The Government has initiated the process of transferring the Assessee’s into the much awaited indirect tax reform GST. The question at present with the Assessee’s is how to start the process. Whether anything is required to be done at present or when it needs to be started.

Process

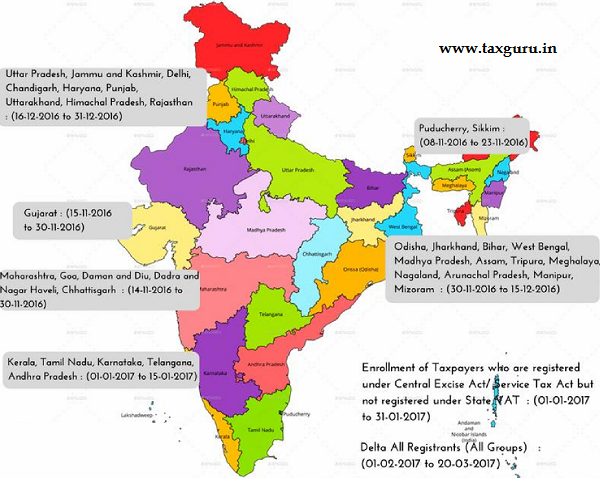

The Goods and Service Tax Act will be applicable in the country effective on the appointed date. Before this date, all the registered taxpayers under the Central Excise, Service Tax, State Sales Tax or VAT, Entry Tax, Luxury Tax and Entertainment Tax need to enroll at the GST Common Portal. The government has divided the whole process into state wise application.

Understand the Process of GST through Full GST PPT.

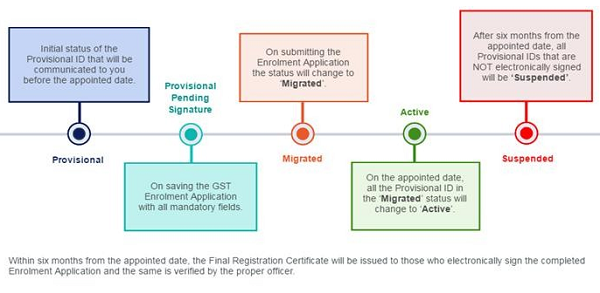

Provisional

1. To begin with the State VAT Department will be communicating the Provisional ID and Password to register the taxpayers with Example in West Bengal – the department is sending an e-mail in the registered email id for logging in the Dealers status to know the above details.

For the other assesses registered under service tax, the department is yet to issue the Provisional Id and Password. The government has only initiated through State Vat departments.

2. Visit the GST Common Portal available at gst.gov.in Use the Provisional ID and password to create your username and password for accessing the portal.

a. Provisional Id Verification

b. OTP Verification – Email & Phone

c. New Credentials – For new user id & password

d. Security Question – for future use

3. Once the process gets completed the new user id & password is active.

Provisional Pending Signature

1. Visit the GST Common Portal available at gst.gov.in. Log in as Existing User.

2. The department has prefilled certain details and certain details needs to be

3. The section has been divided into :

a) Business Details

b) Promoter/Partner Details

c) Authorized Signatory

d) Principal Place of Business

e) Details of Additional Places of your Business

f) Goods & Services Details

g) Bank Accounts Details

h) Verification

4. Once all the details are filled the Form needs to be submitted :

a) Submit with DSC

b) Submit with E – Signature

c) Submit now without signature and sign the application later

On submitting the Enrolment Application status will change to Migrated. On the appointed date (the date on which the GST gets implemented) the status will be changed as Active. If Department feels certain details/ information then it can ask for the same from the Assessee before finalizing the registration.

(Author is associated with ASRK & ASSOCIATES and can be reached at caronakkothari@gmail.com)