As a prospective buyer of a property, it is important for one to check if the property is situated at a place that has got good re-sale value, good groundwater levels, neat ambiance, and proximate amenities. But apart from the above, it is also mandatory to know the legal aspects with respect to Income Tax Act which you must know before purchasing a property in India.

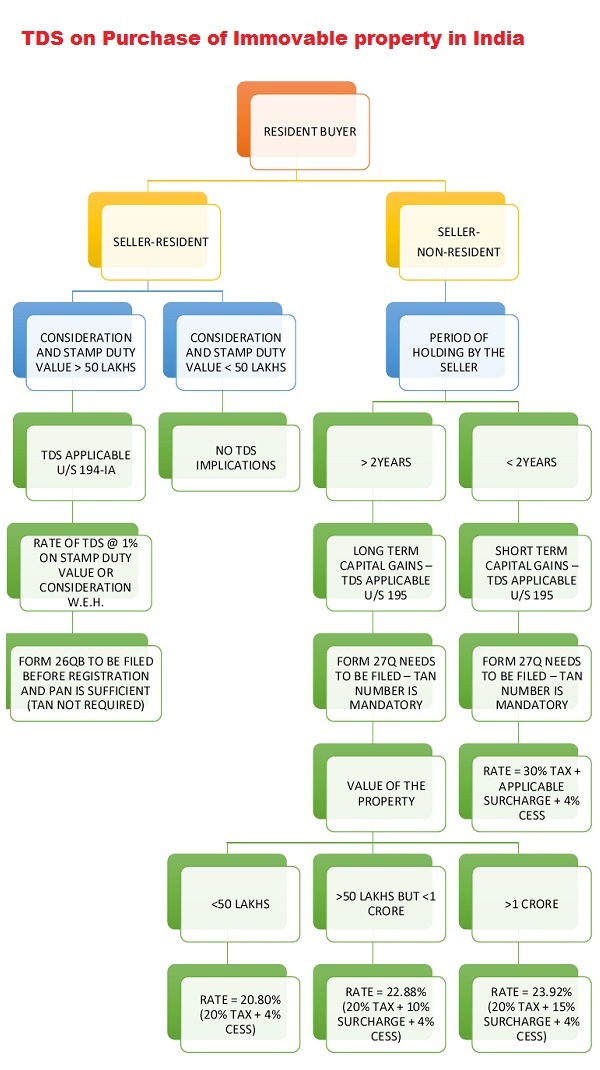

If you are a resident of the country, i.e., you have stayed in India for a period of more than 182 days, and if you are purchasing a property from another resident seller, you have an obligation to deduct TDS if either the consideration or the stamp duty value of the property you purchase is exceeding Rs. 50 lakhs, which is as per Section 194-IA of the Income Tax Act. The applicable rate of TDS is 1% of the value of the consideration paid or the stamp duty value whichever is higher. Here consideration includes all charges in the nature of club membership fees, car parking fees, electricity or water facility fee, maintenance fees, advance fees, or any other charges of similar nature, which are incidental to the transfer of immovable property. This TDS must be deducted at the time of payment made to the resident seller and it has to be deposited to the government within 30 days from the end of the month of deduction. A form 26QB also has to be filed by the buyer wherein he has to fill in the details of the buyer, details of the seller, and the details of the property transferred. This is a mandatory form before registering the property in your name. TDS certificate in Form 16B shall be generated and sent to the seller within 15 days of filing form 26QB.

Whereas if a resident is purchasing an immovable property from a non-resident, then the rules are slightly different. The TDS has to be deducted under Section 195 in this case and you need to obtain the TAN number mandatorily. The rate of TDS depends on whether the property is a long-term capital asset or a short-term capital asset to your seller. This is determined by the period of holding of the property by the seller, i.e., if the property is held by the seller for more than 2 years, then it is a long-term capital asset and if it’s held for less than a period of 2 years, it is short term capital asset. In case of a long-term capital asset being purchased by you the rate of TDS is as given below:

| Particulars | < 50 Lakhs | >50 Lakhs but < 100 Lakhs | > 100 Lakhs |

| Tax | 20% | 20% | 20% |

| Surcharge | NIL | 10% | 15% |

| Education Cess | 4% | 4% | 4% |

| Total | 20.80% | 22.88% | 23.92% |

In the case of short-term capital assets, the TDS rate is 30% plus the applicable surcharge and 4% Education Cess. It is to be noted that if the NRI seller has applied to the Assessing officer and obtained a certificate for shorter deduction of TDS then the TDS can be calculated on the capital gains amount else, this TDS has to be deducted on the value of consideration or stamp duty value whichever is higher.

The TDS has to be deducted by the buyer at the time of payment and the same has to be paid on or before the 7th of the next month except for the month of March where the due date for payment is 30th April. Form 27Q has to be filed at the end of the quarter by the buyer and the TDS certificate in Form 16A shall be generated by him and sent to the seller within 15 days of filing form 27Q.

In addition to this Form 15CA and 15CB has to be complied with where Form 15CA is a declaration made by the person remitting the money wherein he states that he has deducted the tax from any payments so made to the non-resident. Form 15CB is a certificate issued by a Chartered Accountant. These are mandatory if the payment is done directly to the foreign account of the seller, but if you are transferring the funds to the NRO account of the seller this is not mandated by the banker but the obligation to file the form still lies with the buyer of the property and there are penal implications on non-filing of the same.

The whole article is summarized as under:-

| Buyer | Seller | Consideration | Period of holding | LTCG/ STCG | Form No. | Rate of TDS |

| Resident | Resident | Below Rs. 50 Lakhs | >2 years | LTCG | N.A. | NIL |

| Resident | Resident | Below Rs. 50 Lakhs | <2 years | STCG | N.A. | NIL |

| Resident | Resident | Rs. 50 Lakhs and Above | <2 years | STCG | 26QB | 1% |

| Resident | Resident | Rs. 50 Lakhs and Above | >2 years | LTCG | 26QB | 1% |

| Resident | Non-Resident | Below Rs. 50 Lakhs | >2 years | LTCG | 27Q | 20.80% |

| Resident | Non-Resident | Rs. 50 Lakhs & above but less than 1 crore | >2 years | LTCG | 27Q | 22.88% |

| Resident | Non-Resident | Rs. 1 crore & above | >2 years | LTCG | 27Q | 23.92% |

| Resident | Non-Resident | Any value | <2 years | STCG | 27Q | 31.20% |

cogently presented

u/s 194IA date of deposit tds, date is 30 days from the end of month in which transaction takes place.

Nicely Explained !