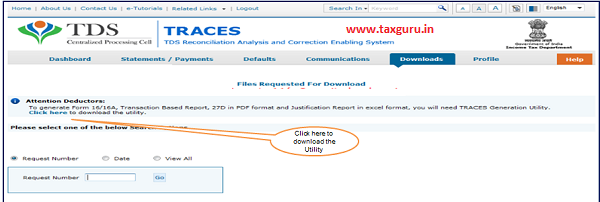

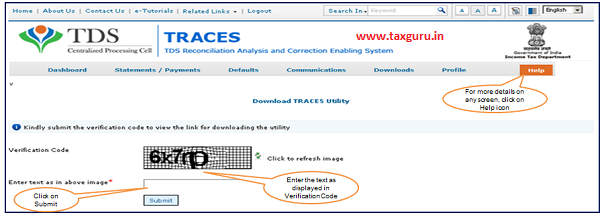

Procedure to Download Transaction Based Report Utility V 1.1

Procedure to convert Transaction Based Report to PDF (Contd.)

Procedure to download Transaction Based Report Utility V 1.1 (Contd.)

Double Click Run . Bat file, which will launch User Interface

Generating TBR (contd.)

Generating TBR

Transaction Based Report

Source- https://contents.tdscpc.gov.in