The World has become Global Village because of Internet. There are over 350 Crore Internet users across the world according to internetlivestats.com.

Social Media has been a revolution in last few years. The Time taken for information sharing across domains of social media have been reduced to seconds or minutes because of various Apps available & Update helps many in decision making, knowledge sharing and awareness.

However with great advantages of anything comes disadvantages. Amongst those disadvantages, prime is rumor or misinformation. A Post goes viral across groups, domains in few minutes. Photoshop is easy tool available in the hands of few anti-establishment persons who use it to make such false post and circulate it so that it will create negative impact about Government establishment, Organisation or a specific person.

People tend to believe and forward these rumors received instantly because of a phenomenon called “Negativity Bias”.

The meaning as per Wikipedia of the term “Negativity Bias” is as follows,

The negativity bias also known as the negativity effect, refers to the notion that, even when of equal intensity, things of a more negative nature (e.g. unpleasant thoughts, emotions, or social interactions; harmful/traumatic events) have a greater effect on one’s psychological state and processes than do neutral or positive things.

In other words, something very positive will generally have less of an impact on a person’s behavior and understanding than something equally emotional but negative.

However by doing so people forget such rumors can be harmful socially, mentally or financially for few. Hence it is high time we should try and go in detail of any post which we feel is impacting us, our family or our client in any manner.

Demonitisation is one event which has led to many such rumors as related posts on Print, TV & Social media are numerous and entire country is following the event since 8th November 2016 as it is affecting one and all currently and will affect also in future.

I will point out few clarification from government agencies on few rumors which were viral across domain in last few days.

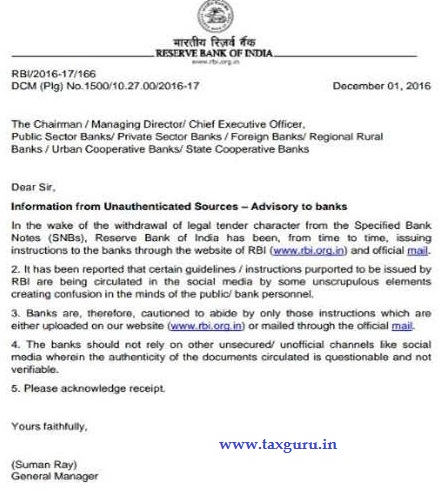

1) Clarification from RBI

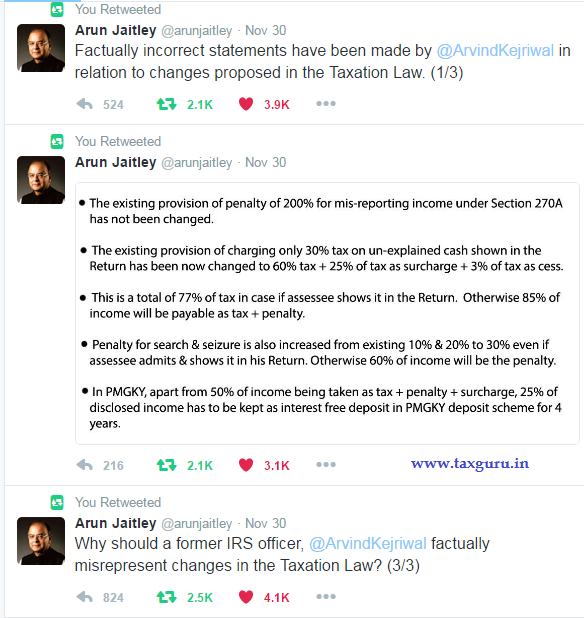

2) Clarification from Finance Minister

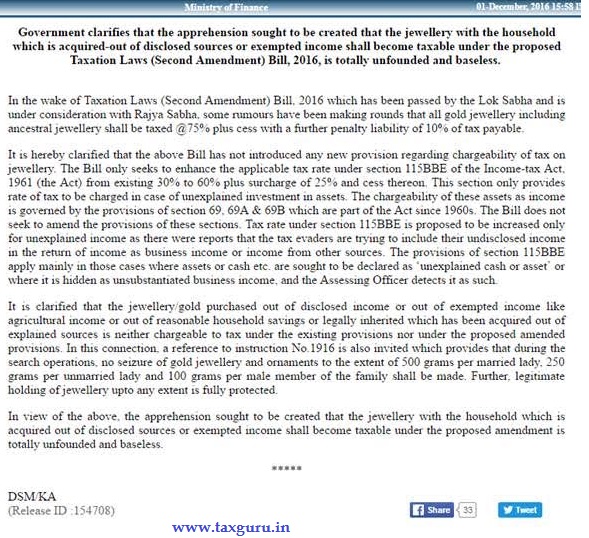

3) Clarification from Ministry Of Finance

These are just few examples of government authorities issuing clarifications in public interest. There were numerous instances other than above which keeps happening in day to day usage of Social media which are forwarded across groups of Whatsapp and timelines of Facebook & Twitter. Even Professional groups are not immune to such viral forwards. The reason for same I have already updated as “Negativity Bias” in the world of Social Media.

I will recommend following steps to avoid loss to anybody while dealing with Legal or Taxation Changes, Notification, Circulars etc.

1) Never forward a post having legal or taxation implication without getting confirmed about its authenticity and impact.

2) All Government Ministries, Organisations and Institutions are having websites and many are also on Twitter. You can easily get the authenticity of such claims from such websites or twitter handles.

3) Ministry / Department wise Press Releases are updated daily on pib.nic.in. You can access it easily. Even you can get it on E Mail daily via subscription.

4) Many times even News agencies analyses a particular legal or taxation amendment incorrectly in the haste of Breaking News. Try to consult your advisor if it affects you, it is in your own interest.

5) Any major change in tax system, tax operation will surely be made public by Government as per constitutional process, it is advisable not to keep faith on such messages which says “ANTICIPATED CHANGE” or “FORWARDED AS RECEIVED” as it denotes lack of confidence of such forwarder. Such changes if any have to be made with due considerations of law having timeline and process of its own.

The way technology is growing, it is obvious that more and more people are going to grasp its benefits. It has brought a lot of advantages for the society. Educate your family, friends, colleagues, clients regarding fallouts of such rumors, it will help many not to fall for such forwards which gives unnecessary nervousness without having any validity.

Remember education for good cause is never wasted and it is also in our nation’s interest.

Suggestions are welcome on atulmodani@gmail.com.

My Last Articled- Demonitization of Old Notes : Few Legal and Income Tax Aspects

Government and IT dept. Should take

action for against the rumour mongers

on misleading the people, Even responsible

Political leaders are also mis guiding the

Citizen and creating hype and confusion to

Suit their interest . Very unfortunate in India !!