RBI has mandated ALL BANKS to make it mandatory for corporate borrowers having aggregate fund-based and non-fund based exposure of Rs. 5 crore and above from any bank to obtain Legal Entity Identifier (LEI) registration and capture the same in the Central Repository of Information on Large Credits (CRILC). This will facilitate assessment of aggregate borrowing by corporate groups, and monitoring of the financial profile of an entity/group. This requirement will be implemented in a calibrated, but time-bound manner. The schedule is given herein below:

Schedule for implementation of LEI

| Total Exposure to SCBs | To be completed by |

| Rs. 1000 crore and above | Mar 31, 2018 |

| Between Rs.500 crore and Rs. 1000 crore | Jun 30, 2018 |

| Between Rs. 100 crore and Rs. 500 crore | Mar 31, 2019 |

| Between Rs. 50 crore and Rs. 100 crore | Dec 31, 2019 |

What is Legal Entity Identifier Code and why it is required for my organization?

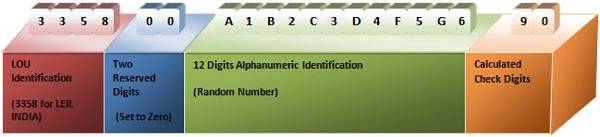

The Legal Entity Identifier (LEI) is a global reference number that uniquely identifies every legal entity or structure that is party to a financial transaction, in any jurisdiction. LEIL will assign LEIs to any legal identity including but not limited to all intermediary institutions, banks, mutual funds, partnership companies, trusts, holdings, special purpose vehicles, asset management companies and all other institutions being parties to financial transactions.

LEI will be assigned on application from the legal entity and after due validation of data. For the organization, LEI will

- Serve as a proof of identity for a financial entity

- Help to abide by regulatory requirements

- Facilitate transaction reporting to Trade Repositories

The structure of the global LEI is determined in detail by ISO Standard 17442 and takes into account Financial Stability Board (FSB) stipulations.

The process to obtain the LEI is given herein below:

1. Self registration with the LEI

2. Courier following documents to the LEI:

i. Board Resolution

ii. Declaration

iii. Annual Report

3. Verification of documents.

4. After successful verification of documents a Fees of Rs. 7000+18% GST i.e. Rs. 8260/- is to be paid (by way of NEFT or DD) for issuance of LEI.

5. After successful payment verification, LEI number is issued and an email is sent to the legal entity which is to be provided to all Banks of the Company.

We should immediately apply for the issuance of Legal Entity Identifier Code.

(In case of any queries, author can be reached at ankursrivastavacs5985@gmail.com)