Article contains Brief Steps for Downloading Form 27D, Important Information on Form 27D and Pictorial Guide for Downloading Form 27D and 27D PDF Converter Utility V1.0.

1. Brief Steps for Downloading “Form 27D”.

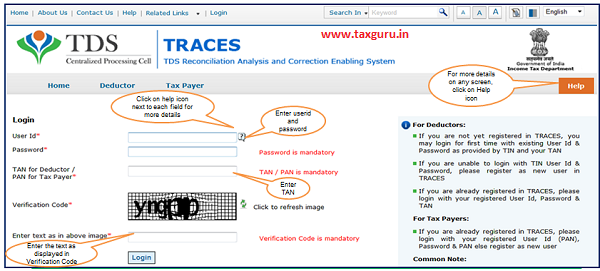

- Step 1: Login to TRACES website by entering the “User ID, Password ,TAN of the Deductor and the Verification Code”.

- Step 2: Landing page will be displayed. Please check statement status under “Statement /Payment Tab ” before raising the request for Form 27D . Request for Downloading Form 27D can only be Submitted when Statement Status is either Statement Processed with Default or Statement Processed with out Default.

- Step 3: Click on “Form 27D” available under “Download’s”

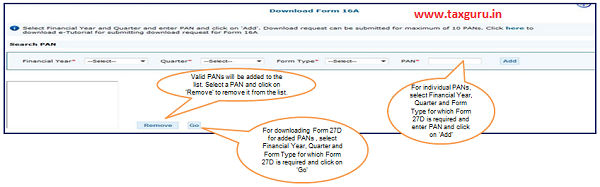

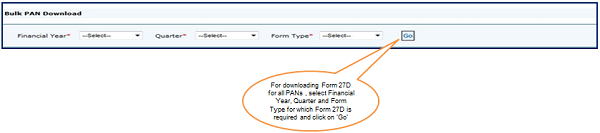

- Step 4: Tax Collector can request for “Form 27D” through “Search PAN download” or “Bulk PAN” downloads option.

- Step 5: Authorized Persons details to be printed on Form 27D will appear on the screen , click on “Submit” to proceed further.

- Step 6: Financial Year, Form type and Quarter for which KYC required will be auto populated. Enter Token Number of the Regular (Original) Statement only, corresponding to the Financial Year, Quarter and Form Type displayed . Enter CIN/ Valid PAN details pertaining to the Financial Year, Quarter and Form Type displayed on the screen on the basis of latest correction statement filed by you. Please DO NOT copy /paste the data.

- After providing correct KYC details, an authentication code will be generated, which is valid for same calendar day for same Financial Year, Form Type and Quarter.

- Step 7: On successful submission of the request, a unique “Request number” will be generated, which can be used to Track the status of the request. Form 27D can only be downloaded if the status is “Available”, user needs to wait for 24- 48 hrs incase request is in “Submitted” status .

- Step 8: Form 27D will be taxguru.in available in “Requested Download” tab, Tax Collector can check the status of Form 27D by using below mentioned options :

– Request Number – Date – View All

- Step 9: Tax Collector can download Form 27D using “HTTP download” or “Download Manager option”.

– HTTP Download is useful to download small files. It will directly download file for the user

– Download Manager is useful to download large files and where internet bandwidth is slow.

- Status for the Request submitted for Form 27D can be :

a) Submitted: Successful submission, Request in processing

b) Available: Form 27D available for Downloading

c) Disabled: Duplicate request submitted for downloading

d) Failed: User are advised to contact CPC(TDS)

e) Not Available: All PAN no. mentioned in the statement are Invalid .

- Step 10: In order to convert Form 27D into PDF, Tax Collector should download “Form 27D PDF Converter Utility 1.0”

2. Important Information on “Form 27D”.

- Form 27D is a TCS Certificate certifying the amount of TCS collected, Nature of Payments & the TCS Payments deposited with the Income Tax Dept.

- Form 27D downloaded from TRACES are considered as valid TCS certificates, as per CBDT circular 04/2013 dated 17thApril‟2013.

- Form 27D is generated only for valid PAN. In case of invalid PAN or if the PAN is not reported in TCS statement, Form 27D will not be generated.

- TCS certificates downloaded from TRACES are non-editable.

- Form 27D can be downloaded from FY 2007-08 onwards for the statement processed by TRACES.

- Collector can download Form 27D by using HTTP Download or Download manager accordingly once it is available.

- Downloaded file will be in ZIP format. Please do not Extract the File.

- Collector need to convert the downloaded Form 27D zip file into PDF by using latest version of PDF convertor utility available on TRACES .

- Authorized person of collector is required to Sign Form 27D manually or by Using DSC.

- DSC can be placed on Form 27D using PDF Generation utility while converting Form 27D Zip file into PDF.

- Password to open Form 27D is TAN number in Capital letters i.e. ABCD12345E.

3. Pictorial Guide for Downloading “Form 27D” and “27D PDF Converter Utility V1.0”.

Step 1: Login to TRACES website by entering the “User ID, Password ,TAN of the Deductor and the

Verification Code”.

Step 2: Landing Page will be displayed.

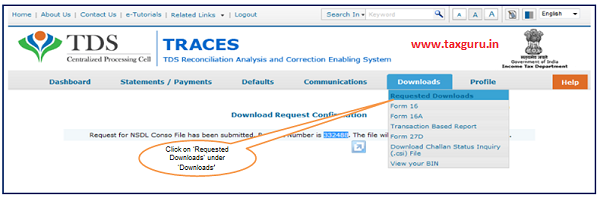

Step 3: Click on “Form 27D” available under “Download’s” tab.

Step 4: Tax Collector can request for “Form 27D” through “Search PAN download” or “Bulk PAN” downloads

option.

- Validation screen will be presented on click of „Go„.

- PAN must be present in PAN database and also in the latest Form 27EQ statements of selected FY and Quarter.

- Form Type field is used to populate validation screen on next step.

Step 4 (Contd.) : Tax Collector can request for “Form 27D” through “Search PAN download” or “Bulk PAN”

downloads option.

- Validation screen will be presented on click of „Go„

- PAN must be present in PAN database and also in the latest Form 27EQ statements of selected FY and Quarter

- Form Type field is used to populate validation screen on next step

Step 5: Authorized Persons details to be printed on Form 27D will appear on the screen , click on “Submit” to proceed further.

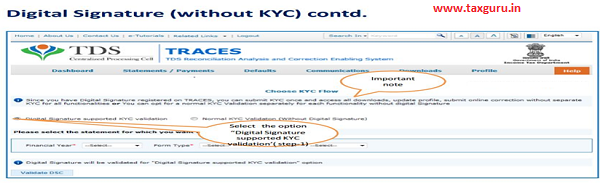

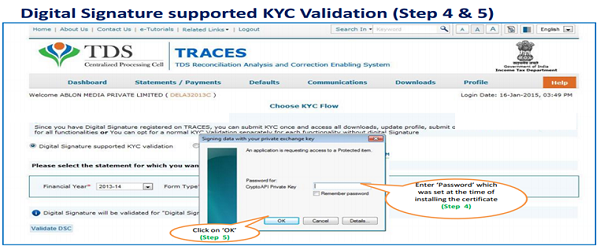

Step 6: KYC Screen user can choose “Digital Signature KYC” OR “Normal KYC”.

- Digital Signature Support KYC validation screen will appear only if Digital Signature is registered. Collector can register/re register their Digital Signature in Profile. Please refer – Digital Signature Certificate Registration e-Tutorial for more information.

- Normal KYC Validation (without Digital Signature) – User can opt a normal KYC validation separately for each functionality without digital signature

Step 6 (Contd.): In case of Digital Signature KYC – Enter the password to proceed further.

Note: ‘Signing data with your private exchange Key’ will not displayed if security level has been Chosen as medium/ low during installing DSC in browser/hard token and ‘applet window’ (as shown in the next screen) will appear directly.

Step 6 (Contd.) : Select the Digital Signature Certificate and Sign.

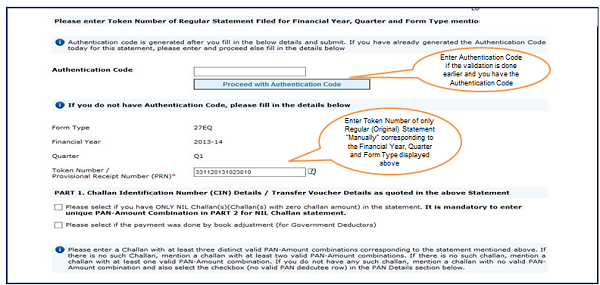

Step 6 (Contd.) : Enter the Token Number

Step 6 (Contd.) : Enter CIN / BIN and PAN details.

Step 6 (Contd.) : Guidelines for KYC.

- Authentication code is generated after KYC information details validation, which remains valid for the same calendar day for same form type, financial year and quarter.

- Token Number must be of the regular statement of the FY, Quarter and Form Type displayed on the screen.

- CIN/BIN details must be entered for the challan/book entry mentioned in the statement corresponding to the FY, Quarter and Form Type mentioned above.

- Government Collector can enter only Date of Deposit and Transfer Voucher amount mentioned in the relevant Statement.

- Amount should be entered in two decimal places (e.g., 1234.56).

- Only Valid PAN(s) reported in the TDS/TCS statement corresponding to the CIN/BIN details in Part1 must be entered in Part 2 of the KYC. Guide available on the screen can be referred for valid combinations.

- Maximum of 3 distinct valid PANs and corresponding amount must be entered.

- If there are less than three such combinations in the challan, user must enter all (either two or one).

- CD Record no. is mandatory only in case of challan is mentioned more than once in the statement.

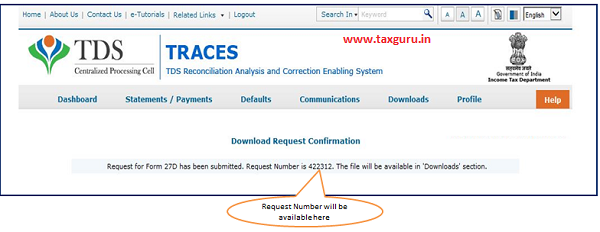

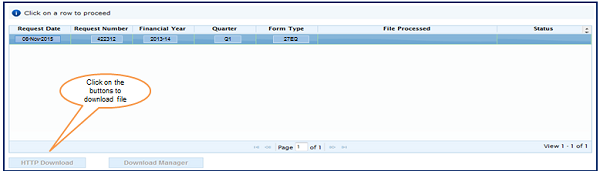

Step 7: A unique “Request number” will be generated.

–

File will be available in „Requested Downloads’

Step 8: Form 27D will be available in “Requested Download”, Tax Collector can search for Form 27D by using below mentioned options.

Step 9: Tax Collector can download Form 27D using “HTTP download” or “Download Manager option”.

- HTTP Download is useful to download small files. It will directly download file for the user

- Download Manager is useful to download large files and where internet bandwidth is slow.

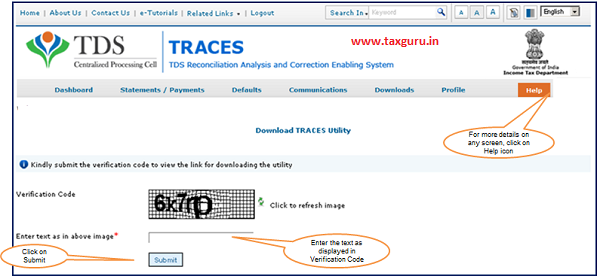

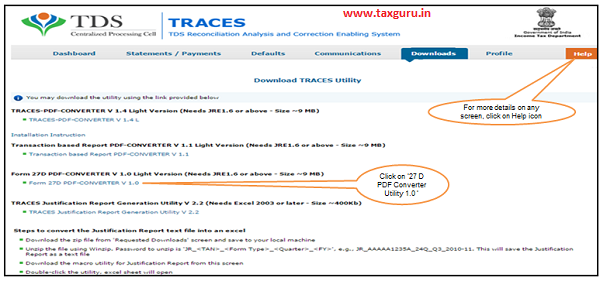

Step to Download “27D PDF Converter Utility V1.0”

Step 10: In order to convert Form 27D into PDF, Tax Collector should download “Form 27D PDF Converter Utility 1.0”

Step 10 (Contd.) : In order to convert Form 27D into PDF, Tax Collector should download “Form 27D PDF Converter Utility 1.0”

–

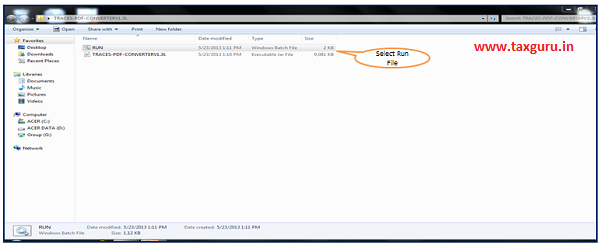

- Extract TRACES-PDF-CONVERTERV1.0L.zip file in a folder on your system.

- If WinZip is not already installed on your system ,download it from winzip.com and install it.

- After extraction you will have bat file and TRACES-PDF-ConverterV1.0L.jar in a same folder.

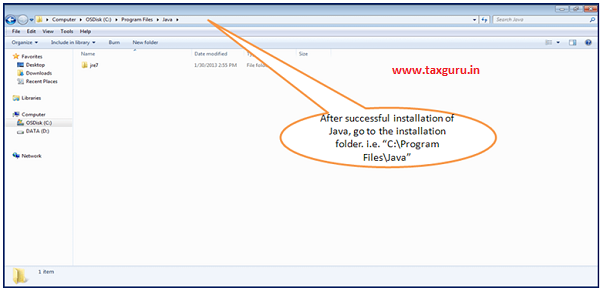

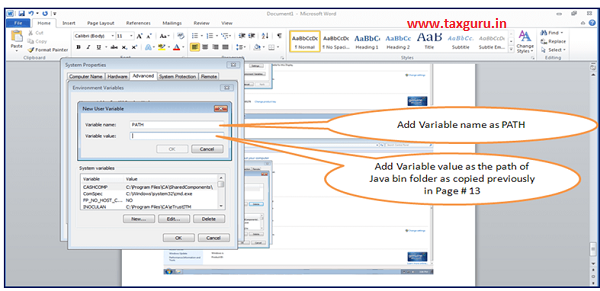

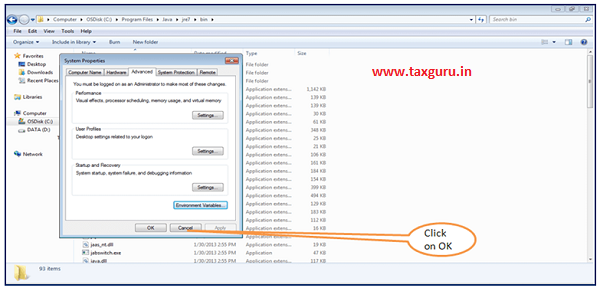

- To run this Utility, JAVA 8 update 45, JRE version 1.7 or above is required. Get the same from www.java.com and install (Steps are given in pages 10 to 22).

Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners

–

–

–

–

–

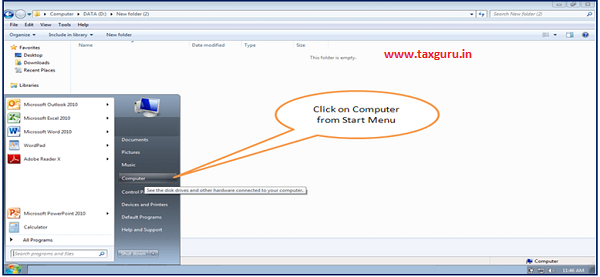

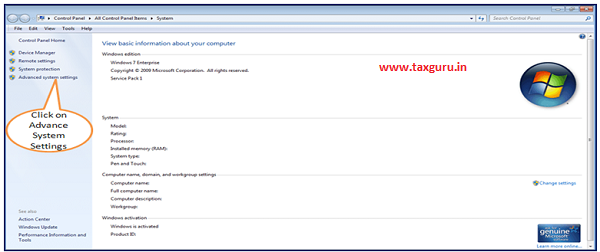

The screen may vary if Windows version is other than 7. Please look for „Advanced System Settings‟ option in the screen if it is different then what is shown above.

–

–

–

–

–

–

–

–

- Separate PDF files will be generated for each PAN and will be saved in the destination folder selected by you

- User can opt to manually sign Form 27D PDFs after printing them

Source- https://contents.tdscpc.gov.in

not working

tcs latest version convertor

Why Form 27D converter takes huge time to convert with digital signature.