‘Foreign Direct Investment’ means an investment by a Resident Person outside India, through equity instruments. The FDI may in an unlisted Indian Company; or if in a listed Indian Company, then it can be ten percent or more of the post issue paid-up equity capital on a fully diluted basis.

Foreign Investment

“Foreign Investment” means any investment made by a person Resident outside India on a repatriable basis, in equity instruments of an Indian Company or to the capital of an LLP.

Foreign Portfolio Investment

“Foreign Portfolio Investment” means any investment made by a person Resident outside India, through equity instruments where such an investment is less than ten percent of the post issue paid-up share capital on a fully diluted basis of a listed Indian Company, or less than ten percent of the paid-up value of each series of an equity instrument of a listed Indian company.

How the funding can be done

The Indian Company shall receive the consideration by way of

1) Inward Remittance through banking channel

2) Debit to NRE/FCNR Account

3) Debit to Non Interest bearing Escrow account in INR with an AO Bank

4) Conversion of Import payable of Capital goods, pre incorporation expense

5) Share Swaps

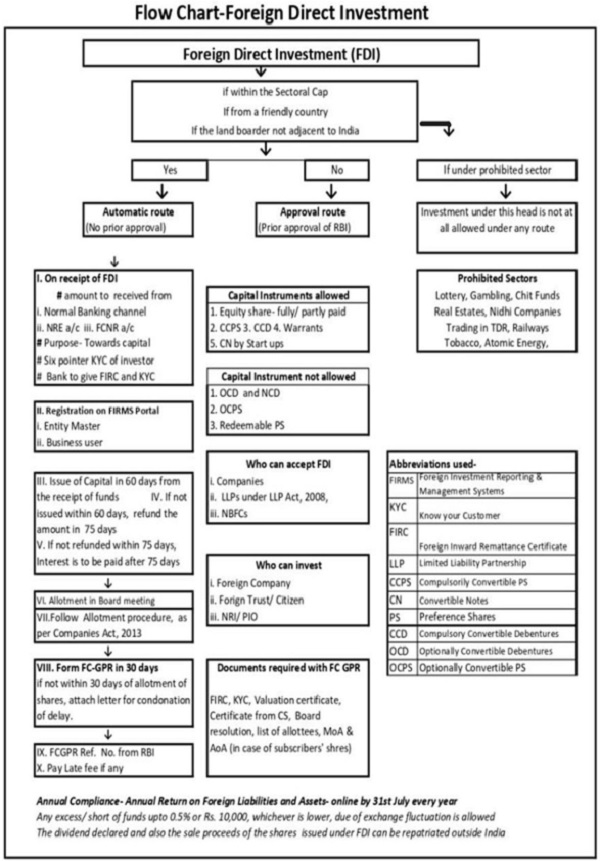

Routes available for an FDI Investment

There are two routes available for FDI: Automatic route and Approval route.

Automatic Route

1) No prior approval required

2) Subject to other applicable conditions

Approval Route

Prior approval required from the Government of India

Permissible sectors for FDI in India:

100% Automatic Route:

1) Agriculture and Animal Husbandry,

2) Air-Transport Services (Non-Scheduled Air Transport Service/Helicopter services/Seaplane services requiring Directorate General of Civil Aviation (DGCA) approval), Airports (Greenfield + Brownfield),

3) Asset Reconstruction Companies,

4) Auto- components, Automobiles,

5) Biotechnology (Greenfield),

6) Broadcast Content Services (Up-linking and down-linking of TV channels, Broadcasting Carriage Services),

7) Capital Goods,

8) Cash and Carry Wholesale Trading (including sourcing from MSEs)

9) Chemicals, Coal and Lignite,

10) Construction Development, Construction of Hospitals,

11) Credit Information Companies,

12) E-commerce activities, Electronics Systems

13) Food Processing,

14) Gems and Jewellery,

15) Healthcare,

16) Industrial Parks,

17) IT and BPM,

18) Leather,

19) Manufacturing,

20) Mining and Exploration of metals and non-metal ores

21) Other Financial Services

22) Services under Civil Aviation Services such as Maintenance and Repair Organisations

23) Petroleum and National gas,

24) Pharmaceuticals,

25) Plantation sector

Permissible sectors for FDI in India:

100% Automatic Route:

1) Ports and Shipping.

2) Railway Infrastructure

3) Renewable Energy

4) Roads and Highways

5) Single Brand Retail Trading,

6) Textiles and Garments,

7) Thermal Power,

8) Tourism and Hospitality

9) White Label ATM Operations,

10) Insurance and Insurance Intermediaries

Up to 100% Automatic Route:

1) Infrastructure company in the Securities Market- up to 49%

2) Insurance- up to 49%

3) Medical devices- up to 100%

4) Pension- up to 49%

5) Petroleum Refining (By PSUs)- up to 49%

6) Power Exchanges- up to 49%

Up to 100% FDI permitted under Automatic and Government:

Airport transport services (Scheduled Air Transport Service/Domestic Scheduled Passenger Airline; Air Transport Service) – up to 49% (auto) (up to 100% under automatic route for NRIs) + above 49% (Government)

Permissible Sectors for FDI in India:

Up to 100% FDI permitted under Automatic and Government:

1) Banking (Private Sector)- up to 49% (auto) + above 49% (Government)

2) Bio Technology (brownfield) – up to 74% (auto) + above 74% (Government)

3) Defence- up to 74% (auto) + above 74% (Government)

4) Healthcare (Brownfield)- up to 74 % (auto) + above 74% (Government)

5) Pharmaceuticals (Brownfield)- up to 74% (auto) + above 74% (Government)

6) Private Security Agencies – up to 74% (auto) + above 74% (Government)

7) Telecom Services – up to 49% (auto) + above 49% (Government)

All the information pertaining to the sectors as stated above, is in line with the extant consolidated FDI Policy issued by DPIIT, as Amended from time to time.

On Apr 22,2020, the Government has notified that FDI from countries which share land border with India or the beneficial owner of an investment into India who is situated in or is a citizen of any such country, shall invest only with the Government Approval.

List of countries sharing land border with India is as follows:

Pakistan, Afghanistan, China(Including Hong Kong and Macau), Nepal, Bhutan, Bnagladesh, Myanmar.

Prohibited Sectors for FDI

1) Gambling and betting including Casinos

2) Chit Funds

3) Nidhi Companies

4) Trading in Transfer Development Rights (TDRs)

5) Real Estate Business* or construction of Farm House

6) Manufacturing Cigars etc.

7) Lottery- Online/Government or Private

Real Estate Business*

Dealing in land and immovable property with a view to earning profit therefrom, which does not include the development of townships, construction of residential/commercial premises, roads, nridges,etc.

Real Estate Broking services is excluded from the definition.

Types of Capital Instruments that can be issued:

1) Equity Shares

Equity shares are those issued in accordance with the provisions of the Companies Act, 2013 and will include Equity Shares that have been partly paid. Equity Shares are transferable i.e. ownership of the Equity Shares can be transferred with or without consideration to the other person.

2) Share Warrants

Share Warrants are those issued by an Indian Company in accordance with the Regulations issued by the Securities and Exchange Board of India in this regard. It is an option issued by the company that gives the warrant holder a right to subscribe Equity Shares at a pre-determined price or after a pre-determined time Bond

3) Preference Shares

A share which entitles the holder to a fixed dividend and whose payment takes priority over that of ordinary share dividends, Preference Shares are fully, compulsorily and mandatorily convertible preference Shares.

4) Debentures

Debentures are fully, compulsorily and mandatorily convertible debentures

Types of Capital Instruments that can be issued:

1. Rights Issue or Bonus Issue

Issuance of Equity Shares to the existing shareholder of the company, as per the Companies Act 2013

2. Employee Stock Options Scheme and Sweet Equity Shares

Shares issued to employees/directors or employees/directors of its holding company or a joint venture or wholly owned overseas subsidiary/subsidiaries who are Residents outside India

Convertible Notes

It is an instrument issued by a start up company evidencing receipt of money initially as debt, which is repayable at the option of the holder, or which is convertible into such number of Equity Shares of such a start up company, within a period not exceeding five years from the date of issue of the convertible note, upon occurrence of specified events as per the terms and conditions agreed.

Documents for the settlement of Remittances:

The following documents would be required for settlement of funds (first allotment as well as the transfer of the Transfer of Equity Instruments)-

1) FDI Declaration and Disposal Instructions for credit

2) A 6-Pointer KYC of the investor/remitter.

3) If the FDI is under the Government Approval route, a copy of the Government approval document is required.

Disclaimer: This article has been prepared in good faith on the basis of information available on the date of publication without any independent verification. The Author does not guarantee or warrant the accuracy, reliability, completeness or currency of the information in this publication nor its usefulness in achieving any purpose. The Author will not be liable for any loss, damage, cost or expenses incurred or arising by reason of any person using or relying on information in this publication. Readers are requested to consult a professional before taking any action.

(Author – Sonika Bharati, FCS, LL.B. is a Company Secretary in Practice from Delhi and can be contacted at sonika.bharati@gmail.com)