Many Professionals / corporate are confused in relation to meaning of Micro and Small enterprises in respect of Notification dated 22.01.2019 by which ‘Specified Companies (Furnishing of information about payment to micro and small enterprise suppliers) Order, 2019‘ been passed by MCA.

In this editorial, author will discuss meaning of MSME for purpose of above Notification.

Legal Language:

Classification of enterprises.—(1) Notwithstanding anything contained in section 11B of the

Industries (Development and Regulation) Act, 1951 (65 of 1951),the Central Government may, for the purposes of this Act, by notification and having regard to the provisions of sub-sections (4) and (5), classify any class or classes of enterprises, whether proprietorship, Hindu undivided family, association of persons, co-operative society, partnership firm, company or undertaking, by whatever name called,—

(a) in the case of the enterprises engaged in the manufacture or production of goods pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (65 of 1951),as—

(i) a micro enterprise, where the investment in plant and machinery does not exceed twenty five lakh rupees;

(ii) a small enterprise, where the investment in plant and machinery is more than twenty-five lakh rupees but does not exceed five crore rupees; or

(iii) a medium enterprise, where the investment in plant and machinery is more than five crore rupees but does not exceed ten crore rupees;

Meaning of Medium Enterprise:

In the case of the enterprises engaged in the manufacture or production of goods, where the investment in plant and machinery is more than five crore rupees but does not exceed Rs. 100,000,000;

NOTE: Form MSME-1 is not applicable in case of Medium Enterprises.

As per notification dated 22.01.2019 “Every specified company shall file in MSME Form I details of all outstanding dues to Micro or small enterprises suppliers existing on the date of notification of this order within thirty days from the date of publication of this notification.”

I. What is meaning of Micro and Small enterprises:-

Micro and small Enterprises: as defined below:

Meaning of Micro Enterprise:

In the case of the enterprises engaged in the manufacture or production of goods, where the investment in plant and machinery does not exceed Rs. 25,00,000/-;

Meaning of Small Enterprise:

In the case of the enterprises engaged in the manufacture or production of goods, where the investment in plant and machinery is more than Rs. 2,500,000 rupees but does not exceed Rs. 50,000,000;

II. Whether for purpose of filing of e-form MSME-1 by specified Companies. Whether Micro or Small Companies required to obtain registration under MSME Act or not?-

As per language of MSME Act, 2006 no where it is mentioned that entity should be registered under MSME Act and fall under above limits shall considered as MSME.

Therefore as one school of thought, one can opine that an entity even not registered under MSME Act, 2006 however, falls under above mentioned limits shall be considered as Micro and Small Company for the purpose of MSME Form -1.

III. Which type of entities cover under Micro and Small entities?-

Micro and small Includes:

- Proprietorship, Hindu Undivided Family,

- Association of Persons, Co-Operative Society,

- Partnership Firm, Company or

IV. How to identify whether creditors entity falls under Micro and Small or not?-

For the purpose of reporting under MSME Form-1. Company should be aware that creditor’s entity is Micro or Small or not. Therefore, Company have to ask a declaration from the creditors whether they falls under Micro or small or not.

V. How many Disclosure Company have to make in respect of delay in payment to Micro and Small Company:

First: Specified Companies needs to file MSME Form -1 with ROC as per MCA notification dated 22nd January, 2019.

Second: As per Section 22 of MSME Act, 2006 “Where any buyer is required to get his annual accounts audited under any law for the time being in force, such buyer shall furnish the following additional information in his annual statement of accounts, namely:

(i)the principal amount and the interest due thereon (to be shown separately) remaining unpaid to any supplier as at the end of each accounting year;

(ii) the amount of interest paid by the buyer in terms of section 16, along with the amount of the payment made to the supplier beyond the appointed day during each accounting year;

(iii) the amount of interest due and payable for the period of delay in making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under this Act;

(iv) the amount of interest accrued and remaining unpaid at the end of each accounting year; and

(v) the amount of further interest remaining due and payable even in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise, for the purpose of disallowance as a deductible expenditure under section 23.

VI. Which are Specified Companies:-

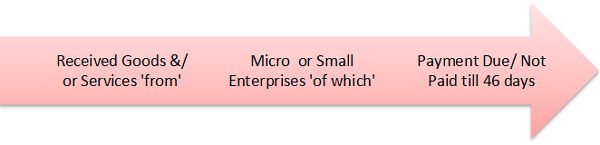

Every Company “Public or Private” if falls in below mentioned condition:

VII. Which form Specified Company required to file with ROC:-

Specified Companies are required to file returns with ROC in e-form MSME-1:

Two Type of Returns required filing by “Specified Companies” like:

- One Time Return

- Half Yearly Return

VIII. Which is due date of filing of “One Time Return”?

One time return required to file within 30 days of publication of these rules i.e. 20th February, 2019 (22nd January, 2019 + 29 days)

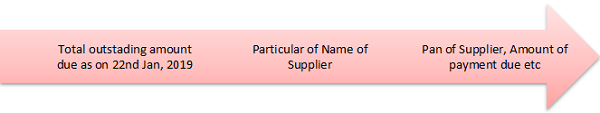

IX. In “One Time Return” which type of information required to submit with ROC?

X. Which is due date of filing of “Half Yearly Return”?

For Half year period ‘April to September’ 31st October

For half year period ‘October to March’ 30th April