Finance Act 2020 applicable for AY 2021-22 has altered the provisions for Indian Citizens and Persons of Indian Origin (PIO). Accordingly the period of 182 days specified in the Explanation for Indian citizen and person of Indian origin with total income other than income from foreign sources more than Rs. 15 Lacs, has been reduced to 120 days.

The Finance Act 2020 also introduced the concept of Deemed Resident i.e. according to the new Provision introduced, those Indian citizens having total Income other than Income from foreign sources exceeds Rs. 15 lacs, who don’t have a domicile or residence in any other country, will be Deemed to be Resident of India.

1st Amendment: Reduced period of 120 days as against 182 days for Residential Status u/s. 6

1.1 Conditions to be satisfied for applicability

The following conditions are required to be fulfilled cumulatively for the individual to be considered as a Not Ordinary Resident pursuant to the amendment:

1. Total Income during the year, other than income from foreign sources, should exceed Rs. 15 lakh; and

2. Total Stay in India during the year should be more than 119 days, but less than 182 days; and

3. The Period of Stay in India in the immediately preceding 4 years should be 365 days or more

4. Individual should be Indian Citizen or Person of Indian Origin (PIO), who being outside India, comes on a visit to India during the year.

However, such individuals will be considered as “Resident but Not Ordinarily Resident (RNOR)”

Kindly Note that in case assessee is being treated as Resident in two countries, then Tie Breaker rule as per DTAA will apply and assessee will be treated as Resident of only country. So before finalizing residential status of any individual, kindly refer DTAA with respective country as well.

Such Indian citizens whose period of stay in India is 182 days or more were anyway considered as Residents and will continue to be considered as residents. Thus, there will be no impact on such individuals

| Sr. No. | Stay of individual in India during the financial year | Total Income (other than income from foreign sources) | Indian Citizen or PIO with stay in India in the immediately preceding 4 years exceeds 365 days? | Residence status of individual (before amen-dment) |

Residence status of individual (after amen-dment) |

Amen-dment has any Impact? |

| 1 | Less than 120 days | More than Rs.15 Lakh | Exceeds 365 days / Don’t Exceed | Non Resident | Non Resident | No |

| 2 | Less than 120 days | Less than or equal to Rs. 15 Lakh | Exceeds 365 days / Don’t Exceed | Non Resident | Non Resident | No |

| 3 | 120 days or more, but less than 182 days | Less than or equal to Rs. 15 Lakh | Exceeds 365 days / Don’t Exceed | Non Resident | Non Resident | No |

| 4 | 120 days or more, but less than 182 days | More than Rs.15 Lakh | Exceeds 365 days | Non Resident | Resident but Not Ordinary Resident | Yes |

| 5 | 120 days or more, but less than 182 days | More than Rs.15 Lakh | Don’t exceed 365 days | Non Resident | Non Resident | No |

| 6 | 182 days or more | Any Level of Income | Exceeds 365 days / Don’t Exceed | Resident | Resident | No |

1.2 Tie Breaker as per DTAA

An individual is a resident of both Contracting State (i.e. being treated as Resident in Two Countries as per Tax Law), then his status shall be determined as follows:

(a) he shall be deemed to be resident of the State in which he has a permanent home available to him ; if he has a permanent home available to him in both States, he shall be deemed to be a resident of the State with which his personal and economic relations are closer (centre of vital interests)

(b) if the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident of the State in which he has an habitual abode;

(c) if he has an habitual abode in both States or in either of them, he shall be deemed to be a resident of the State of which he is a national ;

(d) if he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement.

Importance of tie breaker rule to increase as an individual is more likely to qualify as resident of both countries pursuant to the amendment

Permanent home: Permanent home means a home arranged and retained for permanent use; not intended for short duration

Personal relations: family and social relations

Economic relations: place of business, major source of income etc

Habitual abode: Frequency, duration, and regularity of stays that are part of the settled routine of an individual’s life

Nationality: Country of which the individual is a national

Competent authorities: Both the countries to determine the residential status if residential status cannot be determined by applying the tie breaker rule

Some Important rulings on tie breaker rule application in case of individuals:

- DR. Rajnikant R. Bhatt versus CIT, [1996] 222 ITR 562, AAR

- DCIT v. Shri Kumar Sanjeev Ranjan, IT Appeal No. 1655 (Bang.) of 2017, ITAT Bangalore

- Mohsinally Alimohammed Rafik, In Re, [1995] 213 ITR 317, AAR

- Mrs. Shalini Seekond versus ITO, I.T.A. No. 3877/ Mum/2012, ITAT Mumbai

1.3 Scope of Taxability

Resident (Ordinary Resident) ROR is taxed on its global income in India arising during the Financial Year

Non-resident (NR) is taxed only on income that is received in India or the income that accrues or arises in India during the Financial Year. Income that accrues or arises outside India is not taxable in India in the hands of Non-resident

Resident but Not Ordinary Resident (RNOR) is taxed on income that is received in India or that accrues or arises in India or the income that accrues outside India but is derived from a business controlled in or profession set up in India during the Financial Year. Any other income that accrues or arises outside India is not taxable in the hands of RNOR

1.4 Meaning of Foreign Sources

The new provisions will be applicable only if the ‘total income, other than the income from foreign sources, exceeds Rs 15 lakhs’.

“Income from foreign sources” has been defined to mean income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India) Thus, for computing the threshold of 15 lakhs, the total income will include any income (other than income that accrues or arises outside India, except where such income is derived from a business controlled in or a profession set up in India)

The following incomes will be includible while computing the threshold of 15 lakhs:

a) income that accrues or arises in India or is deemed to accrue or arise in India,

b) Income that is received in India or is deemed to be received in India,

c) Income that accrue or arise outside India but is derived from a business controlled in or a profession set up in India

1.5 Examples of Incomes to be Included in 15 Lakhs

Examples of income includible while examining the applicability of threshold of INR 15 Lakhs:-

√ Dividend or interest income received from a resident in India,

√ Income from business controlled in or profession set up in India

√ Capital gain arising on transfer of a shares of a company which derives its value substantially from property situated in India

√ Rental Income from a property situated in India

√ Capital gain arising on transfer of shares of an Indian company

√ Capital gain arising from transfer of a an property situated in India

1.6 Examples of Incomes not to be Included in 15 Lakhs

Examples of income not includible while examining the applicability of threshold of INR 15 Lakhs

√ Salary income received on account of services rendered outside India

√ Dividend income arising from overseas sources

√ Rental income from property situated outside India

√ Business income from overseas sources having no nexus with India

√ Capital gain arising on transfer of properties situated outside India

√ Interest income arising from overseas sources

1.7 Exempt Incomes: Interest on NRE & FCNR A/c

√ Exemption in respect of Interest on NRE account balance that is available to a non-resident as per FEMA;

√ Exemption in respect of interest on FCNR deposits that is available to a non-resident or a RNOR – Hence No Effect of Amendment

Such income should not be included while computing total income for evaluating applicability of INR 15 lakhs threshold as the term used is ‘total income’ and exempt income does not form part of total income

Section 10(4)(ii) provides exemption to an individual who is a ‘person resident outside India’ as defined in clause (w) of section 2 of the Foreign Exchange Management Act, 1999 or is a person who has been permitted by the Reserve Bank of India to maintain the aforesaid Account in respect of any income by way of interest on moneys standing to his credit in a Non-Resident (External) Account in any bank in India in accordance with the Foreign Exchange Management Act, 1999, and the rules made thereunder

The above said exemption is not linked to resident status under the Income Tax Act but with resident status under FEMA. Under FEMA, a person resident outside India means a person either whose stay in India is less than 183 days or a person who has gone out of India or who stays outside India for taking an employment outside India or for carrying on business outside India or who has an intention to stay outside India for an uncertain period. Thus, the amendment in definition of resident under the Income Tax Act will have no bearing on such exemption which will continue to be available as long as the taxpayer is a nonresident under FEMA.

2nd Amendment: Concept of Deemed Resident

2.1 Concept of Deemed Resident

An individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding Rs. 15 lakh rupees during the year shall be deemed to be resident in India in that year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature. Such deemed residents will be considered to be ‘Resident but not Ordinarily Resident’ under the Act

2.2 Meaning of ‘Not Liable to Tax’

‘Not liable to tax’ is not the same as ‘exemption from tax’ or “non-payment of tax’ or ‘not being subject to tax’. Expression ‘liable to tax’ does not necessarily imply that person should actually be liable to tax; it is enough if other contracting State has right to tax such person, whether or not such a right is exercised.

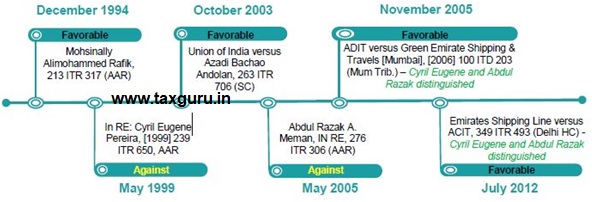

2.3 Judgments regarding ‘Not Liable To Tax’

2.4 Impact of Amendment

The impact of the amendment on such Indian Citizens who qualify as deemed resident (RNOR) pursuant to the amendment will be the same as explained earlier in respect of such Indian citizens who will now be considered as RNOR on account of period of stay in India exceeding 119 days as against 181 days earlier.

However, in case assessee becomes Resident of two countries, then Residential Status as per tie-breaker of DTAA will be referred. (as explained above)

About the Author

Author of the article is NRI Taxation Expert at firm ‘Journey2Tax’ dealing in Tax Compliance of Income Tax, TDS, GST & Company Law, can be reached at email journey2tax@gmail.com for any assistance, guidance, queries, issues & recommendations.

Disclaimer

Please refer all the relevant section, rules, notifications and amendments as applicable. The Author is not responsible for any losses incurred.