Introduction: The concept of Updated Return under the Income-tax Act offers relief to taxpayers, allowing them to rectify errors or omissions post the filing deadline. This article explores the need for updated returns, its implications, and the procedure for filing, providing valuable insights into this crucial aspect of tax compliance.

Need for the concept of Updated Return

If the timeline to file the Income-tax Return (“ITR”) has been passed, earlier the only way to file the return is by filing condonation application (manual) under section 119(2)(b) of the Income-tax Act (“the Act”) with the jurisdictional Principal Commissioner of Income-Tax (“PCIT”) except if the case is under Assessment. If the PCIT is satisfied with the reason for delay in filing the ITR, then they will provide an approval, grant condonation & also provide a letter with a unique number, which will be incorporated in the ITR. The process of obtaining condonation is not much used process as it involves lot of time & cost for the taxpayer.

In order to provide relief and give more time to the taxpayer to file ITR, Government of India vide Finance Act 2022 introduced the concept of Updated Return u/s 139 (8A) of the Act. Further, Form ITR-U was introduced for filing the Updated Return.

As per the Memorandum to the Budget 2022 introduced, it was mentioned that the provisions of Updated Return were inserted to bring use of huge data with the IT Department to a logical conclusion resulting in additional revenue realization and on the other hand, it will facilitate ease of compliance to the taxpayer in a litigation free environment.

Firstly, Updated Return cannot be filed in the following cases:

a) If the return is of a loss [Therefore, as per provisions contained in section 139(3), return of loss is required to be filed within the due date prescribed u/s section 139(1)] except if the original return filed is a return of loss and now the taxpayer wants to file updated return where the return is a return of income, then he is allowed to file update return; or

b) If the return has the effect of decreasing the total tax liability determined on the basis of return furnished u/s 139(1) or 139(4) or 139(5); or

c) If the return results in increase of refund due on the basis of return furnished u/s 139(1) or 139(4) or 139(5); or

d) Where a search has been initiated u/s 132 or books of accounts or other documents or any assets are requisitioned u/s 132A; or

e) a survey has been conducted u/s 133A, other than sub-section (2A) of that section; or

f) a notice has been issued to the effect that any money, bullion, jewellery or valuable article or thing, seized or requisitioned u/s 132 or section 132A in the case of any other person belongs to the taxpayer; or

g) a notice has been issued to the effect that any books of account or documents, seized or requisitioned u/s 132 or section 132A – in the case of any other person, pertain or pertains to, or any other information contained therein, relate to, such taxpayer; or

h) Where updated return has already been filed for the relevant assessment year; or

i) any proceeding for assessment or reassessment or recomputation or revision of income under this Act is pending or has been completed for the relevant assessment year in his case; or

j) the Assessing Officer has information in respect of such taxpayer for the relevant assessment year in his possession under the Smugglers and Foreign Exchange Manipulators (Forfeiture of Property)Act, 1976 or the Prohibition of Benami Property Transactions Act, 1988 or the Prevention of Money-laundering Act, 2002 or the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 and the same has been communicated to him, prior to the date of furnishing of return under this sub-section; or

k) information for the relevant assessment year has been received under an agreement referred to in section 90 or section 90A of the Act in respect of such person and the same has been communicated to him, prior to the date of furnishing of return under this sub-section; or

l) any prosecution proceedings under the Chapter XXII have been initiated for the relevant assessment year in respect of such person, prior to the date of furnishing of return under this sub-section; or

m) he is such person or belongs to such class of persons, as may be notified by the Board in this regard.

From the above, government’s intention is clear that the option of updated return will not be given in case there is a loss of revenue to the government or the matter is under litigation or the Assessing Officer has the information under other Acts which causes to believe that the taxpayer has escaped income or done any illegal acts.

Tax on Updated Return

1. Where no ITR has been furnished u/s 139(1) or 139(4) of the Act and tax is payable on the basis of updated return to be furnished, the following taxes should be reduced from the gross tax payable:

a) Advance Tax;

b) TDS or TCS;

c) Relief u/s 89 of the Act;

d) Relief u/s 90 or 90A or 91 of the Act; and

e) Tax Credit to be set off with provisions of section 115JAA or section 115JD

The taxpayer is liable to pay tax along with interest and fee for any delay in furnishing the return or any default or delay in payment of advance tax along with Additional Income-tax computed.

2. Where ITR has been furnished u/s 139(1) or 139(4) or 139(5) of the Act and tax is payable on the basis of updated return to be furnished after increasing the amount of refund issued, if any, in respect of earlier return filed. The following taxes should be reduced from the gross tax payable:

a. Amount of relief or tax referred in section 140A(1) of the Act which was taken in earlier return;

b. TDS or TCS on income which has not been included in the earlier return;

c. Relief u/s 90 or 90A or 91 of the Act on such income which has not been included in the earlier return; and

d. Tax Credit to be set off with provisions of section 115JAA or section 115JD of the Act

The taxpayer is liable to pay tax along with interest for any default or delay in payment of advance tax along with Additional Income-tax computed and reduced by the amount of interest paid under the provisions of the Act in the earlier return.

| Additional Income-Tax Payable | Time Limit for ITR to be filed |

| 25% of Total Tax and Interest Payable | Within 12 months from the end of relevant Assessment Year |

| 50% of Total Tax and Interest Payable | Within 24 months from the end of relevant Assessment Year |

Note – Additional Income-Tax payable shall include surcharge and cess.

Timelines for filing Updated Return

Updated return can be filed within 24 months from the end of relevant assessment year. Further, due date for filing updated return in respective of few assessment years is given below:

| Financial Year (FY), Assessment Year (AY) | Due Date |

| FY 2020-21 (AY 2021-22) | 31-03-2024 |

| FY 2021-22 (AY 2022-23) | 31-03-2025 |

| FY 2022-23 (AY 2023-24) | 31-03-2026 |

| FY 2023-24 (AY 2024-25) | 31-03-2027 |

| FY 2024-25 (AY 2025-26) | 31-03-2028 |

| FY 2025-26 (AY 2026-27) | 31-03-2029 |

Manner of filing Updated Return

An updated return shall be filed electronically under Digital Signature Certificate (DSC) in case of the following taxpayers:

(a) Company

(b) Political Party

(c) Any person whose accounts are required to be audited under Section 44AB of the Income-tax Act except person filing return in ITR-7.

For other taxpayers, the updated return shall be filed electronically either under DSC or under Electronic Verification Code (EVC).

Updated Return can be filed online through following steps :

Step-1: Login to your Account on Income-tax e-filing portal with PAN and password

Step-2: Click on e-file, press Income Tax Return and press File Income Tax Return

Step-3: Select Assessment Year, select filing type as 139(8A) – Updated Return, select whether audited u/s 44AB or political party as per section 13A, press ITR type you require to file and click on continue.

Further, updated return can be filed through Excel Utility by selecting Filed u/s – 139(8A)-Updated Return under Income Details Tab and Part-A Gen 139(8A) Tab will be auto-populated.

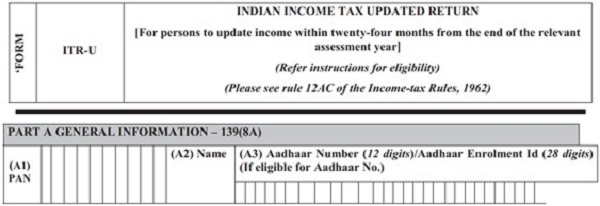

Form of ITR-U – ITR-U is incorporated in every ITR form which you will select while filing the ITR.

Provide the general information relating to PAN, Name and Aadhaar Number.

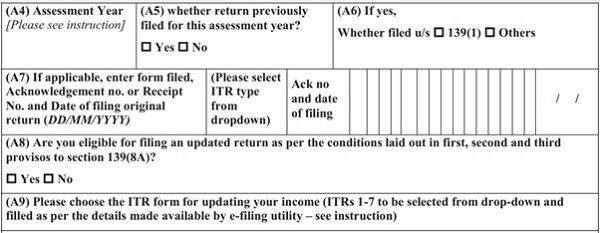

Provide information relating to whether tax return was earlier filed and if yes, under which section [139(1), 139(4), 139(5)], acknowledgment number, type of ITR form, date of filing.

Further, provide your confirmation whether you are eligible to file updated return along with ITR Form you are choosing to file in Updated Return.

Provide reasons for filing Updated Return, the period during which you are filing the Updated Return to calculate the additional amount of Income-tax payable and whether Updated Return is filed to reduce carried forward loss or unabsorbed depreciation, if yes, provide the details.

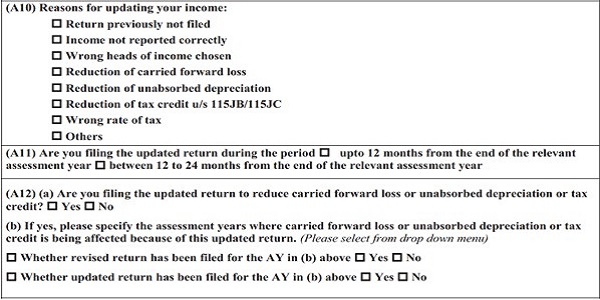

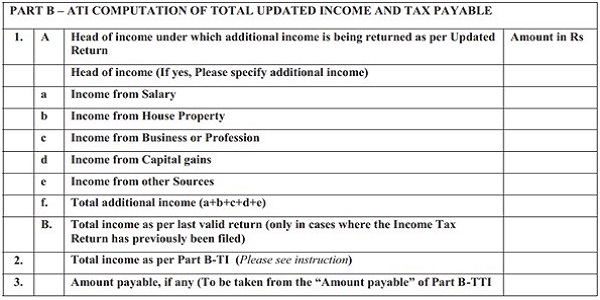

Provide all sources of income, any additional income to be included, amount payable etc.

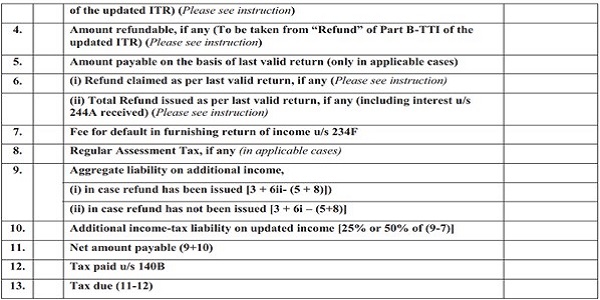

Provide amount refundable, refund claimed in the earlier return filed. Aggregate income tax liability, additional income tax liability, net tax due will be computed.

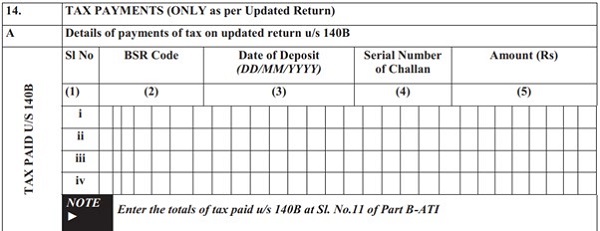

Provide the details of additional taxes paid on updated return u/s 140B of the Act.

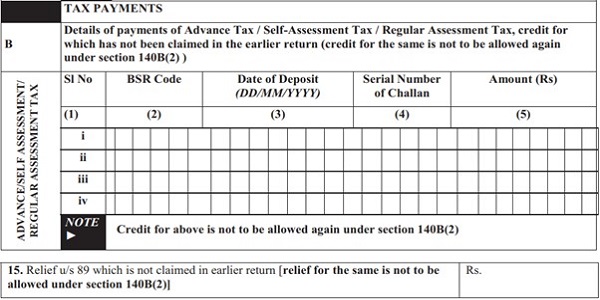

Provide the details of Advance Tax, Self-Assessment Tax and Regular Assessment Tax, credit for which has not been claimed in the earlier return filed.

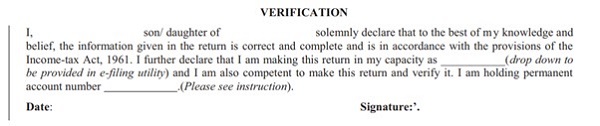

Verification details will be auto-populated while preparing the ITR.

Conclusion: With the introduction of Updated Return provisions, taxpayers gain flexibility and relief in rectifying errors or omissions in their income tax filings beyond the deadline. Understanding the nuances of this concept is crucial for ensuring compliance and avoiding unnecessary penalties.

*****

Disclaimer: This article serves an educational purpose and should not be considered as professional advice. Consultation with a qualified individual is recommended before making any decisions based on the content provided. The author bears no responsibility for any actions taken based on this article.