The following are the various legal entities vide which business can be started in India

1. INDIAN COMPANY

The following are the models to set up business as an Indian company-

- Joint Venture

- Wholly Owned Subsidiary

N.B. :-

-

- The JV/Wholly Owned Subsidiary is set up as (i) Private Limited or (ii) Public Limited Company, as per Companies Act, 2013 and subject to sectoral caps and requisite approvals to be discussed in future Issues

2. FOREIGN COMPANY

The following are the models to set up business as a Foreign company in India –

Liaison Office (LO) –

> It represents the parent company in India. LO cannot undertake any commercial activity and acts as a channel of communication between the principal place of business or head office and entities in India. Its role is limited to collecting information about possible market opportunities and providing information about the company and its products to prospective Indian customers.

> Eligibility Criteria – Profit making track record during the immediately preceding three financial years in the home country and net worth of not less than $ 50,000 or its equivalent.

> Permitted activities – It can promote export/import from/to India and also facilitate technical/financial collaboration between the parent company and companies in India. It cannot earn any income in India.

Branch Office (BO) –

> It is established to undertake activities such as Export, Import, research, consultancy etc. BO can be set up by foreign companies.

> Eligibility Criteria – Profit making track record during the immediately preceding five financial years in the home country and net worth of not less than $ 100,000 or its equivalent.

> Permitted activities – The permitted activities include export/import of goods; rendering professional or consultancy services; carrying out research work, in which the parent company is engaged; promoting technical or financial collaborations between Indian companies and parent or overseas group company; representing the parent company in India and acting as buying/selling agents in India; rendering services in information technology and development of software in India; rendering technical support to the products supplied by the parent/ group companies and foreign airline/shipping company.

Project Office – PO can be set up to execute specific projects in India and cannot undertake or carry on any activity other than the activity relating and incidental to the execution of the project.

N.B. :-

- RBI guidelines regarding the establishment of LO/ BO/ PO shall be discussed in future Issues.

- As per Companies Act 2013, only a resident Indian with PAN to be appointed for receiving notices in India for foreign company.

PROCEDURE TO SET UP BO/LO/PO –

# The application for establishing BO/LO/PO in India may be submitted by the non-resident entity in Form FNC to a designated AD Category-I bank along with the prescribed documents mentioned in the Form and the LOC, wherever applicable.

# There is a general permission to non-resident companies to establish POs in India, provided they have secured a contract from an Indian company to execute a project in India.

# The Annual Activity Certificate (AAC) as at the end of March 31 each year along with the audited financial statement needs to be submitted before 30th September.

# BOs are permitted to remit outside India profit of the branch net of applicable Indian taxes, on production of the specified documents to the satisfaction of the AD Category-I bank through whom the remittance is effected.

# A foreign company establishing a place of business in India should submit within 30 days to ROC Copy of balance sheet and P&L account with English translation and list of places of business established by the foreign company in India. Audit of accounts of foreign company shall be conducted by practicing CA.

3. LIMITED LIABILITY PARTNERSHIP

The following are the models to set up business in India through a LLP-

- LLP

Subject to provisions of LLP Act, 2008

N.B. :-

- FDI is permitted under automatic route in LLPs operating in sectors/ activities where 100% FDI is allowed, through the automatic route and there are no FDI-linked performance conditions

APPROVALS REQUIRED FOR FOREIGN DIRECT INVESTMENT –

# Foreign investment is permitted up to 100% on the automatic route IN MOST CASES except in few cases where there are sectoral Caps.

# Aggregate foreign portfolio investment up to 49% of the paid-up capital on a fully diluted basis or the sectoral or statutory cap, whichever is lower, shall not require Government approval or compliance of sectoral conditions as the case may be, if such investment does not result in transfer of ownership and control of the resident Indian company from resident Indian citizens or transfer of ownership or control to persons resident outside India and other investments by a person resident outside India shall be subject to the conditions of Government approval and compliance of sectoral conditions as laid down in these rules.

# The onus of compliance with the sectoral or statutory caps on such foreign investment and attendant conditions, if any, shall be on the company receiving foreign investment.

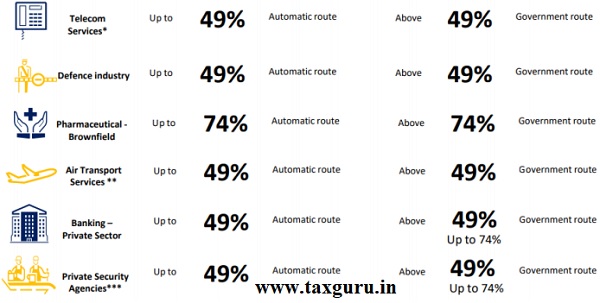

SECTORS WISE STUDY

100% FDI permitted through Automatic route * (Check Details FDI policy)

100% FDI permitted through Government Route * (Check Details FDI policy)

Up to 100% FDI permitted through Government + Automatic route * (Check Details FDI policy)

Up to 51% FDI permitted through Government/ Automatic route * (Check Details FDI policy)

Prohibited Sectors* (Check Details FDI policy)