Economic liberalization has resulted in robust growth over the years and has made India an attractive investment destination hub globally. COVID -19 pandemic has surely disrupted the growth chart but it is expected to regain the momentum soon making our country one of the fastest growing large economies. With an intent to promote foreign investment, Government has eased off the regulatory environment with a framework that is transparent and comprehensible.

Investment Route

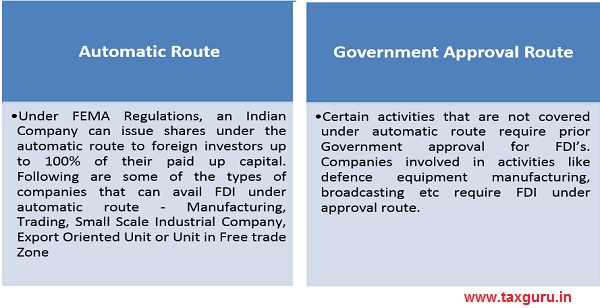

Foreign Direct Investment (FDI) in India can be made under the below routes:

- Automatic Route

- Government Approval Route

Share Allotment Process

Permissible Capital Instruments:

An Indian Company is permitted to issue capital instruments to a person resident outside India subject to entry routes, sectoral caps and guidelines specified for foreign investment. Capital Instruments to be considered under FDI are

- Equity Shares – to be issued in accordance with the provisions of Companies Act, 2013 and will include equity shares that have been partly paid

- Debentures – issued to be fully, compulsorily and mandatorily convertible

- Preference shares – issued to be fully, compulsorily and mandatorily convertible

- Share Warrants – issued on or after July 8,2014 will be considered as capital instruments

Investment in any other instrument shall be treated as borrowings.

Pricing Guidelines:

The price of the Capital Instruments of an Indian Company issued against the Foreign Direct Investment should not be less than:

- The price worked out in accordance with the relevant SEBI guidelines in case of a listed Indian company or in case of a company going through a delisting process as per the SEBI (Delisting of Equity Shares) Regulations, 2009or

- The valuation of capital instruments done as per any internationally accepted pricing methodology for valuation on an arm’s length basis duly certified by a Chartered Accountant or a SEBI registered Merchant Banker or a practicing Cost Accountant, in case of an unlisted Indian Company.

In case of convertible capital instruments, the price/conversion formula of the instrument is required to be determined upfront at the time of issue of the instrument. The price at the time of conversion should not in any case be lower than the fair value worked out, at the time of issuance of such instruments, in accordance with the extant FEMA regulations.

Manner of receipt of payment:

An Indian Company issuing shares under FDI should receive the share allotment money through any of the following two modes:

- Inward remittance through normal banking channel

- Debit to NRE / FCNR(B) / Escrow account maintained with an Authorised Dealer or Bank in India in accordance with Foreign Exchange Management (Deposit) Regulations, 2016

If the capital instruments are not issued by the Indian company within 60 days from the date of receipt of funds, then the funds are to be refunded within 15 days from date of completion of 60 days through the same channel as receipt of funds.

Reporting Guidelines:

The Reserve Bank of India has simplified the foreign investment reporting by Indian entities by consolidating different forms in one master form namely Single Master Form (SMF) on the Foreign Investment Reporting and Management System (FIRMS). The introduction of SMF has dispensed with the earlier two stage reporting i.e. first reporting after the receipt of money in Advance Reporting Form (ARF) and second after the allotment of shares in form FC-GPR. Now only one reporting is to be made after allotment in form FC – GPR (Foreign Currency – Gross Provisional Return).

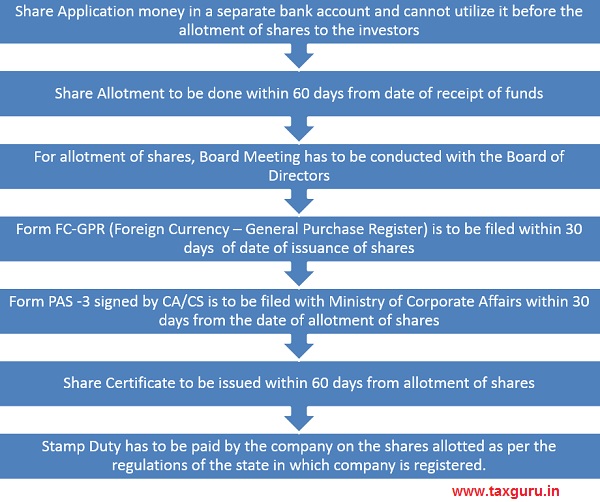

A. As per the Companies Act, 2013, the company has to keep the amount received as Share Application money in a separate bank account and cannot utilize it before the allotment of shares to the investors. Non compliance leads Promoters and Directors liable for a penalty upto the amount involved or INR 2 Crores whichever is higher. Also, company shall refund all the money to the subscribers within the period of 30 days from the day of penalty along with the interest of 12% p.a.

B. As per Ministry of Corporate Affairs the Company has to issue/ allot shares within 60 days from the date of receipt of funds.

C. For allotment of shares, Board Meeting has to be conducted with the Board of Directors.

D. A report in the form FC-GPR is to be filed with the Reserve Bank of India within 30 days from date of issuance of shares. The form covers the details of the investee company, main business activity for which investment is made, percentage of FDI as allowed by the FDI policy, route of investment, date of issue of shares, details of foreign investor, type of security issued.

The form should be filed along with the following documents:

- Certificate from the Company Secretary of the company accepting the investment

- Share valuation certificate by the Chartered Accountant for the shares issued to the foreign investor

- Board Resolution for the share allotment

E. Form PAS -3 signed by CA/CS is to be filed with Ministry of Corporate Affairs within 30 days from the date of allotment of shares. The form covers the details regarding:

- Type of security issued

- Date of Allotment

- Number of Allotment

- Amount of consideration received

- Whether the allotment of shares is for consideration other than cash

The form is to be attached with list of allottees of shares and Board Resolution.

F. Share Certificate is to be issued within 60 days from the allotment of shares.

G. Stamp Duty has to be paid by the company on the shares allotted as per the regulations of the state in which company is registered.

About the Author

Author is Ruchika Bhagat, FCA helping foreign companies in setting up and closure of business in India and complying with various tax laws applicable to foreign companies while establishing a business in India. Neeraj Bhagat & Co. Chartered Accountants, is a well-established Chartered Accountancy firm founded in the year 1997 with its head office at New Delhi.

Author is Ruchika Bhagat, FCA helping foreign companies in setting up and closure of business in India and complying with various tax laws applicable to foreign companies while establishing a business in India. Neeraj Bhagat & Co. Chartered Accountants, is a well-established Chartered Accountancy firm founded in the year 1997 with its head office at New Delhi.

Is there any procedure to be followed by a foreign investor holding shares in physical form, for bringing the share certificates into India? Also, are there any stamp duty implications for such instruments brought into India?

Is the procedure same if the shares are subscribed while forming the company itself ? is there share valuation and all other procedures required ?

Is the procedure same if the shares are subscribed while forming the company itself ? yes there is a same process. is there share valuation and all other procedures required- Share valuation is not required in case of MOA subscription.

Do let me know in case of any other concern.